The following strategy update will be in effective for the February rebalancing. QuantTrader user will get a notice of the updated QuantTrader.ini strategy file when they start QuantTrader. You can also download the file also manually from here: https://logical-invest.com/quanttrader/QuantTrader.ini

It is my opinion that going forward, inflation poses a serious risk for investors. From 1980 to 2015 Inflation went down from more than 10% to near 0%. Since 2015 inflation is steadily rising from nearly 0% to now more than 2%. Inflation is a bond’s worst enemy. Since we use Treasuries to hedge our strategies, rising inflation may have a very negative impact on our TLT Treasury ETF positions.

It is not just bonds. Inflation could negatively impact the equity markets as well. Many U.S. companies are running on cheap credit and are deeply in dept. The Russell 2000 small caps, in aggregate, have already negative earnings today. Higher credit costs due to inflation would mean the end of many of these companies, resulting in a strong market correction. All this could mean that stocks and bonds go down together which would negatively affect our strategies.

One solution to this is to use Gold. Gold has always been one of the best hedges against inflation. So I decided to use it and build a more universal, “inflation-proof” hedge.

The Hedge strategy

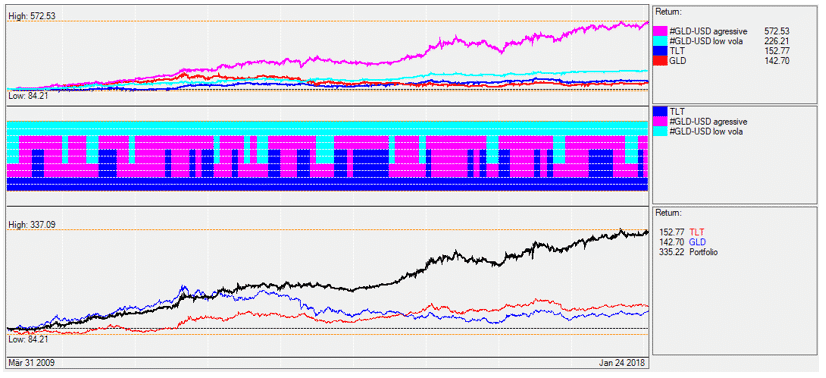

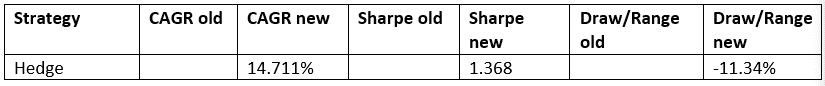

This Hedge is now a separate strategy called “Hedge”. It is composed by TLT, the long term Treasury bond and a slightly redesigned GLD-USD strategy.

The new Hedge did perform quite well in the past and can be used profitably as a standalone strategy. This is an advantage for the strategies which use it as a hedge. Most of the time the “Hedge” gets about a 50% allocation within the strategy, and so we are much better prepared for unforeseeable “black swan” events.

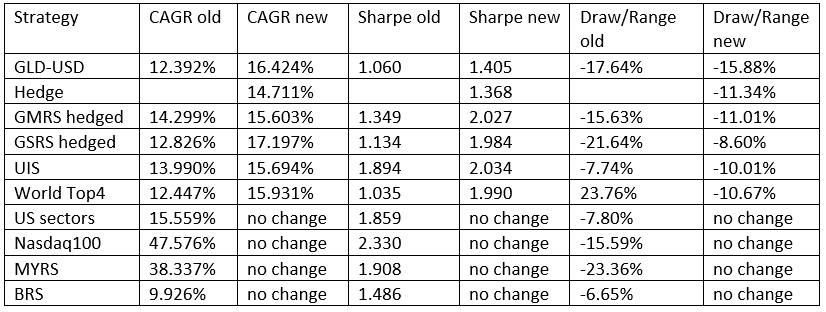

The updated GLD-USD strategy

The “GLD-USD” strategy now uses two sub-strategies. The backtests show it would have performed much better during the last 10 years. The strategy is composed, in equal parts, of two different GLD-USD sub-strategies.

One is an aggressive GLD-USD strategy and the other a low volatility GLD-USD strategy. Using two sub-strategies, we can better adjust the EUR/YEN/AUD currency protection and avoid the over-protection we had last year.

