We have made some quite important changes to the Logical Invest strategies for 2019. Please note that the January strategy allocations will be calculated based on these updated strategies.

401 / IRA compliant base strategies

The new strategies will not use leveraged or inverse ETFs, making them and the portfolios derived from them, more 401 / IRA friendly. The changes have been backtested and do not reduce the performance of the strategies due to a well redesigned new hedging strategy.

New hedging strategy

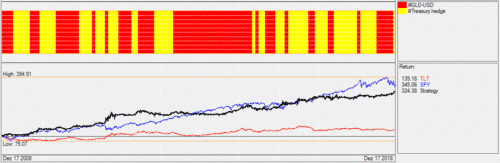

The hedging strategy is a very important part of all strategies. The new hedging strategy switches between a Treasury sub-strategy and a Gold sub-strategy, depending on which sub-strategy is performing better at the moment. The following chart shows how the strategy switches between the yellow Treasury Hedge and the red Gold-USD strategies.

With an average performance of 12.5% per year the strategy has been a good performer in itself. More importantly, it has no or even negative correlation to equity strategies. This makes it a good safe-haven hedging strategy for difficult market periods.

The strategy does not switch directly between GLD and TLT because this way we can not get more than 6% annual performance for a 10 year backtest. The reason is that there have been long periods where equity was performing really well and both Gold and Treasuries were underperforming. Adding a hedging strategy with a bad performance can be quite a drag to the overall performance of a strategy.

We had to find some alternative ETFs we could use instead of GLD or TLT.

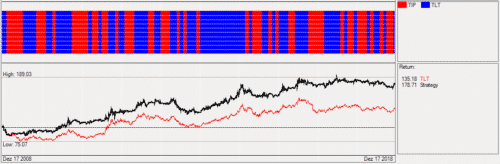

For TLT we had already developed the Treasury strategy in the past which switches between the TLT (iShares 20+ Year Treasury Bond ETF) and the inflation protected TIP (iShares TIPS Bond ETF). This strategy has been used before in some of our strategies.

The chart below shows the return of the Treasury hedge strategy compared to the TLT Treasury ETF. With an annual performance of 6% this strategy does about twice as good as just investing in the TLT ETF with 3% annual return.

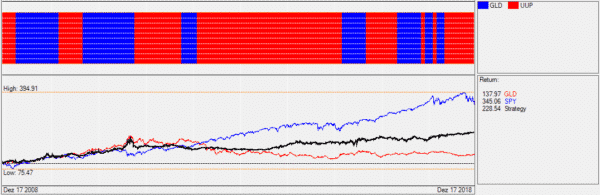

In the Gold-USD strategy we now switch between GLD and UUP, the US Dollar Index ETF. These two ETFs have a negative correlation to each other but still have a very low correlation to equities. Looking back to the market corrections of the last 20 years, UUP often acted as a safe-haven ETF. At every correction, at least one of the two ETFs was going up.

The chart below shows the chart of the GLD-USD strategy. As you see about half of the time this strategy was invested in the US Dollar index and was able to avoid most of Gold’s decline after 2011.

Switching between these two quite simple strategies resulted in quite a solid performance of the new Hedge strategy. All 4 ETFs are very liquid and are also allowed in many 401 / IRA accounts which is a mayor advantage to the last version of the Hedge strategy which incorporated the short sector strategy (composed of leveraged inverse ETFs).

The new U.S. market strategy

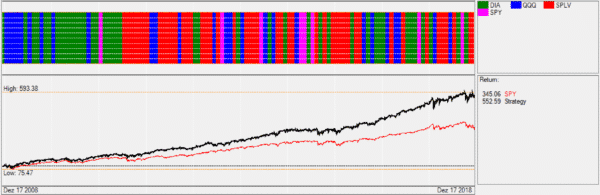

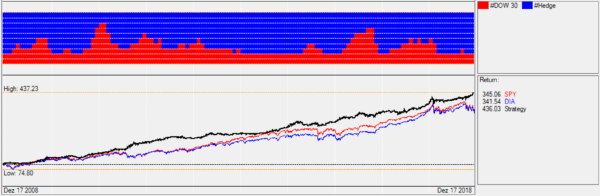

Instead of investing only in the SPY (S&P 500) ETF for a US market investment, we designed a new US market strategy for this purpose. The new strategy can now switch between SPY (S&P500), QQQ (Nasdaq 100), DIA (Dow 30) and SPLV (S&P 500 low volatility). All these ETFs are very liquid with a very small spread so it should be easy to switch between them with negligible cost.

The strategy did perform substantially better than a simple SPY investment. The average annual performance for the last 10 years was 18.6% compared to 13.2% for the SPY ETF. Quite beneficial is the possibility to switch to the defensive SPLV S&P 500 low volatility ETF in times of increased market volatility.

This strategy is also used as a sub-strategy in the World Country Top 4 strategy and in the Global Market Rotation strategy. The strategy however can also be used on its own combined with the Hedge strategy. This way we end up with a slightly enhanced version of our old Universal Investment Strategy which did invest in SPY-TLT.

The hedged US Market strategy had an average performance of 16.6% with a Sharpe ratio of 2 during the last 10 years. As a comparison, the classic SPY-TLT combination performed only at about 10% annually with a Sharpe of 1.2 (using parameters targeting a low volatility portfolio). An average allocation for such a setup would be about the 60% SPY – 40% TLT, an allocation which is used by many investors.

