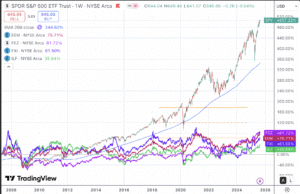

Our proprietary algorithms combine diverse asset classes, including US and global equities, bonds and gold with smart hedging into strategies that maximize risk-adjusted returns.

* Results are hypothetical based on backtests and do not account for slippage, fees or taxes. Backtesting has many inherent limitations, some of which are described in our Terms of Use.

Smart Hedging

Smart Hedging helps protect you from market crashes.

Transparency

Thoroughly backtested and documented so you know what’s “in the box”.

Customization

Combine multiple strategies to create your own personal portfolio.

Monthly Signals

Use our strategy signals to trade in your own accounts.

QuantTrader Software

Use our desktop application to create your own strategies for you or your clients. Learn more

Watch Our Welcome Video

Take control of your retirement account

Whether you have a 401k, an IRA, a Roth IRA, a SEP IRA or a taxable account, we give you the tools to design your investment portfolio using simple, cost-effective and proven strategies. You are in it for the long run and we can help you stay the course, avoiding emotional decision making and constant second guessing. There is no commitment, no fund transfers. Just register with your email address for a free trial.

Recent Posts:

Frequently Asked Questions

What is Logical Invest’s core philosophy?

Logical Invest, founded in 2013, specializes in transparent, rules-based investment strategies. Our core philosophy is to empower self-directed investors by providing clear, mechanical approaches that remove emotional decision-making. We offer thoroughly researched strategies that can be traded in personal accounts like 401ks and IRAs, helping you reduce expenses and potentially improve returns.

How does Logical Invest’s “smart hedging” work?

Our strategies incorporate smart hedging mechanisms designed to protect portfolios from significant market downturns. This involves dynamically adjusting allocations to assets like gold or bonds that tend to perform well when equities decline. Our algorithms objectively adapt to changing market conditions, which helps to minimize the impact of volatile periods.

When are trading signals released and when should I trade?

For backtesting purposes, trades are theoretically made on the close of the last day of the month. In practice, our signals are released shortly after the month closes and are sent to subscribers via email. Most subscribers typically execute their trades on the first day of the next month. The strategies are “low frequency,” so a one-day delay does not significantly affect performance.

What is the difference between a “Strategy” and a “Meta-Strategy”?

A Strategy is a defined set of rules that governs a specific investment decision, such as asset selection and allocation. A Meta-Strategy is a portfolio construction method that combines multiple sub-strategies. For example, a meta-strategy might dynamically adjust its capital allocation between different core strategies based on their individual performance and market conditions.

What is the QuantTrader software?

QuantTrader is our proprietary desktop backtesting software. It allows users to create and backtest their own customized strategies, optimize parameters like lookback periods, and generate real-time trading signals. It is an advanced tool designed for serious investors and financial professionals who want to go beyond our pre-built models.

How do I know if my subscription needs to be a “Professional” plan?

Your subscription is considered professional if you or your company charges fees to third parties for services like portfolio construction, advising, or strategy development. If you are using our strategies for personal use, even if through a company you own, a standard subscription is appropriate.