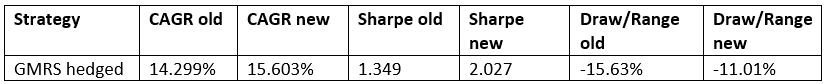

The updated GMRS – hedged strategy

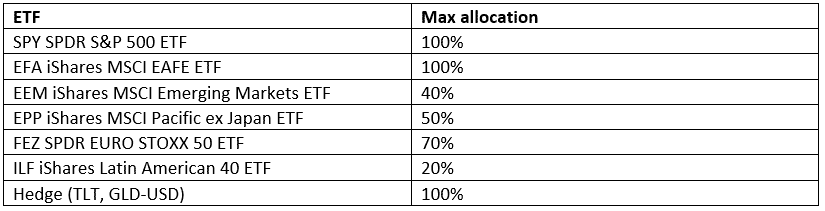

The updated Global Market Rotation strategy has been simplified by removing all the currency-hedged ETFs. We now have a natural currency hedge incorporated in GLD-USD strategy inside our main Hedge.

In an effort to better control risk, the strategy now limits the maximum allocation to more volatile markets ETFs, like the Latin American ETF.

The performance of the new strategy is better, and draw-downs are reduced.

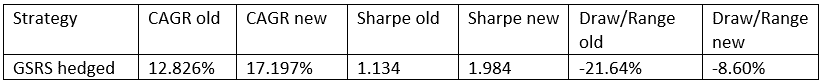

The updated GSRS – hedged strategy

The updated Global Sector Rotation Strategy has been modified by splitting the sector strategy in two sub-strategies. One selects safe low volatility sectors while the other is more aggressive, uses a shorter lookback period and selects faster growing, smaller sectors. These two sub-strategies are combined with the Hedge strategy which adds a performance improvement as well as a much lower maximum drawdown.

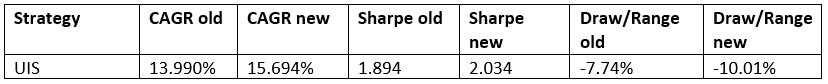

The updated UIS – hedged strategy

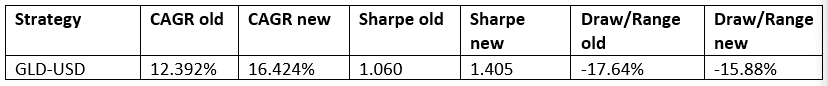

The updated Universal Investment Strategy has been adapted by replacing the Treasury hedge with the new Hedge strategy. I must admit that the strategy now looks very similar to the classic SPY-TLT-GLD Permanent Portfolio strategy, but this only shows that going forward, GLD has a good probability to work well as an inflation hedge.

The new UIS strategy also had a better performance in the past than the original strategy, even with GLD added, in spite of Gold being a bad investment for past 10 years.

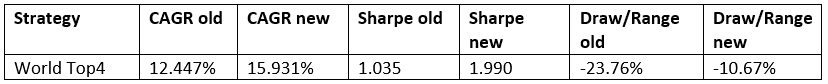

The updated World Top4 – hedged strategy

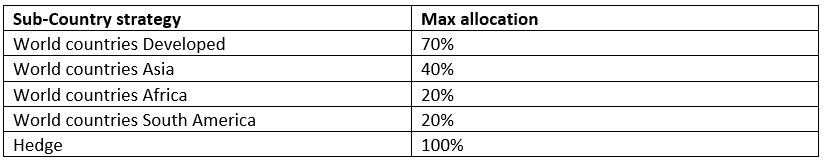

The risk of the old strategy was that it mixed together and weighted all countries equally. This could result in the strategy being invested in small volatile countries. This led to some painful corrections in the past.

The new strategy builds from 4 sub-strategies: Developed countries, Asia, Africa and South America. The maximum allocation is limited for each sub-strategy, which results in a better mix of stable, low-volatility larger countries vs better performing and volatile smaller ones.

The strategy did much better than the old one and the maximum drawdown was much lower due to the maximum allocation limitations.

Overview of the Strategies

The backtest covers about 8 years. It is limited by of the EUR/YEN/AUD currency ETFs used in the Hedge strategy. I have also made backtests for up to 20 years using a similar Hedge strategy without these currency ETFs. This way the Hedge strategy did not perform as good as the currency hedged strategy, but still the results of all strategies are better than the original strategies.

Finally, I hope that going forward the strategies will be better protected against an inflationary environment.

The MYRS and Nasdaq100 strategy have not been updated. They still use the 3x leveraged TLT hedge which fits better to the high volatility of the single Nasdaq 100 stocks. You can however replace TMF by 3x the allocation of the Hedge strategy.

For the Nasdaq100 strategy I have updated the list of the 100 stocks included.

The US sector strategy has not been modified, as this strategy hedges by shorting an industry sector. This is something which should also work if there is inflation.

Frank,

I am sure you will get a few questions. I use UIS 3X–is there a chance of a hedge similar to the file named “Hedge” but suited for 3X leverage?

