Forum Replies Created

- AuthorPosts

- 03/05/2023 at 12:29 pm in reply to: Portfolio Builder vs. Quant Trader Light for identifying strong ETFs #84557

Vangelis

KeymasterIt sounds like you are experienced in momentum and rotation strategies, so we would recommend using QuantTrader Light or even better QuantTrader pro, which is what we use. In QT light you can use our strategies and better see how they work. In QT pro you can create custom strategies including what you are used to doing in Excel (create a list of ETFs and then pick the x best by pure performance) but with the added feature of using risk-adjusted performance. It can be pure momentum (rank by x-day return), or risk adjusted momentum (return/risk) or even just minimum volatility (consider mostly risk and correlation).

Another benefit is that you can create multiple sub-strategies of say 10-50 ETFs each and then ‘rank’ the sub-strategies as if they are ETFs themselves. This way you are not mixing 200 ETFs, most of which correlate highly to SPY, in the same basket.

You get a 30-day trial of pro so feel free to experiment creating a strategy.

https://logical-invest.com/quanttrader-application/backtesting-software-tutorial/Vangelis

Keymaster1. Entry and exit prices are not that critical given we rebalance once or twice a month. You can place MOC (market on close) orders on the first day of the month or use a limit order during the trading day. You could also use a fill at open if the ETF is very liquid.

2. After the 30-day trial you will only see delayed allocations. Registering will unlock current allocations.

3. It’s rare but it doesn’t hurt having QT run on an old windows pc just in case.Vangelis

KeymasterHi Zeke,

We will consider doing that. For now we have a change log for QuantTrader that shows when a major strategy update happens. https://logical-invest.com/quanttrader-application/download/

Keep in mind all our strategies originate from QuantTrader which you can download and play around for free (30 days).Vangelis

KeymasterFrank, jmont,

Good points. Some addressed in our new year’s newsletter. T-bills are not a bad choice at all. https://logical-invest.com/the-logical-invest-newsletter-for-january-2023/Vangelis

KeymasterDear Zeke,

We update our strategies every few years depending on the markets. Our last update was on July 2022. When we do, we change strategy parameters and we re-backtest the whole history. Usually the backtested results are better as we change parameters to compensate for things that have already happened. A good example is TLT and the bond markets. As we adapt strategies to rely less on TLT, we create strategies that would have behaved better in the past and that we hope will behave better in the future.For example by adding TIPS to our hedge strategy, we make it more robust to an inflationary environments. We don’t force TIPS, we just add it to choices the algo can make. When we re-backtest the algo obviously picks TIPS more often and creates a different equity than the actual one, when TIPS was not a choice.

I hope this explanation helps.

Our strategies come from QuantTrader. You can see the change log here:

https://logical-invest.com/quanttrader-application/download/Vangelis

KeymasterWe update our strategies every few years depending on the markets. Our last update was on July 2022. When we do, we change strategy parameters and we re-backtest the whole history. Usually the backtested results are better as we change parameters to compensate for things that have already happened. A good example is TLT and the bond markets. As we adapt strategies to rely less on TLT, we create strategies that would have behaved better in the past and that we hope sill behave better in the future.

For example by adding TIPS to our hedge strategy, we make it more robust to an inflationary environments. We don’t force TIPS, we just add it to choices the algo can make. When we re-backtest the algo obviously picks TIPS more often and creates a different equity than the actual one, when TIPS was not a choice.

Our strategies come from QuantTrader. You can see the change log

https://logical-invest.com/quanttrader-application/download/Vangelis

KeymasterUnfortunately not. It’s windows only.

Vangelis

KeymasterAgain, if you can use QuantTrader, you can get correct updated strategy signals until we correct the website data.

Vangelis

KeymasterThere has a problem with the updates on the site. We are still looking into it. If you have access to QuantTrader (all plans except “Core”), please update the data and check the new allocations there. https://logical-invest.com/quanttrader-application/download/

Vangelis

KeymasterAll strategies rebalance in a predictable schedule, on the first business day of every month. Exceptions are the Maximum Yield and Crypto Top 2 strategies that additionally rebalance mid-month. Each subscriber receives a monthly newsletter email with their new portfolio allocations but can also just go online on the designated day and get the allocations, in cease the email fails.

Let us know if you have more questions.Vangelis

KeymasterTrue. We had a a minor technical problem. It has been fixed. Thank you for your patience.

Vangelis

KeymasterIf you are based in the U.S. and use a major brokerage you should be able to either use Bitcoin spot (Interactive Brokers via Paxos), the BITO ETF (most brokerages) or Bitcoin CME Futures.

Non-US customers hava an even bigger choice including Canadian, E.U. based or Swiss ETFs.

Vangelis

KeymasterOf course you would! It’s like you long time favorite 3xUIS but version 2 ;)

Watch out the draw-downs, though!Vangelis

KeymasterDear Jason,

Apologies for the delay. We did respond via email: In effect your subscription has been cancelled. The reason it is “pending cancellation” is that it allows you to use the rest of the subscription time. It will not renew.

If you want a pro-rated refund, that is a different issue. We provide a choice of monthly-based subscriptions as well as a 60-day full refund policy and a yearly plan discount vs the monthly subscription. Usually we do not refund past the first 60-days. If you feel that is unfair just reach out and we can work something out.Vangelis

KeymasterFebruary it is. Thank you for the correction.

Vangelis

KeymasterOn the chart, you can always drill down to the strategies that are part of the conservative portfolio and see the details (using ‘Holdings’ and ‘Allocations’ links). It seems our HEDGE strategy (which is part of the US Market, which in turn is part of the conservative portfolio) was in GSY before but has since switched to GLD for February. hence the allocation to to GLD.

Vangelis

KeymasterHi Nelson,

Draw/Start is the drawdown since the start of the strategy.

Draw/Range is the DD during the range depicted in the chart.I Hope this helps!

Vangelis

KeymasterThe forums are active and monitored, alas less often due to holidays/family engagements. Keep in mind the forum is best used to exchange ideas amongst users and there is no way for us to be notified directly (via @). We manually go through all new posts but we may miss one on occasion. For questions concerning us directly feel free to email us: (name) at logical-invest.com.

Vangelis

KeymasterI proposed a permanent portfolio back in January that includes Bitcoin on my personal site: https://sanzprophet.com/2020/01/bitcoin-plus-harry-browns-permanent-portfolio-a-mix-in-heaven/

If there is demand we can incorporate and track it here at LI as a portfolio.

As for guidance I’ll be glad to help our. An easy way to start is to open a Coinbase account and just transfer funds from your bank or broker via ACH, then buy Bitcoin. Other options include Gemini, itBit or even BlockFi (pays interest on you holdings). If you have access to futures you can also buy CME’a future contract.

Of course you can eventually hold your own BTC in a hardware wallet but starting from a U.S. regulated and reputable exchange is a good start.

