Home › Forums › Logical Invest Forum › Strategy: Global Market Rotation Strategy

- This topic has 21 replies, 10 voices, and was last updated 6 years, 10 months ago by

Alex @ Logical Invest.

- AuthorPosts

- 10/27/2014 at 12:41 am #12108

Alex @ Logical Invest

KeymasterSupport and discussion thread for the strategy.

12/28/2014 at 2:43 pm #15304Noam

ParticipantIn your performance spreadsheet, you show two positions MDY (50%) and EDV (50%) for the date of 10/31/14 thru 11/28/14. Your stated rules indicate that you would be invested in the top-ranked position. On that date, my calculations indicated that MDY was the top ranked ETF. Why did you change the rules and use two positions instead of one? I know you use money management, but I thought money management referred to an investment of a certain percentage into the top ranked fund plus a percentage into cash ie (MDY (50%) and CASH (50%) or MDY (70%) and CASH (30%) etc, not an investment into the top 2 ranked funds. Could you please explain this, and when do you use the top two ranked ETF’s instead of the top ranked ETF?

Thank you.

12/28/2014 at 4:26 pm #15309Alex @ Logical Invest

KeymasterNoam, thanks for the comment. As of October we have updated this strategy to the new “Adaptive Allocation” logic, e.g. instead of binary switching into the Top1 ranked ETF we now deploy a Sharpe Ratio optimization and vary the allocation % into the Top2 ranked ETF. This results in much smoother changes in the allocation, less transaction costs, and much better performance. We’re gradually changing all former strategies into this new “Adaptive Allocation” algorithm, but based on your feedback might have missed the opportunity to inform you properly. Here the full article on this change, we plan to do further posts with greater detail. Glad to receive your feedback on this change.

12/30/2014 at 12:48 am #15361Noam

ParticipantAlexander, thank you for the quick response. You say that you are “changing all former strategies into this new Adaptive Allocation algorithm”. Does this mean that strategies which used to select 1 ETF such as the Max Yield, Global Market, and Global Market Enhanced, will now select the top 2 ETF’s?

12/30/2014 at 2:13 am #15362Alex @ Logical Invest

KeymasterNoam, yes. Here the respective posts which also have been part of the strategy signals for MYRS, GMR and BRS in the past two months. Also see the “Historical Return Tables” for how this has worked in practice so far. You can see the feedback and discussion in each post, we’re working on further articles in more depth.

Let me add that this is rather a logical evolution than a revolution. This adaptive allocation now incorporates the hedging proposals Frank has provided already in the past, and allows for much smoother changes in the allocation than the former binary 100% switches.

05/10/2015 at 1:08 pm #22167STEPHEN

ParticipantOn May 10 L-I Tweeted “Our Global Market Rotation Strategy – 10% Return last 3 months,” but here https://logical-invest.com/portfolio-items/global-market-rotation-strategy/ I see a 3 Months -1.5%. Furthermore, when I click on the 3 Months Zoom the 3 Months Strategy Performance is .28%. What’s with all the different performance results for the same period? Am I missing something? I sent a message to you about other Tweet performance claim discrepancies without any reply from you.

05/10/2015 at 3:30 pm #22174Alex @ Logical Invest

KeymasterStephen, the tweet you mention was a static snapshot I took on 3/19, covering the 3months before also for the other strategies. My idea was to update the tweets every month, but that was a bit to ambitious with our current backlog of things to publish. Will update them to show performance since inception, this requires less maintanance, and avoids the perception we’re publishing wrong or cherry-picking the numbers.

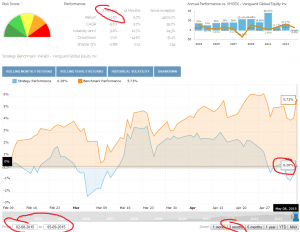

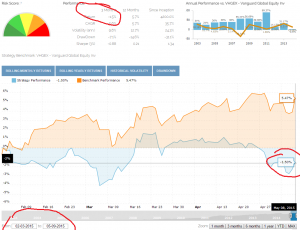

On your other observation, the statistics in the performance table uses a 66 days (22 trading days/m * 3) window which is a common simplification, while the chart by default uses true 3 calendar months, this explains the difference. This is a technical imperfection we’ve not been able to eliminate yet, but below two screenshot to show you the reconciliation as of today.

Finally, sorry for not responding your previous message, had some notebook free ‘Cinco de Mayo’ days at the beach, promise improvement going forward.. normally we proud ourself for a quick turnover in responses even if one partner is out, but failed you here..

Selecting ‘3months’ window in chart, e.g. 02/08 – 05/09 –> 0.28%:

‘3months’ = 66 trading days in performance statistics, e.g. 02/03 – 05/09 –> -1.5%:

05/11/2015 at 8:33 am #22346STEPHEN

Participant“The perception we’re publishing wrong or cherry-picking the numbers” IS the only perception of a person who checks the claims. I must admit that such a practice now makes me question the back-test results of all the strategies. Also, it seems to me that you should do the right thing and delete the Tweets that aren’t current and are in fact inaccurate.

05/11/2015 at 12:29 pm #22367Alex @ Logical Invest

KeymasterStephen, I cannot change your perception, only continue to give you all the facts and elements so you change it by your own. This is why we publish all backtest and live performance data with a lot of transparency and hopefully clarity. Happy to chat live over Skype on any remaining doubt, can reach me under AlexanderHorn672

All the best,

Alex05/12/2015 at 6:34 am #22475STEPHEN

Participant“Happy to chat live over Skype on any remaining doubt” – it appears that you deleted the Tweets in question. That improves my perception immensely.Thank you.