Also, will the online portfolio builder get these new modifications?

At the moment the easiest way to use this hedge instead of TMF is just to buy 3x the amount of ETFs in the hedge. This should be no problem if you have a margin account. If you have a normal account, then you can use the unleveraged UIS strategy and just replace SPY,TLT and GLD by the 3x leveraged SPXL, TMF and UGLD. For the currency ETFs EUO,YCS and CROC there is not a more leveraged replacement, but I would just propose that you stay with these ETFs. I will see If I can develop a leveraged Hedge strategy to be used as a replacement of TMF.

Hi Frank,

In regards to the MYRS, would it be prudent to replace the TMF allocation with TMF+UGLD as allocated by whatever the current Hedge strategy is?

Yes, I think you can do this, however I will do some backtests next week to see how this would have performed in the past.

Looks like nice updates! I agree with RD in that it would be nice to see these updates in both the Portfolio Builder and Consolidation tool…. If you could also do one more rev of the Excel xlsm file, that would be nice as I have a modified version of that to track my accounts offline. thanks

You already have this in the consolidation tool which comes with QuantTrader

Thanks Frank. While you gave the new parameters (DD, Sharpe, etc) associated with each of the new strategies, I was hoping to use portfolio builder to see what my portfolio of strategies parameters now looks like given the changes that are coming.

Thx

Mark

Please download the latest version of QuantTrader and then you can easily set up a mixed protfolio in the “consolidated Allocations” window and see the backtest and performance parameters.

Pls download the Zip file which contains also the latest QuantTrader.ini file

https://logical-invest.com/quanttrader/QuantTrader510S.zip

Thanks Frank. I see that update in 510 now. I do have two questions though.

With using gold as such a major hedge across all of the strategies, are you worried that you may be allocating too much hedge into only one ETF?

Since I am a quant light user, if I wanted to backtest the strategies without the 3X hedge, would I just replace .ini file in the 508 version and put it in the 510 folder?

Thx

Bama

Yes, you can always just use an older QuantTrader.ini file with the newest QuantTrader version to get the old type of strategies. With only the Treasury you had in fact the problem to have all hedging money in only one ETF. Now you always allocate between Treasuries and Gold and nearly always are invested in both.

Hi Frank,

I am still somewhat new and a little confused. It was my understanding that the strategies GMRS, GSRS, World Top 4, etc as of Dec-16 were currently using a rotation of bonds (as opposed to just TLT). Is the new hedge eliminating the rotation approach and just using TLT as the bond? And if so, what was the impact?

Thanks.

Tom C

Yes, I discontinue to use the Bond Rotation Strategy as a hedge. The problem was, that in fact only the two treasuries in this strategy have been a hedge. Convertible bonds and junk bonds behave like stocks and have a positive correlation to stocks which means that they do not reduce the volatility of a strategy. In case of an inflation scenario with falling stock and bond markets we would not have any protection. In fact it could well be that then the safe Bond Rotation Strategy will not do well.

The new hedge now is really a hedge which means that the ETFs used have normally a low or negative correlation to the stock market. In my opinion this is just the safer way to protect our strategies.

Isn’t UGLD already a 3x leverage ETF? If so, couldnt one simply replace TMF with UGLD using the same percentages in the 3x UIS Strategy? Thanks Frank.

Yes, UGLD is 3x leveraged and is probably a good replacement. I will backtest this next week and if it works I will update also the leveraged strategies.

Hi Frank, thank you for the interesting and informative article.

Would TIP (Inflation-protected Treasury ETF) be a suitable substitute for TLT?

Would TIP avoid the need to introduce GLD as a hedge?

Thank you.

I don’t like TIP’s because they don’t really move and therefore they are not much better than going to cash. If markets get really shaky, it is better to have a hedge which makes bigger moves in the inverse direction than the stock market. Gold and Treasury are much more volatile than TIPs, and most of the time this volatility has a negative correlation to the stock market.

Hi Frank & Co,

Well done for keeping on evolving. Have been having some attempts at solving the hedge issue with Tips & gold. It is an issue for sure. There is enough probability to warrant action.

May I ask if you are looking at solving this for the leveraged portfolios ? I know this may not suit the guys using 401K or restricted broker accounts but for the QT crowd that use modified versions of your strategies it would be great to get your insight. I currently have a portfolio with Leveraged versions (3x) of GSRS and GMRS. However enough about me :-) you have a great number of fans that run Myers, SPXL etc that could benefit from your view… I am able to hedge with FWs and options and I am sure some of the QT subscribers also have this access. Lastly a comment on the currencies. Have you looked at expanding the range EG use currency like CHF too that also play on USD weakness. Or are you restricting your self to stay within the ETF offering ?

