Logical Invest

Investment Outlook

October 2017

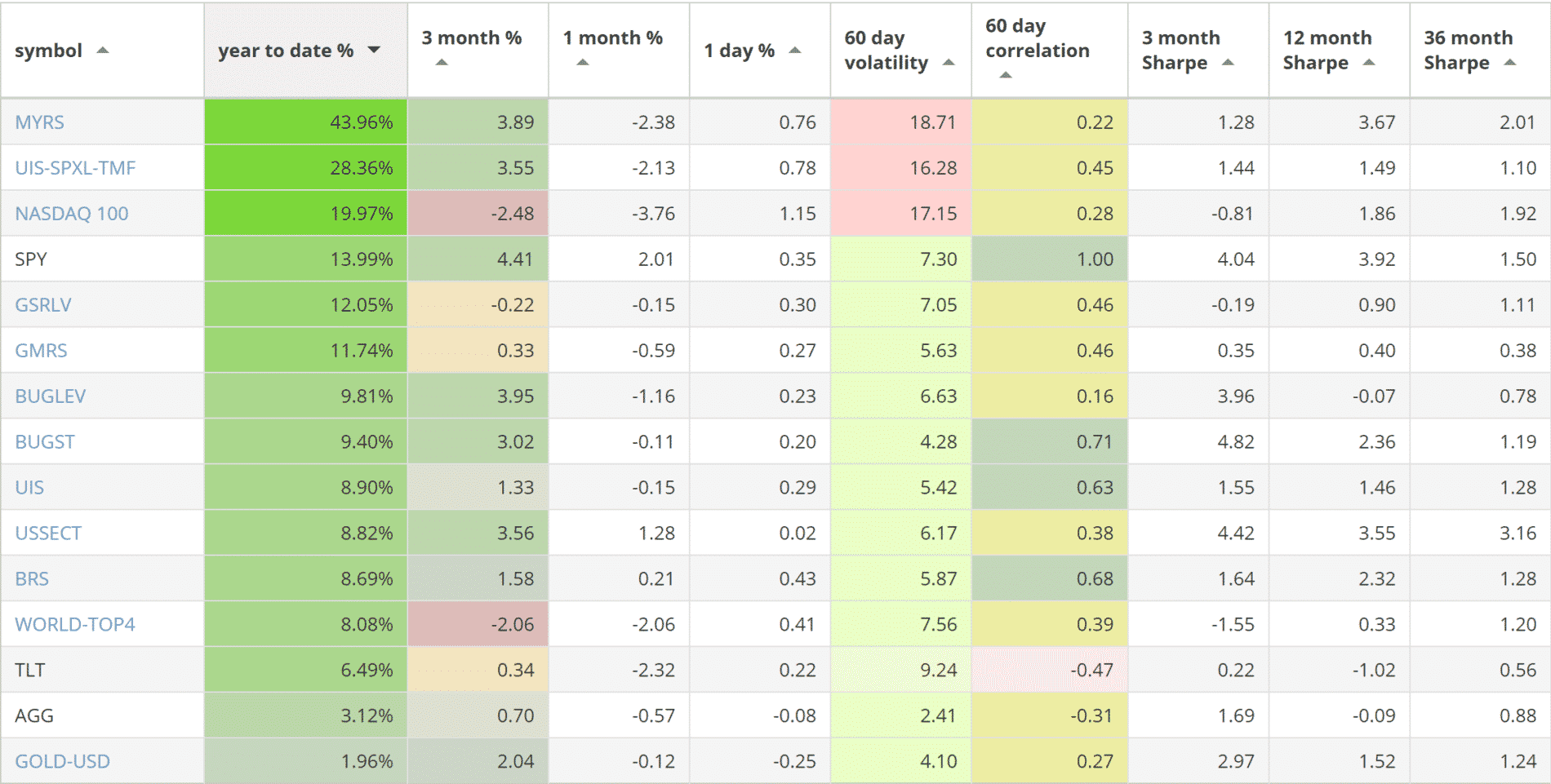

Our top 2017 investment strategies, year-to-date:

- The Maximum Yield strategy with 43.96% return.

- The Leveraged Universal strategy with 28.36% return.

- The NASDAQ 100 strategy with 19.97% return.

SPY, the S&P500 ETF, returned 13.99%.

Market comment:

The S&P 500 has reached new heights, gaining +2% for the month, influenced by a more optimistic tax reform outlook. On the other hand, president Trump’s proposed tax cuts and the possibility of a growing U.S. deficit caused U.S. Treasuries to sell off, pushing the benchmark 10-year yield to 2.26% and the TLT price down by -2.32%.

Most of our strategies had a pullback partly due to our strategies using the TLT etf (or TMF) as a hedge. Strategy losses ranged from -3.76% for the Nasdaq 100 to -0.11% for the non-leveraged BUG strategy. Winner for the month was the U.S. Sector strategy (+1.28%). The Bond rotation strategy managed to stay positive at +0.21% despite the widespread bond sell-off. Our Gold-USD strategy lost -0.12% managing to hedge the gold correction (GLD: -3.37%) for the month.

Seasonally, October is a volatile month but often leads to a favorable pre-Christmas equity environment.

We wish you a healthy and prosperous 2017.

Logical Invest, October 1, 2017

Strategy performance overview:

Visit our site for daily updated performance tables.

Symbols:

BRS – Bond Rotation Strategy

BUGST – A conservative Permanent Portfolio Strategy

BUGLEV – A leveraged Permanent Portfolio Strategy

GMRS – Global Market Rotation Strategy

GMRSE – Global Market Rotation Strategy Enhanced

GSRLV – Global Sector Rotation low volatility

NASDAQ100 – Nasdaq 100 strategy

WORLD-TOP4 – The Top 4 World Country Strategy

UIS – Universal Investment Strategy

UIS-SPXL-TMF – 3x leveraged Universal Investment Strategy

AGG – iShares Core Total US Bond (4-5yr)

SPY – SPDR S&P 500 Index

TLT – iShares Barclays Long-Term Trsry (15-18yr)

What is the UIS strategy for Oct 1

Julian,

I just send you the strategy emails.