05/18/2015 at 7:45 pm #23177scrichley

ParticipantI very much prefer the new strategy for the reduced trading/slippage as well as for smoothing out returns resulting in the improved Sharpe ratio. Can I ask the management how the move to adaptive asset allocation should affect the alpha of the algorithm? I would expect if back tested all the way back, there might be some small reduction? I’m sure this strategy adjustment was back tested prior to the official change.

05/18/2015 at 9:45 pm #23190Vangelis

KeymasterScrichley,

I may not be following your question. The new improved MaxSharpe engine was fully tested and implemented around late last year. We looked at the results back through the full history and it does smooth the outcome.

Does this help?

Thanks

Scott05/19/2015 at 3:50 pm #23262scrichley

ParticipantScott, thank you for the quick response! Sorry I’ll try to make my question more clear. I understand the new algorithm should come with smoother returns. My question is should we expect a reduction in expected CAGR going forward based on the back testing?

06/08/2015 at 6:52 pm #25741STEPHEN

ParticipantWhat is the date of this “snapshot” Tweeted on June 8? It doesn’t appear to accurately reflect the YTD results. Am I missing something?

https://twitter.com/Logical_Invest/status/608014653348708352/photo/1

06/12/2015 at 8:58 am #26153Frank

ParticipantHi,

I’ve implemented the GMR Strategy based on the information in your related Seeking Alpha article and its comments. It comes quite close to the monthly ETF selections of Logical Invest’s version of the strategy, many months with exact matching, other months with just small differences in the ranking scores that lead to a different selection.But I have also found a few months with major differences in the scores where Logical Invest’s selection had a huge positive impact on the performance while the published version of the strategy kept investing in an ETF that suffered a major loss during the following month. In the ranking with the published strategy I get score differences of about 50% between the two ETFs, in a 0 to 100% range of the scores. So the ETF selected by Logical Invest was far from being at the top position. It was not a just slight difference in the scores that led to the selection of the other ETF.

Based on the momentum and volatility based ranking logic, even with dynamic calculation of the best look-back period and other parameters I don’t see a chance to get to the ETF selection as it was made in those situations. The most important case in the history of the strategy is the switch from EDV to MDY at the end of September 2011. That was brilliant bottom picking!!! I’d like to be able to make that decision in that moment! However, the momentum didn’t indicate by 30th Sep 2011 that there would be a bottom in MDY on 4th October and a powerful market turn which initiated an uptrend that lasts until today.

Does your proprietary strategy consider other things than momentum and volatility such as extreme market situations that scream for mean reversion? I observed that in most cases where my ranking of the ETF you selected gave it a score that was far from the top position, it was that the published strategy kept investing in a spiking EDV while the Logical Invest strategy switched to equities which were about to win in the comming market turn.

06/13/2015 at 6:14 pm #26273Vangelis

KeymasterFrankS,

I appreciate that you were not able to exactly replicate our formula. I guess that means we did our job, which was to provide a lot of hopefully useful information, but not enough to allow replication. This is our business and I am sure you appreciate that we prefer to give our intellectual property confidential.

All of our signals are shared with our subscribers in the published history, which we never change.

Kind Regards,

Scott04/01/2016 at 6:58 am #33276mk

ParticipantHello,

when and why have you added IHDG to the asset universe? Oh, and TMF and HEDJ. They were choosen in https://logical-invest.com/strategies/investment-and-return-tables/ but are not listed in the asset classes here https://logical-invest.com/portfolio-items/global-market-rotation-strategy/

best regards, M

04/30/2017 at 10:00 am #41083Michael Puchtler

ParticipantHello – the updated allocation for this strategy is ACWV + TLT, but TLT is not the best bond ETF. Can you check into this and either correct the signal or let me know if I missed an update to the strategy? Thank you.

04/30/2017 at 11:35 am #41094reuptake

Participant[quote quote=41083]Hello – the updated allocation for this strategy is ACWV + TLT, but TLT is not the best bond ETF. Can you check into this and either correct the signal or let me know if I missed an update to the strategy? Thank you.

[/quote]I have the same question, I even send a mail about it. For last few months I even used BRS strategy as a hedge for GMRS instead of single bond ETF. Now I’m bit puzzled, what should I do, since TLT is not used in BRS for next month.

05/01/2017 at 10:17 am #41208Vangelis

KeymasterFrom Frank Grossmann:

GMRS uses the Top1 ETF bond rotation strategy. This one has a shorter lookback of only 34 days. The result is a ranking like this:We rather like short lookback periods for the hedge because like this it reacts faster once the market begins to go down.`

Regards Frank

[attachment file=41210]

06/03/2017 at 12:49 pm #42339Howard

ParticipantWill you consider releasing a leveraged version of GMRS or WorldTop4 strategy? As a subscriber to all strategies, I found having 2 options (leveraged and un-leveraged) for the Univeral Investment Strategy very helpful. Tks, Howard

06/21/2017 at 6:42 am #42776Alex @ Logical Invest

KeymasterHello Howard,

do not think we´re going to lauch leveraged versions of the GMRS or WorldTop4 strategy – at least not as a subscription service. It would be very interesting though to test some versions in QuantTrader, see here for a discussion thread of other strategies from the community: https://logical-invest.com/forums/topic/showing-off-the-best-strategies-and-portfolios/

And if you have not so far, give QuantTrader a try with our free trial: https://logical-invest.com/rent-a-strategy/backtesting-software-quanttrader-free-trial/

- AuthorPosts

- You must be logged in to reply to this topic.