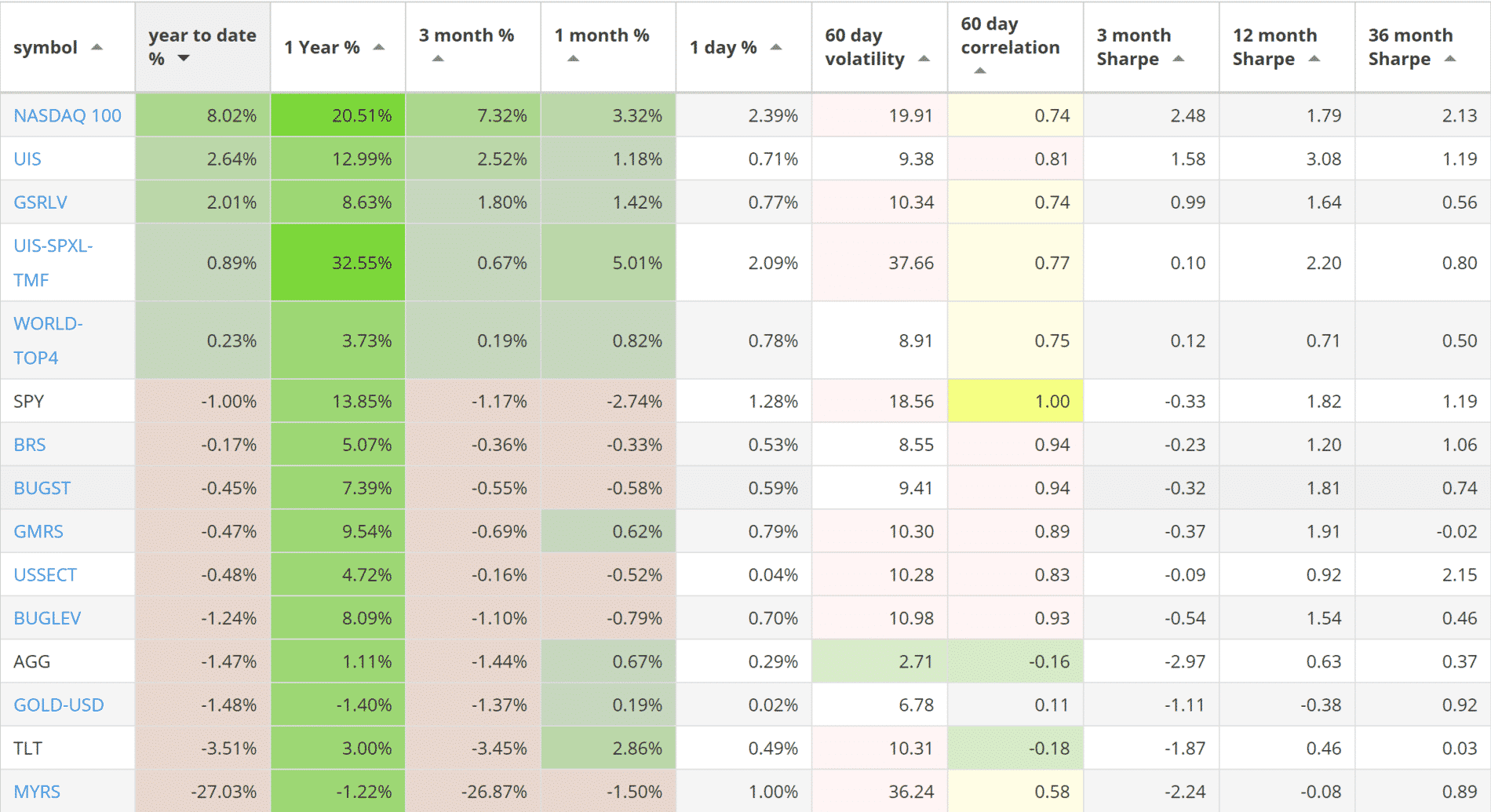

Our top 2018 investment strategies, year-to-date :

- The NASDAQ 100 strategy with +8.02% return.

- The Universal Investment strategy with +2.64% return.

- The Global Sector Rotation strategy with +2.01% return.

SPY, the S&P500 ETF, returned -1.00%.

Market comment:

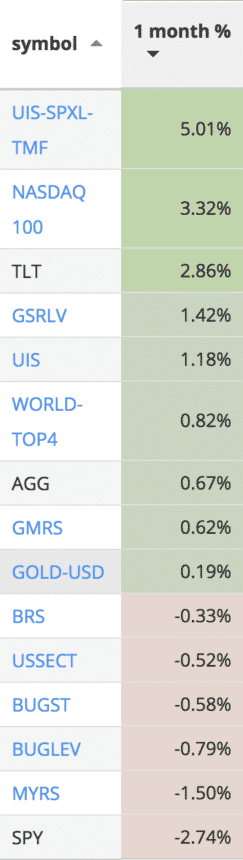

In the beginning of March, most of our strategies allocated large amounts to TLT, the Treasury ETF. Subscribers using multiple combined strategies ended up with Treasury exposure north of 70%. This was quite difficult to digest considering the current sentiment towards rising rates. And yet TLT was one of the few assets that were positive for the month returning +2.86% vs SPY at -2.74%. To the right you can see the performance table sorted by 1-month return as all strategies outperformed SPY due to the treasury hedge.

The biggest winners for the month were the 3x UIS, adding 5% and the Nasdaq 100 adding 3.32% to reach a respectable 8% for the year. Worst performers were the two BUG strategies losing -0.58% and -0.79% and the MYRS losing -1.50% and remaining at a large drawdown year-to-date.

We wish you a happy Easter and a healthy and prosperous 2018.

Logical Invest, April 1, 2018

Strategy performance overview:

Visit our site for daily updated performance tables.

Symbols:

BRS – Bond Rotation Strategy

BUGST – A conservative Permanent Portfolio Strategy

BUGLEV – A leveraged Permanent Portfolio Strategy

GMRS – Global Market Rotation Strategy

GMRSE – Global Market Rotation Strategy Enhanced

GSRLV – Global Sector Rotation low volatility

NASDAQ100 – Nasdaq 100 strategy

WORLD-TOP4 – The Top 4 World Country Strategy

UIS – Universal Investment Strategy

UIS-SPXL-TMF – 3x leveraged Universal Investment Strategy

AGG – iShares Core Total US Bond (4-5yr)

SPY – SPDR S&P 500 Index

TLT – iShares Barclays Long-Term Trsry (15-18yr)

I thought this article is about outlook for April, didn’t see anything about it ?

Dear Yong, you are right. Not much of an outlook for this month’s newsletter. Sometimes we rather look at how strategies are navigating the current environment and how the algorithms swift asset classes as they react to a difficult market. We rather be careful about expressing opinion unless we have something useful to say. If you look at the past two newsletter (March, April) we do have a point of view but would rather stay neutral and let the algos decide.

It ‘s time to invest in levarage UIS-SPXL-TMF – 3x leveraged Universal Investment Strategy or not still yet ?

Thanks

Petr

The VIX term structure curve is still inverted but we are not in the extreme levels reached in the beginning of February. UIS 3x is a viable choice.