Love the progress I have been using LI as a back backbone for my private portfolio with both success and enjoyment.

Best

Joachim

I will begin to backtest hedging solutions also for the leveraged TMF next week. I don’t like so much the use of currencies. They can make huge jumps when the national banks interfere. Remember the 20% one day drop when the Swiss National bank ended the 1.20 SFR/EUR. Gold is in fact a very good protection against a week US$. If you compare the charts GLD moves nearly inverse to the USD/CHF price.

Great looking forward to seeing it and yes you are correct regarding the currencies. In fact as is inflation we are concerned with currencies may not help a lot.

If inflation is bad for bond holders, is being short US bonds better than being long? Is adding TMV to the TMF mix an option?

With interest rates at 0%, some people concluded that rates can only go up. They discovered that rates can go negative. Who could have guessed. Also note that many young money managers have never lived in a world of rising interest rates and have no experience with the scenario. One last item of fear. Is there too much focus on USD as a reserve currency at the expense of other options?

Even if treasuries don’t do well it is very difficult to make money by shorting them. You just have the bonds yield working against you and if there is really a sudden market correction, being short Treasuries could cost you a lot of money because such a short position would spike down together with stocks. Only long Treasury positions are safe haven investments.

Hello Frank and LI,

Perhaps interest rate increases and consequent bond price erosion will be driven by escalating demand for debt financing as new financial sleight of hand takes place this year.

With US Fed Quantitative Tightening on the horizon, and the US Treasury preparing to sell even more bonds monthly by next fall to cover the US federal government’s breathtaking cash flow deficit, not to mention some retreat of the EU bond buying program, there will be a confluence of debt offerings looking for buyers on a significant scale. Supply and demand..will lead to increased yields and depressed values.

Ken Rogoff recently expressed his concern:

“If interest rates go up even modestly, halfway to their normal level, you will see a collapse in the stock market. I don’t know how everything from art and bitcoin to stock prices will react as interest rates go up.”

While I’ve benefited from LI aggressive strategies, the NASDAQ 100 and 3X UIS this year, I’m interested in taking some risk off the table at this stage. The updated LI strategies you designed to better deal with inflation are very interesting and should offer an improved risk-reduction hedge for our portfolios. I took a closer look at the GSRS-hedged especially and think it could deliver some safety as well as a satisfactory return in an environment that’s likely to be dangerous to the traditional bond hedge.

Still, I remain interested in the leveraged strategies and what new hedges would work in that arena while risk is still off and am eager for the results of your work this week.

Many thanks for all the LI team does for its subscribers.

Richard Manley

I have just updated the strategies using TMF as a hedge with a new 3x leveraged hedging stategy

Pls download the Zip file which contains also the latest QuantTrader.ini file

https://logical-invest.com/quanttrader/QuantTrader510S.zip

Thanks Frank and team. Very exciting updates for sure. Like many of the other QT users, I’m interested in a Hedge for TMF. I look forward to seeing what Frank comes up with!

One other question – this is the first time that the .ini file has changed since I started using QT. Is best practice for me to manually re-create my custom strategies off of this new .ini file, or is there an easier way to make this happen? Thank you!

Yes, I think best is to recreate your strategy using the newest file. Perhaps you can also just use the new “consolidated Allocations” window to allocate your mix of strategies. You can now instantly see the backtest and performance parameters.

Pls download the Zip file which contains also the latest QuantTrader.ini file

https://logical-invest.com/quanttrader/QuantTrader510S.zip

For those using the strategies in a 401K and restricted from buying the GLD ETF, is there a suitable mutual fund alternative?

I think you mean the 3x leveraged UGLD ETF because it seems to me that normal GLD would be allowed in every 401 account.

I don’t think you can use the leveraged strategies in a 401k account and you will also not find a leveraged mutual fund.

I was actually looking for a mutual fund alternative to the GLD ETF. Many 401ks only allow mutual funds and not ETFs. There are plenty of mutual funds that invest in gold mining companies, but that won’t necessary replicate the returns of gold bullion, which is what the GLD ETF invests in. I’m hoping any member can reply with an answer. One thought I have is replacing the GLD investment with a lower percentage of a gold miner fund and the balance in a cash-type fund. This would be to try and offset the volitility of miners, but still get the exposure to gold.

Hi Frank,

Having looked at the new hedged strategies on Quanttrader I have spotted what appear to be a few anomalies. I’d be grateful if you could clarify these for me.

