Home › Forums › Logical Invest Forum › Strategy: Maximum Yield Strategy

- This topic has 77 replies, 28 voices, and was last updated 5 years, 6 months ago by

Vangelis.

- AuthorPosts

- 10/27/2014 at 12:43 am #12112

Alex @ Logical Invest

KeymasterSupport and discussion thread for the strategy.

12/13/2014 at 2:15 am #14698xmonika

ParticipantDoes the new balanced strategy have the algorithm to get out of the EDV and ZIV in case that high valued bonds and index will go south simultaneously? How it will behave in that case?

12/13/2014 at 8:16 am #14702Frank Grossmann

ParticipantYes, the new algorithm is calculating the composition which gave the best return to risk ratio (Sharpe ratio) for the lookback period. If no positive Sharpe ratio is found because both assets go down, then the algorithm will slowly reduce the total allocation from 100% invested up to 0% (= 100% cash). The strategy will also go partially to cash when volatility is too high.

12/16/2014 at 2:28 pm #15017xmonika

ParticipantThank you for the previous reply, Frank. Can you guys please check Investment & Return tables of this strategy with focus on what type of price is used for opening the trades?

It seems to me the table is using Close prices of previous day i.e.

2014 28-Nov-2014 15-Dec-2014 20%ZIV+80%EDV 1.8563% 588% 23.08% -3.71% 171% 9.52%means that the 1.8563% performance is valid for 15.12. Close – 28.11. Close but the subscribers had received the alerts on 30.11. and 16.12. respectively. So they can only trade next bar at open at earliest. This time the return would be 3.109%. So what I am missing then?

12/18/2014 at 5:25 am #15046Frank Grossmann

ParticipantYou are right, you can not trade at close, but I would also not trade directly at the next open, because then you have normally quite big variations. I would trade during the first 2 days of the month. It makes not much difference on the performance, because the allocation will most probably not change during these 2 days. Backtests have shown, that the price variations during this short period are rather random. If you trade for several months, then the differences to a trade at close of the last day of the month are more or less zero. But sure, if you look only at one month, there can be a big difference. The only important thing is to execute the rebalancing trades very near together.

01/01/2015 at 2:01 am #15412ua87_SP

ParticipantHi Frank,

I am an international investor who uses Interactive Broker and cannot use margin and as you may know there is T+3 delay in settlements, so when I am rebalancing following the rotation signals, the sell part of rebalancing trades are okay, however I will not be able to execute the buy part of the rebalancing trades due to the T+3 wait period meaning I would have to wait at least 3 business days for the funds from the sell transactions to clear. This will puts parts the rebalancing trades by at least 3 days (some times even 4 days), is this okay?

Is there a solution to this? How would you guys (yourself and your partners) overcome this T+3 settlement delay which I believe is forced by all other brokers too unless you are using margin or keep like 50% of the funds in cash to be able to execute both sell and buy side together at the same time/day.

Thanks,

Fred01/04/2015 at 9:23 pm #15560Jeff McCarter

ParticipantHello, I’m a new subscriber to all of the strategies, and this month made allocations by Sharpe ratios which seemed a reasonable way to start. Since this strategy (MYS) has good [hypothetical] risk-adjusted performance, I’m prepared to allocate more heavily towards it. So I was a little confused by this annotation accompanying this month’s signals:

“For the moment I would not invest too much in this strategy. Better wait for the next bigger correction and then go in again.”

So I find this confusing. Doesn’t it defeat the purpose if we have to do our own market timing to decide when allocate more heavily to each strategy? I thought the whole idea was that these were “internally” risk-managed based on the ability to allocate more towards bonds (using short TMV as proxy in this case) and that this particular strategy was even more tightly risk-managed by re-balancing twice monthly. So, I’m confused at the admonition to shy away from the supposedly best-performing strategy unless you’re suggesting that the results thus far — and I understand they are hypothetical — are unlikely to be sustained?

I would appreciate your elaboration on this. And, as a new member, I find myself impressed by your site content and enthused about working with you.

As an aside, also very intrigued by the fund-of-fund logic in which algorithms would suggest varying allocations toward various strategies each month. Is it realistic to think that might be implemented anytime soon — do you have any time table?

Thank you in advance and kind regards,

Jeff01/04/2015 at 10:16 pm #15561Vangelis

KeymasterHi Jeff,

Excellent question.

All strategies do take on risk, as they are not market neutral and you are “buying beta”. The good news is, they have a lower level of risk vs simply buying the indexes, for the reasons you have read about, including varying degrees of shifts towards low/inverse correlated assets, like treasuries.

Frank’s statement is a reflection of his valuable judgment and experience that later points in the coming months might provide stronger relative strategy returns, but does not include the optional crystal ball.

Historical results are quite real, starting from June 2013 when the strategy went live, however, performances going forward will shift with the market conditions. We are confident it will add value over time, but one should not expect a straight line of growth.

One can further reduce risk by further spreading around assets between strategies, and, managing how much assets are at risk. Of course, you might miss an opportunity. No free investment return lunch here, but we do strive to provide better quality lunches with ways to access at lower cost.

I hope this helps.

01/04/2015 at 11:28 pm #15562Vangelis

KeymasterJeff,

PS: Regarding the “fund of funds” strategy – which we internally call a “meta-strategy”; it is a high priority, already working in “alpha” form. We plan to offer a version in the next 2 to 3 months. Thanks for your interest – will keep it high on the list.

01/05/2015 at 10:41 am #15576Vangelis

KeymasterFred,

Why not use or upgrade to a Reg T Margin or even portfolio margin account instead of using a cash account?

Alternative there is an IRA account that ‘clears’ and makes sale proceeds available instantly:

http://ibkb.interactivebrokers.com/article/1380

If these two choices are not viable I would suggest you contact IB support and explain what you would like to do. Maybe they have a suggestion.

Vangelis01/06/2015 at 6:38 am #15583ua87_SP

ParticipantThanks for your suggestion Vangelis.

I am not a US citizen so no IRA account for me and IB does not provide margin account (any sort) to residents of Australia!, they say this is temporary and they have no other solutions as per the customer support so I guess I just have to reserve something like 20% of the funds in cash and hope that the partial rotations signals does not exceed my reserved cash otherwise I would have to wait at least 3 business day to execute the buy sides.

Fred

01/09/2015 at 4:42 pm #15666Vangelis

KeymasterIt also depends on which strategies you are using. Some make smaller adjustments than others. If you are forced into a 3 day delay, keep in mind that historically the end of month days have a slight positive bias (good for selling) while 2nd to 5th days of the month are relatively weak, i.e. better for buying (even though this has recently changed).

