Logical Invest

Investment Outlook

June 2017

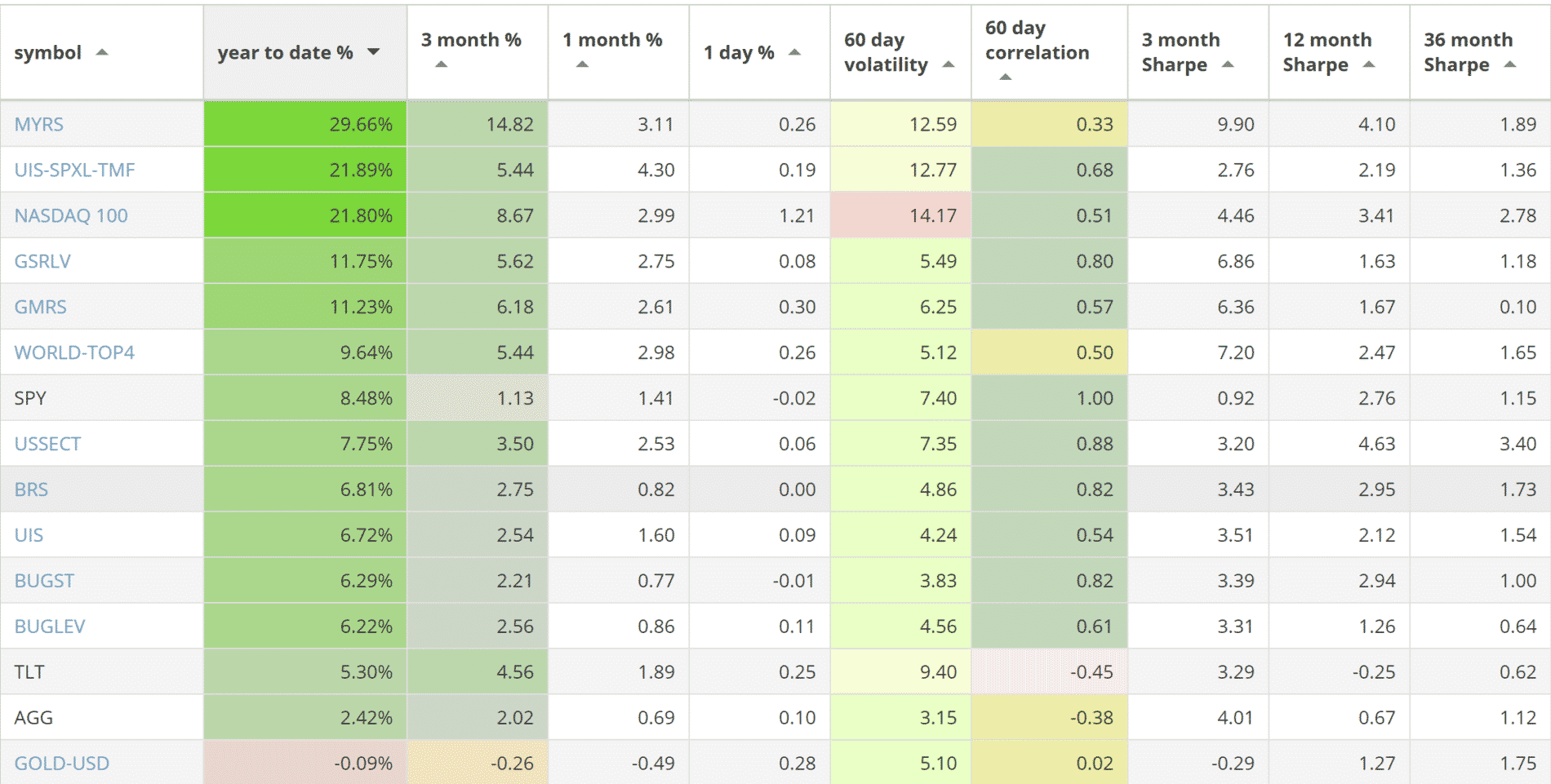

Our top 2017 investment strategies, year-to-date:

- The Maximum Yield strategy with 29.66% return.

- The Leveraged Universal strategy with 21.89% return.

- The NASDAQ 100 strategy with 21.80% return.

SPY, the S&P500 ETF, returned 8.48%.

News:

- Our brand new U.S. Sector Rotation made its live debut with a +2.53% return for the month. You can subscribe for free.

Market comment:

Both the U.S. equity and the U.S. bond markets were positive for May. SPY (S&P 500 ETF) added +1.41% and TLT (30-Year Treasury ETF) added +1.89%. Even though SPY is reaching new all-time heights, it under-performed many of our strategies and in particular the ones with foreign exposure, such as the World-Top 4, Global Market and Global Sector Rotation strategies. This shows that the U.S equity market is slowing down compared to foreign and emerging markets. On the other hand, Brazil, with a, -18% drop on May 18th reminds us that these markets suffer from local political risk and need to be properly hedged and diversified.

Our top 3 strategies continue to be the biggest gainers for May. Our 3x UIS strategy added another +4.3%, the MYRS added +3.11% and the Nasdaq 100 added +2.99%. On the 4th and 5th spot are the Global Market rotation(+11.23% YTD) and Global Sector Rotation (+11.75% YTD) strategies.

Summer is often volatile. Our slow and steady risers cam limit your risk: BRS (+6.81 YTD%) and the BUG (+6.29% YTD) bond-based strategies.

We wish you a healthy and prosperous 2017.

Logical Invest, June 1, 2017

Strategy performance overview:

Visit our site for daily updated performance tables.

Symbols:

BRS – Bond Rotation Strategy

BUGST – A conservative Permanent Portfolio Strategy

BUGLEV – A leveraged Permanent Portfolio Strategy

GMRS – Global Market Rotation Strategy

GMRSE – Global Market Rotation Strategy Enhanced

GSRLV – Global Sector Rotation low volatility

NASDAQ100 – Nasdaq 100 strategy

WORLD-TOP4 – The Top 4 World Country Strategy

UIS – Universal Investment Strategy

UIS-SPXL-TMF – 3x leveraged Universal Investment Strategy

AGG – iShares Core Total US Bond (4-5yr)

SPY – SPDR S&P 500 Index

TLT – iShares Barclays Long-Term Trsry (15-18yr)