Special Topic: IRA Investments using QuantTrader, our Backtest Software

Logical Invest

Investment Outlook

November 2016

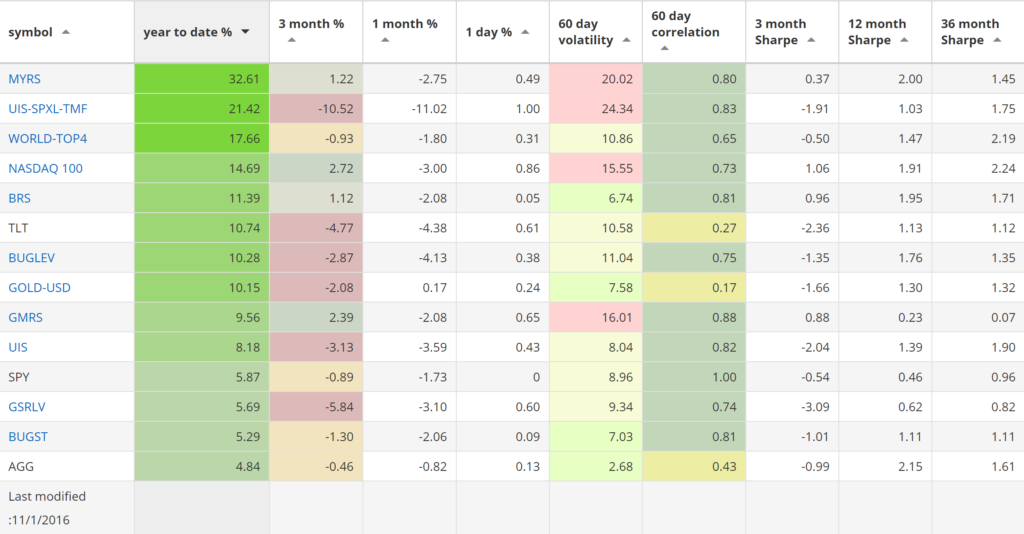

Our top year-to-date strategies:

- The Maximum Yield strategy with 32.61% return.

- The Leveraged Universal strategy with 21.42% return.

- The World Top 4 with 17.66% return.

SPY, the S&P500 ETF, returned 5.87%, year-to-date.

Market comment:

Recent surveys show that fund managers have increased cash positions1 while outflows from equity funds are at historically high levels2. From a contrarian point of view this could be considered market positive. There are two bullish seasonal biases kicking in: The presidential year is nearing an end and we are walking into the traditional strongest months of the year. The beginning of the month may be volatile as markets react to elction results. It remains to be seen how and if these results will affect the rest of the year.

All our strategies corrected during October. Our hedged Gold strategy was almost flat at +0.17% while our aggressive 3x UIS suffered a -11.02% correction. The World Top 4 lost -1.80% while most other strategies lost anywhere from -2 to -4%.