01/11/2015 at 10:18 am #15733Michel Alvarez-Correa

ParticipantMy concern about this strategy is that it cannot be traded with large amounts of money. The daily volume of the ZIV, VXZ and EDV is quite low. The bid-ask spread is very high at most times. This results in execution costs that are unacceptably high if one trades, say, $1MM or more on this strategy (TMV is better as far as volume)

Have you tried studies which utilize ETF’s that have higher volume characteristics such as for instance the SVXY instead of the ZIV for instance. I know that SXXY is more volatile than ZIV but that could be compensated through the allocation.

My goal is to be able to eventually trade $3-$5MM per strategy. Do you feel that that is realistic? What are the strategies in your arsenal that are best suited to larger amounts of money?

01/12/2015 at 7:42 am #15759Frank Grossmann

ParticipantIf you invest large amounts of money, then it makes sense to trade (short) the VIX (5/6 month) and UB treasury futures instead ZIV/EDV. These futures have a very high liquidity and are traded 24h a day. I personally always trade the underlying futures if you can do this for an ETF.

ZIV has quite a small volume, but underlying are very liquid VIX futures month 4-7. So also high amounts of ZIV can be bought without problems. The same is valid for EDV.

You can not replace ZIV, which is a medium term volatility ETF, with the high volume front month ETFs like SVXY, XIV, TVIX. These have a much higher volatility. ZIV has the much better return to risk ratio.

I think it is no problem to invest several millions in a strategy because most of the time the allocations do only change by 10-20% each month.

If you invest larger sums, then you should not buy all at open, but better accumulate slowly with limit orders. You have enough time to do the changes.01/13/2015 at 12:31 pm #15802Michel Alvarez-Correa

ParticipantThank you for your prompt response. I would like to try utilizing futures instead of ETF’s as you suggest. However, I am having trouble understanding how many contracts to buy or sell.

Assuming that I want to trade $1MM on this strategy. Furthermore assuming 30% ZIV / 70% EDV and the June VIX contract at 19.50 and the March UB contract at 172, how many contracts should I short/buy of each?

Should I match the expiration of the UB contract with the VIX contract and buy June UB instead of March UB?

Should I switch contracts for the VIX futures once a month in order to keep a constant 5 month period to expiration?

Lastly, the back testing of this strategy does not extend the the “acid test” period of 2008 when the VIX reached 90. Do you have any idea of how the strategy would have performed then and what the drawdown would have been?01/14/2015 at 7:52 am #15836Frank Grossmann

ParticipantYou would need to short 300’000$ VIX futures. One future is 1000x the price, so at 19.50 you would need to short about 15 VIX June futures. The UB future is quite expensive. One future is about 172’000$. 70% EDV would be 700’000$ EDV or 1.5x = 1’050’000$ TLT equivalent. This means you need to buy 6 UB futures.

The UB futures need to be rolled every 3 month. You can keep the VIX future also for 2 month. I would close it before it moves down to month 3.01/17/2015 at 8:09 am #15966Michael P

ParticipantIn the description above it says “Since December 2013 we have added adaptive asset allocation to the strategy. ”

Wasn’t the adaptive allocation adopted in December 2014?

01/17/2015 at 10:58 am #15981Alex @ Logical Invest

KeymasterIn Dec 2013 we introduced an equal volatility mechanism, so when one of the ETF was above a certain volatility threshold its position was scaled down and the strategy partially in cash. This has now evolved into what we consider now a real “adaptive allocation”, where the strategy does not switch “binary” between the ETF, but gradually changes the allocations; so this now incorporates the prior volatility control and also the hedging positions Frank had described in addition the the strategy signals before. Indeed the name “adaptive allocation” was used twice and this might lead to confusion.

See here for a more detailed explanation of how they work.02/13/2015 at 1:00 pm #17208mikernorton

ParticipantFrank,

While looking at historical price volatility of ZIV, I noticed that on December 30, 2014, ZIV declined by roughly 50% then subsequently bounced back 100% the next day (see chart below). I was wondering if you could shed any light on what happened to ZIV during this short time period. Also, wouldn’t this rapid decline and bounce-back significantly distort the modified Share Ratio calculation, since it would be captured in the look-back period?

Thanks,

Mike

02/13/2015 at 2:37 pm #17209Alex @ Logical Invest

KeymasterMike, this is a technical glitch in the Yahoo data, not real market data (compare in Bloomberg for example). We have algorithms in place to filter this kind of errors, so they do not hit our strategies. But we obviously cannot correct Yahoo data in the charts we also show here

02/14/2015 at 9:54 am #17253STEPHEN

ParticipantThat erroneous spike distorts the chart:

04/03/2015 at 10:51 am #19099

04/03/2015 at 10:51 am #19099STEPHEN

ParticipantThe MYRS Sortino = 5.71

That’s considerably better than all of the other L-I strategies. Is it correct?

04/03/2015 at 1:30 pm #19100Alex @ Logical Invest

KeymasterStephen, I also noticed the relative difference and went into detail when setting this up. The reason is the following.Definition of Sortino Ratio

As the portfolio builder is based on weekly data, for the downside volatility (StDev) we’re only considering the weeks where the performance was negative (r<0). In the MYRS, indeed only 147 out of 377 weeks under observation had a negative return, and the annualized standard deviation of these returns was (only) 9.62%.

Which means Sortino Ratio = CAGR / (Downside Volatility) = 54.65% / 9.62% = 5.68 (as of week March 30, 2015).

Interesting enough that the absolute value of the Sortino Ratio therefore can change drastically depending on the granularity of the analysis, e.g. monthly, weekly, or daily. This is one of the main reason why the Sortino Ratio should only be used for a relative analysis of assets or portfolios.

I left the calculation sheet for the downside volatility open in this sheet, have a look by yourself.

Happy to discuss in detail

07/23/2015 at 3:00 pm #28379Sentient

ParticipantI remember Frank writing somewhere that during times of low volatility, one might consider reducing allocation in MYRS, whereas after a VIX spike to 22 or more, one might consider moving more funds from defensive strategies into MYRS/ZIV to capture the mean reversion.

My question is this. What should be given more emphasis in such a decision – the VIX term structure and percentage contango, or the actual spot price of the VIX?

For example at this moment the spot VIX is very low at ~12, however the term structure still shows significant contango. How do you recommend to use these observations to judge expected returns in the short term for MYRS/ZIV strategy?

08/09/2015 at 10:05 am #28836Alex @ Logical Invest

KeymasterHi Sentient,

Franks’s comment was referring to some additional trading he is doing beside the published MYRS strategy. He indeed is betting that in case of spikes in VIX in generally calm market, the overreactions we’ve seen recently will lead to gains from short term mean reversion. So the “spike” of VIX above the level of 22% – which he determined as his threshold – in a generally calm market (avg 13-16%), in a contango market would be the “specs”.

To be clear, this is not referring to the backtested quantitative MYRS strategy, but rather a discretionary bet – quite succesfull during the last 12m though. So keep in mind this can always backfire if suddenly you end up investing into a major turmoil – do not take this as investment advice.

