Forum Replies Created

- AuthorPosts

Vangelis

KeymasterDear Stefan,

We usually work with the assumption that all strategies are available to our subscribers. This is why we made such a recommendation. Obviously this is wrong and we apologise.

How you would determine when it is recommended to re-enter into 3xUIS? Is it based on VIX having held a certain level for a certain period of time?

You can re-enter when the VIX future’s term structure is back to normal, ie when the curve at vixcentral.com slopes upwards and it is time to rebalance.

That the subscriber community would be informed of that change/improvement in the volatility environment.

We can post/email when this happens.

As I took the LI Investment Outlook comment as a discretionary recommendation to exit 3xUIS, can I please recommend that the LI team model in QT returns based on rotating out of 3xUIS and into 1xUIS.

This would confuse a new subscriber 1 year from now. They would be looking at the UIS 3x chart and history and suddenly see a different allocation, using different ETFs. If the market was to crash tomorrow, they would look back and be sure we are somehow cheating. The forum, the newsletters and both UIS and 3x UIS signals are available online so that everyone can research and track what happened.

I would also recommend that LI make it very clear when apparently discretionarily overriding a strategy and make explicit the basis of the reason for this override and when LI recommend re-entering the strategy.

We will do that. If we override, we will be clear about it and write it in the signals post or via private email. Not in the newsletter which is opinion and published to the general public.

Furthermore, we had a February recommendation to invest in Gold which is no longer in the March recommendation – can you please confirm why this changed?

I assume you mean this:

“Our strategies have been adapted, starting this February, to include gold in our new hedging mechanism. Gold is a well respected safe heaven asset. It performs well in inflation regimes and can be a “go-to” safety asset for institutional investors if stocks and bond fail. You can read more about this major update in Frank’s article.”This is not a recommendation. We adapt our strategies once every few years to keep up with market changes. We added Gold as an extra hedge to our strategies. The strategy algo may (or may not) allocate to gold depending on the state of the market.

Vangelis

KeymasterI guess the comment was vague and not worded correctly so let me try to clarify. This is not about wether the UIS or 3x UIS strategy will continue to perform as expected. Neither does it mean that one should rotate from one to the other. It has to do with which version tends to be more efficient at certain environments because of how leveraged ETFs work.

Let’s take an example: Let’s say SPY is at a theoretical price of 100, SPXL (3x long) at a price of 100 and SPXS (3x short) is at a price of 100 . After fluctuating up and down, 1 month later SPY ends up back at 100. For reasons I will not get into here, SPXL will end up at around 97 (due to ‘tracking error’) and SPXS will end up around 95. The divergence is a function of how volatile (larger ups and downs) the moves are, the leverage of the ETFs (2x or 3x) and whether the leveraged ETF is an inverse one (bigger divergence for inverse). So if one is expecting a flat and volatile market and has the funds and access to short leveraged ETFs, the preference would be:

a. Implement UIS by shorting SPXS and TMV and gain slightly from the tracking error (minus borrowing costs)

b. Long UIS.

c. Long 3x UIS (loose from the tracking error).The opposite happens when the market goes straight up (or down). If SPY ended up at 110 and every day was an up day (no ups and down) SPXL would end up at 140+ (ie gain of more than 3x the underlying). Th opposite is true also. If SPY were to ‘crash’ in a straight line, SPXL would crash more than 3x times.

So 3xUIS is less efficient in a flat or falling market.

This does not mean you would ‘rotate’ from one strategy to another. It just means that if you have enough funds and expect a correction or a flat market, it may be better to stay with UIS than use the 3x. Again, it is a minor comment. Normally the choice between the three version comes down to how much money is available to commit (ie 10,000 vs 500,000) and whether there is access to short 3x ETFs with cheap borrowing cost. I trade the inverse 3x’s, Frank enhances further by using options :)

The bottom line is that UIS is a strategy that has worked in the past and hopefully will continue to do so. Whether you trade using 3x ETFs, shorting inverse ETFs or selling puts may bring some extra returns provided you have the time and energy to deal with these minor tweaks.

Vangelis

KeymasterHi Aati,

True, this is a bit confusing and undocumented so here’s a short explanation:

Our methodology is to rebalance on the last day of the month. To see what this allocation is for this month (ie, the signal produced on the last day of January), you go to Allocations–>Invested tab. This will show you what you would be invested in had you followed the signal on Jan 31th. On the other hand, QT calculates allocations on every new data, ie every day. So if you were to rebalance today, you would use the Allocations–>Actual tab and the allocation would be different from the allocation at the turn of the month. This give the flexibility for users to rebalance on any day of the month.Vangelis

KeymasterYour impression is correct. I got carried away thinking we were discussing MYRS.

Only MYRS rebalance twice a month. All other strategies, including the Nasdaq 100, rebalance monthly.Vangelis

KeymasterI see you have done your homework! I was accepted in the closed Beta a couple of months ago. It is a great idea as it facilitates rebalancing and is more secure than an exchange. The problem I encountered with Prism is the fees. For now they are waived but at a proposed 0.5% per rebalance they are outrageous. That means that if you rebalance monthly you give away 1%/month = 12% per year. This is peanuts for crypto buffs but for equity traders it’s a pretty substantial number. What will be interesting if prism opens up both sides of the market, as they propose to do, so that you can post collateral and get part of that 12% :) Once fees become ‘logical’ it seems like be a viable management tool for us.

Vangelis

KeymasterThe signals for the 15th rebalance are published on the site the next morning (16th). What you are seeing on the site are the allocations that were calculated and published on Feb 1st. When you run QT, it gives you the theoretical current signals as if you were to rebalance today (which you may choose to do on the 15th). They will usually differ from the signals it gave on the 1st. Hope this helps.

