Special topic this month: 401k Investments

Logical Invest

Investment Outlook

January 2017

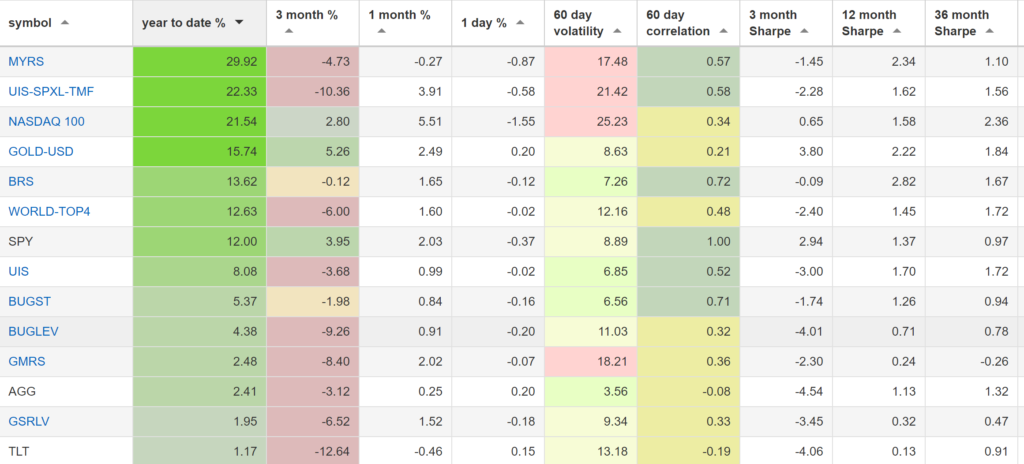

Our top 2016 strategies:

- The Maximum Yield strategy with 29.92% return.

- The Leveraged Universal strategy with 22.33% return.

- The NASDAQ 100 strategy with 21.54% return.

SPY, the S&P500 ETF, returned 12.00%.

Market comment:

To put 2016 in perspective, we must go back to 2015 and remind ourselves how the rising dollar environment affected diversified investors. Most asset classes suffered through 2015. The S&P 500 stayed flat, long term Treasuries lost 2%, gold lost 9%, emerging markets shed 17% and USO, the crude oil ETF was down 44%. To make things worse, in August 2015 there was a sharp correction in equities which caused many “weak hands” to just exit the market.

The first half of 2016, by contrast, rewarded anyone holding any of these assets.The second half proved far more challenging as rising yields expectations depressed bond prices, with TLT loosing 16% from July to December. Expecting higher yields in the U.S. can cause an appreciation in the U.S. dollar which in turn causes weakness in dollar denominated assets like gold and foreign equity. All of these assets gave back some of the early 2016 gains. Two major events, the Brexit vote and U.S. elections proved to be much less disruptive than expected. For 2016, The S&P 500 returned 12%, long term Treasuries gave up early gains to stay flat and gold gained 6%. Emerging markets gained a respectable 14%.

All our strategies were positive for the year. Our ‘non-equity’ strategies did well outperforming their respective benchmarks: Our volatility harvesting strategy (MYRS) returned 29.92%. Our Bond rotation strategy (BRS) returned 13.62%, compared to 1% for TLT and 2.4% for AGG. Our Gold hedged strategy (Gold-USD) returned 15.74% compared to 6% for Gold.

For 2017, in preparation for rising yields, we have adapted our strategies to rely less on the 30-year Treasury ETF (TLT). We introduced inflation protected treasuries as an additional hedge and used dynamic selection of the hedging instrument based on a new TLT/TIP switching algo as well as our successful Bond Rotation Strategy.

Our Portfolio Builder tool gave many of our clients the opportunity to build multi-strategy portfolios using pre-set optimization targets, including minimum volatility and maximum sharpe with drawdown restrictions. Alex discusses how these portfolios would have performed on his latest article.

We also created online versions of our online portfolio tool as well as a consolidated signals tool to facilitate our existing subscribers.

Finally we decided to make our proprietary software, QUANTtrader, available to non-professional traders and smaller advisors. QUANTtrader is a sophisticated tool that can customize, combine existing or create brand new strategies.

For 2017, we know better than to publish predictions or political and financial analyses. Suffice to say that we are aware of the major geopolitical changes and the large forces sweeping through the U.S., Europe, Asia and the Middle East. We are moving forward into 2017 with uncertainty and keen interest on what the future holds. We cannot control it.

What we can do, is control and protect our portfolios.

We enter 2017 armed with solid models providing sophisticated exposure to both aggressive and defensive assets: Equity (NASDAQ100 strategy), foreign equity (World-Top4, GMRS), bonds (Bond Rotation Strategy), gold (Gold-USD strategy) and volatility (Maximum Yield Strategy).

And combinations of the above.

We wish you a healthy and prosperous 2017.

Logical Invest, January 1, 2017

Strategy performance overview:

Visit our site for daily updated performance tables.

Special topic 401k Investments

Read how to apply our development backtest software QuantTrader as a DIY investor or passive investment advisor to create your own 401k Investments in just a couple of minutes. Contact us with your special requests for building your own ETF Rotation Strategy for your 401k Investments.

Symbols:

BRS – Bond Rotation Strategy

BUGST – A conservative Permanent Portfolio Strategy

BUGLEV – A leveraged Permanent Portfolio Strategy

GMRS – Global Market Rotation Strategy

GMRSE – Global Market Rotation Strategy Enhanced

GSRLV – Global Sector Rotation low volatility

NASDAQ100 – Nasdaq 100 strategy

WORLD-TOP4 – The Top 4 World Country Strategy

UIS – Universal Investment Strategy

UIS-SPXL-TMF – 3x leveraged Universal Investment Strategy

AGG – iShares Core Total US Bond (4-5yr)

SPY – SPDR S&P 500 Index

TLT – iShares Barclays Long-Term Trsry (15-18yr)