08/13/2015 at 2:04 am #28896Sentient

ParticipantThanks for the informative reply Alex.

08/18/2015 at 8:33 am #29030Mkimpe

ParticipantHi,

Thanks for being so transparent about the performance results of the various strategies. Regarding MYRS, do you have data into the expected performance and drawdown of this strategy during a period similar to 2008/9? If the specific ETFs did not exist, is there a way to extrapolate performance and drawdown using other info?

Thanks,

Marc08/24/2015 at 3:47 pm #29150RB

ParticipantHi,

I’m starting to lose faith in the strategies. At least ever since I started investing back in February 2015, the performance has been pretty bad with the strategies I selected (on top of the monthly $100.00 fee to LI). As an example, telling us to invest in SPXL (for example) just in time to enjoy the largest downturn in the market in 4 years. It looks like overall performance for this year will be at best flat. Of course, this depends on the strategy(ies) one is invested in, but I think we’ve pretty much all shared the recent pain no matter what strategy you’re invested in at the moment. I will stay the course with the investment strategies I started this year, but for now, I honestly regret having embarked on this journey because I think the strategies are unable to cope with the type of environment we’ve experienced during the last year or so.

It’s like I told my last financial adviser: I don’t need any help losing money…I can do that all by myself.

Thanks,

Ron08/25/2015 at 2:51 pm #29179Anonymous

InactiveRon,

I feel your pain. I’ve been a member since January, 2014, and have had a wonderful ride so far. I am actually using my gains from the past year or so and pulled back my original capital. I’m strictly riding profit at this point. I switched from the MYRS to the Hell on Fire just a few months ago. I even use TQQQ instead of SPXL, so I’m really aggressive. Don’t get me wrong, I’m taking a pounding right now and I’m just not used to seeing a lot of red in my portfolio. This market is indeed acting strange. Look at TMF falling hard today while VIX is at levels not seen in years while the market appears to be in a rally mode. As Frank said in his market summary at the beginning of August, strange things are rippling through the market and unless he declares and “all cash” movement, I’m along for the ride, although it’s a painful ride at the moment.

I’m confident we will be in the right mix once the market decides what it wants to do. It just needs to start trending in one direction instead of whipsawing back and forth. Can’t wait for September’s Market summary.

08/27/2015 at 10:51 am #29207xmonika

ParticipantThe maximum drawdown of this strategy from backtest 2011-2015 has been reached this week. There are stocks falling and bonds as well. Are there any recommendations to rotate into cash or it is recommended to wait till end of two week rotational cycle?

09/16/2015 at 12:35 pm #29585Wassenich

ParticipantI too am concerned about this years performance for several strategies including Maximum Yield.

I am wondering, since all were backtested in years of falling interest rates that maybe they

won’t perform well in a rising rate scenario (Or like now with an anticipated rise.) Is there

a way to backtest in a falling rate scenario – or since it was so long ago these etfs didn’t exist?09/20/2015 at 1:34 pm #29633Alex @ Logical Invest

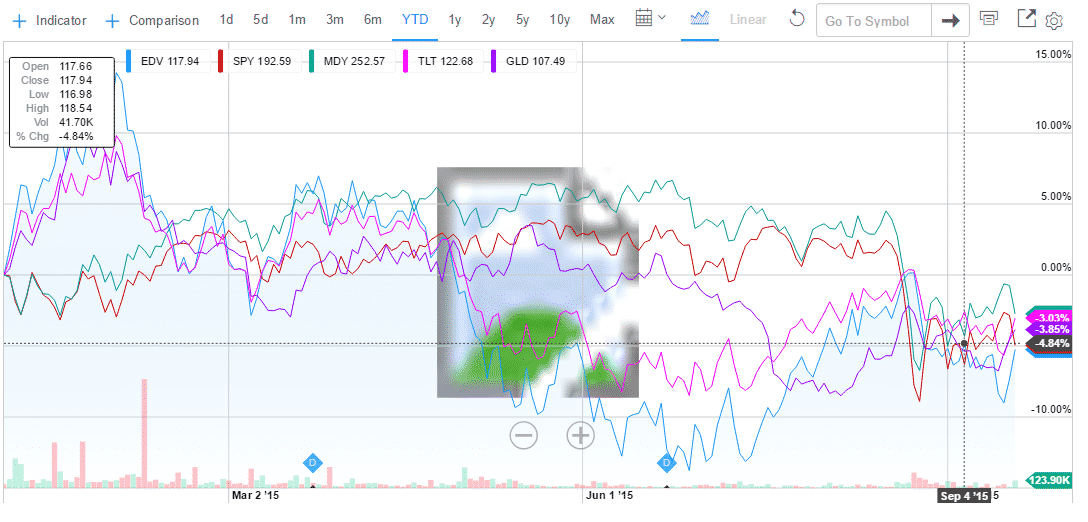

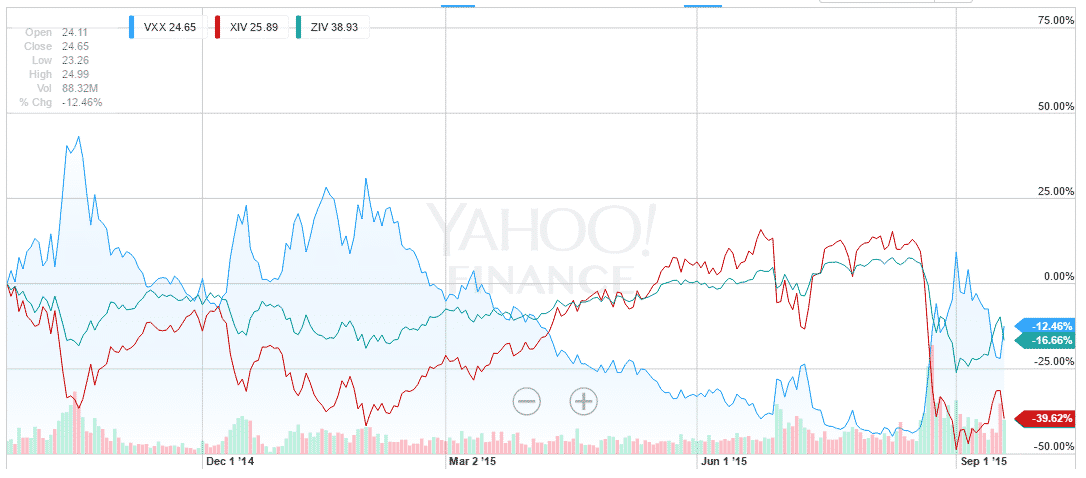

KeymasterAll, thanks for sharing your perception for discussion in the forum. As we have outlined in the monthly newsletters, this year indeed is a very ugly environment for our rotational strategies:

– Yellen / FED risk-on/off since February due to anticipation of rate hikes

– Europe / Greece risk-on/off environment during whole 2015

– Commodity crash (WTI, PM, FM, agri)

– China crashIn a nutshell, there is no trend in any market!