Vangelis

KeymasterWe are waiting for final data to be adjusted for dividends before we calculate and publish allocations. Should be in the next hour or so before NYSE opens.

Vangelis

KeymasterInteresting ideas Midnight122! For better or worse we run by quant strategies and rules, so the actual models dictate allocations. However we do evaluate markets and our own opinions do ’tilt’ how strategies are build and to what sectors (like small caps) we expose them to. We ‘ll keep this in mind.

Vangelis

KeymasterDear Brad,

As you know we responded via email but I am pasting some of the answers here as others may find the information useful:

We only rebalance on the 1st of the month so you only need to check for new signals then (exception is the Maximum Yield Strategy that trades 2 times a month). Once you setup “My portfolio”, you will receive an email/newsletter on the 1st with the new allocations.

We recommend that you check the site and directly retrieve allocations on the 1st, few hours before NYSE opens.

The other option is to use QuantTrader (see previous email).Quantrader has 2 options: Light and Pro

Light gives you read only access to strategies and portfolios. The benefit is that sine QT holds the strategies, you can issue each strategy allocations when you choose to rather than being tied into the publish day (1st of the month). So you could download intraday data at the end of the month and trade before closing rather than wait for the 1st.

https://logical-invest.com/quanttrader-to-cut-signals/QuantTrader Pro lets you customize and/or create your own strategies as well as portfolios of strategies. It is best suited for Advisors/Managers servicing multiple clients.

Vangelis

KeymasterYou should do your own research but some additional risks inherent in leveraged ETFs is price decay

https://rightsideofthechart.com/leveraged-etf-price-decay-explained/

as well as what happened to XIV, which is termination by the issuer when price swings of the underlying become too extreme.

https://www.investors.com/etfs-and-funds/etfs/investors-lawsuit-lost-money-xiv-meltdown/

Using leveraged products always contains a greater risk of ruin (for you and the issuer) and backtests never fully reflect future black-swan events. You should always prepare for much higher drawdowns of what backtests show. Backtest drawdown numbers are most useful for comparing one strategy vs another.09/19/2020 at 5:46 am in reply to: Markowitz portfolio theory in an era of 0 and rising interest rates #80147Vangelis

KeymasterHello Michael,

Both Mark and Frank have a point. I may add that this same argument was present a few years back were yields were again very low. At that point, for the many reasons you mentioned, we created the HEDGE sub-strategy instead of purely relying on TLT for hedging equity risk. The HEDGE sub-strategy added access to TIPS, cash and gold. The adjustment has been towards possible inflation which can be captured via GLD and in part TIPS, or pure deflation via GSY (cash). Interestingly, despite everyone believing interest rates can only go up, TLT managed to be one of the best asset performers and was an excellent hedge to the March 2020 crash. Lesson is we just don’t know what will happen and how long interests will be close or sub-zero. Our HEDGE is flexible enough to deal with a changing environment, even an inflationary one.

Vangelis

KeymasterHi Bruce,

Not really. All our backtested models are based on the assumption that the strategies/portfolios are re-balanced monthly. There is no need to rebalance more often. If you were to do so, it would be a different strategy, one that assumes mean reversion is at play as you would be selling the asset that gained in price and buying the one that lost in price.

Vangelis

KeymasterJames,

To give credit where credit is due, Frank is our ‘master strategist’. He picks parameters based on optimazation on QT, using tools to avoid overfitting as well as using common sense and his own experience as a trader.

Vangelis

KeymasterHi James,

The best way to look at the components and rules for the strategies is to download QuantTrader and see the components, lookback periods etc.

Both consist of 2 sub-strategies. A HEDGE sub-strategy and a US Market unheged one.

But if you read the description of HEDGE vs HEDGE 2X you will see there are different ETF choices. H2xHEDGE can only allocate to Gold2x and Treasury2x while HEDGE can additionally choose allocation to TIPS and GSY (cash).

Vangelis

KeymasterYou best bet is to spend some time reading through our forum which goes back to 2014. We have kept it open and uncensored so you can read the good and the bad. You can also build an understanding of our pov, get a feel of who we are and whether our service can add value to your own investment decisions.

08/09/2020 at 5:19 am in reply to: Covered Call Writing Strategies for the Enhanced Permanent Portfolio? #79716Vangelis

KeymasterOne such strategy is run by Frank (@LI) as described here:

https://logical-invest.com/forums/topic/logical-invest-teams-own-personal-allocations/#post-78980Keep in mind that holding an asset and selling calls against (ie, covered call) is equivalent to selling a Put. Both strategies have the same risk/reward profile (assuming there is enough cash to back the put in case of assignment).

Looking fwd to other ideas. Given enough interest I may try to backtest a simplified version of this.

Vangelis

KeymasterIt seems something is up with our email provider.

We send you an email.

Feel free to contact us: mail at [our website address]Vangelis

KeymasterThank you for the feedback Robert. I think many subscribers agree with you in that we do need to further discuss these Core portfolios changes.

Vangelis

KeymasterSome subscribers trade on the last day of the month, some on the first, I myself sometimes trade on the second.

There is no rule as to when to trade. If there was one, it would defeat the purpose as everyone, at least from LI, would crowd the trade. In our experience it is best to at least wait 30 minutes after NYSE opens so that the market stabilises if there was news or similar events that creates volatility. Our advice is to pick a date and time that suits your own work and family schedule and then stick to that.

As for dividends I am not aware of that. I am sure there are strategies out there detailing how to capture dividends or avoid them and trade the price instead.

Vangelis

KeymasterRobin, we extended a 30-day free access to premium QuantTrader so you can explore the 2x idea. Then you can let us know :).

Try logging in to QT again.

Some QT stuff here: https://logical-invest.com/quanttrader-application/portfolio-optimization-backtesting-software-help/Vangelis

KeymasterQT Light lets you visualize all Logical Invest strategies, sub-strategies, settings, metrics, etc. It also allows you to issue ‘signals’ (i.e. see current model allocations) at any time, not just on the 1st day of the month.

QT Premium lets you additionally:

1. Import your own symbols

2. Customize pre-existing strategies or create new ones.

3. Mix our (or your) strategies into your own dynamic ‘meta-strategies'(portfolios that dynamically pick and combine strategies).An example would be an investor who likes our Universal Investment strategy (SPY/HEDGE) but wants to replace SPY with QQQ. The could create a custom UIS_qqq_version, backtest it, find robust parameters and then use it to issue their own signals.

Vangelis

KeymasterEveryone now gets the reduced pricing:

https://logical-invest.com/app/subscribeOur pricing used to be substantially higher ($100/m for All Strategies) as we catered more to advanced users with larger funds.

Vangelis

KeymasterThe reduction is for previous subscribers on the $49/$100 plans.

Vangelis

KeymasterI adjust the re-balance date. Much like MYRS, the strategy takes advantage of contango but it has its’ own sets of rules, some being discretionary. This may not be the best time for such a strategy without using some extra type of protection. There are also variations that can be traded like selling a spread that can reduce risk.

