All quiet on the western front

All seems to be going well in the investment world, at least according to the mainstream media. Major central banks have successfully raised interest rates, taming runaway inflation which is now decreasing towards a desired 2%, or at worst a manageable 3%. All done without so much as cracking an egg, avoiding a recession or causing any pain to equity investors. The so called ‘soft landing’ is underway and the Fed is now preparing to embark on a new path of forthcoming rate cuts. The timing is still uncertain, with current predictions ranging from early March to the beginning of summer.

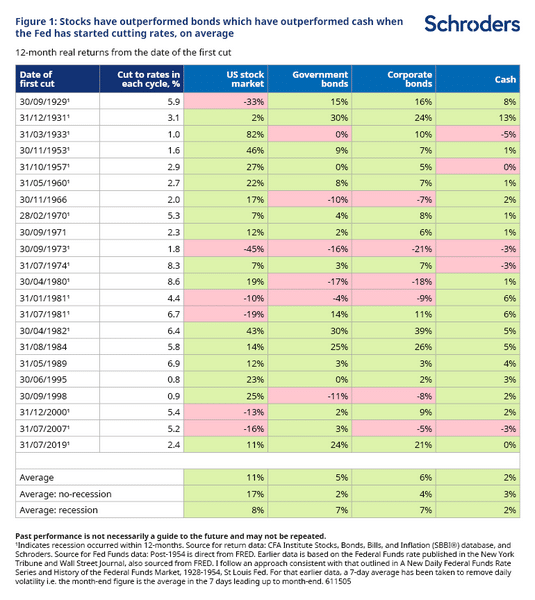

A rate cut, or the start of a series of rate cuts, is very bullish for both Equities and Bonds. A recent post by Schroders’ D. Lamont called “How do stocks, bonds and cash perform when the Fed starts cutting rates?“, shows that historically, the shift from raising to cutting rates is followed by an average performance increase of 11% over the next 12 months for equities and 6% for government bonds. More information can be found in the table below:

Clouds for March?

If you’ve been around the markets long enough, you may be disconcerted by this rare consensus that everything is fine. It’s unusual and potentially worrisome. The markets are never that straightforward. So, let’s diverge from the mainstream and consider an alternative perspective.

What is BTFP?

On his latest blog Arthur Hayes (of crypto exchange BitMEX infamy) suggests that not everything is as rosy in America. In the article called “Yellen or Talkin’?” (a pun on a previous title regarding Yellen, “Bad Gurl“), he argues that the market is running on “Hopium”, hope originating In FED talk. Talk of cutting interest rates and talk of injecting liquidity.

However, he claims, we should be focusing on the impending end of the “Bank Term Funding Program” (BTFP), the Fed’s emergency tool to contain the March 2023 bank panic and liquidity crisis. It is set to expire on March 11. Without further action, Hayes argues, banks may be forced to repay the nearly $200 billion borrowed, potentially triggering a liquidity crisis.

Despite this, Hayes maintains a long-term bullish outlook: He believes any crisis will be short-lived, forcing the Fed to go beyond just ‘talking’ and start ‘Yellen’—either by extending the program or by injecting liquidity propelling the market forward once again.

Logical Invest Strategy performance

Most strategies were positive for the month with the exception of the riskier strategies that suffered from exposure to safe heavens as treasuries (TLT -2.2%) and gold (GLD -1.4%) corrected.

Let us know what you think in our forum.

The Logical-Invest team.