1. On GSRS Aggressive, there is an ETF displayed as FAN, has this now replaced TAN?

2. From your description of the changes to GSRS described above I was under the impression that all the previous sectors had been split into two separate groups, however for the past 10 years it seems that the GSRS low vol has used (all bar one) the same etfs that are in the Aggressive strategy.

Thanks,

Richard T

1) FAN is Global wind energy and TAN is global solar energy

2) You can click on the two GSRS sub strategies in QuantTrader and you will see that the agressive strategy changes much more often the ETF than the low volatility strategy. It can however be that they both invest in the same ETF. They don’t really know what the other strategy does. The low vol strategy was more than half of the time during the last 10 years invested in the quite safe KXI Global Consumer Staples ETF while the aggressive strategy also invests in smaller sectors like Lithium, wind energy or coal mining.

Hi Frank,

Thanks again for the updates. Going forward I am hoping that the new hedging philosophy will be better than the bonds given the current financial environment we are in/heading into. Like you said, with GLD not doing well the last 10 years, it is hard to get an accurate representation when doing the backtesting.

Concerning QuantTrader. Since I am a lite user, I never really utilized QT in the past. I relied on Portfolio Builder to build and backrest my portfolio of strategies and the consolidated tool for the allocations. The transition to the Allocation part of QT Lite is not that big of a jump and is pretty straight forward. The backtester portion of QT, on the other hand, does not have as good a GUI as the online portfolio builder. To me it is cumbersome having to use the graph to scroll around and get monthly/annual returns. PB’s tabular format was much cleaner.

While I know it is easier to carry the changes in only 1 tool, was there any talk of updating PB this last time while people get used to using the QT type interface?

Thx

Bama

I have such a year-month return table on my todo list, but the priority is quite low. There are still some other quite important tasks to be done before this. Sorry, but we are only two working on QuantTrader.

Hi Frank,

Is there a reason why the Online Portfolio Builder (OPB), the Portfolio Builder Excel (PBE) and QuantTrader (QT) all have different historical data sets. The PBE has history going back to March 2008. The OPB to June 2008. QT appears to only have data going back to 2012, at least this is what most of the portfolios I have entered start from, despite selecting 20 years for the history range.

With these differences it is very difficult to just use one of the three systems.

Clearly having history going back to October 2007, for those strategies that existed then, would be ideal as it would pick up the complete Great Recession (GR). Is it possible to get this extra history into QT?

My biggest ongoing concern about LI, is how well the strategies and portfolios will do during the next major correction. Without data available to us going back to 2007 it is a bit of an unknown quantity. The only way that I have been able to address this is to set up my strategy of MaxCAGR with MaxDD < 7% in PBE and to take a copy of the EquityLines and DrawDown sheets and perform some calculations against that data to work out the monthly returns and MaxDD during the period of the GR that is available to me.

For these reasons, until you are able to get GR data into QT I need the PBE available to me to carry out analysis of different strategies during the GR.

Regards,

Richard T

Hi Richard,

what limits the availability of data is the inception date of some symbols. When you run a portfolio of strategies in QT, it limits the backtest to the most recent inception date, while the online and offline sheet show at least the return of the available strategies. This is the main reason for the deviation between the tools.

We´re working on an automated solution to extend the necesary symbols with synthetic tickers. This will allow you to extend the backtests also in Quanttrader. Still the uncertainty will remain whether a backtest covering the 2008/09 GR is a valid prediction for the “next GR” – as the big unknown is where it will come from.

Just a quick note following an exchange with a subscriber:

As the new hedge strategies are double-layered, e.g. sub-strategies of sub-strategies, when you try to get the new allocation from the strategy backtester you will see cryptic allocations to #Gold-USD aggressive and #Gold-USD low-vol, but not the underlying ETF.

Instead just input a 100% to the strategy in the consolidated signals page, which then shows the allocation down to the underlying ETF.

Example screenshots for GMRS:

Strategy backtester: https://logical-invest.com/wp-content/uploads/2018/01/GMRS-Strategy.png

Consolidated Signals: https://logical-invest.com/wp-content/uploads/2018/01/GMRS-Consolidated.png

Hi Frank,

I see the new hedging strategies use ECO, a Proshares etf. Since this etf is an MLP, it is not allowed to be traded in an IRA account at Interactive Brokers. DRR is another similar double inverse euro etf that is allowed for trading at IB. Would this be a good replacement for EUO?

Regards,

Dan

Yes, absolutely. Actually need to see whether we change it to DRR permanently as other IRA holders have the same issue.

Here tracking chart: https://yhoo.it/2E466vh

Sorry, typo in the first line. Should be EUO not ECO.

Dan