Vangelis

KeymasterJust to clear up the discussion on credit card data: We use PayPal and Stripe to process payments. Both are high quality, tried and true U.S. based payment providers. We do not collect, keep or process any credit card data.

As for the website: You are right! As we have said before, we are horrible at both web-design and marketing. We are better at trading so we do spend most of the time researching and investing our own funds. This costs us some business but it is a choice we have made…

That said we added a much needed Contact Us link on the main site , corrected the link and we are considering how to simplify our ever growing complicated site!

Vangelis

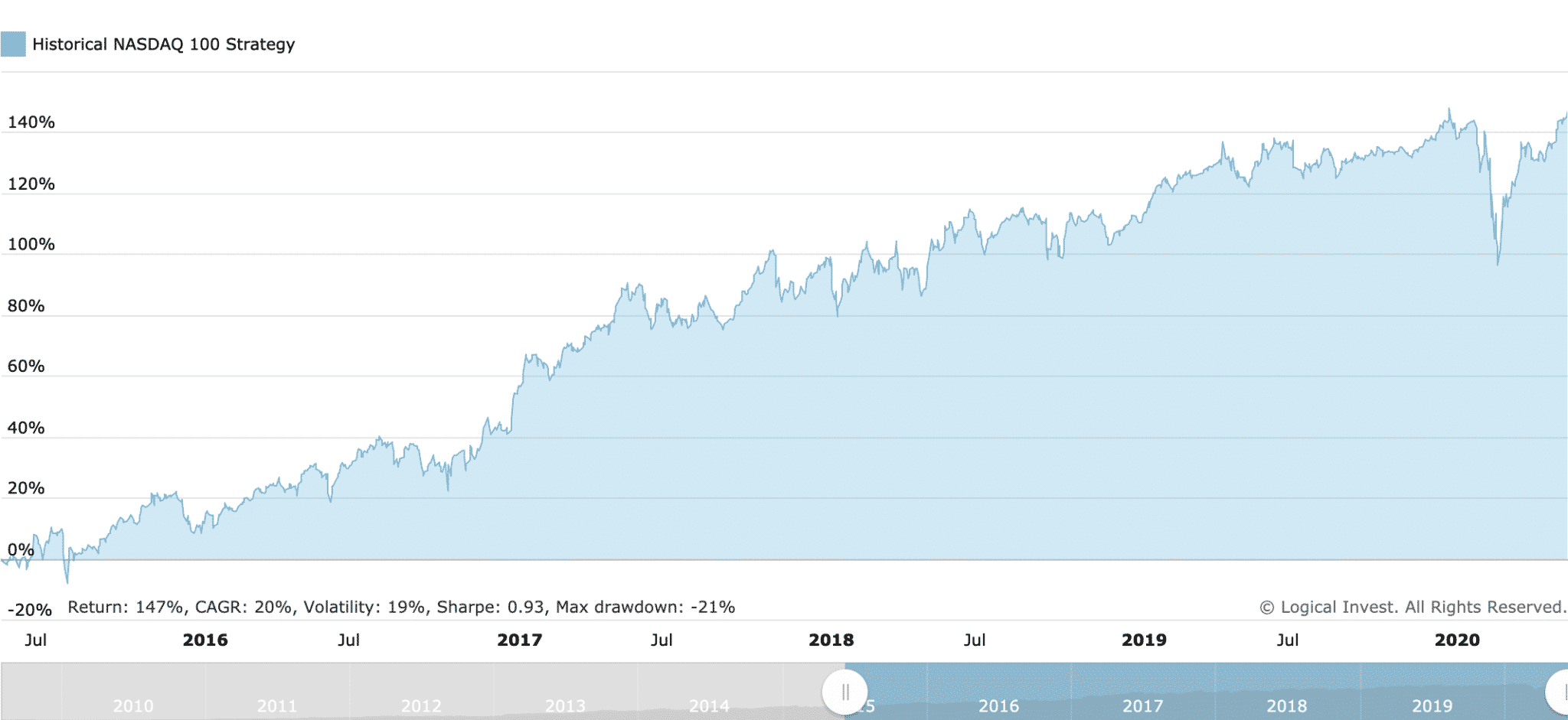

KeymasterYou could do that using Norgate data and Amibroker. Unfortunately it is not that simple to input the data to QuantTrader, our proprietary software since we would have to create a whole ‘subsystem’ from scratch just to handle that data. It’s probably easier to create the N100 startegy in Amibroker and run the backtest there. But this too is complicated and inefficient since the N100 strategy (and most LI strategies) are not a good match for the AB ‘vector type’ logic. We have run our own private tests and our conclusion is that it’s not worth the effort. We have survivorship-free out-of-sample data since July 2015 when N100 went live that seem to validate the logic.

https://logical-invest.com/app/strategy.php?symbol=NAS100! (you need to be registered to view)

Vangelis

KeymasterWe are well aware of survivorship bias but both the Nasdaq 100 and Dow30 backtests do not take it into account. That means that long term backtested are optimistic. On the other hand the Nasdaq 100 has been ‘live’ for a few years now and has gathered historical performance data that is indeed survivorship-bias free.

Vangelis

KeymasterThey can both allocate to cash via our HEDGE substrategy that picks from treasuries, gold, cash etc. https://logical-invest.com/app/strategy/hedge/hedge-strategy

Vangelis

KeymasterYou should be able to see all three Core portfolios including the Moderate one. If this persists I can reset you account but please use our form

https://logical-invest.com/app/help.phpVangelis

KeymasterMy strategy of choice is the Top3 strategy. As I am a bit conservative I often tend to err on the side of cash. On my more active account I use variations of the permanent portfolio, MYRS (using futures) and some non-LI shorter term strategies. I also trade crypto.

Vangelis

KeymasterThere are very valuable and correct points being made in this discussion. Let me try to show our point of view:

The main purpose of developing these strategies was to cut down on risk and protect accounts from large drawdowns. LI was really born out of the 2008 crisis. Outperforming the SP500 was never our intention. But as James mentioned if someones wants to outperform they are welcome to create a portfolio using LI tools and then leverage it up, taking advantage of lower drawdown limits.

We have 3 goals we try to achieve:

a. Diversify: From individual stocks to ETFs, from ETFs to strategies-of-ETFs and from strategies of ETFs to a portfolio-of-different-strategies. What we could call a level-3 diversification.

b. Limit risk: Cut down large drawdowns as to gain from long-term from growth. This means keep intelligent hedges that don’t cost money such as put options or (long) VIX ETFs and futures.

c. Make it simple: Make complex rules-based models ‘investable’ and not just theoretically possible. This is a big deal since we do have complex option and futures-based strategies that we can (and have) build. But it makes no sense unless someone can actually realistically trade it, for the long run. So we tried to make everything come down to a handful of ETFs that one has to buy/sell once a month.Other than that we do not pretend to be very smart (except Frank who is actually a really a smart trader) or to create alpha out of nowhere. There is nothing wrong in just holding DIA or QQQ or a 60/40 SPY/TLT. The problem is that investors with no rules end up being aggravated by emotions and end up losing even though markets go up (for the most part) in the long term. So we provide some rules to help.