Vangelis

KeymasterThe advantage of trading the inverse 3x ETFs is that you get an extra return from their tracking errors. So if SPY starts at 200, then goes up and down for a few months and then ends up back at 200 (0% return), SPXS may start at 40 but will probably end up at 34, so shorting it will produce a slight return (minus the borrowing fees for shorting). On the contrary SPXL may start at $40 but will end up around $34, ie loosing compared to 3x it’s benchmark. Error is path dependent so it works best when volatility is high and direction is choppy (not straight up or straight down as we just experienced).https://www.signalplot.com/the-definitive-guide-to-shorting-leveraged-etfs/

Yes, weekly strategies need to stay on the exchange, which is a problem. The only solution is to keep it small, use leverage and diversify across exchanges. Trading is a nightmare compared to trading stocks/ETFs/Futures, liquidity is poor, fees and spreads are high, you need multiple wallets and transfers are error prone etc, etc. So far what seems viable is running a topX ‘large cap’ QT type strategy picking from 10 coins and rebalancing once a month. I use cointracking which is a must to keep track of multiple exchanges/wallets, etc.

I also make a few judgment calls outside the systems (when to go to cash and when to re-enter) since as another subscriber mentioned, Bitcoin seems to follow fibonnacci retracements / extensions surprisingly well.Vangelis

KeymasterI currently trade the UIS 3x (using inverse ETFs), a MYRS variety using futures and a couple of short term mean-reversion systems. On an another account, I run a strategy-of-strategies currently in BUG/GMRS/USSector 40/20/40. I also trade weekly/monthly rotational systems on crypto. Once every few years I take a p.o.v. on currencies since I am EU based but trading in $$.

Vangelis

KeymasterSome thoughts.

Black swan events will always happen in the markets and they will always be hard to avoid even using intelligent systems. This is because as players adapt to the market, the market adapts back. The next crash is usually different than the last one. Building systems to avoid, or even profit from these crashes is possible but these systems cannot be profitable, long term.We cannot always win. History shows that exiting during these crashes has been a bad idea. Historically it has been better to wait for some type of a reaction and return to short term normally before re-evaluating positions. As you can imagine we cannot advise to ‘stay in’ or ‘cash out’ and It is not our job to do so. What we can do is re-evaluate our systems and see if there can be a mechanism to detect longer term structural shifts (ie, interest rates rising) in order to limit (not avoid entirely) long-term losses.

What Tom proposes has been somewhat used in Wouter’s PAA strategy (implemented here). PAA lost 7-10% so far this February. As Reuptake mentioned, trying shorter term lookback periods will result in multiple whipsaws as modern market protective mechanism tend to correct short term catastrophes (ie mean revert or as Zero Hedge fans call it “The plunge protection team kicking in”).

That said, Frank is experimenting with possible go to cash mechanisms for QT. My own older backtests point to rising rates –> lower market returns.

Vangelis

KeymasterYes, the US Sector is 20% in cash.

Vangelis

KeymasterDear Stephen & Dom,

Your remarks are noted. We should have something soon.Vangelis

KeymasterWe found a solution and moved away from Yahoo data. Both QuantTrader and the Consolidated Excel sheet use IEX for last price data.

Vangelis

KeymasterFor those who download and use the “offline” Excel Signal Consolidation Tool, we are testing a new data source.

The Excel downloads last price data from the IEX API service. This is in “beta” and was done as a result of Yahoo interrupting its intraday data service.

If you have any issues getting correct prices let me know.https://logical-invest.com/blog/strategy-signals-simple/ (click on “Consolidated Signals for November 15 2017”)

Vangelis

KeymasterThere is a problem with intraday Yahoo data. It seems the format has changed since November 1st 2017 and QunatTrader cannot download intraday data. We are working on a solution.

Vangelis

KeymasterI am testing different strategies that rotate through BTC and altcoins but as of late everything has underperformed simple buy and hold of Bitcoin. We are at a very bullish stage, it seems. Bitcoin is an interesting asset because it exhibits “upside” risk. Wars, political instability, capital controls all present opportunities for Bitcoin’s price to jump. Eventually if CME futures are offered one could devise a strategy that uses BTC in conjunction with our familiar VIX, Gold, FX futures (as in MYRS, GLD-USD, UIS strategies).

Vangelis

KeymasterI am actively trading a crypto strategy on a personal account and testing different ideas.

Vangelis

KeymasterAati,

Welcome!

LI strategies trade monthly, in the beginning and end of the month. The only exception is MYRS that trades every 2 weeks. The exit day of the current month does not refer to when you should exit but rather it is today’s date (or the last day that we have updated data) so that we can keep track of performance from the last day of last month – to current day (month-to-date performance). Every time we update data the exit day will move to the current day, until we close the month. You should trade on or after the first of the month.

I hope I did not confuse you more…

I will let Alex respond about his baby, the portfolio builder :)

Best,

VangelisVangelis

KeymasterUsama,

Thank you for the feedback. We will consider doing that in the near future.Vangelis

KeymasterI created a portfolio of the top 5 cryptocurrencies + USDT based. You can find it in the attached zip file. I included the historical data up to yesterday (25 Sept 2017).

Instructions:

This forum does not allow .zip file, hence the .txt. Once you download the file, change .txt to .zip. Then once you unzip the file, you will have a folder called “QT_Crypto_Large_Coins” with csv files, a Quanttrader.ini file and a few more files. Place this file anywhere you want (but not in the Apps folder). Go to your regular QuantTrader folder, copy QuantTrader502s.exe (or the latest version you use) and paste it in this folder. Then run the .exe from this folder. When the popup appears choose Local Data so you force it to read the csv files. Do not tick the “Reload” box.Vangelis

KeymasterYes, you could do that. The main two obstacles are:

1. Getting the data from Cryptocompare.com and formatting it for QT

2. Create a sensible strategy. All cryptos have very high correlation to each other so it becomes difficult to diversify risk.I can create such a QT project (with historical data) and post it in the next few days.

