Special Topic: IRA investment using QuantTrader

Logical Invest

Investment Outlook

December 2016

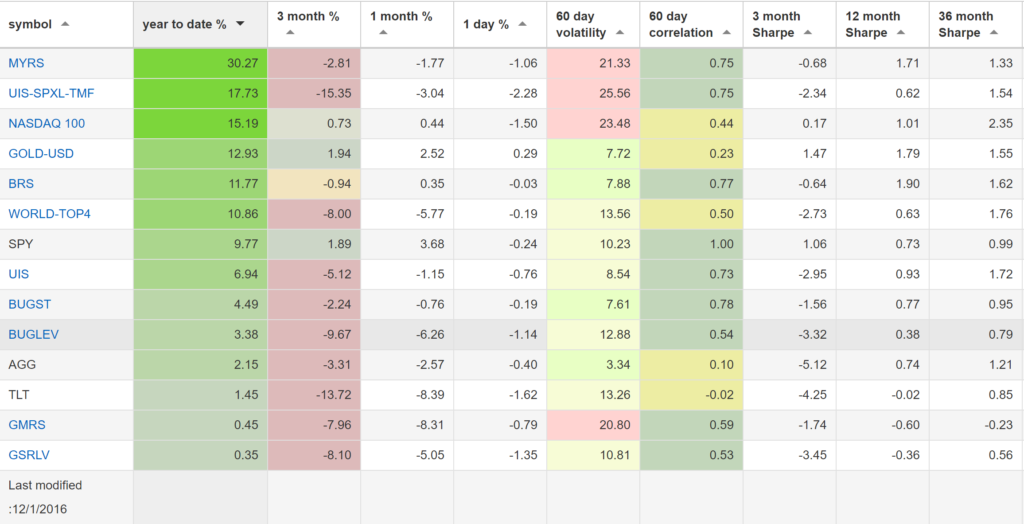

Our top year-to-date strategies:

- The Maximum Yield strategy with 30.27% return.

- The Leveraged Universal strategy with 17.73% return.

- The NASDAQ 100 strategy with 15.19% return.

SPY, the S&P500 ETF, returned 9.77%, year-to-date.

NEWS:

- Enhancement of the Treasury hedge in our strategies (link).

Market comment:

Presidents change, markets change and so do we.

As our subscribers know well, Treasuries have been a cornerstone of our strategies. For the last few months many investors remained sceptical as 0% interest rates meant there was only one way for rates to go: Up. Although the logic has merit, markets often defy common sense and with the help of central banks the unthinkable became a reality: negative interest rates. Adding Treasuries to one’s portfolio proved to be an excellent strategy, post 2009.

We still believe the 30-year Treasury etf (TLT) is an excellent diversifier for our strategies but recent developments convinced us that alternative hedging instruments are worth pursuing.

For that reason we are changing our methodology to allow the use of inflation protected treasuries (TIPS) as well as well as our Bond Rotation strategy itself (BRS), as hedges to our equity portfolios. As an example, our Universal Investment strategy will allocate a percentage of assets to SPY and the rest to either TLT or TIP based on TLT vs TIP rules-based evaluation. Strategies like the Global Market Rotation will hedge their equity part with the BRS strategy as a whole. You can find a more detailed explanation of the new methodology in this article.

This month was a difficult one for many of our strategies because of the simultaneous drop in treasuries, gold and non-U.S. equity markets as the US$ surged about 4.5% compared to major foreign currencies. GMRS lost 8% this month alone, followed by the BUG (leveraged version) at -6% due to the TLT and GLD corrections. The World Top 4 strategy also corrected at -5.77% and is now up 10.86% year to date.

Our Gold and Bond strategies outperformed their respective assets: The Gold-USD strategy managed a 2.5% increase while our Bond strategy BRS remained flat at 0.35% despite the drop in bond prices.

As traders ourselves we monitor the markets and if need be, update our models to cope with changing environments.

We wish you a healthy and profitable December.

Logical Invest, December 1, 2016

Strategy performance overview:

Visit our site for daily updated performance tables.

Special topic IRA Investment

Read how to apply our development backtest software QuantTrader as a DIY investor or passive investment advisor to create your own IRA Investment in just a couple of minutes. Contact us with your special requests for building your own ETF Rotation Strategy for your IRA Investment.

Symbols:

BRS – Bond Rotation Strategy

BUGST – A conservative Permanent Portfolio Strategy

BUGLEV – A leveraged Permanent Portfolio Strategy

GMRS – Global Market Rotation Strategy

GMRSE – Global Market Rotation Strategy Enhanced

GSRLV – Global Sector Rotation low volatility

NASDAQ100 – Nasdaq 100 strategy

WORLD-TOP4 – The Top 4 World Country Strategy

UIS – Universal Investment Strategy

UIS-SPXL-TMF – 3x leveraged Universal Investment Strategy

AGG – iShares Core Total US Bond (4-5yr)

SPY – SPDR S&P 500 Index

TLT – iShares Barclays Long-Term Trsry (15-18yr)