You can see some actual historical returns by going back to our published end of year newsletters:

https://logical-invest.com/the-logical-invest-newsletter-for-january-2020/

https://logical-invest.com/the-logical-invest-mid-month-newsletter-for-january-2019/

https://logical-invest.com/the-logical-invest-monthly-newsletter-for-january-2018/

https://logical-invest.com/update-january-2017-401k-investments/

https://logical-invest.com/the-logical-invest-monthly-newsletter-for-january-2016/Vangelis

KeymasterSince it is via PayPal, we can refund you the discount rather than blocking/re-subscribing. Please check your email.

Vangelis

KeymasterVangelis

KeymasterCorrect. Thank you Jerome!

Vangelis

KeymasterExactly right. Thank you Jerome!

Vangelis

KeymasterYes that is right. So yes, you could pick a portfolio and add/subtract strategies from it to create a custom one. You can then save it as “My Portfolio” and that should report aggregate allocations every month.

There is an upside and a downside to this design. The upside is that we give you the tools to build a portfolio according to your preference of risk/safety/mix or assets etc.

The downside is that it is more complicated and there is a bit of homework to do, at least in the beginning.Vangelis

Keymaster@socoolme Hello!

We have all been burned before, namely in 2008. That’s why we build Logical-Invest in the first place.

We start with ETFs that represent a basket of stocks/bonds/commodities, etc: https://www.investopedia.com/terms/e/etf.asp

Sometimes we also use individual stocks.We then build a “model”, which we call a strategy, which is a set of rules on how to trade a specific basket of ETFs, ie when to buy and sell.

We then build portfolios by combining multiple strategies (which themselves combine ETfs, which themselves combine stocks, bonds,etc).

Once a month, we unwind all this to give you a list of what ETFs/stocks the portfolio holds each month.

Since these models are based on rules, we can backtest them to see how they did in the past. That does not mean they will do so in the future.

Lastly, we are not advisors and cannot give you personal advice based on your life circumstances. We develop and publish strategies and portfolios that can help you make better (or at least more diversified) decisions in your own investing.Vangelis

KeymasterWelcome Bob,

Feel free to use the form at the bottom of the About Us page:

https://logical-invest.com/about/about-us/

or email us: info at logical-invest.comVangelis

KeymasterIt’s a challenge to pick an optimization period. Mark and Stefan are pointing you in the right direction. What I can add is this: Our most robust strategy, out-of-sample. has been the Universal Investment strategy (UIS). If you open UIS in QT and optimise different periods you always get fairly good results no matter how much you change lookback periods and other parameters. This is because the base strategy, the 60/40 portfolio, is robust on a fundamental level. So if you have some free time, an exercise is to run different optimisations on your strategy at 2 to 4 year lookback periods from different points in time. For example you could optimize from 2013-2016, write down the parameters and then see how they would perform from 2016-2018.

All the above refers to QuantTrader. For the online portfolio optimizer a lookback period should at minimum include a bad year (2015 or 2018) and a good one. Because the underlying strategies are being optimized themselves, there is an argument for not optimizing too much or too far back on a meta-strategy level. Some studies argue that equal weight portfolios perform better than most other combinations. There is nothing wrong in running the online optimizer, adjusting the weights towards equal-weight while still using common sense, i.e. putting less weight on risky ones. In other words optimisation on the meta-strategy level is not critical and could be subjectively corrected.

Vangelis

KeymasterThank you Mark!

Vangelis

KeymasterThe strategies should rebalance once every month (except MYRS which is twice/month). No need to adjust weights. So one trade a month is all you have to do.

The backtester assumption is that trades happen on close price on the day before the 1st of the month (ie January 31st). This is slightly different than trading on the 1st but it is not a critical difference according to our tests.

It is possible to trade on the last day of the month using QuantTrader by downloading intraday data before the close and issuing signals at your own workstation/laptop. I suggest that you download and use our 30-day free trial of QuantTrader. You can then check exactly how our strategies work and even backtest instantly different rebalance days (+-1,2,3).

https://logical-invest.com/quanttrader-application/Vangelis

KeymasterHello Benjamin,

The my portfolio tool is not designed to track live intraday performance. There are tools out there that can do that much better than we could so we thought, let’s stick to what we know (strat.developement) rather than build another one.When you are viewing a portfolio in the portfolio library (or in any other page), you can go to the asterisk on the top right of the page and click it to “Set as my portfolio”. To combine strategies you need to use the portfolio builder.

You cannot combine multiple portfolios into one online. Here is a guide on how you could do it on your own using a spreadsheet:

https://logical-invest.com/create-portfolio-of-portfolios-portfolio-builder/Vangelis

KeymasterNo updates really although some clients have created their own strategy versions. The way we have solved this is 1. Got professional status so we can trade US ETFs. 2. We trade VIX futures and options, a strategy that we may soon open to investors via a managed IB account.

Vangelis

KeymasterBased on backtests it is better to just enter the positions. If you are unsure you can also scale-in but both sides at the same time.

As for the price, you are covered for the period you subscribe to. If you choose the yearly, you will be protected from any price increases for the year.Vangelis

KeymasterI see you have registered with us before. New pricing:

https://logical-invest.com/app/subscribe?newpricingVangelis

KeymasterHello Balraj,

In QuantTrader Lite you can see the backtests, the signals, etc but you cannot change parameters (lookback periods, etc) or create/combine strategies into new ones.

Another way to put it is that Lite is ‘read only’ and used to get LI strategy signals on your own time.

The full version, is ‘read-write’ and is quite powerful. It is what we use to create and tweak our strategies and meta-strategies. You can stress test the current strategies, create copies and tweak parameters and see instant backtests. You can combine strategies into portfolios or new strategies and issue signals for those.Vangelis

KeymasterHello jmont42,

As StefanM mentioned we highly recommend to at least try out QuantTrader for the free trial period. This will get you an inside look at how the portfolios are constructed.

You can then continue with your own custom strategy or just follow the Top 3 Strategies (MST3).

Since you have been through both major crises you probably know how it goes. You need to stay protected as no correction quite resembles the last one, but you also need to participate and not miss out on multi-year growth. We are currently running fairly conservative in our 2020 ‘settings’. To give you an idea, current allocations for MST3 are about 40% GSY (cash equivalent), 25% in different bond classes (not Treasuries) and less than 20% in equities.

Welcome and happy new year!Vangelis

KeymasterWelcome!