Best,

vangelisVangelis

KeymasterThanks for the update Eli. The bad news is the beta is closed for new users, the good news is Norgate is getting closer to a commercial release. We will follow their progress.

Vangelis

KeymasterHello Rishi,

Welcome, thanks for posting and for providing a solution in troubled times :)

We look forward to the new release!

Best,

VangelisVangelis

KeymasterHello Branislav,

We are not advisors and cannot give specific advice. That being said, a strategy of strategies helps diversify across assets AND strategies, so it would help limit losses arising from single ETF or strategy ‘failure’ events. As you become familiar with QT you can modify (make a copy first) the Strategy of strategies to fit your particular needs: You could for example limit max allocations to more aggressive strategies such as MYRS or change the attenuator to make the algo pick more conservative strategies. Our BRS and BUG strategies are often chosen by more conservative investors but you do have to consider the tax on ETF dividends that apply if you are European or non-U.S.

Hope this somewhat helps.Vangelis

KeymasterHello Tony,

Alex addressed these differences here: https://logical-invest.com/forums/topic/online-portfolio-builder/#post-35434

“The differences between Excel and Online version come from the different timeframes, there is a three months off-set in the Excel tool, so some of the flat days in early 2008 are excluded, which increases the CAGR”

Hope this clarifies.Vangelis

KeymasterHello Eli,

Thanks for the feedback. As a former (and current) Amiboker user I am aware of Norgate. Actually it was the first option we tried when Yahoo dropped the ball. The problem is that the data is not adjusted for dividends, which makes things a bit more complicated for us. Nevertheless, I do believe we need a option where a subscriber can import their own data (whether it’s from Norgate or another csv source) to QT so I will fwd the request to the team.Vangelis

KeymasterWe are testing all kinds of strategies, including European and forex based strategies on our own copies of QT. I am sure we will work out a solution. Access to mutual fund data is important, too. We will know more next week.

Vangelis

KeymasterThe new version uses Tiingo.com as its data source instead for Yahoo finance, following Yahoo unannounced change in its service. Tiingo does not support mutual funds, European ETFs or forex symbols. This is a temporary solution in response to Yahoos unannounced adjustment. We will keep mutual funds data in mind as we look to expand our data options.

Vangelis

KeymasterWe have updated Quanttrader to version 3.16S. Please go to the update forum or download from the link below:

Version 316S changes:

– This version switches to a new financial data provider after the Yahoo finance servers stopped to work for over a week.

The download time for all symbols is still quite slow (about 10 min), but we will make it faster next week.

Make sure you delete all old csv files if you install this version in a existing folder.

When you start QT with one of your QuantTrader.ini files, then a popup window will tell you that some symbols have not been found.

Pls. check then all symbold and then delete them.

These symbols are non US symbols and are not used for our strategies. At the moment we can only download US symbols.– New feature: QuantTrader now does an automatic version update if QT finds a newer version on our server.

Vangelis

KeymasterEventually you should be able to do intraday as well. Once we get the daily working we should have an ETA for that as well.

Vangelis

KeymasterThere has been an unannounced API change from Yahoo finance that affects many apps including QUNATtrader. QT relies on Yahoo data. We are working on a workable version in the next few days.

https://logical-invest.com/forums/topic/quanttrader-software-updates/#post-41823Vangelis

KeymasterFrank tried Goodle finance first. The data is unreliable even for liquid ETFs like “TLT”. You get horizontal lines because of no data updates for days. Quandl is another obvious choice but their premium service is @50/month.

Yahoo continues its service so you can get data. The problem is that Yahoo, without notice, changed the API AND transitioned to unadjusted data. We need to take dividends into account so unadjusted data will not work for either reporting or ranking. We are now looking into Tiingo.com which is a fairly new service.

This has been a big problem for a lot of people and self directed investors:

https://forums.yahoo.net/t5/Yahoo-Finance-help/Is-Yahoo-Finance-API-broken/m-p/251312#M3123Reading the forum you can see there is a wide open space for a data provider to enter get data from the exchanges and adjust it for a small fee ($5-$7/month). I hope someone jumps in. We would support them :)

Vangelis

KeymasterWe are working towards an updated version of QT with an alternative data source by end of the week (Friday 5/26/2017).

Thank you for your patience.Vangelis

KeymasterHello Alberto,

Thanks for the pointers. The tiingo API could be useful.Vangelis

KeymasterUpdate 20/5/2017: Yahoo has changed their data service. This has affected a lot of software that retrieve data from their servers, including QUANTtrader. We are working on a solution.

Vangelis

KeymasterAt the moment (18/5/2017) we are not able to get pricing data from Yahoo servers. The Yahoo server gives back the message “Will be right back” since Monday.

https://forums.yahoo.net/t5/Yahoo-Finance-help/bd-p/finhelp

We are working on this problem and will probably add a second data provider in the future for the case Yahoo does not work.

We apologize for the inconvenience!

Vangelis

KeymasterFrom Frank Grossmann:

GMRS uses the Top1 ETF bond rotation strategy. This one has a shorter lookback of only 34 days. The result is a ranking like this:We rather like short lookback periods for the hedge because like this it reacts faster once the market begins to go down.`

Regards Frank

[attachment file=41210]

Vangelis

KeymasterHello,

In QuantTrader you can set minimum and maximum allocations per asset under portfolio–>Components in the portfolio manager screen (see https://logical-invest.com/wp-content/csvrepository/QuantTraderHelp-web/index.html#Advanced%20Settings%20for%20Strategies%2C%20Meta-Strategies%20and%20Portfolios )

The hedge assets should be the last one on the list when you construct the strategy and should be used with the ranking algo that supports hedging (DR, DRRE).

