Logical Invest

Investment Outlook

December 2017

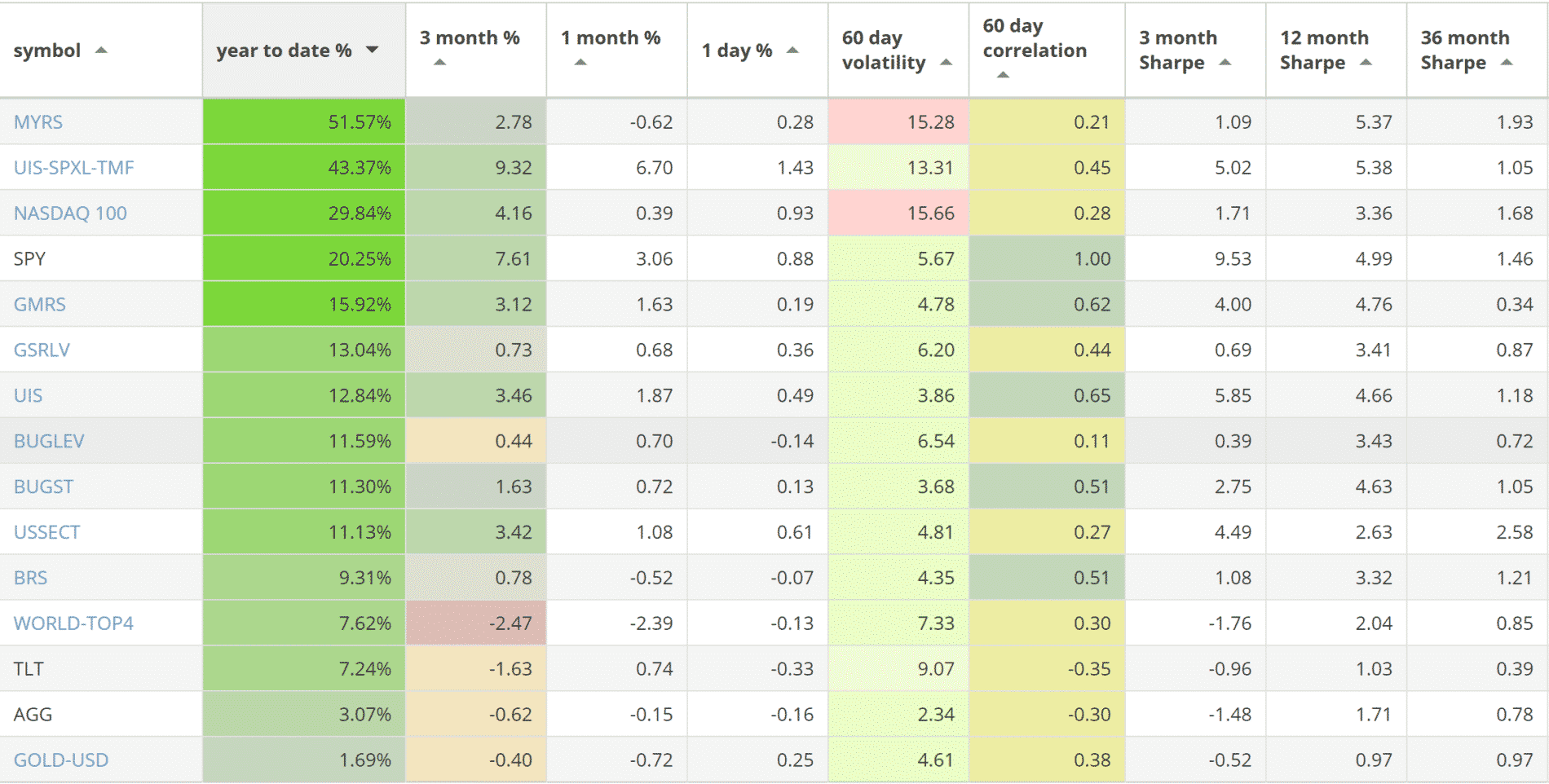

Our top 2017 investment strategies, year-to-date:

- The Maximum Yield strategy with 51.57% return.

- The Leveraged Universal strategy with 43.37% return.

- The NASDAQ 100 strategy with 29.84% return.

SPY, the S&P500 ETF, returned 20.25%.

News:

Our strategy development software QuantTrader has been updated and can once again fetch intraday prices.

Market comment:

November was another positive month for the S&P 500 with the index gaining +3.06 %. More risk-sensitive indicators such as the Russell 2000, emerging markets indexes as well as high yield and foreign bonds showed increased volatility and signs of weakness. This may be due to expectations of coming inflation and interest rates hikes rather than economic factors. U.S. Treasuries gained 0.74% but still remain weak. Gold remains flat adding +0.36% for the month.

Our strategies experienced some volatility mid-month but eventually recovered. Our best performer was the leveraged Universal Strategy (UIS 3x) with 6.70% as both SPY and TLT returned gains. Our worst performer was the World Top 4 (WT4) strategy shedding -2.39% mostly due to the Chilean ETF dropping -12.1%. Our enhanced permanent portfolio strategy (the “BUG“) added a 0.7%, the Global Rotation Strategy added 1.63% and our Nasdaq 100 strategy managed 0.39% for the month despite some larger moves in it’s individual allocations (LRCX -7.79%, ISRG +6.51) . Our Maximum Yield strategy reminded us that it can experience large corrections as volatility turned up mid-month only to recover later and end up with a slight (-0.62%) loss. MYRS remains above the 50% for the year.