As these are monthly strategies, is not critical to enter on the very first day of the month. Entering on the second or third day should be fine as it may result to slightly better or slightly worse results. If you do enter on the first day it’s best to avoid the opening as it gets crowded.Vangelis

KeymasterHello and welcome!

The Max DD 15% is a portfolio constructed from QT strategies but outside the software using standard max-return/ min-drawdown optimisation. Two ways to go about it:

1. If your brokerage fees are low you can jump in based on the October 1st allocations.

2. You can wait for the November allocation.

3. Or you can:

a. Find which strategies are used and at what percentage (ie, 30% BRS, 50% UIS, etc)

b. Run current allocations on each strategy inside QT and export the allocations in an spreadsheet.

c. Add the ‘weighted’ component allocations and calculate portfolio allocations.Our recommendation would be in the order written.

Vangelis

KeymasterIt is hard to map these last three ETFs to European ETFs. Even when European ETFs exist, they are quite illiquid.

Here is a good resource:

https://www.justetf.com

If you are European, depending on local taxation, it may be suffice to do the simple UIS strategy (SPY/TLT/GLD), given you may have no taxes using UCITS ETFs.Vangelis

KeymasterHello R.D.,

By deafult QuantTrader uses dividend adjusted returns, ie dividends are included in the returns. Both the Tiingo and EODHistorical data feeds use dividend adjusted returns. As for S.A., thanks for spreading the word!Vangelis

KeymasterTake a look at the top3 strategy: https://logical-invest.com/app/strategy/mst3/top-3-strategies

It a bit more adaptive and has a shorter lookback period.Vangelis

KeymasterThe 3x UIS Leveraged strategy is an extremely risky strategy and should not be utilised by itself. It should make you uncomfortable to trade it. The model provides recommendations so if it sounds too risky or does not sense you should not follow it until you gain some faith in it.

That said, the model uses rules. According to those rules it thinks it’s best to go UGLD/SPXL rather TMF/SPXL which makes sense as gold had a better risk adjusted performance. The problem with UIS3x is that even it’s most balanced allocation, 50% TMF – 50% SPXL, is extremely risky unless used in a small account that can withstand -40%+ draw-downs.Vangelis

KeymasterWe backtest our strategies and create portfolios of strategies based on recent theoretical strategy performance. This article explains why we have to use backtested data vs historic to do that: https://logical-invest.com/backtested-data-vs-historical-data/

We do track strategy historical performance based on signals issued here: https://logical-invest.com/app/historical.php

Our portfolios will never achieve peak theoretical backtested performance although when writing this note MYRS historical performance (based on issued allocations) is at 32% and 3x UIS is at 44%. Our Dow strategy on the other hand lost -6% and our US market is at 1.5%. SPY is at 22%.Here is another article of how we strive to avoid overfitting and base our decisions on objective rules:

https://logical-invest.com/walk-forward-testing-avoid-curve-fitting-backtesting/We obviously cannot guarantee performances but we are transparent in our practices, strategies, parameters and logic of our strategies. How? We actually give you access to the software that builds the models.

What we offer is the tools to create portfolios based on multiple rules-based strategies. These strategies are based on clear logic and rules and have been backtested. We provide our QuantTrader software for you to test or modify the logic/parameters of the strategies we build. For $50/month you get access to rules-based investing, you get to test our or your own ideas and you get to create a diversified and hedged portfolio that may limit your risk vs stock picking or emotional based trading.

Vangelis

KeymasterHi Mark,

The Max DD 15% is optimized outside QuantTrader using standard optimization techniques, https://logical-invest.com/app/portfolio_optimizer

The settings are to maximize CAGR given a maxDD constrain choosing from any of our the strategies (no % limit on allocations).

If you wanted to create something closer to this in QT, you would use the SR algo, quarterly rebalance, a long lookback period (5 years +) and a volatility attenuator that historically keeps MaxDD under 15%.Vangelis

KeymasterHello Mark,

Thanks for sharing. We will load up the .ini and take a look. It is fine to post here until we create a dedicated place to share files.Vangelis

KeymasterTaxes differ for everyone as we have subscribers from different countries. 401k/IRAs should be ok with rebalancing monthly. U.S. taxable accounts will be subject to short term capital gain taxes, so as Deshan mentioned you have to consider your own situation. Same with dividends, especially for non-US persons who may end up with a 30% tax on U.S. based dividends, thus affecting bond-heavy strategies such as the BRS. We cannot advise on an individual basis, as we are not registered to do so but we can help provide information on general cases.

Vangelis

KeymasterWe apologize. We should be back ‘online’.

Vangelis

KeymasterAnthony,

You are not alone. My broker split FOXA to part DIS part CASH part FOXA at a different price. After this month’s signals we will take a look at the rational so we can compute a cost basis.Vangelis

KeymasterUnfortunately, we do not support single strategy subscriptions any more. This was done so we freely develop and implement and make new strategies available to our Portfolios without the administrative overhead. We offer Core portfolios, All-strategies, QuantTrader subscriptions as well as a few free porfolios (PP, US Sector, BUG). https://logical-invest.com/app/subscribe

Vangelis

KeymasterDerrick,

Since you have been with us you know our main strategies are changed/updated rarely. Maybe every few years. This past two months we have introduced 2 new strategies, and a new Hedge sub-strategy that affects all existing ones. When QT runs a backtest with the latest parameters, it just does that. Produces a backtest. So all allocations are based on the current parameters. So under the new Hedge strategy, N100 would have invested in TLT not UGLD. That does not mean that the signals issued at the time (UGLD) were wrong. It just means that we (and QT) are adapting to the markets and finding better solutions going forward. This happened in the past but was less pronounced. The actual signals and performances are here https://logical-invest.com/app/historical.php

Also see a better explanation here: https://logical-invest.com/backtested-data-vs-historical-data/

I hope this makes sense.Vangelis

KeymasterThank you, Howard. Marry Christmas to you!

Yes, we can do managed accounts for international (non-U.S.) clients.Vangelis

KeymasterHoward,

Sorry about the delayed response. We now have some new core portfolios that may be of help.

These will use only ETFs, no single stocks:

https://logical-invest.com/app/strategy.php?symbol=Conservative401

https://logical-invest.com/app/strategy.php?symbol=Moderate401

https://logical-invest.com/app/strategy.php?symbol=Aggressive401What you may find to be a problem, though, is that they exclude N100 and the new Dow 30 strategy.

The only way to create and test a QLD+TMF (or QQQ + TLT, etc) is to use QuantTrader. You can easily try QT for a month free but you will need to put some time to go through the basic tutorial and learn how it all works.Vangelis

KeymasterDear Howard,

I had a similar problem when trying to incorporate the N100 strategy with other strategies for a smaller account. I would end up with too many ETF/Stocks since n100 by itself added 4 extra stocks. So I created a similar strategy using QLD and TMF. This came closer to the N100 performance albeit with increased risk.

In my case that was ok since I run this strategy in conjunction with other ones and I kept it capped it to a smaller percentage of the overall portfolio.