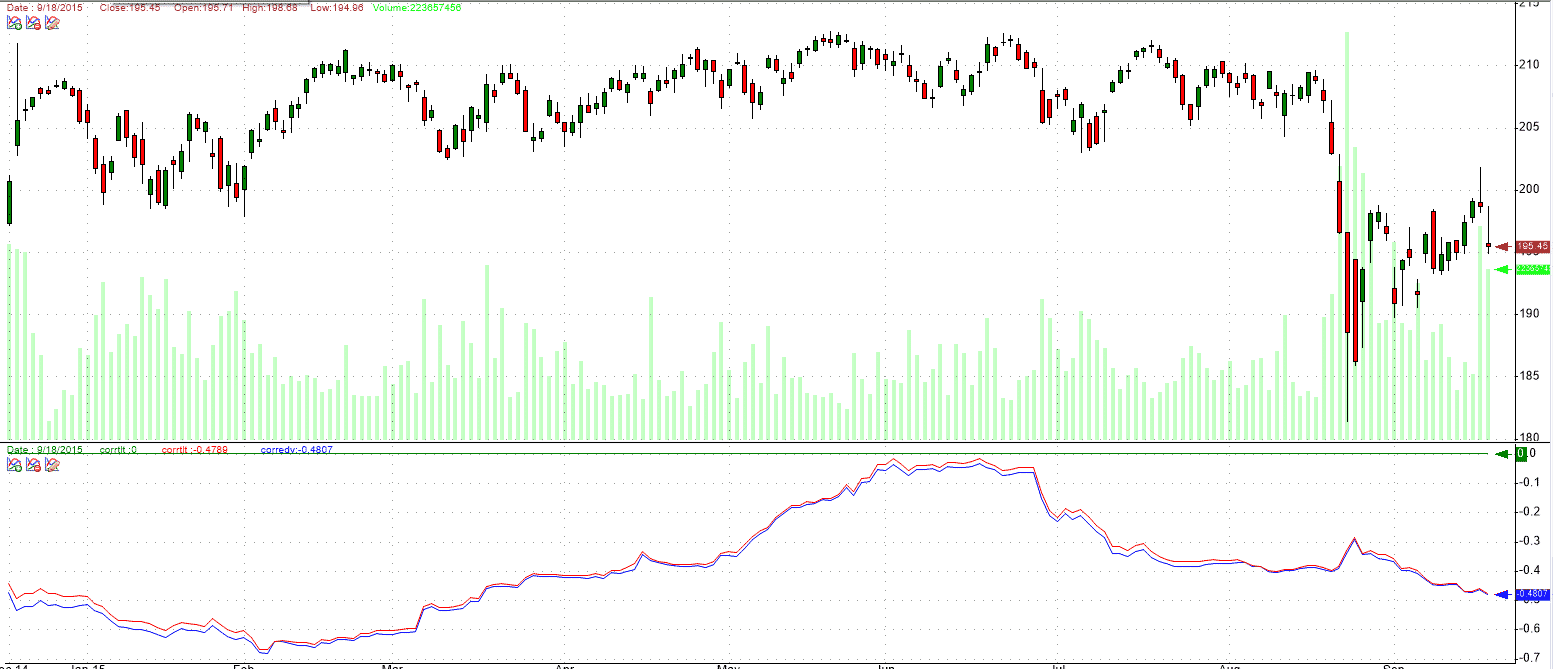

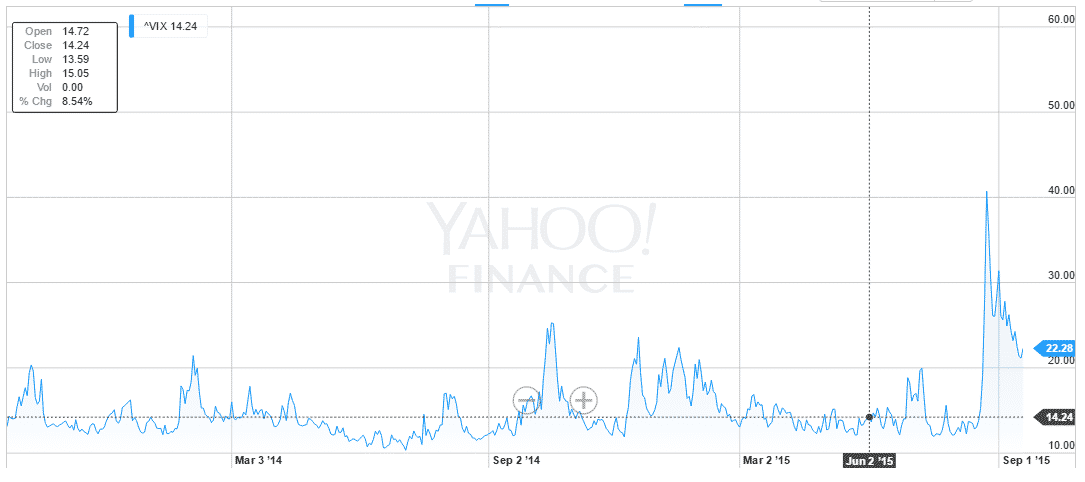

Volatility has been very low beginning of the year, but then suddenly jumped during last months:

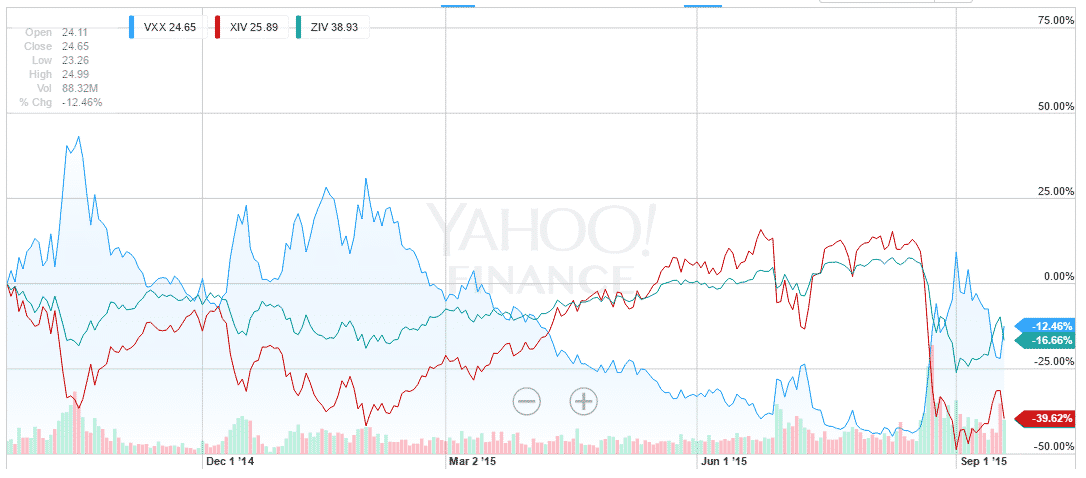

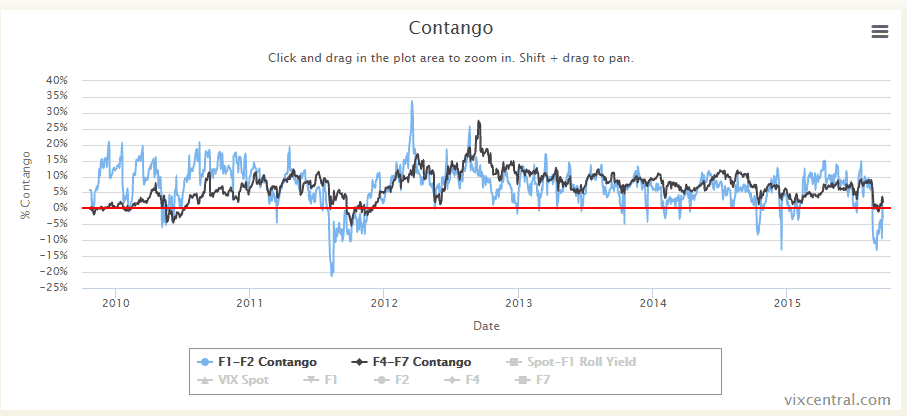

For the first time since 2012 we’ve been in backwardation:

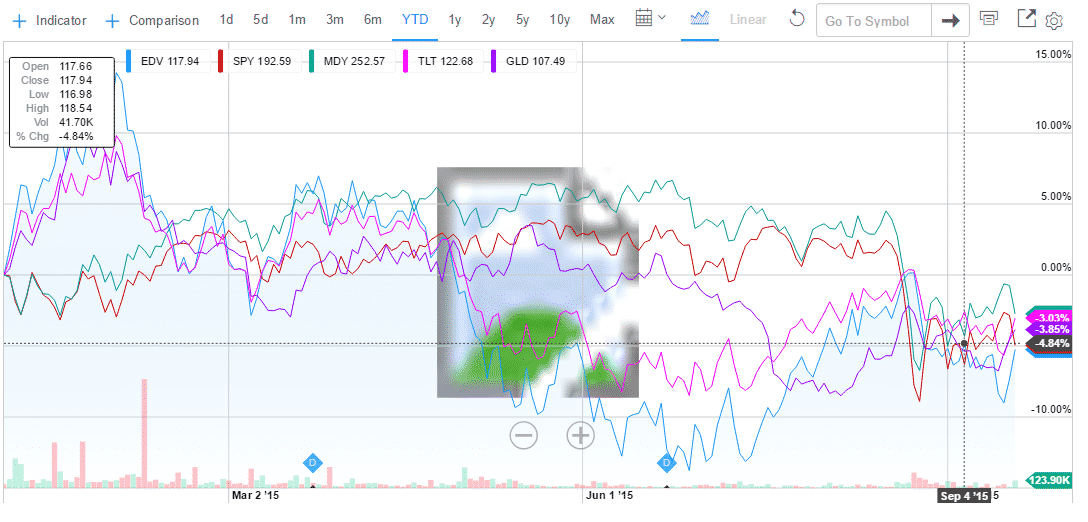

The only think which gives us some relief, is that the negative 60d correlation between SPY and TLT/EDV still holds. So even if it could not prevent the smaller corrections this year, we’re confident it will aliviate the effect from any major crash. Note we’re not talking about any hike in rates, but bonds acting as safe haven in case of any crash, e.g. attracting the money-flow and moving up by demand (independent of rate).

09/20/2015 at 1:57 pm #29636

09/20/2015 at 1:57 pm #29636Alex @ Logical Invest

KeymasterXMonika, please refer to the Sept newsletter for the recommendation to go partially to cash.

There are two effects which are affecting Max Yield currently:

– For the first time since 2012 we’re again in a backwardation mode, e.g. VIX 7 month futures below 1 month. This explains the crash in ZIV this month and also the inexisting premium from the roll-overs.

– Basically no trend in any market with high volatility resulting from China and FOMCIndeed a very ugly environment for Max Yield currently, but we are still confident in the underlying assumptions in the long term.

09/20/2015 at 2:02 pm #29639

09/20/2015 at 2:02 pm #29639Alex @ Logical Invest

KeymasterSentient, last weeks were a wonderful example for this trade. Could you make use of the trade?

03/17/2016 at 12:01 pm #33143

03/17/2016 at 12:01 pm #33143Patrick

ParticipantHi.

I would like to know what makes TMF increase or decrease.

Thanks

Patrick

11/29/2016 at 5:00 am #36850Howard

ParticipantHi, I am a new subscriber. Thanks for all the great work so far. I am wondering whether the team has looked at using VIX/VXV as a signal as well. I am doing more research on when to go OW on the short vol ETF and have read from various sources that VIX/VXV < 0.9 also signal a good time to initiate a short vol position. Would be great to hear your thought on this topic.

12/27/2016 at 7:51 pm #37325Kish

ParticipantHello Gentlemen,

I am looking for an aggressive strategy to begin following and investing in. I’m debating between the Nasdaq strategy, MYRS, and 3X Leveraged UIS.

Some questions:

1. Will any of these three (or any of the other strategies) be ok for small accounts? Most of my money is tied up in my 401k. However I have a small trading account that I would like to trade aggressively in. The account size is about $40K, but I don’t want to trade with much more than $10,000 in an aggressive strategy.2. With regards to the MYRS strategy, I noticed that there are trades every two weeks. (I’m most interested in this strategy based solely on the high returns over time. Since Interactive Brokers has a 3 day waiting period between sells and buys, would a two week hold time be too little time to see significant results? For instance if the alert comes out on Friday, then the sell orders are filled on Monday, the new buy orders cannot be filled until Thursday. That only leaves a little over one week in a position before the next alert is issued.

I was a subscriber to the NASDAQ strategy about 1 year ago, but got so busy with family matters that I stopped paying attention, and eventually cancelled the subscription. I’m ready to get back into it now.

Thank you,

Kish12/28/2016 at 6:08 am #37328Vangelis

Keymaster1.Yes, all three strategies can be traded with a smaller account size. Nasdaq may be the most inefficient for 10K since you will get slightly bigger commissions (the IB minimum x 5 transactions = $5).

2. I am not sure how IB handles available cash on a smaller account. Assuming IB provides at least the standard 2x leverage, even if you need to borrow for 3 days, the cost should be small.

Happy holidays!01/29/2017 at 12:20 pm #37909Anonymous

InactiveLooking back at these comments from many months ago gave me a chuckle. Looked like the world was gonna end and the LI strategies were going down too. I feel badly for those that gave up. I stayed the course and am very happy customer. One thing needs to be addressed. This strategy is not a get rich quick scheme. If past performance continues, then it will take 5 to 10 years for a 100k portfolio to rise to 1M with bumps along the way.

