Special topic: Passive Investment

Logical Invest

Investment Outlook

October 2016

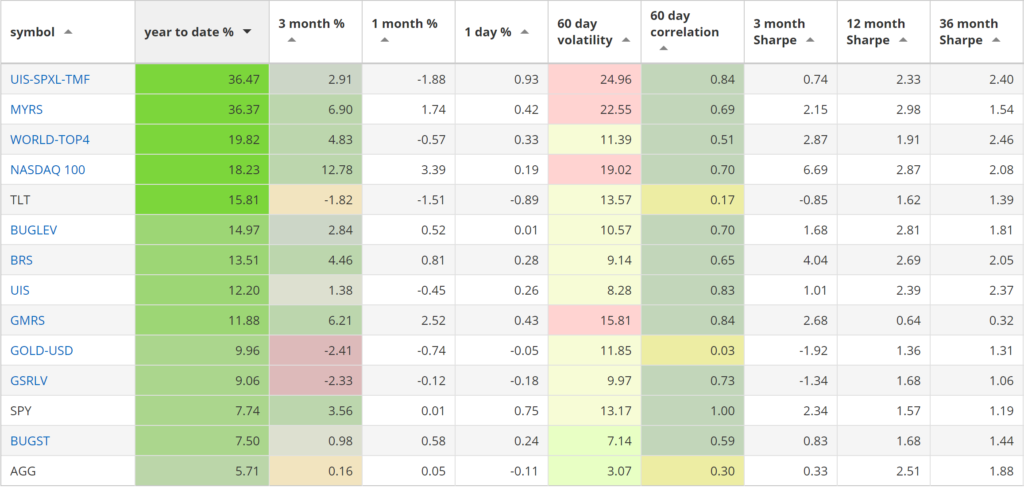

Our top year-to-date strategies:

- The Leveraged Universal strategy with 36.47% return.

- The Maximum Yield strategy with 36.37% return.

- The World Top 4 with 19.82% return.

SPY, the S&P500 ETF, returned 7.74%, year-to-date.

News:

- Introducing Richard´s Corner, a new Logical Invest User Community, moderated by Richard Manley. Richard is a long time user and critical commenter of our services. Subjects range from making the best of your 401K , using Fidelity or Vanguard funds to using our various tools, including our new QUANTtrader software.

- Coming soon in QUANTtrader: Reduced pricing for non-professionals as well as AUM based pricing for smaller RIA’s and managers.

Market comment:

Following a quiet summer, volatility has increased this past month. It was first introduced in the bond market as participants became concerned about an upcoming rate hike as well as the effectiveness of central bank policy. This was reflected in a sudden 4% drop in the 20-year Treasury ETF (TLT ) during the first few days of September. The SP500 (SPY) also had it’s first 3% sharp correction since July. Both these ETFs have since recovered but uncertainty has remained due to upcoming U.S. elections, world politics as well as the deterioration of Europe’s most prestigious bank.

Most of our strategies remained flat for the month although some experienced a correction during the first week. The Nasdaq100 was the best performer with a 3.39% return followed by GMRS at 2.52%. Our worst performer was the aggressive 3x UIS losing 1.88% for the month.

We wish you a healthy and profitable October in your Passive Investment.

Logical Invest, October 1, 2016

Strategy performance overview (Visit our site for daily updated performance tables.)

[fusion_builder_container hundred_percent=”yes” overflow=”visible”][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none” last=”no” hover_type=”none” link=”” border_position=”all”]

Special topic Passive Investment

Read how to apply our development backtest software QuantTrader as a DIY investor or passive investment advisor to create your own Passive Investment in just a couple of minutes. Contact us with your special requests for building your own ETF Rotation Strategy for your Passive Investment.

