Special topic this month: Passive Investments

Logical Invest

Investment Outlook

September 2016

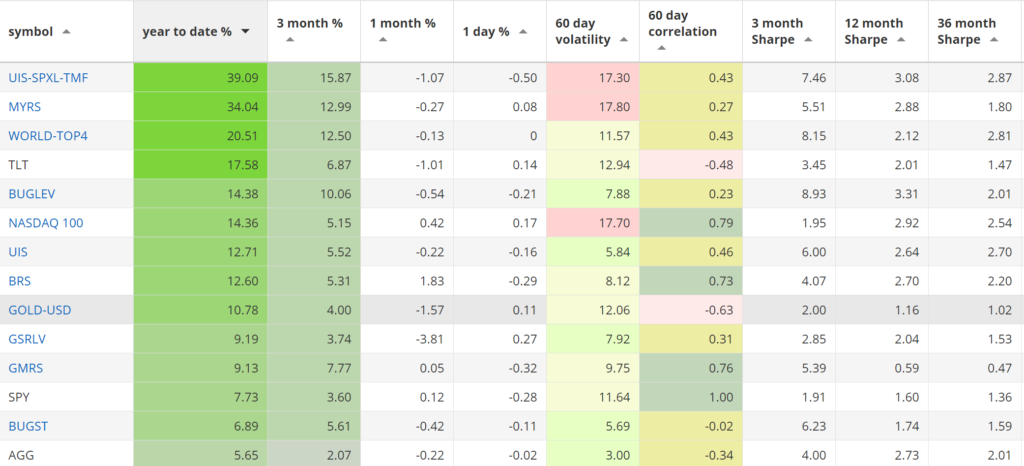

Our top year-to-date strategies:

- The Leveraged Universal strategy with 39.09% return.

- The Maximum Yield strategy with 34.04% return.

- The World Top 4 with 20.51% return.

SPY, the S&P500 ETF, returned 7.73%, year-to-date.

- New tools:

- The Online Custom Portfolio Builder

- The Consolidated Signals tool.

Market comment:

The summer market showed strength compared to its seasonal bias. The old saying “Sell in May and go away” did not hold up this year as SPY rose 5% and emerging markets jumped 8% during the summer. We are now moving into the fall season with the SPY near all time highs and the VIX index at very low levels. September and October have, historically, been good entry points for equity investors that led them to bullish end-of-year returns. This coupled with the election cycle are all market positive factors. Whether a correction materializes in the next two months is anyone’s guess. Our strategies are partially hedged with treasuries and should be able to handle such a correction better than buy and hold.

In regards to strategy performance, not much changed during August. Our top two strategies remained flat, holding on to their exceptional YTD returns of 34% for MYRS and 39% for 3x UIS. Our average return of all our strategies is at 16.7%.

August’s winner was the Bond Rotation strategy, adding 2%, reaching a very respectable 12% for the year. Interestingly TLT lost 1%, another example on how our BRS bond strategy is not always correlated to the long term Treasury ETF. Last month’s BRS positions in emerging market credit (PCY) and U.S. high-yield (JNK) did pay off. The worst performer was our Global Sector Rotation, loosing 3% for the month.

For September we favour our BUG strategy, the World Top 4, the Gold-USD and our stable Universal Investment Strategy.

All=Strategy subscribers can read about our new tools can help allocate across strategies.

We wish you a healthy and profitable September.

Logical Invest, August 31, 2016

Strategy performance overview:

Visit our site for daily updated performance tables.

Special topic Passive Investments

Read how to apply our development backtest software QuantTrader as a DIY investor or passive investment advisor to create your own Passive Investments in just a couple of minutes. Contact us with your special requests for building your own ETF Rotation Strategy for your Passive Investments.

Symbols:

BRS – Bond Rotation Strategy

BUGST – A conservative Permanent Portfolio Strategy

BUGLEV – A leveraged Permanent Portfolio Strategy

GMRS – Global Market Rotation Strategy

GMRSE – Global Market Rotation Strategy Enhanced

GSRLV – Global Sector Rotation low volatility

NASDAQ100 – Nasdaq 100 strategy

WORLD-TOP4 – The Top 4 World Country Strategy

UIS – Universal Investment Strategy

UIS-SPXL-TMF – 3x leveraged Universal Investment Strategy

AGG – iShares Core Total US Bond (4-5yr)

SPY – SPDR S&P 500 Index

TLT – iShares Barclays Long-Term Trsry (15-18yr)

Vangelis

Thanks for the update. Would you mind explaining your rational for picking the 4 “favored” strategies each month?