I’ve been customer since 2013. What I have learned is that you must rebalance your shares even when signals remain same. That’s something I didn’t understand fully when I started, but understand now. That’s the whole point of the “rotation” strategy. Also, I subscribed because I believed these strategies, expecially this one and 3x leveraged, to be most aggressive. Watching financial news like cnbc can make trading these signals hard sometimes. So, tuning out that noise helps. Faithfully execute the signals each month and move on. That’s the key to emotion free investing and it has not let me down this far.

I even used the data displayed all over this site and created my own excel spreadsheet to start and stop at various points in history. Even when I go back and begin at the worst possible moment, the strategy always out performed the market. Always. That is something no other mutual fund I can find had done. Yes, there are stocks out there that have, but those are hit and miss and take some studying and gut calling.

Personal Capital called me last month wanting me to give them total control over my investment account so they could help me with my portfolio goals. They offered great presentation. I asked them what makes their service better than Logical Invest? I even gave then website. They told me my portfolio allocations didn’t make sense to them. They called back and told me I could lose 100 percent of my account. I told them to go fly a kite.

The key is knowing this is a 5 to 10 year strategy, minimum and rebalance within first couple days of trading month no matter what allocations are. My rule is to rebalance 1 hit hour before market close on 1st day of month.

01/29/2017 at 2:51 pm #37911Alex @ Logical Invest

KeymasterDeshan,

I appreciate your comment very much, good encouragement for other subscribers also! Yes, second half of 2015 was a difficult time, especially for recent subscribers who just signed up some months ago.

Here the picture of what they experienced, must have felt like falling off a cliff. And then psychology plays it´s games and it´s hard to stay the course, same to everybody.

Your tip of virtually starting the strategy in different point of times is great advise. When I develop a strategy I also “walk it through” with a limited window of time visible in the chart, trying to understand how it works and how it “feels”.

We´re currently again in a low volatility environment, with good contango, but a lot of noise out there. So it´s just statistics that there will be a jump in the VIX some time, but till then it´s important to stay course and harvest the risk premium others pay to avoid the jump. Not intuitive, but money-making!

Thanks again,

Alex01/29/2017 at 3:40 pm #37913Richard

ParticipantThanks for the comments Deshan. Recognizing this is not a get rich program but a discipline that produces superior results over the longer run is central to the strategy, as you point out. I’ve experienced my personal weaknesses in times of market stress so I try to keep volatility and draw down low to reduce anxiety and my emotional reaction to overall market movement. Best wishes on your continuing success.

02/17/2017 at 12:07 pm #38454Kish

ParticipantDeshan,

Thanks for the clarification on the rebalancing, even when the signals stay the same. I was wondering about this, especially since the signal has stayed the same for the last few weeks.I’m a new subscriber to MYRS, and loving it so far!

03/16/2017 at 12:01 am #39456Howard

ParticipantLI team – The market cap for ZIV and TMF is only circa $86mm and it seems like the share outstanding has been decreasing over time. Do you still think it is liquid enough? Have you started looking at alternative instruments for this strategy just in case? Tks

03/16/2017 at 12:38 am #39457Alex @ Logical Invest

KeymasterFor Ziv there is no replacement, only ETF in the inverse medium category. Volume indeed is lower than we´d prefer but still around 50k shares per day, so liquidity should be ok for retail investor account size, and using limit orders.

TMF has avg 3month volume of 500k shares/d, which is very liquid – even if 90m AUM is indeed low, also no real replacement in the 3x leveraged category. You can use 3x TLT either by using margin or by scaling down overall allocations to stay at 100% total – or futures, but that a different game than ETFs.

We are aware of the concerns, but think it´s manageable for avg account size and using limit orders. Volume data from etfdb.com.

05/31/2017 at 3:12 pm #42121Jared Marks

GuestHello,

I noticed that a while back, the use of EDV was discontinued and a dynamic allocation model was adopted. I was wondering if there is any commentary written on how the dynamic allocation model works and why there is now an allocation between funds instead of the “100% invested” method. I do not see any updates in the notes of the strategy, so that is why I am wondering.

Thanks

06/16/2017 at 8:08 am #42649Edmund Dlugensky

ParticipantThe change in MYRS today (6-16-17) was both dramatic and a shock. A question comes to mind: Won’t these dramatic shifts on a less than monthly basis run in to accounting problems with taxable accounts due to the wash sale rules? If potentially every 15 days you could be asked to buy, sell, buy, sell, etc, shares it seems like pretty soon you would have wash sale complications. Has anyone ever thought about this point and, if so, how do they handle it? I believe in this service (and checking vix central on a daily basis), but I can’t get my head around the potential tax complications. Comments please.

06/21/2017 at 6:18 am #42772Alex @ Logical Invest

KeymasterHi Jared,

the dynamic allocation was introduced with the Universal Investment Strategy, see detailed description here: https://logical-invest.com/universal-investment-strategy/.

We then adopted it in all other strategies as well, but on purpose did not change the original white-papers – sorry if this is confusing. If you need any further clarification please let us know.

06/21/2017 at 6:23 am #42773Alex @ Logical Invest

KeymasterHello Edmund,

thanks for the comment! It is important that you review potential tax implications and ways to minimize them with your tax accountant. Our follower base covers many different countries and tax regimes, so it is not possible for us to dive into all potential aspects – hope for your understanding.

Hope there are other community members who can further comment on this.

06/21/2017 at 6:34 am #42774Alex @ Logical Invest

KeymasterWhile not trying to make any predictions, see the impressive ramp-up of ZIV since early 2016 – and be aware of the similarities with the 2012-2015 time-frame – and the correction in Aug 2015.

https://www.barchart.com/etfs-funds/quotes/ZIV/interactive-chart

VIX continues at historical lows (3rd percentile, e.g. 97% of all times has been higher), and we´ll see it moving higher – question is when. MYRS is an aggresive strategy with 23% historical volatility and +20% drawdowns, it is important to diversify it with other strategies. This is something I also have to remind myself from time to time..

07/16/2017 at 5:12 pm #43873giles Robertson

ParticipantI have noticed that the TMF increase in value has been positively correlated with increased volatility and decreasing S&P values but has been delayed by several months such that the correlation is delayed. Could this hedging strategy be improved by using VXX as the hedge rather than using TMF as the hedge?

07/16/2017 at 7:04 pm #43874Edmund

GuestI am not trying to advise anyone. That said, here is what I do and why. At this time I think interest rates are going to rise over the next XX years; therefore, I won’t touch the TMF. I keep the portion that “should” be in the TMF in cash and the ZIV portion in the ZIV. The cash also helps me to backup the cash position needed to for the margin requirements for various cash backed short puts and put spreads that are sometimes in the account.

