Summary

- We added VTIP to our #Cash and #Hedge sub-strategies.

- We added the #Cash sub-strategy to the Universal Investment strategies and to the Enhanced Permanent portfolio strategy.

- Updated Nasdaq and Dow components as well as added some new sector ETFs.

- Since the #Hedge substrategy is part of all our strategies, all strategies have been re-optimized.

- Historical backtests will differ from actual historical returns. starting July 1. Read why that happens.

- Historical returns will still be available here.

- All updates will be live starting July 1st.

Motivation

As the environment changes so do our strategies. As In real life trading, we periodically re-evaluate our models and assumptions. We retest them and adapt if necessary. This is not done often as it would mean we would be chasing ‘what has recently worked best’. Or in quantitative jargon we would be ‘over-optimising’. We do this every few years, or as often as necessary, especially when fundamental market changes are at play. Which is the case now.

#CASH sub-strategy

Our #CASH sub-strategy (also called Short Term Bond Strategy or STBS) is essentially a place to park cash that earns interest. When combined with other higher risk strategies it creates a lower risk portfolio and generally improves the portfolio’s Sharpe ratio.

VTIP

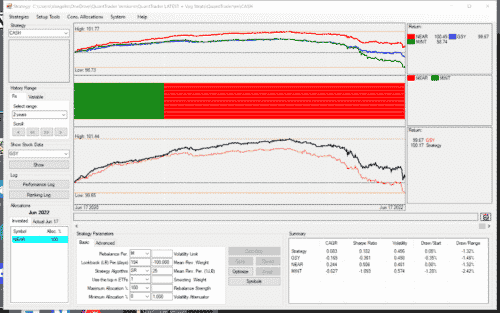

Our first change is giving our #Hedge and #Cash strategies access to the Vanguard Short-Term Inflation-Protected Securities ETF (VTIP). We call this the ‘inflation protected cash”. Below are the 2-year backtests of the old version (no VTIP). Sharpe ratio of 0.182.

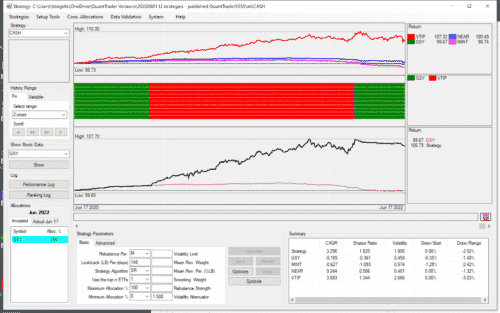

vs the new version that includes VTIP. Sharpe ratio of 1.825.

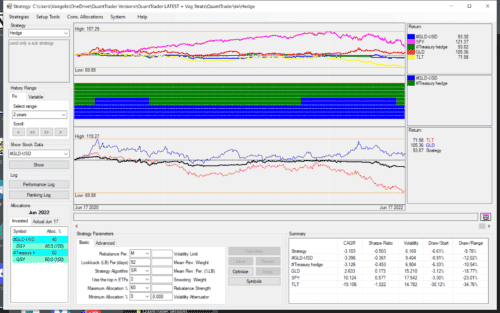

We are doing the same with our #Treasure hedge substrategy, which is used in our #HEDGE, which in turn is used in almost all our other strategies as a variable hedge.

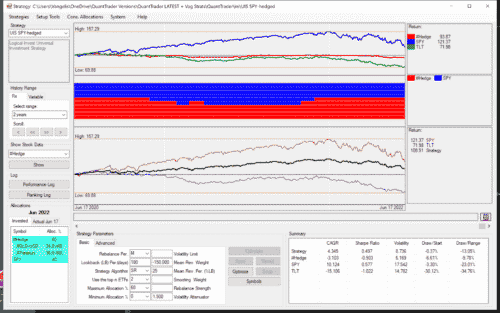

The old #HEDGE

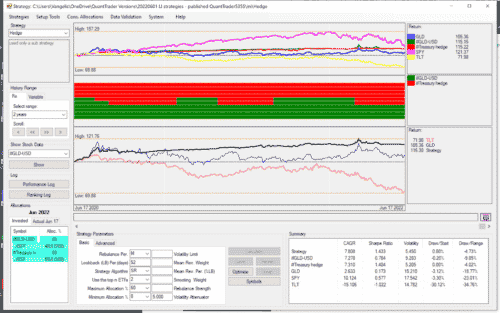

vs the new #HEDGE with VTIP added:

Adding #CASH to Universal Investment strategies and to the classic Permanent portfolio strategy.

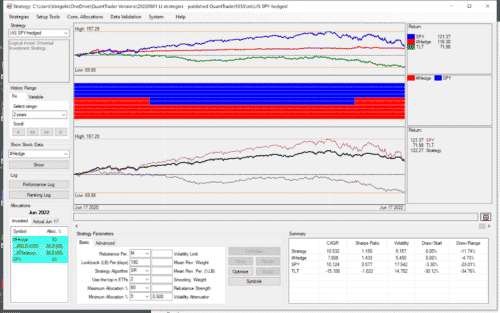

Due to the high correlation between stocks (the risky asset) and bonds/gold (the hedge asset) strategies have stopped working as intended. We are adding #CASH as a way to allocate away from both Equity, Bonds, even gold. Again, #CASH gives access to GSY but also to inflation protected cash, VTIP. Below is the old UIS strategy

vs the new UIS strategy.

The differences are not huge but substantial enough to warrant change.

Updated GLD-USD leveraged strategy as CROC was de-listed

Our best performing strategy for the year has been the GLD-USD Leveraged strategy. It has returned 19% YTD. It trades GLD against various currencies such as the Yen, the Australian dollar and the Euro. Until now we used inverse leverage ETF to short the currencies. One of these ETFs, the ProShares UltraShort Australian Dollar fund (CROC) has been suspended.

From now on we will use AUDfx. EUROfx and YenFx in the strategy instead. It is up to you to use the correct instrument that bests suits your situation (futures, FX, etc) if you choose to follow the strategy.

Updated Sector ETFs in Global Sector Rotation strategies (GSRS)

We have added additional sector ETFs in the strategy. For a full list, visit the updated strategy page after July 1st.

Backtest results will not reflect actual historical performance

Since we have updated the strategies and re-optimised the strategy parameters (before you ask, yes, we have tools to avoid over-optimization), backtests on the site will not reflect actual historical performance. In other words if you have traded the Nasdaq 100 strategy from January 1, you may have lost -9%. The backtested equity on the site may show a loss of -2%. That is normal and expected since the strategy backtests are based on the new (after the fact) rules.

This seems ‘not fair’ but it is necessary (read why) as with these new rules the upcoming allocation will be calculated. The actual historical returns of the strategies are still on site:

https://logical-invest.com/app/historical

We wish you a great end of June. More on our regular Newsletter July 1st.