Of course it all comes down to what you are looking for, how you combine it with our other strategies and how much risk you can take.For you second question, you can play around with the optimizer tool but to create more precise strategies/portfolios with target risk/return profiles you may need to try QuantTrader.

Vangelis

KeymasterIn principal we avoid going long VXX as it is a long time looser (graph goes to zero). We actually base MYRS on this fact by investing in it’s almost opposite, ZIV. I did try VXX in UIS 3x and if you do not change the settings (DR algo and add VXX as last ETF) the software assumes VXX is the hedge (DR algorithm always includes allocation to the hedge) so it always includes it in the allocation. If you shift the algo to SR and use top 2 ETFs you will get different results.

Adding VXX was not a disaster. I would expect much worse. It actually helps in recent history. It would be interesting looking into it more. I also tried VXZ with not such good results.

Soon we will be able to include any reasonable custom strategy that you build (ie, 3xUIS_VXX) in our webapp. All we would need is a XXX_Strategy.ini file from you and we could track it on our online app.Vangelis

KeymasterThanks for pointing this out. It has been fixed.

Vangelis

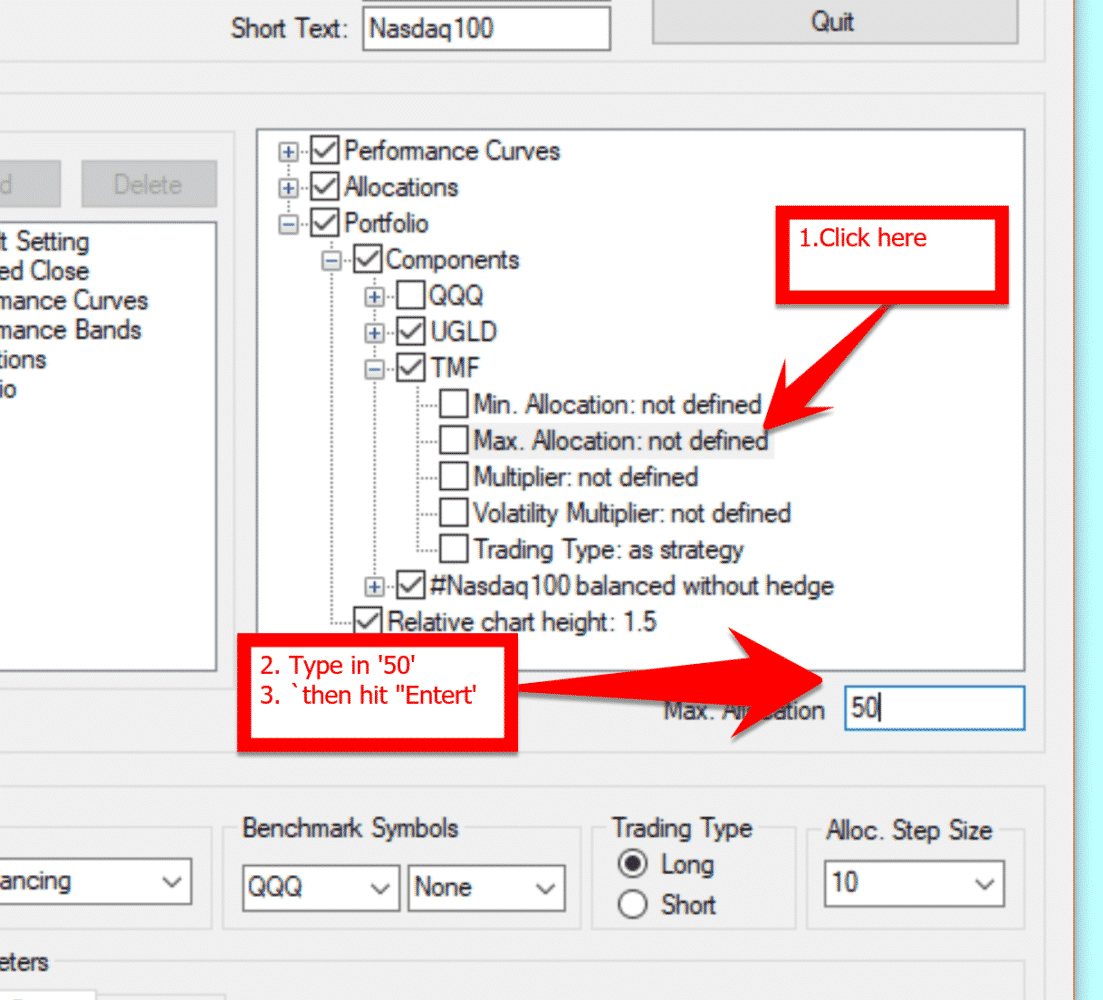

KeymasterInstead of re-ticking the Max Allocation box, click on Max Allocation: Not defined. This will trigger a field just under the window with a blinking cursor. Type 50 and hit ‘Enter’. Let me know if this is what you were trying to do.

Vangelis

KeymasterThank you for letting us know. It’s fixed. The allocations remain the same as the last period but now you should be looking at 10/15/2018 as the new rebalancing day.

Vangelis

KeymasterLook into your QuantTrader folder (where you run QuantTrader.exe from). There should be a new “Ranking Report strategyname.csv” file that was created when you hit the save as button.

Vangelis

KeymasterDear Richard,

Thank you for the constructive criticism. The changes to the strategies you mentioned were announced in the March newsletter (https://logical-invest.com/the-logical-invest-monthly-newsletter-for-march-2018/) that was sent out to all subscribers. This of course is far from optimal as many people will not read it and I, myself had trouble finding where we did document these changes 3 months later! We will look for a more visible place where to publish these “strategy updates”.

I will let Frank discuss the justifications for the strategy changes.Vangelis

KeymasterYes, I assumed it wasn’t that easy… :)

I tried loading intraday prices but cannot re-create the problem. I assume you have custom items? Can you send us the .ini so we can troubleshoot?Vangelis

KeymasterStart up QT with default settings (using Tiingo EOD). Then go to the consolidated allocation tool and choose Intraday prices. Do you still get this error?

Vangelis

KeymasterYou can create a text file with the following format, name it _yourstockname.csv and add it to inside the QT folder.

Date,Open,High,Low,Close,Volume,Adj Close

2018-03-29,238.090,240.840,234.760,235.650,4671145.000,235.650

2018-03-28,244.080,246.930,235.600,236.680,4174405.000,236.680

2018-03-27,248.080,254.250,241.600,244.370,6309121.000,244.370

2018-03-26,247.670,248.830,240.510,247.730,4559848.000,247.730

2018-03-23,243.380,245.215,240.405,242.480,5845337.000,242.480

2018-03-22,242.030,246.720,241.500,243.570,4215848.000,243.570

2018-03-21,240.580,250.590,240.060,246.000,5439448.000,246.000

2018-03-20,245.100,248.050,241.280,242.360,6121449.000,240.648Vangelis

Keymasterlaunching an Ec2 instance for the first time is no small task, especially with windows giving you all kinds of permission problems. Not sure why you cannot download QT. If you are using explorer you should download Firefox (you may need to change IE permissions) and use that browser instead. The easiest way to exchange files is through a Dropbox or google drive account. There maybe an issue installing QT on a new windows server. If you want, email me directly, maybe I can help.