Christmas and New year’s have always been kind to investors. This year, with the S&P500 already at +20% year-to-date we are curious if the market will once again reward risk takers. Either way we follow our models and keep a diversified and balanced exposure to the markets.

We end this newsletter with a look at crypto-currencies. When we first mentioned Bitcoin in our July newsletter, 1 BTC was worth $2,346. Two days ago (Nov. 29 2017) it hit the $11,000 mark and has since quickly corrected to the 9,000 mark (-18%). This type of action with huge payoffs and draw-downs is a lesson in psychology: As lucky as they are, Bitcoin owners now feel the pressure as they sit on large unrealised gains and watch as the mainstream CME, CBOE and NASDAQ exchanges prepare to throw an elephant (the new BTC Futures contracts) into this tiny, illiquid and somewhat secretive market. Large players and professional traders are about to come in with full leverage and we expect some very interesting action.

Logical Invest, December 1, 2017

Strategy performance overview:

Visit our site for daily updated performance tables.

Symbols:

BRS – Bond Rotation Strategy

BUGST – A conservative Permanent Portfolio Strategy

BUGLEV – A leveraged Permanent Portfolio Strategy

GMRS – Global Market Rotation Strategy

GMRSE – Global Market Rotation Strategy Enhanced

GSRLV – Global Sector Rotation low volatility

NASDAQ100 – Nasdaq 100 strategy

WORLD-TOP4 – The Top 4 World Country Strategy

UIS – Universal Investment Strategy

UIS-SPXL-TMF – 3x leveraged Universal Investment Strategy

AGG – iShares Core Total US Bond (4-5yr)

SPY – SPDR S&P 500 Index

TLT – iShares Barclays Long-Term Trsry (15-18yr)

The Logical Invest back testing going back approx 10 years covers primarily a major bull market in both equities and bonds, with central banks buying like drunk sailors, money being printed as if there was no tomorrow, companies buying back shares by the boatload using low interest loans. In such a market it is hard not to make money, and volatility at all time lows.

Going forward, we have QE being stopped then reversed, bonds at a level that leave little room for further appreciation, interest rates rising, and a very old bull that is by many measures overvalued and due for correction. Given these factors, do you expect the Logical Invest strategies to continue to do well in their current incarnation ?

More broadly, what do you advise investors who use your service to do to recognize the changing fundamentals underpinning the markets ?

Hi Gordon,

thanks for your comment!

We´ve had this discussion since 2013/14 already, in that time the bull was only 5 years old, “taper tantrum” just passed and everybody expecting the central banks to start tightening, EU at the brink and China markets taking off… What has happened since then? Markets much higher, rates not changed that much, volatilty at historical lows. And probably many people who opted to stay at the sideline scratching their head.

Would backtesting models since the 70s raise your confidence and / or lead to better trading? In our thought probably not, as we believe markets end environment do change. Our high-flyer MYRS just did not exist before 2010/11, vola trading in the retail sector just started after inception of the ETF. Other “proven” momentum strategies with long backtest just stopped working in 2015.

We´re not too much into fundamentals, but rather into price action mechanisms which are statistically sound .. and work. When diversifying our portfolios across several of these mechanism (strategies) you always will have some that over-perform, while others lag. And as all of our strategies have a hedging component (bonds, precious metal, FX) you benefit from less overall volatility and higher risk/return.

All partners of LI lived through and traded their way out of the 2007-9 crash and one could argue that is why we actually created our strategies that later became Logical. We were unhappy with the way our accounts were treated by certain professionals and felt that we needed to take maters into our own hands and protect our own capital. Thus we tested and created strategies and have since adhered to rules of trading rather than instinct or hunch or ‘feeling’. Our strength is not in a bull market. If you look at BRS, GLD-USD, the BUG (enhanced permanent portfolio) you will see that they will underperform the SP500 in a bull market but will out-perform in a mixed one (bull and bear) by minimising drawdowns. Strategies like the BUG and GLD-USD can deal with inflation by having gold to allocate to. MYRS which is a bullish strategy, will also work in flat and mixed markets since it collects premium. As the markets change we adapt. We actively research and if the time comes that inflation kicks in for good we will be looking to commodities for diversification. We are also open to new assets classes such as Bitcoin as, ironic as it may sound, an alternative safe heaven asset in case of bear markets, political trouble or fiat devaluation. We are traders so we keep our eyes open. I will agree that in a bull market everyone can make money. It is in a bear market that you will need rules, logic and a system (even not ours) that can keep you from ruin.

OK thankyou both.

Speaking of mean reversion, mentioned a number of times in your site, do you advise following a “dogs of logical invest” approach, to switch into your lowest performing strategies each year on the assumption that mean reversion will give them a lift on average the following year ?

When I say lowest performing, I mean relative to their historical average. So a strategy that returns 20% one year but is 7% below its average could be one of the low performers while a strategy with a 15% return which is 4^ above its average could be a high performer.

Hi Gordon,

talking about mean-reversion, there are two documented phenomena – short term (couple of days) and long term (months). We normally refer to short term, which we use in some of our strategies to add a 4-6 days mean-reversion to our medium-term momentum look-back.

What I would not like about a “dogs of logical invest” (beside the name, but that’s a different story..) is that we are well aware that some strategies might just “stop working” – and not come back as market environment has changed, let’s take the example of the MYRS which higly depends on the risk-premium, aka contango in the VIX curve. There are periods, especially like 2015 where several of our strategies performed less than expected, and then next year performed much better. But instead of betting on the laggers to come back, a more rational approach would be to invest into a Top2-5 sub-set of the winners – like I’ve outlined here: https://logical-invest.com/top-performing-etfs/

Happy to get to know your thoughts,

Alex