If you want you can post your .ini file here (or email us privately) so we can better understand how you are setting up.

If you have not seen the webinar, please do, it is very useful https://www.youtube.com/watch?v=d_YpwxuJkhc

Best.

VangelisVangelis

KeymasterFrom Frank:

The default ranking day and trading day is the close of the last trading day of the month. If you enter 31 as ranking day, the QT just searches the latest trading day of the month. We only use closing prices, so QT never trades at open.

By default QT ranks and trades at close of the last trading day of the month. This is not really possible, however what you can do is to download the 15min delayed prices for example at 3pm of the last trading day and then do “at close” orders. It is very rare that the allocation changes within the last hour.

Trading delay also always uses the next trading day as the calendar days entered may not be trading days (Saturday/Sunday …)Vangelis

Keymasterhttps://papers.ssrn.com/sol3/papers.cfm?abstract_id=1404708

http://www.q-group.org/wp-content/uploads/2014/01/Madhavan-LeverageETF.pdfLeveraged ETFs experience decay and do not track, long term, their corresponding ETFs at the stated multiplier. So TMF does not return 3 times the returns of TLT over two or three years. The decay is larger as the leverage gets bigger. The decay gets larger for inverse etfs. So the decay of -3x instrument is biggest than all others (-2x,+2, etc). That being said, it is volatility that causes this decay. If an ETF’s price path is 100,101,99,101,99,101,100 the +3x equivalent will not end up at 100 (0%) and will end up loosing money. If the ETF’s price path is 100,101,103,104,105, the +3x equivalent will not return 3x (ie 3×5% = 15%) but actually more than that. See the second paper for more info.

Vangelis

KeymasterThere are many online resources that discuss leveraged ETFs and how they behave vs normal ETFs.

Most of the time it is most efficient to short the inverse levereged ETF. In this case shorting TMV. There is an exception and that is if TLT goes straight up.Vangelis

KeymasterIf you did 50/50 in the top two picks each month the returns and risk would be similar to the current BRS strategy (where current max/min allowed allocations are 60/40). The best way to try these scenarios for yourself and really see how the strategies work is to try QuantTrader.

Vangelis

KeymasterThe Quanttrader subscription is all you need. It includes the All-Strategy subscription so you will have access to all signals online and via email.

Vangelis

Keymaster1.Yes, all three strategies can be traded with a smaller account size. Nasdaq may be the most inefficient for 10K since you will get slightly bigger commissions (the IB minimum x 5 transactions = $5).

2. I am not sure how IB handles available cash on a smaller account. Assuming IB provides at least the standard 2x leverage, even if you need to borrow for 3 days, the cost should be small.

Happy holidays!Vangelis

KeymasterThis is the latest QuantTrader Version 306S with the updated ini file of our strategies.

For most strategies there are 3 versions. Example:

GMRS (is the equity only strategy)

GMRS hedged (is the hedged strategy composed of the GMRS equity strategy and the hedging strategy (BRS Top1))

GMRS table output (is only used to produce the ranking tables with all ETF symbols)306S Changes:

– New Parameter in the advanced tab to delay trading up to 21 days (one month). Also the Analysis day can be individually set. Before it was always the last day of the month. Now it can be set to any day of the month with this additional delay until the trade is made.

– Several bug fixes concerning the duplication and renaming of strategies.

– Bug fix with trading costsVangelis

KeymasterWe do review the Nasdaq 100 QT stock selection and use common sense. In some cases news or other short term events may cause a stock to move in an extreme fashion. In other cases an upcoming news event may make a stock extremely risky. We may choose to replace such a position with one lower in the rank.

The BUG strategy included in QT is a similar but not the same strategy as the BUG that we publish. Both strategies use the same underlying ETFs and both use risk adjusted momentum but the algos run on different platforms and are a bit different. The QT BUG finds the best combination of 4 ETFs and corresponding weights while the BUG ‘straight’ uses momentum criteria to overweigh winners. Cannot say which is best, except that the correlation between the two strategies is very high.Vangelis

KeymasterHello John,

You should receive a welcoming email with the download link as well as your username. Please contact us for further help.Vangelis

KeymasterMy thoughts:

Case A:

According to my Banker one should benchmark everything to their own native currency. In your case that would be AUD. The logic is that one should benchmark to their cost of living. So if you hold dollars, you are exposed to “currency risk”.

If you subscribe to that point of view, you have two possibilities:1. Your IB account base is $US

2. Your IB account base is AUD.If your account is based in $U.S., then you could hedge your currency risk by buying AUD/USD to cover all your funds and trade normally in $$. So if you had a $100,000 account you would buy $100K worth of AUD/USD (or use futures if you don’t want to get IB’s confusing accounting) and take the signals as they are. These would give you two main factors driving your account: Strategy performance and currency performance.

Basing your IB account in AUD is something I would not really be familiar with.

Case B:

You do not want to base your benchmark on your local currency but want to manage currency as a whole.

Assuming you have multiple accounts, you could aggregate currencies.

Example:

You trade 100K in IB with LI strategies.