Vangelis

KeymasterThe N100 backtests has survivorship bias. In other words we are backtesting on todays available list. To do a real survivorship-free test you need a far more complicate setup.

Our “live performance”, after 2015, on the other hand, is not backtested but rather based on real-time signals we have issued, so it is survivorship free.

We adjust the Nasdaq 100 list ourselves so don’t have to manually add or subtract companies.

Vangelis

KeymasterYes, of course. With QuantTrader you can rebalance any day of the month you want to.

Under the “Allocations” box you will 2 Tabs:

1. “Invested” – This shows you what you would be holding if you were to rebalance at the end of the previous month (the default).

2. Actual – This allocation is calculated based on today’s prices and may vary from the previous one.If you wanted to rebalance today (say the 3rd) or any other day, you would just follow the “Actual” allocations.

Vangelis

KeymasterOne way to do this is to set up a ‘virtual PC’ via the Amazon EC2 service and set up QuantTrader there. When you are on the road, you just connect using Microsoft Remote Desktop app from a tablet (or from a public PC) and can run QT as if you were in front of the computer.

This is what I do and it costs me around $14/month, for a small 24/7 Windows instance. You can also launch such an instance by hour, which would cost even less. This is very easy if you already have an Amazon account.

Well, thinking about it again, we could launch an instance as Logical Invest and then just give you access. That would be much easier.

Let me check with Alex & Frank.Vangelis

KeymasterIn the context of LI strategies things are simpler. TLT is used as a hedge for many of our strategies (the most basic being the UIS strategy). What the hedge is supposed to do is to limit drawdown in a crisis. If you hold a portfolio that looses 50% of it’s value, you will have to gain 100% just to break even. So in long term investing, both empirically and quantitatively, it is of outmost importance to limit losses rather than to chase after high returns. The easiest way to limit losses is to hedge with an anti-correlated asset, such as Treasuries or Gold (and to of course diversify both in assets and strategies). So if the market fell by 50% in a period of few days, chances are that TLT (as a safe-heaven) would rise maybe 10, 20 or even 40%. Holding both would limit portfolio losses, which in the long run results in higher compound returns.

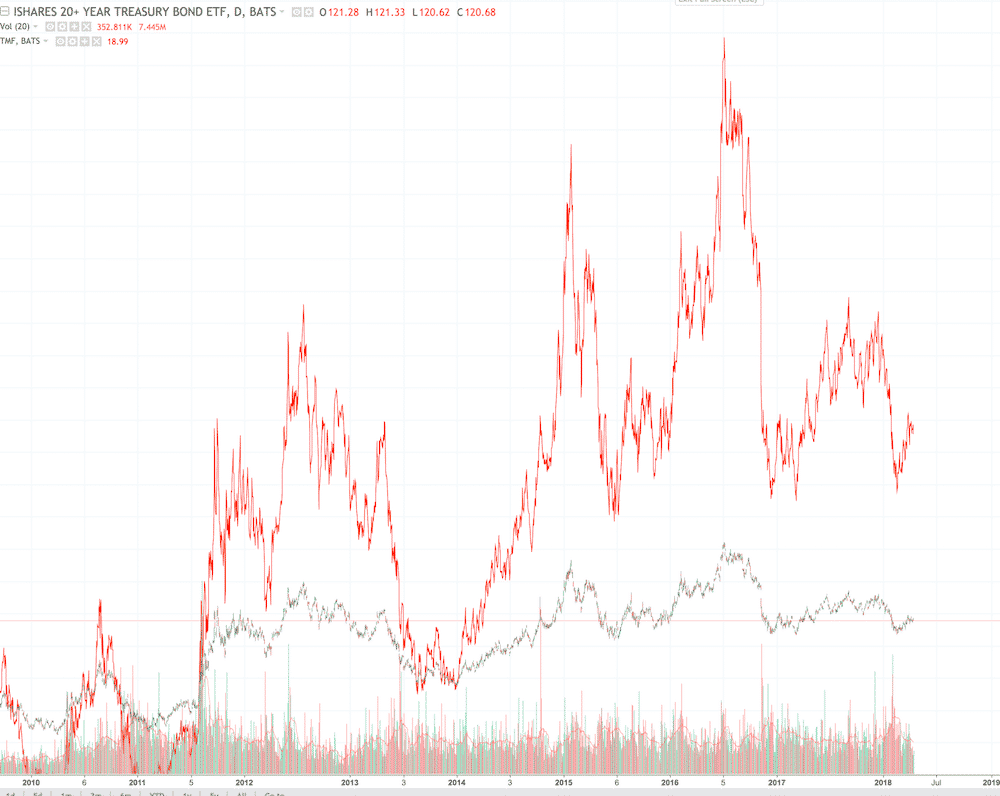

TMF is used for the same purposes in our riskier strategies. It just “boosts” the hedge since 10% of portfolio in TMF is almost like buying 30% TLT. Whether TMF tracks exactly at 3x or 2.4X the TLT is of less importance. What is very important is that SPY and TLT, Equities and Treasuries, remain negatively correlated in the medium term so that a 2008 like crisis would result in Treasuries moving up and softening the blow.

That said, if you were to trade UIS using SPY/TLT or SPXL/TMF or shorting SPXS/TMV it maybe better to short SPXS/TMV as you would gain a little extra return from the decay of both ETFs, although you would have to factor in borrowing costs. Hope this helps clarify.Vangelis

KeymasterI own 2 macs with windows installed via bootcamp. QuantTrader runs fine on both. I also keep a small Amazon aws EC2 instance running windows 24/7 that I can remotely connect from anywhere and run QuantTrader (as well as other windows apps, costs around $14/month). This is good solution since you can connect from a borrowed laptop or even a smartphone and get the signals from anywhere.

Vangelis

KeymasterLeveraged funds have decay and do not track the underlying at the quoted multiplier. TMF in the long run will not perform 3x the TLT. That just means that it may perform 2.3 or 1.5 times the underlying, depending on the path. When someone says it is not recommended to hold leveraged funds it is meant in the context of expecting to make 3x or 2x the underlying. This is not what we expect with TMF. We use it as a hedge. Best is to look at a graph between TLT and TMF.

Vangelis

KeymasterHelo Michael,

First of all, to retrieve any custom strategies after a portfolio update, you can go back to older .ini files that QT regularly backs up. They look like this:180223112233_QuantTrader.ini, where the numbers in from stand for Date and time. Create a new folder, place a copy of the QuantTrader.exe file together with an older .ini file, Rename the xxxxxx_QuantTrader.ini file to QuantTrader.ini and run the .exe from that folder. This will launch QuantTrader and force to read the local .ini file.