“For September we favour our BUG strategy, the World Top 4, the Gold-USD and our stable Universal Investment Strategy.”

Hello Mark,

It’s a good question.

As you may know we do have the tools to run a “META-Strategy”, a quantitatively based allocation across our strategies. We do not publish this but it is available by using our software QuantTrader. The rational is the following;

We run two models that pick and allocate across strategies. They give us similar but slightly results. We then consolidate these results (loosely) by issuing a comment that we favour a,b,c and maybe d strategies. A very simple way to do this yourself would be to pick the strategies showing the best 3-month sharpe and weight them according to their (inverse) volatility. A better way is to license QuantTrader or download our publicly available equity data and process it on your own quantitative model.

Vangelis,

Is what you are referring to the same as the “fastest horses each month” Meta Strategy that has been referred to in other posts?

Do you plan on making that Meta Strategy part of the All Strategies service beyond what you are doing now with a,b,c & maybe d recommendation in the monthly update?

Is there an optimal percentage allocation in the Meta Strategy each month? For example a=30%, b=30%, c=25%, d=15% for a total of 100% If so, can that be listed also?

Thanks.

Hello John,

Yes, we are referring to the “fastest horses each month” Meta Strategy. And yes there are multiple optimal allocations given certain constrains like acceptable risk, etc.

For now, this is available by licensing our QuantTrader software. We are initially targeting larger Advisors/Managers at 500/month but we are discussing whether to make this available to smaller RIA’s and private investors at a different price range.

Thanks Vangelis. I would be very interested as a private investor. I hope the additional price add on to the All Strategies program is small and reasonable for private investors.

Hi Vangelis. Put me down as a very interested private investor in the Meta Strategy

Hi Vangelis,

Another question on the monthly comment favouring a,b,c,d:

With respect to BUG and UIS it doesn’t appear you distinguish between BUGST and BUGLEV or UIS and 3xUIS. Or if you do, I’m not sure. Can you please clarify if you distinguish between the straight and leveraged versions of those strategies in the monthly comments. And if so, how we should determine the correct version.

Thanks.

We do not distinguish between the versions because everyone has a different broker, different access to leverage and different instruments available to them. We leave it up to you.

To choose allocations you can try our portfolio tool which takes into account each strategy’s volatility and gives you an idea of how to weight them.

Rules of thumb:

1. UIS leveraged 3 times will, in the long run, outperform the 3xUIS. The reason is 3x ETF decay in periods of high volatility.

2. The BUGLEV is preferable to the BUGST as it is a better ‘thought out” strategy and can recover quicker. If you can (ie, have an Interactive Broker account or similar) trade that one. The BUG ‘straight’ is a little safer and closer to the permanent portfolio logic.

Hoep this helps.

Regards.

Vangelis

Thank you for your explanation and suggestions. Your comment regarding allocations “download our publicly available equity data and process it on your own quantitative model.” made me think of the offline PortfolioBuilderExcel. Seems that selecting the four favored etfs and running the pre-defined quantitative models(or user defined) would be equivalent to your suggestion. Sound right? I’m sure there are differences portfolios suggested by PortfolioBuilder and those by QuantTrader but either way, should give viable portfolios.

For interest, the inverse volatility portfolio (60 day) comes out:

BugST 34%

WTop4 17%

UIS 33%

Gld-Usd 16%

CAGR 13%

Vol 6.3%

Sharpe 2.00

The Max Sharpe Scenario from PortfolioBuilder;

BugST 5%

WTop4 16%

UIS 42%

Gld-Usd 37%

CAGR 17.5%

Vol 7.6%

Sharpe 2.30

Sounds right, although using QuanTrader we get more flexibility in setting parameters like lookback period, how aggressive or conservative the target portfolio is, etc. Keep in mind that portfolio builder runs an optimization so results will always be ‘too good’, ie sharpe >2. As a tool it ‘s best used to give you an indication of how things worked in the past and how various strategies worked together.

Guys, thanks for the new web based tools. Makes it easy to run various scenarios. I always had issues running the old excel files on my Mac even with parallels running the windows in virtual machine. Pls keep up the great work.