You also own a bond worth 100K of AUD in your local bank.Roughly your currency split is 50/50 USD and AUD. Now you have to manage this :)

You can either do it discretionary (ie, subjectively) or develop a long term system that will re-balance your currencies. Either case you would use IB and futures or fx to increase/decrease currency exposure.Vangelis

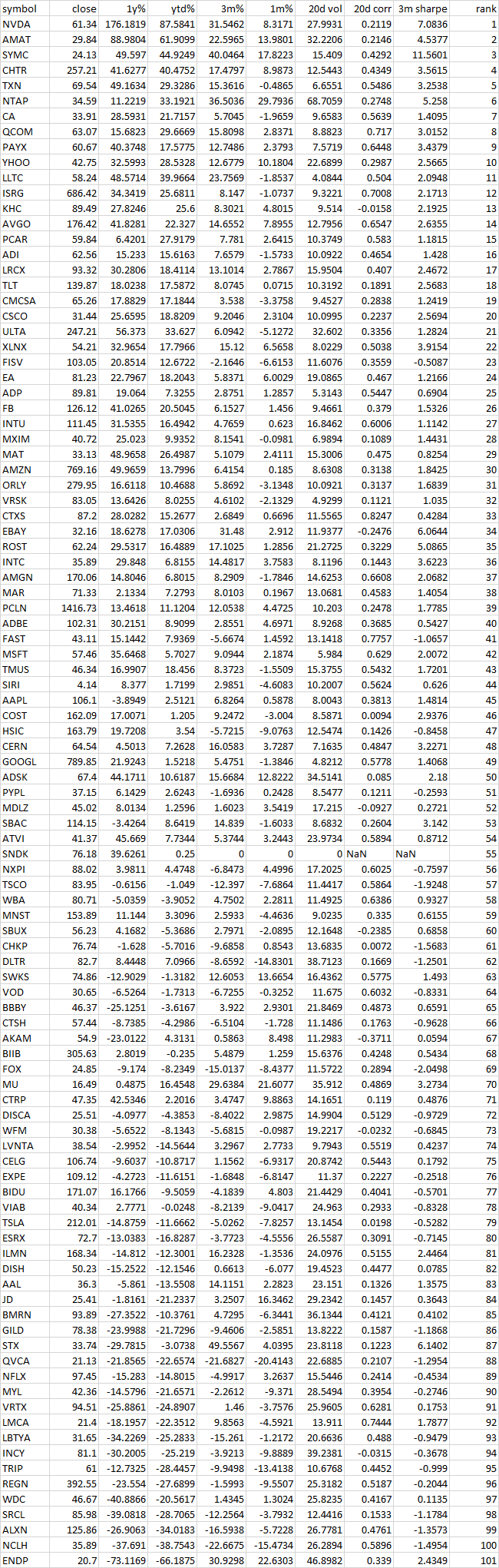

KeymasterThank you for your interest in our strategies. Here’s a sample (September 2016 signals for Nasdaq100):

Private: The Nasdaq 100 Strategy – Investment for September 2016

This is the monthly email of the Nasdaq 100 Strategy.

Investment for September 2016:

20% AMAT, 20% NVDA, 20% SYMC, 20% CHTR, 20% TMFThe 2016 year to date (date of the strategy email) performance of the strategy is: 14.36%

The ETF ranking for this month is:

The table is showing the ranking based on the closing price of the last day of the previous month. The values in this table are for “reference only”. The current allocation can be quite different of the top ranked stocks in this table because QuantTrader considers additional data like mean reversion or cross-correlations which can not be displayed in this table. We may also exclude companies which recently had big price jumps because of a takover bids, earnings or any other special events. ETFs can be added or removed at any time during the year.

Vangelis

KeymasterHi James,

As a subscriber, the ranking is part of our monthly signal. You can find it under “Strategy Signals” –> “Private: The World Top 4 Strategy signs for ….”Vangelis

KeymasterYes there is and you could do that. The ranking cannot quantify certain factors that our algo does (cross correlations, variable lookback periods) but it is close enough. Keep in mind that low volume does not always mean there is no liquidity Here’s an example: https://am.jpmorgan.com/blob-gim/1383272223898/83456/1323416812894_Debunking-myths-about-ETF-liquidity.pdf

Regards,

VangelisVangelis

KeymasterDear Evan & Ivan,

If you are worried you could increase your cash allocation or choose strategies that are less affected by a possible correlation break-down, possibly the BUG, GLD-USD, maybe the World Top 4.That being said, near zero yields have been a concern since 2012. I remember reading an article back then about the ‘no-brainer’ opportunity of a lifetime: Short Treasuries. The market defies logic. Bonds continue to perform exceptionally well while holding their negative correlation to equities. The only exception was 2015. That year is a good and real example of what happens when nothing works (equities, bonds, gold and everything else fell). We did go through it, survived adapted and are continuing into a profitable 2016. If this or a similar scenario materializes again we will adapt again. We do have strategies that hedge with Gold (the BUG) as well as exposure to foreign markets, which in turn have exposure to commodities, that may be positively affected by rising rates. Gold is always a prime candidate for an alternative ‘safe heaven’ hedge to rising rates so it could become a useful additional hedge to us in the future.

Vangelis

KeymasterWe have but the Bug is a conservative and defensive strategy. It is a building block in our arsenal that has low correlation to our more growth oriented strategies. To achieve what you are suggesting we could create a strategy to allocate funds between the BUG and the World Top 4 strategies.

Vangelis

KeymasterWe are discussing how to best adapt our service to accommodate some of these very reasonable requests. We have a variety of clients both professional and private investors located in different time zones. Some are active traders, others are longer term investors that need to review, customize and trade across different accounts in different continents. We will try to satisfy everyone’s needs while we grow. In the near future we are looking into:

a. Being able to issue intraday bare-bones signals, at the end of the month.

b. Keep our current ranking, performance tables and commentary that many subscribers demand, for the next day as is done today.

c. Partner with a U.S. registered Advisory firm that will offer our strategies as managed accounts for hands-free investing.

d. Lower the $$ entry point for QUANTrader so that an individual non-proffesional investor can do what he wishes with our strategies (trade any day, customize parameters, backtest picking N top stocks/etfs, etc)Some patience please as we are a small team.

