Logical Invest

Investment Outlook

February 2018

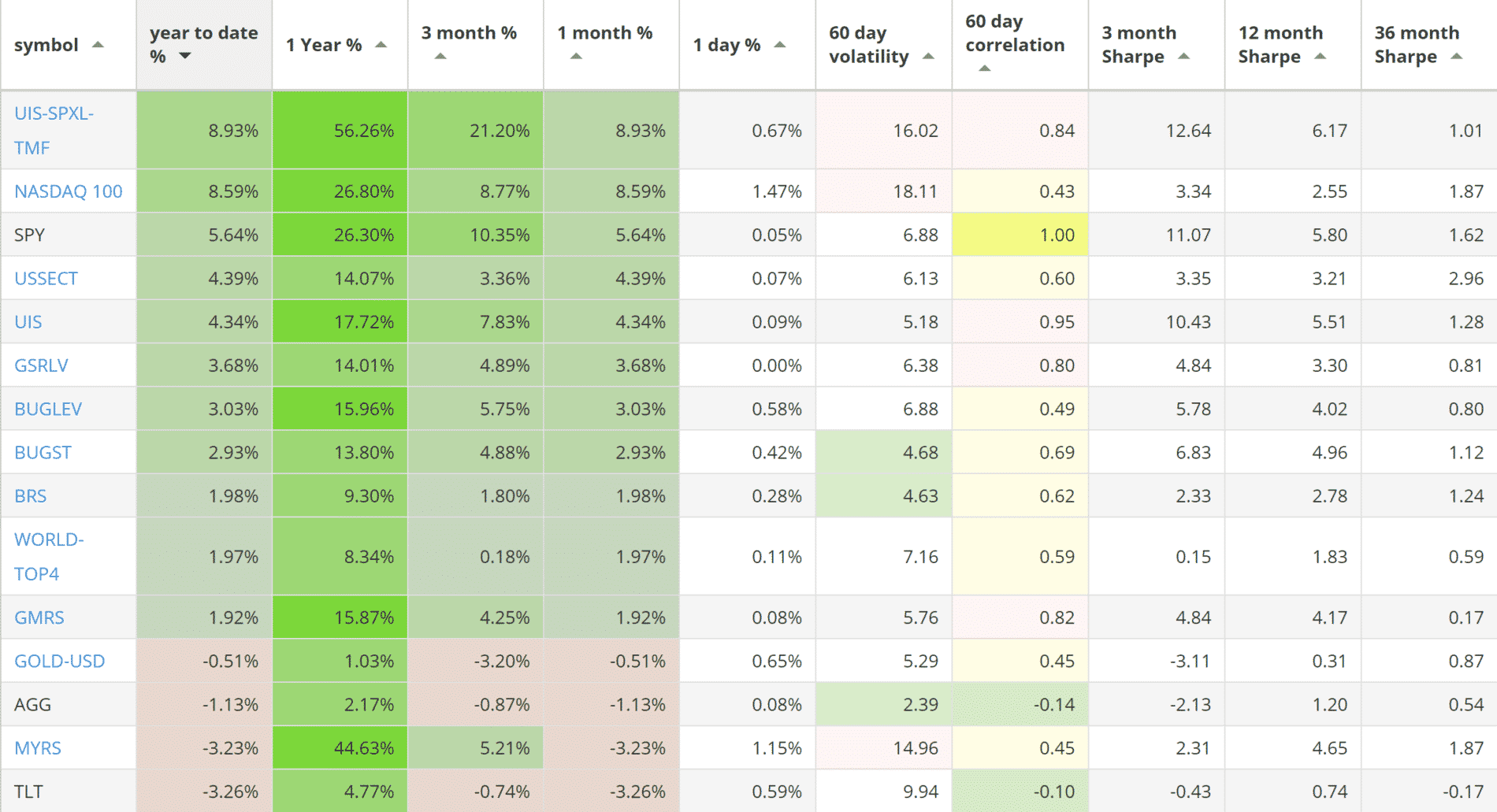

Our top 2018 investment strategies, year-to-date :

- The Leveraged Universal strategy with +8.93% return.

- The NASDAQ 100 strategy with +8.59% return.

- The U.S. sector strategy with +4.39% return.

SPY, the S&P500 ETF, returned +5.64%.

News:

- QuantTrader Light is available to all subscribers, even to single strategy ones. Just download a copy and login with your LI username/password. Depending on your subscription level you will be able to access the corresponding strategies. This gives you the opportunity to update your portfolio during the last day of the month.

- Major strategy update: Leveraging on our multi-strategy framework, Frank created a new Hedge strategy that includes Gold. The new Hedge is included in most of our strategies and helps decrease Treasury exposure. Read more in our detailed article.