Symbols:

BRS – Bond Rotation Strategy

BUGST – A conservative Permanent Portfolio Strategy

BUGLEV – A leveraged Permanent Portfolio Strategy

GMRS – Global Market Rotation Strategy

GMRSE – Global Market Rotation Strategy Enhanced

GSRLV – Global Sector Rotation low volatility

NASDAQ100 – Nasdaq 100 strategy

WORLD-TOP4 – The Top 4 World Country Strategy

UIS – Universal Investment Strategy

UIS-SPXL-TMF – 3x leveraged Universal Investment Strategy

AGG – iShares Core Total US Bond (4-5yr)

SPY – SPDR S&P 500 Index

TLT – iShares Barclays Long-Term Trsry (15-18yr)

Vangelis,

I noticed you didn’t list any favorable models this month at the end of the newsletter as you have the past several months. Have you discontinued those comments?

Dear John,

That is correct. We decided against it. We would rather let each subscriber use our rankings table, online and excel based allocation tools or QUANTtrader itself to pick and allocate across strategies. ‘Favorites” although based on a model, can seem subjective and based on opinion which is not what we want.

Dear Vangelis,

I suppose I am still hopeful that the LI team will provide that information as a service to the All Models Subscribers. You have so much more experience and tools at your disposal than I do. I feel like I’m second guessing myself and feeling around in the dark when I try to do it. Actually, I’m not even sure exactly how to do what you are suggesting. I think you are suggesting using a shorter look back period of 90 days to evaluate the models based on return and volatility and upgrading each month to a select few models. It seems it would be easy enough for LI to do this and publish it monthly for the All Models Subscribers. One thought is to use the stock portfolios you have already developed under the custom portfolio builder such as Max CAGR/Max 7% Vol, Max CAGR/Max 10% Vol, Max CAGR/Max 15% Vol and then limit the meta model to 3,4 or 5 models. That’s just an idea, perhaps you are aware of better metrics and choices through all of your tools, experience and ability.

I really like LI and as an individual investor who’s subscribing to a monthly service, I’m hoping to be able to quickly and easily identify the best monthly choices and feel confident that I have made the best choices based on the math available at the moment. Right now I don’t have that confidence. It seems like an easy piece for LI to add to the service. I’d really prefer not to purchase another service, Quant Trader, and then attempt to do the analysis myself, and still not feel confident I did it better than you could have.

I hope this makes some sense. Please feel free to ask any questions.

Best,

John

Hello John,

Everything you say does make sense and thank you for sharing your thoughts. You comment has triggered an internal discussion here at LI. We will keep you posted.

I have two items:

1–I am confused by the October Nasdaq 100 stock list. It was identical to September, yet several of the group had fallen off in short term relative strength. (AMAT to #30, CHTR to #36).

2–I am disappointed that the general guidance statement was omitted. Please reconsider this, as I am not going to dive into the technical decision making. (I have tried in the past; that is why I subscribed to LI in the first place.)

You are right. The first 4 stocks are still the same. The reason is that this strategy uses a rather long lookback period of 164 days. So, the strategy should find companies which have a strong long time growth. The strategy should find companies like Google, Tesla, Amazon, Facebook … and stay invested even if they fall short of short term signals like relative strength. In our backtests this has proven the better strategy then relying on short term patterns. People normally stick to these long term outperforming companies for quite long periods until they change their mind. Short term signals are a lot of times only due to heavy trading activity and the risk of mean reversal is high. You risk to fall into a buy high, sell low pattern.

Concerning guidance, this is a dificult item for three reasons. First we are not registered investment advisors, so we should not give recomodations as we could be made personally responsible for any losses resulting of our advice. Second reason is that markets are difficult and mainly driven by FED statements which we can know in advance. Third reason is that you get best results by investing in the strategies which had the highest sharpe during the last months, and this is something you can see in the performance table.

Regards Frank

Frank,

Thank you for your detailed explanation.

Is the November newsletter out yet? I did not see any email, when I received the monthly signal emails and cannot find the newsletter on the web site either.

Hello Sunil, yes, was published just shortly after your note: https://wp.me/p5ls2b-9tW