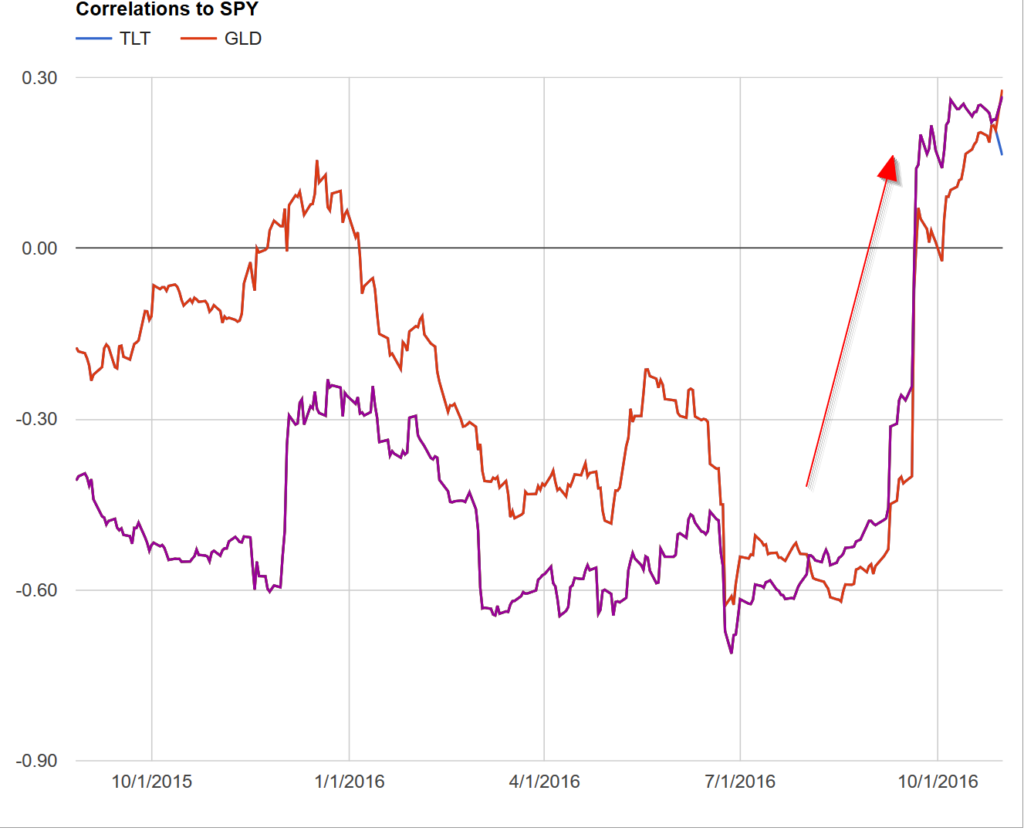

This was partly due to a sudden correction in Treasuries, causing TLT to lose almost 5% for the month. SPY was down -1.73% and GLD -2.74%. This type of rise in cross-asset correlation was seen in 2015. In the graph below you can see how TLT an GLD correlations to SPY turned positive in October.

Correlations of TLT and GLD become positive end of October.

We have found this type fo behaviour to correlate to a strengthening dollar. UUP the ETF that tracks the dollar index is up 3% for the month, a fairly large move, causing the index to approach towards it’s 2015 highs. We are taking this into consideration even though the environment is quite different this year. While commodities and foreign markets were crashed by the 2015 dollar move, selected markets are showing tremendous strength, namely coal (KOL:+69% YTD), metals & mining (XME:+51% YTD), Brazil (EWZ:+68% YTD).

We wish you a healthy and profitable November.

Logical Invest, November 1, 2016

Strategy performance overview:

Visit our site for daily updated performance tables.

Special topic IRA Investments

Read how to apply our development backtest software QuantTrader as a DIY investor or passive investment advisor to create your own IRA Investments in just a couple of minutes. Contact us with your special requests for building your own ETF Rotation Strategy for your IRA Investments.

Symbols:

BRS – Bond Rotation Strategy

BUGST – A conservative Permanent Portfolio Strategy

BUGLEV – A leveraged Permanent Portfolio Strategy

GMRS – Global Market Rotation Strategy

GMRSE – Global Market Rotation Strategy Enhanced

GSRLV – Global Sector Rotation low volatility

NASDAQ100 – Nasdaq 100 strategy

WORLD-TOP4 – The Top 4 World Country Strategy

UIS – Universal Investment Strategy

UIS-SPXL-TMF – 3x leveraged Universal Investment Strategy

AGG – iShares Core Total US Bond (4-5yr)

SPY – SPDR S&P 500 Index

TLT – iShares Barclays Long-Term Trsry (15-18yr)

—————————————————————–

1. BofA Merrill Lynch October Fund Manager Survey 2. ICI Combined Estimated Long-Term Fund Flows and ETF Net Issuance October 26, 2016

In several of the whitepapers, Frank wrote the models will switch to cash instead of TLT when correlations rise above 0. Is cash switching still part of the algorithms?

Also, any progress on the meta-strategies employing 2-4 strategies?

Thank you.

Yes, it is still an option, however there have been many short periods in the past where correlations became positive but on the long run and when markets really crashed Treasuries always came back to be a save haven asset with negative correlations. It may however be that now we enter in a long period where Treasuries don’t work anymore as a hedge if rates rise steadily. In this case we would need to think of other hedging instruments. I do not like cash because normally you always realize a loss when going to cash because cash has no upside potential.

SHOW PRIOR MONTH % HOLDINGS AS WELL

Gentlemen-

Perhaps when you send out your monthly email strategy posts (or bi-monthly in the case of MYRS), you could include the prior month’s setup just below your new allocation. This would save those of us already invested in the strategy the trouble of looking up last month’s setup to determine if we need to make any changes for the new month.

Thanks,

Gordon

Hello Gordon,

thanks for the feedback. We´ll add a note if allocations have not changed versus prior month. Please keep in mind that even if there is no change in allocations, you might need to rebalance your portfolio anyhow.

The full list of past allocations can always be found here: https://logical-invest.com/blog/strategy-signals-simple/