The Bull continues – All strategies positive for the month

In July, all our strategies were positive as the SP500 price nears it’s all time high.

South America first to lower rates

The Federal Reserve (FED) paused rate hikes last month, creating expectations of a possible plateau in tightening policy. However, it surprised the market by deciding to raise rates in July by 0.25%, signaling its continued commitment to fighting inflation.

Meanwhile, in Chile, the central bank held rates at 11.25% for 9 months and successfully lowered inflation. It has now made a significant move by deciding to cut rates by 100 basis points. Uruguay has already led the charge regionally with a 25 basis points cut in April and a 50 basis point cut to 10.75% in July. Brazil, the region’s largest economy, is also expected to start cutting rates in August.

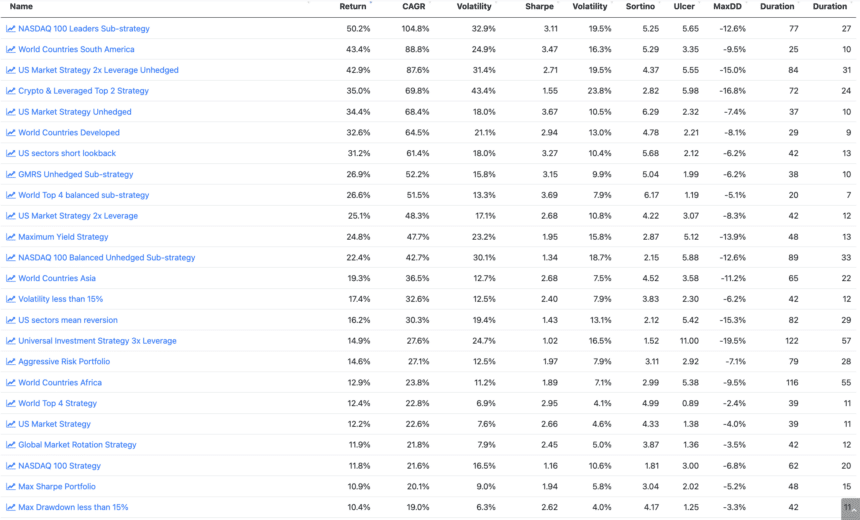

As markets often move faster than we can keep up with, falling rates typically indicate a booming equity market. Confirming this trend, our foreign equity, unhedged strategies show impressive year-to-date returns. The World Countries South America strategy stands out with a 43.4% return, while the more diversified World Top 4 balanced sub-strategy prints at 26.6%.

Our main strategies protect

It’s worth highlighting that our main strategies are primarily focused on capital preservation, as they are carefully hedged to safeguard against unexpected events or sudden market corrections.

If, however, your goal is to outperform the SP500, we recommend considering our non-hedged sub-strategies.

Our un-hedged strategies

As mentioned in our previous newsletter, you can browse through our sub-strategies and access our aggressive non-hedged strategies that do best in bull markets, including the NASDAQ 100 Leaders Sub-strategy (+50.2%), the World Countries South America (+43.4%), US Market Strategy Unhedged (+34.4%), World Countries Developed (+32.6%) and many more.

It is best to combine them to express your own point of view on the market while still maintaining discipline by following the model rules. Visit the sub-strategies here.

Let us know what you think in our forum.

The Logical-Invest team.