The new Dow 30 Top 4 strategy

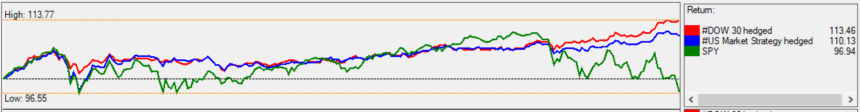

We developed the Dow 30 Top 4 strategy some years ago together with the Nasdaq 100 strategy. We never published it because the Nasdaq 100 Top 4 strategy was outperforming the Dow strategy in the technology driven bull market we had now for years. Going forward however the Dow 30 Top 4 strategy could be very beneficial, as stock picking becomes much more important in volatile, sideways moving markets. This year’s (2018) 14% performance of the strategy is very impressive and shows that the Dow includes many defensive and stable consumer or utility stocks which perform well in difficult markets. This month (December 2018) the strategy is invested in Coca-Cola, Pfizer, Merk, and Procter & Gamble.

The Dow 30 Top 4 hedged strategy performed at annual 15.9% with a 1.96 sharpe ratio for the last 10 years.

The performance of the Dow 30 strategy is quite the same as the simpler US market strategy, however in volatile markets like this year, the stock picking Dow 30 outperformed. Notably, the February drawdown (red chart versus blue chart) was only half of the US market strategy as the Dow strategy excludes high volatile stocks.

401k and Roth IRA compliant portfolios

With the above mentioned changes to our strategies, we’re now also able to offer portfolios which are fully compliant with most 401k and IRA ROTH plans. For investors in these plans we offer our Core Portfolios, while investors with taxed accounts can choose from a broader and unconstrained set of portfolios in our Portfolio Library.

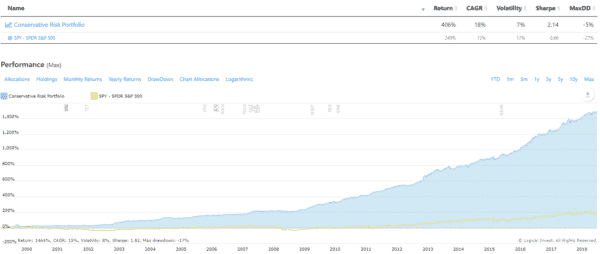

The reviewed Conservative Portfolio has historically achieved a CAGR of 18% with a muted volatility of only 7% over the last 10 years:

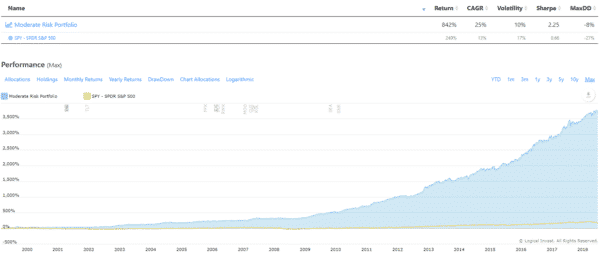

At the same time investors seeking moderate risk exposure will be interested in our Moderate Risk Portfolio, offering an annual return of 25% with only 10% historical volatility over the same period:

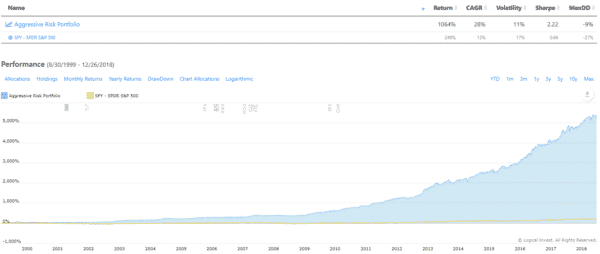

For more growth oriented investors we’ve build an Aggressive Risk Portfolio with a historical return of 28% and a dream Sharpe Ratio of 2.2:

All portfolios now can allocate to the newly introduced strategies and have been re-optimized for this purpose, your can do further research and customization with the Portfolio Optimizer.

Looking forward to a vivid discussion in the comment section,

Logical Invest, December 2018

Thanks Frank..Question on 401k/IRA type strategies…I only trade/invest using tax sheltered accounts. The GLD-USD strategy uses UUP which issues K-1s These are not favorable in IRAs/401Ks…..especially at the % levels the hedges utilize them. They would surely trigger UBTI. Is the an alternative you could suggest? The only thing I found that was close was USDU from WisdomTree….Thoughts? Thx

Beside USDU you could just buy forex USD/EUR instead (or sell EUR/USD) as the Euro is by far the biggest currency part in UUP. You can also buy the DX future, however the disadvantage is that one future is about 100’000$, so it only works for bigger accounts.

Frank, I am a new member here. Do you change your holding b/w a month or is it just once at the start of the month ?

We only rebalance once at the end of month

Hi Frank, I have been using UIS, Leveraged Gold Currency and GMRS with my German broker. We used to adjust to available ETF`s in the German market. After the change UUP – Invesco DB USD Index Bullish Fund is a dominant ETF in this month. This UUP is not available in Germany. Do you have an alternative recommendation? Is the following: ETFS Short USD Long EUR; WKN: A1EK0W; Emittent: ETFS Foreign Exchange Limited a suitable replacement? Thank you, Jochen

Buying UUP is basically the same as buying forex USD/EUR. This has even the advantage that you get a 2-3% rate return

Hello, how long have your strategies been trading live (in other words, out of sample)?

We do the strategies since about 5 years, however they are constantly adapted. The latest update was an enhanced hedging strategy composed by the two Gold and Treasury strategies. So going forward, these are new modifications which have only been in place for one (out of sample) month now. If we do modifications, then we always keep the character of the strategy and we always look that the current strategy would have also worked well for all market corrections during the last 20 years. We use a statistical evaluation of the parameters to make sure that the strategies are not overfitted but are working stable within a broad range of the optimizing variables.