All strategies positive for 2019

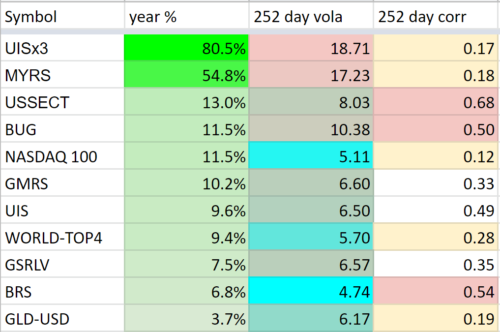

Logical Invest 2019 historical strategy performance based on actual signals issued.

Last column is the correlation of each strategy to the S&P500.

- The Leveraged Universal Investment strategy (3x UIS) up 80%.

- The Maximum Yield Strategy (MYRS) up 54%.

- Our modified permanent portfolio (the “BUG”) up 11% with less than half the SP500 volatility.

- The Bond Rotation Strategy (BRS) up 6% with 1/3 the SP500 volatility.

- Most strategies had a correlation to the SP500 of less than 0.3.

For 2020: Stability & Protection

Starting January 1 2020, we are implementing several modifications to our strategies to make them less volatile. The biggest modification concerns the Hedge sub-strategy to ensure proper diversification between equities and multiple safe-heaven assets. Frank’s 2020 Logical-Invest strategy update is a must-read.

Commentary

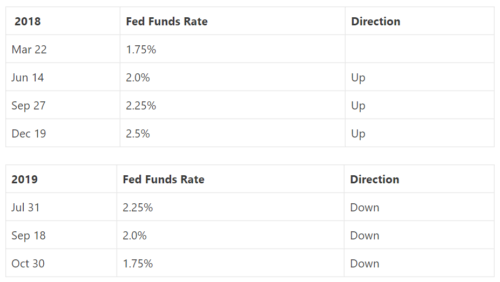

Contrary to expectations 2019 proved to be an excellent year for investors. Various economic and political risk including the inverted yield curve, negative rates, the unfolding Brexit saga, government protests, trade wars, a presidential impeachment as well as general rising inequality and global populism, did nothing to rattle the market. Volatility remained low as the SP500 broke straight through the 3000 mark. This has been partly fuelled by an extension of fiscal and monetary policy with the FED briefly trying to tighten in 2018 but backing off on the first sign of weakness :

Could it come down to that? 2018 was a horrible investing year for all asset classes, while 2019 was an excellent one.

Walking into a new decade there are already quite few theories about investing themes and potential changes in economic regimes. Some call for increased inflation as governments try to devalue their way out of the coming pension conundrum. Some argue that increasing productivity via artificial intelligence, IoT, etc will solve such problems and growth can continue as usual. Some argue that climate change and sustainability are inevitable costs and will hinder, short term, global growth. Some argue that tectonic geo-political changes are coming that may bring unpredictable changes in the balance of powers to be.

When it comes to investing, things may be simpler: Using a flexible set of tools one can navigate through inflationary, deflationary, stagnant or growth markets.

We are taking a defensive stance for 2020 as we are looking to protect profits amassed during a 10 year bull market. We stay in the markets to capitalise on further U.S. or international growth as well as fight inflation. But we also weigh in on safe heaven assets so that our strategies are always hedged in case a large correction does materialise.

Portfolio Optimization

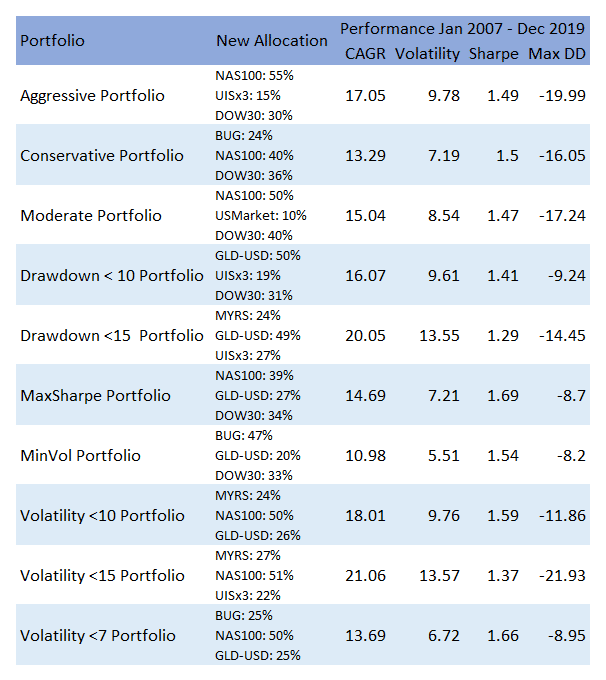

For the new year we have also performed the Markowitz style optimization of our default portfolios. This allows us to incorporate now the information from 2019, while the optimization period is from Jan 1st, 2007 to Dec 31st, 2019, so now 13 years of history are considered.

You can see the new allocations of the portfolios to the strategies below, and the resulting historical performance of the 2007-2019 period:

Recall our default portfolios have a static allocation to the strategies, while these change their allocations to EFT/Stocks in the monthly rebalancing cycle.

Again please do read Frank Grossmann’s strategy update coming into 2020 and add your comments and thought.

We look forward to a vivid discussion. Visit our site for daily updated dashboard.

US markets outperformed during the last 10 years, but wouldn’t it make sense to include any international exposure to the Core Portfolios? Perhaps by adding GMRS?

Hi,

Is it possible to get what the allocations were for 2019?

Thank you

Hello Nicolaas,

I can send you a file with allocations. Let me know for which ones.