I try to follow the Logical-Invest percentages; however, I do not make a change if it would not change the amount of ZIV shares by less than about 10%. Also, I look at vixcentral.com usually once or twice daily to view the curve. As long as the curve looks okay, I’ll usually stay with 50%+ in the ZIV (the recommended percentage at the time). When it is not in contango (or gets funky) for a few days, that is a huge caution flag for me and I may cut or even eliminate my ZIV position between Maximum Rotation emails. Currently, I have about 25% of my portfolio allocated to this system and it seems to work quite well. So, most of the time, the ZIV position has been at 25%, or less, of the overall portfolio. Currently, it stands at ~20%.

08/01/2017 at 11:45 am #44310Anonymous

InactiveWow – the last post was back in Feb of this year!

Question: Whats the general approach. Say, I have 1M to invest and want to make use of this strategy. Would it be foolhardy to go all the way in (MYRS: 100%)? I only ask because we have not seen a bear market for a long time and this strategy has never been field tested in that environment. I realize all investments have inherent risks but want to know how others would play this. Thanks.

08/01/2017 at 2:03 pm #44322Edmund

GuestI had been in MYRS a few years ago when it was a little more complicated. Got back in a few months ago when the recommended split was 50/50. I went 50/50 and then upped it to 80/20 when that call was made. With today’s call, I did sell a small amount of ZIV. Note: I do hold the remainder in cash (or tax-exempt money fund) rather than a bond ETF. This is not investment advice, but as long as the vixcentral.com readings are in contango I see no reason to not start a “MYRS position.” This system has been great over time, but I’d determine how much you wanted to dedicate to investing in MYRS…and then putting 25-50% of that into it now at the recommended split. I started with an amount over $100K and rebalance semi-monthly (Currently, if the repositioning is more the $3K). My MYRS portion on the account (about 25% of my overall account) is up over 10% in about two months. When the vix curve goes into backwordation and/or we have a recession in the US, I will go to all cash in the MYRS account and might even add some new funds when it is clear to start getting back into a ZIV position.

Hope this helps and gives you some ideas.08/01/2017 at 4:31 pm #44337Anonymous

InactiveI just noticed that the threads in this forum are not arranged chronologically. My recent post (Aug 1, 2017) is wedged between much older posts. Bizarre.

08/02/2017 at 4:56 am #44351ben123789

ParticipantHi Edmund, I’m new here so many thanks for the tips. Regarding the contango and backwardation of the VIX, I read another poster somewhere where he doubled down during backwardation or a spike in vix. The idea is that the VIX and the backwardation mean reverts. It’s an aggressive strategy but seems to have worked well for the poster. My concerns following that strategy is that I need my beauty sleep and that I have zero knowledge about the ZIV so I don’t know if any “decay” would materialize during massive spikes (up or down) in the VIX. I fear that it will decay like leveraged ETFs during market chaos (e.g. great financial crisis) such that the ZIV would lose value even after the VIX and its term structure goes back to normal. I know that ZIV buys low and sell high to roll over their short positions in the VIX in normal market condition so the decay mechanism would not be similar to the normal leveraged ETFs. If there’s no decay or some other strange things going on with it over time then I think ZIV should be in everyone’s long term investment portfolio.

08/16/2017 at 7:33 am #44665Alex @ Logical Invest

KeymasterHi Ben,

even if ZIV is not a leveraged ETF and on the medium term part of the curve, it is still an aggressive instrument. THE MYRS provides some hedging with the TMF allocation, but still I personally would not allocate more than 25% of my investment to MYRS and/or ZIV. See August 2015 as example.

11/10/2017 at 9:04 am #47375Mark Faust

ParticipantIn looking at the last couple of months, I agree with Edmund and Giles….IMO TMF is no longer the best hedge to be used in MYRS…the near term future of long term bonds is questionable. In using the website https://www.etfreplay.com/correlation.aspx and inputting ZIV and TMF, you can see that The correlation factor is all over the map. If you input something like TZA as a hedge, you get a much less volatile and still negatively correlated fund. (Not saying that TZA is the correct hedge fund to use, but just the first example I picked using another correlation website https://www.etfscreen.com/corrsym.php?s=ziv )

While I can see using cash as the hedge in this case, I think that the full value of this strategy would be better utilized using a different leveraged negatively correlated fund….Bama

[quote quote=43874]I am not trying to advise anyone. That said, here is what I do and why. At this time I think interest rates are going to rise over the next XX years; therefore, I won’t touch the TMF. I keep the portion that “should” be in the TMF in cash and the ZIV portion in the ZIV. The cash also helps me to backup the cash position needed to for the margin requirements for various cash backed short puts and put spreads that are sometimes in the account…………

[/quote]01/17/2018 at 1:01 pm #49173Kish

ParticipantThank you gentlemen, for providing such a great service, and great 2017!. I wasn’t able to manage the 60%+ gain, (probably due to my exit and entry points) but trouncing the S&P500 is a great feeling.

Just based on the long term track record of MYRS, I’m thinking of opening another IB cash account, so I can grow my kids’ college savings. Maybe I’m crazy, but since my first child won’t enter college for at least 8 years, I figure I have some time.

Glad to be part of Logical-Invest!

01/26/2018 at 1:31 am #49393Anonymous

Inactive[quote quote=49173]Thank you gentlemen, for providing such a great service, and great 2017!. I wasn’t able to manage the 60%+ gain, (probably due to my exit and entry points) but trouncing the S&P500 is a great feeling.

Just based on the long term track record of MYRS, I’m thinking of opening another IB cash account, so I can grow my kids’ college savings. Maybe I’m crazy, but since my first child won’t enter college for at least 8 years, I figure I have some time.

Glad to be part of Logical-Invest!

[/quote]I agree with you as I head into my 5th year with LI. My 4 year CAGR is currently at a market crushing 45%. Couldn’t be happier.

02/06/2018 at 2:31 am #49867Anonymous

Inactive[quote quote=49393]

Thank you gentlemen, for providing such a great service, and great 2017!. I wasn’t able to manage the 60%+ gain, (probably due to my exit and entry points) but trouncing the S&P500 is a great feeling. Just based on the long term track record of MYRS, I’m thinking of opening another IB cash account, so I can grow my kids’ college savings. Maybe I’m crazy, but since my first child won’t enter college for at least 8 years, I figure I have some time. Glad to be part of Logical-Invest!

I agree with you as I head into my 5th year with LI. My 4 year CAGR is currently at a market crushing 45%. Couldn’t be happier.

[/quote]And then today happened. Biggest VIX spike in history that has hammered or possibly destroyed XIV and SVXY. Will be another interesting VIX spike to watch and could be profitable for ZIV rebound.

What’s interesting to note is all the times the market drops and the end of the world seems certain, then a few months pass and we look back and say what was all the fuss about. Will this time be the same? Odds say yes.