It’s a good idea to keep multiple QuantTrader folders, one with the latest portfolio and others with other custom setups that you do not update.

The problem of migrating a meta strategy to the new strategies has not been solved yet. QuantTrader can import and export simple strategies only, not strategies of strategies. Usually custom meta-strategies run on custom sub-strategies with often non-modified names so importing a meta-strat becomes error-prone.

So far there is not an easy solution to this. You have to either run an older custom setup or get the latest portfolio and re-create the meta-strategy from scratch. We are working on this to find a sensible way to accommodate custom workflows.

Vangelis

KeymasterBryan,

Your number (2) example is correct.

A simpler example:

SPY

EFA

EEM

TLTThe last stock/ETF in the list in the portfolio manager works as a ‘hedge’ if the DR Algo is chosen and will always be included. So when we pick DR and Top 1 ETF, the algo will pick the best ETF from SPY/EFA/EEM and then combine it with TLT. The result will be allocation to two ETFs always inclusive of the last ETF.

In the Nasdaq 100 hedged, the last symbol is #Nasdaq. So the DR algo would rank TMF and UGLD and then combine the best with #Nasdaq, i.e., what you mentioned as choice (2).Alex just included a much needed table explaining the modified sharpe algos in this new post:

https://logical-invest.com/video-tutorial-quanttrader-a-complete-walk-through-for-new-users/Vangelis

KeymasterDear Stefan,

We usually work with the assumption that all strategies are available to our subscribers. This is why we made such a recommendation. Obviously this is wrong and we apologise.

How you would determine when it is recommended to re-enter into 3xUIS? Is it based on VIX having held a certain level for a certain period of time?

You can re-enter when the VIX future’s term structure is back to normal, ie when the curve at vixcentral.com slopes upwards and it is time to rebalance.

That the subscriber community would be informed of that change/improvement in the volatility environment.

We can post/email when this happens.

As I took the LI Investment Outlook comment as a discretionary recommendation to exit 3xUIS, can I please recommend that the LI team model in QT returns based on rotating out of 3xUIS and into 1xUIS.

This would confuse a new subscriber 1 year from now. They would be looking at the UIS 3x chart and history and suddenly see a different allocation, using different ETFs. If the market was to crash tomorrow, they would look back and be sure we are somehow cheating. The forum, the newsletters and both UIS and 3x UIS signals are available online so that everyone can research and track what happened.

I would also recommend that LI make it very clear when apparently discretionarily overriding a strategy and make explicit the basis of the reason for this override and when LI recommend re-entering the strategy.

We will do that. If we override, we will be clear about it and write it in the signals post or via private email. Not in the newsletter which is opinion and published to the general public.

Furthermore, we had a February recommendation to invest in Gold which is no longer in the March recommendation – can you please confirm why this changed?

I assume you mean this:

“Our strategies have been adapted, starting this February, to include gold in our new hedging mechanism. Gold is a well respected safe heaven asset. It performs well in inflation regimes and can be a “go-to” safety asset for institutional investors if stocks and bond fail. You can read more about this major update in Frank’s article.”This is not a recommendation. We adapt our strategies once every few years to keep up with market changes. We added Gold as an extra hedge to our strategies. The strategy algo may (or may not) allocate to gold depending on the state of the market.

Vangelis

KeymasterI guess the comment was vague and not worded correctly so let me try to clarify. This is not about wether the UIS or 3x UIS strategy will continue to perform as expected. Neither does it mean that one should rotate from one to the other. It has to do with which version tends to be more efficient at certain environments because of how leveraged ETFs work.

Let’s take an example: Let’s say SPY is at a theoretical price of 100, SPXL (3x long) at a price of 100 and SPXS (3x short) is at a price of 100 . After fluctuating up and down, 1 month later SPY ends up back at 100. For reasons I will not get into here, SPXL will end up at around 97 (due to ‘tracking error’) and SPXS will end up around 95. The divergence is a function of how volatile (larger ups and downs) the moves are, the leverage of the ETFs (2x or 3x) and whether the leveraged ETF is an inverse one (bigger divergence for inverse). So if one is expecting a flat and volatile market and has the funds and access to short leveraged ETFs, the preference would be:

a. Implement UIS by shorting SPXS and TMV and gain slightly from the tracking error (minus borrowing costs)

b. Long UIS.

c. Long 3x UIS (loose from the tracking error).The opposite happens when the market goes straight up (or down). If SPY ended up at 110 and every day was an up day (no ups and down) SPXL would end up at 140+ (ie gain of more than 3x the underlying). Th opposite is true also. If SPY were to ‘crash’ in a straight line, SPXL would crash more than 3x times.

So 3xUIS is less efficient in a flat or falling market.

This does not mean you would ‘rotate’ from one strategy to another. It just means that if you have enough funds and expect a correction or a flat market, it may be better to stay with UIS than use the 3x. Again, it is a minor comment. Normally the choice between the three version comes down to how much money is available to commit (ie 10,000 vs 500,000) and whether there is access to short 3x ETFs with cheap borrowing cost. I trade the inverse 3x’s, Frank enhances further by using options :)

The bottom line is that UIS is a strategy that has worked in the past and hopefully will continue to do so. Whether you trade using 3x ETFs, shorting inverse ETFs or selling puts may bring some extra returns provided you have the time and energy to deal with these minor tweaks.

Vangelis

KeymasterHi Aati,

True, this is a bit confusing and undocumented so here’s a short explanation:

Our methodology is to rebalance on the last day of the month. To see what this allocation is for this month (ie, the signal produced on the last day of January), you go to Allocations–>Invested tab. This will show you what you would be invested in had you followed the signal on Jan 31th. On the other hand, QT calculates allocations on every new data, ie every day. So if you were to rebalance today, you would use the Allocations–>Actual tab and the allocation would be different from the allocation at the turn of the month. This give the flexibility for users to rebalance on any day of the month.Vangelis

KeymasterYour impression is correct. I got carried away thinking we were discussing MYRS.

Only MYRS rebalance twice a month. All other strategies, including the Nasdaq 100, rebalance monthly.Vangelis

KeymasterI see you have done your homework! I was accepted in the closed Beta a couple of months ago. It is a great idea as it facilitates rebalancing and is more secure than an exchange. The problem I encountered with Prism is the fees. For now they are waived but at a proposed 0.5% per rebalance they are outrageous. That means that if you rebalance monthly you give away 1%/month = 12% per year. This is peanuts for crypto buffs but for equity traders it’s a pretty substantial number. What will be interesting if prism opens up both sides of the market, as they propose to do, so that you can post collateral and get part of that 12% :) Once fees become ‘logical’ it seems like be a viable management tool for us.

- AuthorPosts