- QuantTrader version 510S has a new backtester build into the consolidation tool. You can now check how a portfolio of strategies would have performed in the past.

- 4 new videos will guide you on how to use the portfolio builder and the QuantTrader consolidation tool to issue signals as well as use the Interactive Brokers portfolio rebalancing tool. We hope to publish more videos in the coming months. Feel free to tell us your preferences.

Market comment:

This month’s newsletter comes with a word for caution. The S&P 500 has risen in a parabolic fashion this past month. Sentiment has turned highly positive and most market players are sitting on profits. This is all good but we think we need to prepare for a new, slightly inflationary environment that may prove challenging to navigate through. Rising inflation is already reflected in the 10-year Treasury yield reaching 2.7% . The question is how will higher borrowing costs affect small to medium businesses, some of which rely on cheap credit. Loss of profitability for these companies could trigger a correction in the Russel 2000 and subsequently the rest of the equity markets. For these reasons we need to consider the scenario where both bonds and equity fall. Long standing subscribers know that although our strategies use hedges to limit drawdowns they cannot avoid losses if both major assets (equity and bonds) fall at the same time. This is not to say that the market will not march on to further and larger gains. It is just an observation of a possible longer-term regime change.

Our strategies have been adapted, starting this February, to include gold in our new hedging mechanism. Gold is a well respected safe heaven asset. It performs well in inflation regimes and can be a “go-to” safety asset for institutional investors if stocks and bond fail. You can read more about this major update in Frank’s article.

That said, our strategies had another good month. UIS 3x returned 8.93%, the Nasdaq 100 8.59%, U.S. sector 4.39%, BUG 2.93%. Despite weak Treasury (TLT -3.26 %) and corporate bond (AGG -1.13%) performance, our Bond Rotation strategy turned a 1.98% profit. The notable under-performer for January was the Maximum Yield strategy with -3.23%. This is due to volatility rising from the extremely low levels seen last year to more ‘normal’ levels of VIX of around 14. Subscribers should be aware that MYRS can be a very profitable strategy in the long run but it is a risky strategy and can experience severe drawdowns. Even at current levels volatility is quite low compared to historical norms. Any large spike upward will have a negative, although short term, effect on ZIV (mid-term volatility ETF), MYRS’s main component.

As usual, a quick update on cryptocurrencies: Bitcoin is almost 40% down from January 1st. But not all coins are equal: Ethereum has corrected but still sits above $1000 ($1115 compared to $759 in January 1st) and NEO has almost doubled ($140 vs $78). We think the market is changing and this type of correction, which may continue in price and length, could be healthy and lay the groundwork for new institutional investors to enter the market. It also gives us more time to research our own crypto-strategy for the brave of heart.

We wish you a healthy and prosperous 2018.

Logical Invest, February 1, 2018

Strategy performance overview:

Visit our site for daily updated performance tables.

Symbols:

BRS – Bond Rotation Strategy

BUGST – A conservative Permanent Portfolio Strategy

BUGLEV – A leveraged Permanent Portfolio Strategy

GMRS – Global Market Rotation Strategy

GMRSE – Global Market Rotation Strategy Enhanced

GSRLV – Global Sector Rotation low volatility

NASDAQ100 – Nasdaq 100 strategy

WORLD-TOP4 – The Top 4 World Country Strategy

UIS – Universal Investment Strategy

UIS-SPXL-TMF – 3x leveraged Universal Investment Strategy

AGG – iShares Core Total US Bond (4-5yr)

SPY – SPDR S&P 500 Index

TLT – iShares Barclays Long-Term Trsry (15-18yr)

Vangelis, I have a question regarding Franks last comment in his article about the option of replacing TMF with 3x the allocation of the Hedge Strategy. I was thinking of dong that with the MYRS ; however I don’t see anywhere what the Hedge Strategy would be to do so, aside from utilizing TLT and the redesigned GLD-USD strategy. What would the allocations be for the Hedge Strategy to implement into MYRS replacing TMF? Thanks, DSC

Hi David,

Frank updated MYRS and this month’s signals include a ‘leveraged hedge’ that allocates to UGLD and TMF. It is not 3x the “Hedge” but a simplified version. You can see the allocations on the strategy signals page. Let me know if this answers your question.

Thanks Vangelis,

That is the allocations that I used to rebalance, but was thinking of how to hedge without using the TMF allocation that appears in MYRS, 3xUIS, and the Nas100 strategies. I do agree with Frank that hedging with interest rates heading upwards is important, and have implemented the new allocations accordingly. FWIW I am anxious to get into quantrader and learn to harness its awesome power, in the coming weeks..

Thanks,

DSC