Your ideas are welcome as always.Vangelis

KeymasterWe have discussed this before but we could look at the possibility again. Yes, we do have the capability to roll our results 1 day forward. I will try to post something here in the next few days.

Vangelis

KeymasterHello Ivan. You are right. We benchmark strategies a little different. Here is an excerpt from our F.A.Q.:

Q: To determine which ETFs to invest in the next month it appears that you use adjusted closing prices to determine performance of the previous period (e.g. 29 Feb to 31 Mar if just looking at 1 month) Is this correct?

A: Yes, that is true. We use adjusted closing prices.

Q: However when using the service the actual performance would be from the first day of the previous month to the first day of the following month (e.g. 1 Mar to 1 Apr). There could be significant gaps open or down between the end of the month and the start of the month. So which figures do you use for actual performance?

A: What we use as a performance ‘benchark’ is the close of the last day of the month to the close of the next day of the month (ie, close on June 31st to close on July 31st). This is for convenience in order to simplify our monthly performance report.

Real performance is from day and time of entry to next day and time of exit/entry. This depends on each subscriber’s timing and fill price and will deviate more or less from the model. In the long run, unless an edge exists, these deviations should even out. Sometimes one may get a better fill, sometimes not. If this is not true and there is consistent under-performance of buying the first day versus the last of the month then there is a very simple strategy that can profit from this edge and someone will arbitrage it away.Vangelis

KeymasterThe original strategy developed was the BUG as described here. It was designed for professional traders with Interactive Brokers or similar accounts that have easy and cheap access to 2x leverage. It is not leveraged but rather has an intelligent mechanism to be in the market from 0% all the way up to 200% depending on market conditions.

Since many investors have no access to this type of account, we created a similar strategy that used no leverage and can be traded in a normal account. We call this the BUG ‘straight’ while the original was re-named as’BUG Leveraged’. The BUG ‘stright’ is a different strategy using ‘less intelligent’ leverage control (from 0% to 100% allocation) and only holds up to 4 assets (BUG Lev holds up to 7).

So the BUG leveraged is not just a 2x version of the BUG.

Bottom line is that if you have an IB account, trade the BUG lev if not trade the BUG ‘straight’.Vangelis

KeymasterDepending on volatility, 3x Etfs experience decay and in the long run will not provide 3x the returns of the simple ETFs. UIS with 300K allocated will, most of the time, perform a bit better than 3xUIS with $100K due to 3x ETF decay. There is a lot of literature on 3x ETF decay available on the internet.

Vangelis

KeymasterThe BUG will not allocate to an asset if that asset is in a long term downtrend, i.e. below a long term moving average. If at least 4 out of the 6 assets are above the MA, all is well and the BUG will allocate to the best ones (ranked according to a risk-adjusted metric) and reach a 99-100% allocation. But if for example TLT, GLD, PCY and TIP are in all downtrends, then the BUG will only allocate to SPY and CWB and not reach 100% allocation. This should makes sense: If many asset classes are in downtrend (ie mid to end of 2015) one should be conservative and reduce leverage.

On top of the trend filter, there is a volatility filter. If a chosen asset shows volatility beyond a desired level, then it’s position size is limited. This may also cut an asset down in size even if all 4 ‘slots’ are filled. So you could have a 25% SPY, 25% TLT, 25% PCY and 21% GLD allocation if gold has been very volatile.

Whatever is not allocated stays in cash (not SHY).

Vangelis

KeymasterThank you for the feedback Evan. It’s been corrected.

Vangelis

KeymasterThank you for the feedback. It should be loading proprerly now.

Vangelis

KeymasterHello Evan,

We answered via email but I will post the answer here too. We publish after the close (ie July 16) so you are still looking at the June 15th excel that was erased once the new signal are posted.

Regards,

VangelisVangelis

KeymasterThank you for your feedback. There are no plans for API access at the moment but we do see how this could help many of our clients. We will look into this.

We do license our full QuantTrader software to select professional clients so they can generate our signals in-house.Vangelis

KeymasterHello Gordon,

There is a slight bug in the charts. When clicking on the YTD button, the chart starts from the 1st trading day of the current year and not the last day of the previous year. If you go below and to the left of the chart, you will see two date fields. If you just click on the first field(From: 12-31-2015) and hit enter, the correct date will be used as input and the chart should show the expected return.Vangelis

KeymasterHello Sunil,

Good question.

The world Top 4 strategy is meant as a growth, non-U.S. strategy and diversifier. It is far more correlated to foreign developed and emerging equity indexes than U.S. equity. Foreign markets can grow significantly in the right environment. Last year was not such. If you have invested ‘naked’ in foreign equity markets in the past year, you would have been crashed. Remember, oil did touch below $30 and this influences many commodity producing foreign countries like Canada, Russia, Australia, etc. WT4 offered exposure to foreign counties while protecting from extreme losses by hedging with TMV (Treasuries),

To answer your question: What went wrong. The U.S. dollar rallied causing foreign markets as well as commodities to under-perform. If you believe this will continue you should not invest in WT4 but choose something more U.S. based, like UIS or the Nasdaq 100. But if you believe that commodity producing countries and foreign currencies will eventually outperform, then WT4 may be a good choice and a partial portfolio allocation could help diversify out of the U.S. dollar.Vangelis

KeymasterHello Greg,

The small yearly bar chart was pulling the wrong data. It should show the correct values now.Vangelis

KeymasterUpdate as of April 2016: We have included the Nasdaq 100 strategy in our Excel custom portfolio builder which is a free download for all-strategy subscribers.

Vangelis

KeymasterHistorically, it has been better not to use a MA filter since Treasuries worked better than go-to-cash. In other words, from a backtesting point of view, it has been best to be always invested. The BUG does use the mechanism you mentioned and the leverage version is currently all in cash, because of that.

