August correction

The current month has seen its fair share of market turbulence, with the S&P 500 experiencing a modest decline of 1.7%. While this dip breaks a five-month winning streak, it’s important to keep in mind the broader context. The Nasdaq Composite boasted an exceptional first half of the year, and the S&P 500’s year-to-date gains remain an impressive 18.6%.

Seasonal Trends

August historically presents challenges for the SP500, so a slight correction is in line with seasonal tendencies. Keep in mind that September is seasonally a weak so keep an eye out for possible continued correction or side-action.

China’s 2007 moment?

The recent drop has been influenced by concerns over a potential real estate crisis in China. Two of the largest key players in the Chinese real estate market are in trouble. Country Garden Holdings has posted a first half-year loss of $7 billion and has missed payments on a bond payment raising concerns of possible default while Evergrande has actually taken the step of filing for bankruptcy protection in the U.S. Fortunately, China’s central bank was quick to implemented interest rate cuts, demonstrating a commitment to stabilising the situation.

Interest Rates and Federal Reserve Outlook

Additional pressure on the U.S. market has emerged due to the upward trajectory of Treasury yields. This has prompted concerns that the Federal Reserve may consider extending higher rates. With inflation hovering above their target and a competitive job market, the potential for future rate hikes is very real. As a result, market participants are being cautious.

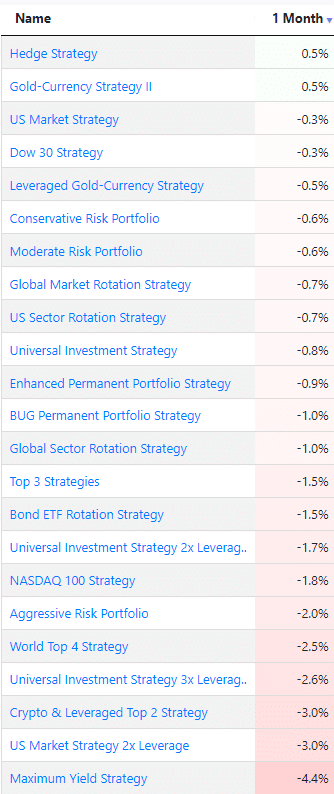

Performances

Mostly negative performances for the month but as expected, with less drawdowns than the S&P500.

Let us know what you think in our forum.

The Logical-Invest team.