Our special topic this month are 401k Strategies

Logical Invest

Investment Outlook

February 2017

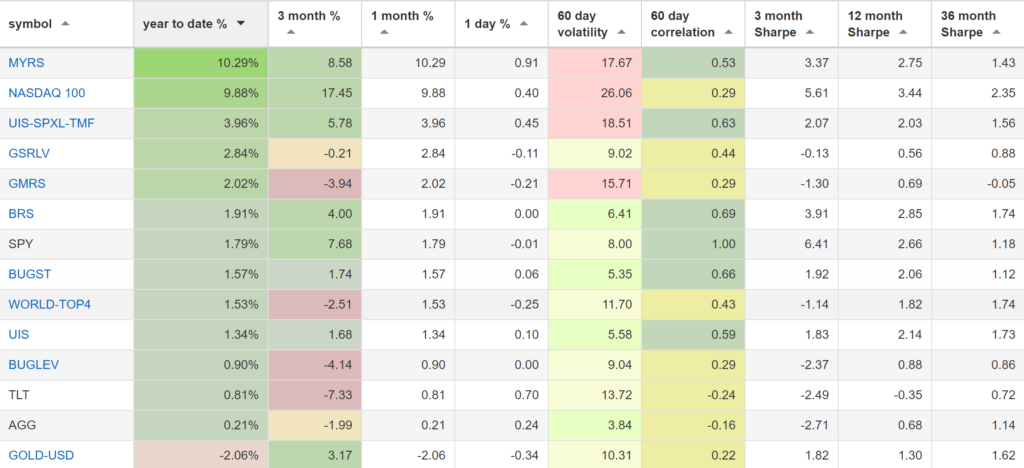

Our top 2017 strategies:

- The Maximum Yield strategy with 10.29% return.

- The NASDAQ 100 strategy with 9.88% return.

- The Leveraged Universal strategy with 3.96% return.

SPY, the S&P500 ETF, returned 1.79%.

Market comment:

2017 started up as a different type of year. Not just in politics.

Despite the unprecedented political uncertainty, volatility in the SP500 dived this month causing our volatility harvesting strategy, Maximum Yield, to return more than 10% in just one month. Our Nasdaq 100 strategy returned 9.88%.

All other strategies were positive for January but with smaller gains of 1-3%. The only negative strategy for the month was the Gold-USD strategy at -2.06%.

We would like to take this opportunity to thank two of our longer-term subscribers for their feedback, comments and support:

Deshan, comment posted January 29, 2017:

“Looking back at these comments from many months ago gave me a chuckle. Looked like the world was gonna end and the LI strategies were going down too. I feel badly for those that gave up. I stayed the course and am very happy customer.” Read more….

Richard, author at Richard’s Corner.

“The universe of options for a conservative retiree who would like both some performance as well as low risk in a simple, stand-alone investment has proven difficult to find…”. Read more…

We wish you a healthy and prosperous 2017 and good performance in your 401k Strategies Investment.

Logical Invest, February 1, 2017

Strategy performance overview:

Visit our site for daily updated performance tables.

Special topic 401k Strategies

Do you know that our Backtest Software QuantTrader allows you to build your custom 401k Strategy in only a couple of minutes? Mix your plan sponsor assets into custom Strategies, see our recent High Performance Strategies webinar. Contact us to learn more.

Symbols:

BRS – Bond Rotation Strategy

BUGST – A conservative Permanent Portfolio Strategy

BUGLEV – A leveraged Permanent Portfolio Strategy

GMRS – Global Market Rotation Strategy

GMRSE – Global Market Rotation Strategy Enhanced

GSRLV – Global Sector Rotation low volatility

NASDAQ100 – Nasdaq 100 strategy

WORLD-TOP4 – The Top 4 World Country Strategy

UIS – Universal Investment Strategy

UIS-SPXL-TMF – 3x leveraged Universal Investment Strategy

AGG – iShares Core Total US Bond (4-5yr)

SPY – SPDR S&P 500 Index

TLT – iShares Barclays Long-Term Trsry (15-18yr)

I did not receive the strategy emails for February.