Keep in mind that UIS 3x is not the best choice for very volatile markets since both 3x components suffer losses. There are other more conservative choices. If you must trade the 3x, it is better to short the reverse 3x’s, or if you cannot, go with the straight UIS.Vangelis

KeymasterBoth BUGs use a moving average filter that rejects positions when an asset’s last price is below it. The two strategies MA periods differ by 10 days (240 vs 250 ). Interestingly enough all 7 assets are below the shorter (240) MA even though SPY and PCY are marginally so. On the 250 period, they are marginally above, so the BUG straight strategy does allocate to them while The leveraged version’s 240 day filter rejects all positions. Zero allocation feels strange but it is a testament to having all 7 assets under-perform, which in itself is historically a rare occurrence.

Vangelis

KeymasterIt is MSFT, we updated the consolidated overview signls as well. Thank you.

Vangelis

KeymasterWe should be able to include it starting next month.

Vangelis

KeymasterLet me start from the second question:

The model changes/adjusts positions at the beginning of the month, only.

The way we calculate the Nasdaq strategy signals is that first, we run the two sub-models. Each gives us 4 stocks + TLT. Then we run the META layer and allocate between the two sub-strategies. The way our software works, the sub-strategy that is NOT chosen gets zero allocation. Hence, we end up with 4 stock allocations above zero (say 20%) and four stock allocations that equal zero. The “zero allocation stocks”, are the choice stocks of the rejected model and should be ignored. So the way to read this is:

SIRI, EXPD, COST, ALTR, TLT @ 20 each.I hope this helps.

Vangelis

Vangelis

KeymasterDerrick,

Your observations are approximately valid. The older years backtests will be less accurate and be directionally overstated.

The more recent data – like the latest year, will be more representative of the “edge”. I have worked with variations of these screening/rankings of momentum stocks related to the Nasdaq and S&P 100 for years out of sample in systems, and I have seen it hold up quite well. It is not likely to beat the market by +40% a year, but it will, over a cycle, beat the Nasdaq with a lower risk profile.

It is easy to look up the older lists of stocks. Operationally, managing the switching between the lists in the rebalancing within our engine has proven difficult, but it continues to be on our “to-do” lists. That is the reason we delayed for six months releasing this, to help ensure we did not overfit the structure.

Thanks for all of the digging; you are a good researcher :)

Scott

Vangelis

KeymasterDerrick,

I am glad you are thinking it through carefully.

We do use the dividend adjusted data in the calculations, and TMF generally reflects the impact of the dividends indirectly.

TMF is less liquid, and can trade with more slippage vs the targeted price execution. For those that are comfortable paying very careful attention to the trade execution (limit orders, paying close attention), TMF is generally worth it if you are conserving capital. Also, there can be some inefficiency of a 3X ETF capture over time relative to the underlying (you don’t get the full benefits of the 3X).

It is easier and you avoid the risk of unintended execution problems by using TLT instead.

In that case, you would put in extra funds into the treasury bucket. That is, if you were buying $5,000 of TMF, you would buy $15K of TLT to get the same effect.I hope that helps.

ScottVangelis

KeymasterDerrick,

That is correct.

TMF has a limited history, so we created a simulated TMF by TLT * 3, used for the longer term backtesting. TLT *3 aligns closely to TMF. The actual signals will be in the form of TMF as it takes up less capital allocation. Does that make sense?

Thanks

ScottVangelis

KeymasterThanks very much – missed that one, we will correct it.

Vangelis

KeymasterRichard,

The blog has some useful posts – use the search tool. For example:

https://logical-invest.com/mid-year-review-portfolio-builder/

https://logical-invest.com/new-fixed-weight-portfolio-optimization/

Regards,

ScottVangelis

KeymasterYou would see must stronger CAGR, gretter volatility and drawdowns. While directionally similar to using a lot of margin, there will be a drag as a 3x ETF tends to underperform what the should achieve due to the way they rebalance and other technical factors (lots of information written about that). For me, I would not use them for that reason, as I avoid inefficiencies.

I hope that helps.

Vangelis

KeymasterMichael,

TLT with 3 times the capital allocation would do about what TMF does.Vangelis

KeymasterWill be back up shortly; sorry for delay.

It will be here https://logical-invest.com/blog/strategy-signals-consolidated/Vangelis

KeymasterSteven,

Thanks for the suggestion.

To check, I just calculated the % Std deviation since CWB start vs same period SPY, and SPY has about 1/4 more volatility. Further, CWB reflects and captures a very different asset class that moves somewhat differently that the S&P 500.

I always urge subscribers to carefully consider and evaluate the underlying asset classes as one of the most critical steps when examining a strategy.

Kind Regards

ScottVangelis

KeymasterFrankS,

I appreciate that you were not able to exactly replicate our formula. I guess that means we did our job, which was to provide a lot of hopefully useful information, but not enough to allow replication. This is our business and I am sure you appreciate that we prefer to give our intellectual property confidential.

All of our signals are shared with our subscribers in the published history, which we never change.

Kind Regards,

ScottVangelis

KeymasterDerrick,

We look at stable results over different time periods for the settings, seeking forecastable plateaus rather than peaks. Generally small performance differences with moderate changes in lookback; radically different values produce strong differences but still generally positive outcomes. Strategy holds up well with small performance decreases with high liquidity ETFs.

Vangelis

KeymasterThank you Derrick. This was a copy/paste mistake. It has been corrected.

Vangelis

KeymasterNelson,

Some of the ETFs do have low liquidity; most are fine. We have tested this without using the lower liquidity ETFs and the results are pretty close; we are intending to give guidance on swap outs in any month when a low liquidity ETF comes up. Being patient with limit orders, as you implied, is necessary for any ETF that has more much than a couple of pennies spread on the bid/ask.We will be adding this to the custom builder; will update everyone on timing.