02/06/2018 at 12:26 pm #49890C0zM1c

Participantdouble post

02/08/2018 at 7:57 pm #49969Kish

ParticipantAfter reading Frank’s post the other day, I was wondering if we should be getting out of ZIV, or ride it out without putting any new money in.

I’m just wondering since the February strategy said to go 80% into ZIV.

Thanks guys.

02/08/2018 at 8:16 pm #49970Kish

Participant[quote quote=49969]After reading Frank’s post the other day, I was wondering if we should be getting out of ZIV, or ride it out without putting any new money in.

I’m just wondering since the February strategy said to go 80% into ZIV.

Thanks guys.

[/quote]Nevermind Gents, I found the comments under the original post in the Academy section.

02/16/2018 at 6:23 am #50166Petr Trauške

ParticipantHello Alex,

I am in 40% MYRS fom the 1/2/17. May I rebalance MYRS to 15/2/17. I will suffer great loss when I´d sold ZIV. What do you reccommend in this case ? To hold and not to feed ? How long should I hold ZIV ?Thanks

Petr

02/16/2018 at 9:29 am #50173Alex @ Logical Invest

KeymasterPetr,

it´s a tough risk / benefit calculation right now for MYRS, here my thoughts, no advise though:

Risks:

As Frank pointed out, the current macro environment is very split. On one hand great GDP, good Earnings, Growth plan, stimulus, etc. On the other hand the inflation and yield threat. Markets have recovered a bit, but there is the risk of another down-leg, which might push mid-term VIX curve even higher, so serious threat to ZIV.Benefit:

For ZIV to recover its YTD losses (ignoring the roll losses in this simple calculation), the mid-term curve would have to get back to the 12-15 level (F4-F7), and honestly I do not see this in the next weeks. If the mid-term curve would get down to a 15-17 range (F4-F7), ZIV should get to about 75, max 78. That´s a 7-8% from the current level, but far from the 94 we had on Jan 12.Also, if and as long the term-curve remains flat or even gets steeper, then the roll-losses will further eat into ZIV.

So, question is how much further down we might get from a macro perspective, vs how much you can possilby recover sitting out the ZIV losses. Or from a different perspective, is ZIV the best holding to benefit from a further recovery?

My personal call is also to rather step out of MYRS for a while (even if it hurts a lot!) and look for a broad diversified portfolio to cover both up and down scenarios.

02/16/2018 at 9:44 am #50174Edmund Dlugensky

ParticipantAfter signing in, I can’t find the recent post about what to do with ZIV after it was listed at 80% going into Feb 2018. As LI has mentioned in a white paper, it is BEST to check vixcentral.com daily and make sure the curve is in a nice contango. If it gets funky for a couple of days or into a sever backwardation, then it is time to get out of ZIV. Period. Only re-enter ZIV when things settle down or when LI says to get back into ZIV AND the vixcentral curve has a nice positive slope. In this case, everyone following MYRS should have been out of ZIV not later than sometime on Feb 5, when the vixcentral curve turned severely negative. The high, low, close for ZIV on 2/5/18 was 86.15, 74.15, and 74.54. I got out of ZIV a few trading days earlier. My recommendation: If you are in the ZIV you have to be aware of the markets undercurrent, the VIX, and the VIX curve. If you do not have internet access for several days (out of the country, cruise, remote area) then it is probably best to either close out ZIV positions or lighten up to 50%, or less. Hope this helps…in the future.

02/16/2018 at 9:54 am #50175Alex @ Logical Invest

KeymasterThanks for the confirmation, Edmund. Here the link: https://logical-invest.com/ziv-myrs/

02/16/2018 at 10:32 am #50176Alex @ Logical Invest

KeymasterFor those wondering where ZIV might stand assuming a recovery in the VIX term curve (or if things worsen), here a quick and dirty estimation: https://docs.google.com/spreadsheets/d/1NqhMq4wpt6WT5LQohVjkPNSlOIkXf2eQ515zcpzeNH8/edit?usp=sharing

Just input your assumption of future VIX term curve in the green cells to get a very rough idea where ZIV price might be. Very rough as this ignores daily rolls, roll losses and further math. But hope it gives you an idea just based on F4-F7 prices.

The sheet is protected, but you can make a copy in your own google drive (“save a copy”).

05/31/2018 at 6:53 pm #52803Mark Faust

ParticipantMYRS getting close to being back in play???even in small amounts???

Looking forward to the read tonight….09/04/2018 at 12:44 am #54873daniel morton

ParticipantHi Alex,

Other than limiting ones allocation to MYRS is there a way to reduce DD in a single month? Any simulations on a stop loss? thanks.

09/04/2018 at 12:02 pm #54881Alex @ Logical Invest

KeymasterHi Daniel,

a straight stop-loss does not work, in a spike you are stopped-out at the wrong moment and lose disproportionate more than you earned from the premium you collected before. Here another way, but requires day-to-day monitoring, which might be prohibitive for you.

Setup a long vix buy order for 3rd or 4th month with buy-limit in 20 to 25 range (20k for future). This works as stop-loss for ZIV or short futures. Once you’re in then you would need to monitor manually, either close-out both, or close short and ride-out the long – very event driven (just another tweet or sth serious?). Futures have better liquidity and spread than ZIV, especially is sudden spikes, so we prefer future buy-order over a stop-loss.

If you want to derisk generally, then trade Vix future spreads instead of ZIV ETF, our preferred way is short 3rd/4th month, long 5-7th month.

09/04/2018 at 12:29 pm #54882daniel morton

ParticipantHi Alex,

Thanks. Do you have any backtesting done on the futures short VIX 3-4 months and long 5-7 months? Does this perform better than the ETF b/c of liquidity or something else?

09/06/2018 at 6:46 pm #54919daniel morton

ParticipantHi Alex,

thought this might be of interest.

http://www.longtailalpha.com/wp-content/uploads/2015/12/Everybodys-Doing-It.pdf

09/06/2018 at 9:39 pm #54922Alex @ Logical Invest

KeymasterThanks, was not aware of this paper.

Here is another one, oldie but goldie: Volatility at World’s End

10/19/2018 at 10:52 am #55597aw

ParticipantShouldn’t there be bi-weekly update on October 15th for the MYRS strategy?

10/19/2018 at 1:36 pm #55599Richard

Participant10/22/2018 at 2:53 pm #55656aw

ParticipantThe consolidate strategy tool on the page https://logical-invest.com/strategies/consolidated-signals/ does not show any updates yet. The numbers look odd as well (e.g. MYRS ZIV 45.10% MYRS TMF 45.10% for 09/28/2018 for the MAX CAGR Volatility 15%).

10/23/2018 at 1:22 am #55662Vangelis

KeymasterThank you for letting us know. It’s fixed. The allocations remain the same as the last period but now you should be looking at 10/15/2018 as the new rebalancing day.

- AuthorPosts

- You must be logged in to reply to this topic.