Logical Invest

Investment Outlook

January 2018

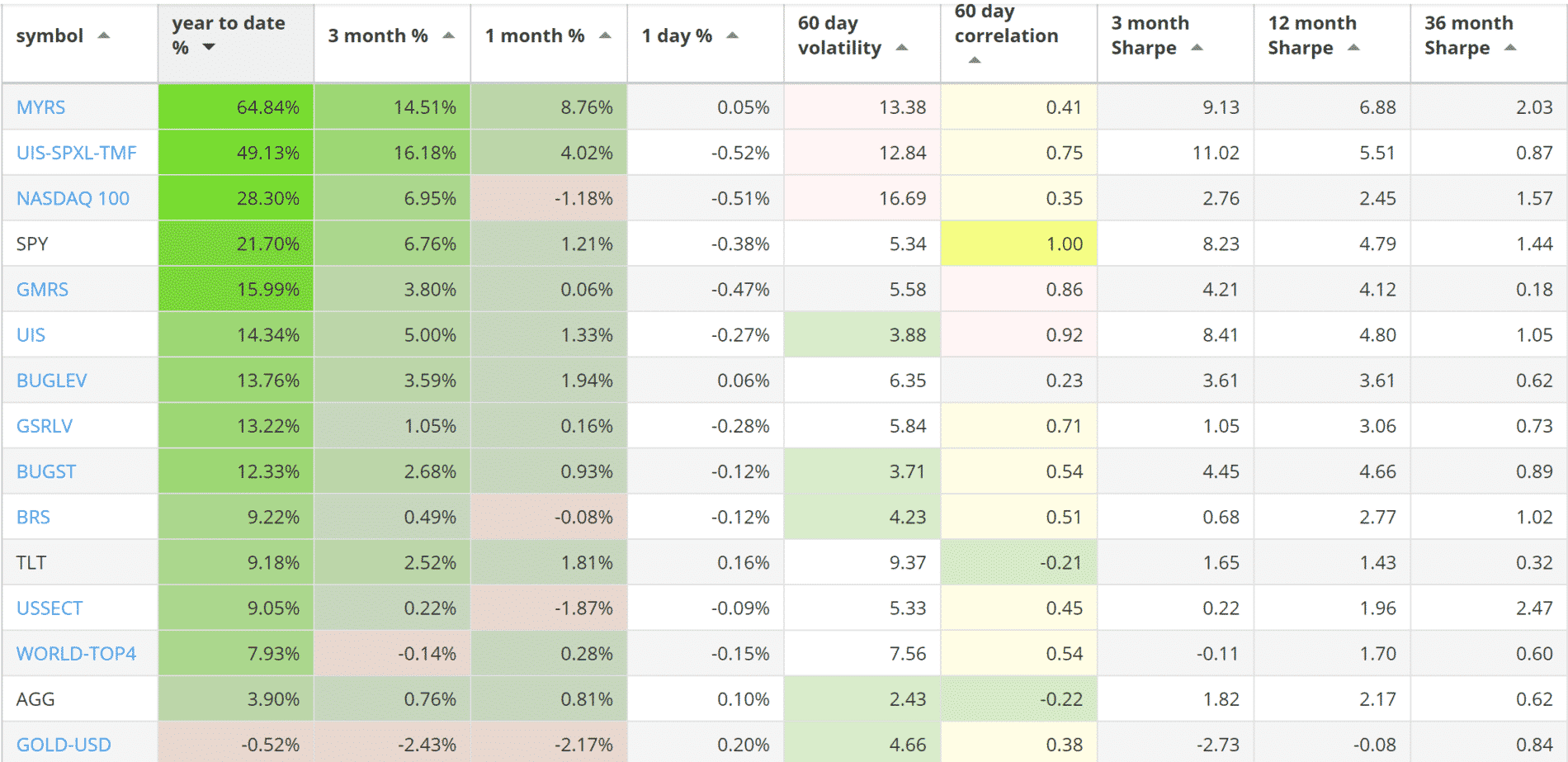

Our top 2017 investment strategies:

- The Maximum Yield strategy with 64.84% return.

- The Leveraged Universal strategy with 49.13% return.

- The NASDAQ 100 strategy with 28.30% return.

SPY, the S&P500 ETF, returned 21.70%.

News:

All-Strategy subscribers will be able to use QuantTrader ‘Light’ at no additional charge.

Market comment:

As we mentioned in our year-end review, the past year was characterized by large returns in U.S. and foreign markets and sustained low volatility despite an increase in geopolitical risk. The S&P 500 (ETF: SPY) returned 21%, Europe (ETF: FEZ) 24% and emerging markets (ETF: EEM) 37%, It is also the year where the U.S. Federal reserve stopped it’s 10-year balance sheet and increased short-term interest rates. Long term treasuries (ETF: TLT) as well as emerging bonds (ETF: PCY) managed a +9% while U.S. corporate bonds (ETF: AGG) barely touched 4%. Despite the announced tightening, the U.S. dollar lost ground: -13% against the Euro and -12% against gold. The most exciting financial event of the year is the attempt to include cryptocurrencies as a new asset class into the mainstream financial system.

Looking at our strategies, our top performers were our riskier strategies: MYRS, UIS 3X and the Nasdaq 100. This is in line with the market being almost ‘perfect’ for 2017 and having very few corrections which benefits pure risk taking. This may or may not continue in 2018 as there are signs of caution: Central banks are slowing down or reversing stimulus programs and real world costs of goods, especially outside the U.S., are rising.

2017 was characterized by the astounding rise of cryptocurrencies, which we have been tracking since May. Bitcoin futures are now available to mainstream traders through Interactive Brokers (via CBOE and CME). Interestingly you need a whopping $50,000 margin to short 1 Bitcoin. For longs, the margin is a reasonable $7000. This exhibits what has been most interesting about this asset for 2017: It had unbound ‘upside risk’.

We wish you a healthy and prosperous 2018.

Logical Invest, January 1, 2018

Strategy performance overview:

Visit our site for daily updated performance tables.

Symbols:

BRS – Bond Rotation Strategy

BUGST – A conservative Permanent Portfolio Strategy

BUGLEV – A leveraged Permanent Portfolio Strategy

GMRS – Global Market Rotation Strategy

GMRSE – Global Market Rotation Strategy Enhanced

GSRLV – Global Sector Rotation low volatility

NASDAQ100 – Nasdaq 100 strategy

WORLD-TOP4 – The Top 4 World Country Strategy

UIS – Universal Investment Strategy

UIS-SPXL-TMF – 3x leveraged Universal Investment Strategy

AGG – iShares Core Total US Bond (4-5yr)

SPY – SPDR S&P 500 Index

TLT – iShares Barclays Long-Term Trsry (15-18yr)