The current signal is up to date in the strategy section.

Kind Regards,

ScottVangelis

KeymasterDear Ron,

There is no edge in picking a day other than being close to reported results. My recommendation for the BUG strategies has been to trade on the second day of the month @ the open if you have IB account or manually during the day, preferably below VWAP, if not. If you are dealing with less liquid ETFs, trade towards the close of the day.

Keep in mind, these are monthly strategies. If you pick a random day in the month, sometimes you will do better sometimes worst than the reported strategy. If there was an “edge” then that would be a strategy in itself. End-of-month trading used to have an edge, not anymore.

https://logical-invest.com/end-eom-strategy-re-balancing/Vangelis

KeymasterScrichley,

I may not be following your question. The new improved MaxSharpe engine was fully tested and implemented around late last year. We looked at the results back through the full history and it does smooth the outcome.

Does this help?

Thanks

ScottVangelis

KeymasterRichard,

As far as I can tell, it works with Excel 2013.

Regards,

VangelisVangelis

KeymasterStephen,

Using a brand name that is more quickly understood has merit :)

Thanks

ScottVangelis

KeymasterIlya,

As you know, the actual rules are far from opaque but we would rather keep a small percentage of the strategy rules/parameters private. This is what fellow partner Alex calls the ‘secret sauce’. I send you a note to clarify any questions you have.Vangelis

Keymasterkwmike,

Yes, it makes sense. For me, generally leaving a open limit order and waiting for the market movement to give me a fill over time often works, but that does not work for everyone. Market on close orders (and others like VWAP) can help. We are considering options of either proving the official signal earlier or, down the road a bit, give more frequent updates to the current state of the signal for those that want to operate on a different time cycle.

Thanks for your thoughts and questions, they are useful.

Regards,

ScottVangelis

KeymasterPortfolio Builder uses the long back test as it is historically aligned and restated to using the adaptive allocation approach. This that is what will be used going forward, we judge that to be more appropriate for future allocation decisions. The stand alone strategy pages/charts align to the strategies as they existed at the time for historical accuracy.

I hope that helps.

Vangelis

KeymasterSome strategies like UIS and MYRS do. You may want to try those, especially UIS which trades extremely liquid ETFs and corresponding 3x ETFs. The BUG does not as it uses ETFs that do not have a corresponding leveraged version (PCY, CWB). Always be careful with leveraged ETFs and use them with caution.

Vangelis

KeymasterPhilip,

Thanks for your well thought out questions. You raise a lot of layers, and you obviously have done a fair bit of homework. I have traded a moderate amount of future contracts (S&P, Russell & VIX), and have helped build some systems with futures, so I can add some insight, but I am far from the “final” answer here.Once someone has sufficient knowledge, experience and account size, futures can be amazingly powerful. Perhaps too powerful (leverage) for some, as it is possible to be confused into thinking in terms of how much money someone is “putting down” for the contract, while one should be making decisions based on the underlying value the contract represents. I have not traded nor studied Treasury futures, and the array of ETFs variations work pretty well for me, so I will let others jump in on those.

Benefits of futures: huge leverage, efficiency (fairly liquid trading 24 hour cycle), easy and natural shorting (many ETFs can be a hassle to short), and, for some types like commodities and the VIX, can use the backwardation/contango contract information to provide an additional edge (although implementing that edge can be tricky). Generally, one should understand future contract combinations (long/short) with different contract months as a conceptual variation of option contracts. If the account capital allocating to the position aligns nicely to the contract sizing objective, then no real negatives. For me, I sometimes do a lot of smaller fine tuning of position sizing, trading around a position and mixing with option layers, so futures do not so easily blend as well with that style of trading.

I hope that helps.

Vangelis

KeymasterMichael,

I assume you mean the BUG leveraged?

Thanks for pointing it out. Will do.Vangelis

KeymasterPeter,

I am not familiar with available futures as far as DKK is concerned. If you do find a solution please share for the benefit of other users. If anyone else has more info feel free to join the conversation.Vangelis

KeymasterPeter,

Depending on your broker you can hedge your USD ETF exposure by buying an equal nominal amount of DKK/USD in the forex market (via margin) or use futures if those are available to you.Vangelis

KeymasterHi caputoe,

Futures involves substantial leverage and other aspects (rolling the positions, etc), so one needs to be sure to get 100% comfortable with all aspects of futures before you consider executing a real dollar position. Also, a good practice is to paper trade a while first. Once one gets to that comfort level, the contract shows you how to translate the cash value of the futures to the “exposure value” of the contract. The idea would be to keep the exposure value ratio of the S&P contract to the Treasuries contract at the same ratio as the ETF signal that you are aligning with. Never think of futures in terms the cash margin requirement, work from the underlying exposure you are taking on, otherwise you can quickly blow up your account with a margin call at the worst possible point.

Vangelis

Keymasterwigmoney,

Overtime the results will often be somewhat similar between SPY and MDY, however for extended times they will deviate by measurable amounts. Over the last year, SPY has been measurable stronger, but that will changes. I would be surprised to see them move in opposite directions for days in a row.

Net…you might be mostly OK, but results will differ somewhat.

Vangelis

KeymasterMichael,

Thanks for the heads up on Folio Investing brokerage. They look like that could work for some subscribers; I will need to give them a call.Vangelis

Keymasterhawaiianwaverider,

Excellent point; that is one criteria we look at and I intend to do more in that direction.Of course, the challenge is developing the strategies that are logical, stable going forward, and non-correlated to each other and the S&P; other than that, it is quite easy. :)

- AuthorPosts