Home › Forums › Logical Invest Forum › Consolidated Signals

- This topic has 50 replies, 11 voices, and was last updated 7 years, 4 months ago by

reuptake.

- AuthorPosts

- 09/30/2017 at 3:57 pm #46003

Alex @ Logical Invest

KeymasterTo enhance the visibility, here a new thread. Please see former discussion here.

10/01/2017 at 9:54 am #46026Richard

ParticipantHello Alex,

Using the on line Signals Consolidation tool for monthly re-balancing today, I find that the allocation table columns are no longer sortable. Of course, the CSV download file can be sorted, but previously I found the ability to sort columns in the tool itself helpful and would like to see that feature enabled once again.

Regards, Richard

10/01/2017 at 3:31 pm #46043Alex @ Logical Invest

KeymasterHello Richard, I re-activated the option again – the default option was not putting the total in the last row, but now found a way. Hope that works for you, might need to do a CRTL+F5 to refresh.

10/01/2017 at 3:55 pm #46044Richard

ParticipantHello Alex,

Works just fine! Many thanks.

Richard

10/05/2017 at 12:45 pm #46151Aati

MemberHi Alex,

If I want to get the allocations for the Portfolio, MaxDD below 15%. Do I do get it online using the Consolidated Tool or do it by using the Excel sheet. I did it both ways and got a variance the Online tool says to purchase 10 shares of MDY (4.6%) , whereas the Excel sheet says to purchase 11 shares (5%).

Also on the LI website, under the Members area, when i click on Strategy Signals, I land on a page with all the strategies and their allocations, and it has two columns which show Entry and Exit dates. The Exit date says 10/5/2017, which is today’s date, I am not understanding this. Is this the date you Exit out of the strategy?

Thanks,

10/05/2017 at 3:21 pm #46152Vangelis

KeymasterAati,

Welcome!

LI strategies trade monthly, in the beginning and end of the month. The only exception is MYRS that trades every 2 weeks. The exit day of the current month does not refer to when you should exit but rather it is today’s date (or the last day that we have updated data) so that we can keep track of performance from the last day of last month – to current day (month-to-date performance). Every time we update data the exit day will move to the current day, until we close the month. You should trade on or after the first of the month.

I hope I did not confuse you more…

I will let Alex respond about his baby, the portfolio builder :)

Best,

Vangelis10/05/2017 at 11:10 pm #46153Aati

MemberVangelis,

Thanks for clearing my confusion about the exit date. I have been reading up on various strategies and articles from the Academy. Did learn quite a bit from Morpeus, but I am leaning towards MaxDD<15%.

My question with regards to the Allocations is primarily, should I use the online tools from the Members Area or the downloadable Excel files?

Alex has been helping me answer questions via email.

Cheers!

10/05/2017 at 11:27 pm #46154Alex @ Logical Invest

KeymasterHi Aati, night shift is mine, so let me jump in. We´re offering both the offline and online tools as our followers have different preferences, finally up to you to choose which you prefer.

The Excel tool comes with close prices from month-end – if you do not update them, while the online tool queries realtime prices once an hour, this explains smaller differences in shares.

10/06/2017 at 1:11 am #46157Aati

MemberThanks Alex. If that’s the case then I will stick with the online tools, much easier to use, and to start with I’ll stick with the available Portfolio Options.

10/15/2017 at 9:37 pm #46707daniel morton

MemberHi Alex,

I am getting unusual stock prices. See attached Oct 2, 2017 Max Sharpe strategy. ISRG shows a symbol price of >$1000 yet the it trades at $360.. when i redownload today it gives the current share price.

Thanks.10/15/2017 at 9:51 pm #46709Alex @ Logical Invest

KeymasterHi Daniel, Yahoo reports a 3/1 share split on Oct 6, so this explains the difference. See here: https://finance.yahoo.com/quote/ISRG/history?p=ISRG, now prices are already back-adjusted.

10/15/2017 at 9:58 pm #46710daniel morton

Memberok cool got thanks.

11/15/2017 at 12:51 pm #47494daniel morton

MemberHi Alex,

I don’t see the mid-month signals for MYRS?

Also, something I don’t understand is MYRS has ACWV and Max Sharpe includes a 7% allocation to MYRS, yet Max Sharpe doesn’t include any ACWV? did I miss something? Thanks.11/16/2017 at 7:27 am #47510Alex @ Logical Invest

KeymasterGood Morning Daniel,

The MYRS mid-month signals are always published during the night/morning of the 16th (UST), so a couple of hours after your post – now are in, and no change in %.

Not sure I get your point about ACWV, it’s not part of MYRS. Please clarify.

11/16/2017 at 8:40 am #47511Vangelis

KeymasterFor those who download and use the “offline” Excel Signal Consolidation Tool, we are testing a new data source.

The Excel downloads last price data from the IEX API service. This is in “beta” and was done as a result of Yahoo interrupting its intraday data service.

If you have any issues getting correct prices let me know.https://logical-invest.com/blog/strategy-signals-simple/ (click on “Consolidated Signals for November 15 2017”)

11/16/2017 at 12:19 pm #47518daniel morton

MemberHi Alex,

Thanks, ok understood re. timing.

ACWV – Agreed, I didn’t think it was part of MYRS either. I ran consolidated signals yesterday under Maximum Yield (unless I made a mistake) and it allocated to 70% to ACWV and 30% CWB. If possible I would suggest in the export that it includes the Total it shows what the custom portfolio is in some abbreviated version. Or you can see my log file if I or system made a mistake. Should be easy to find under my name search was for $500K USD.

11/16/2017 at 8:34 pm #47521Alex @ Logical Invest

KeymasterHi Daniel,

yesterday you queried twice the Max Sharpe portfolio, where ACWV is included, and today only MYRS. Good hint, will try to include the strategies of the custom query, give me some days.

Overall is the tool now easier to handle? Any feedback is appreciated.

P.D. The log is only for this kind of analysis, not doing anything else with the data and delete it regularly. Can use [email protected] as email input if any concern :-)

11/16/2017 at 8:58 pm #47524daniel morton

MemberThanks Alex. hmmm, that doesn’t seem to explain it. So assume I made a mistake and selected max sharpe 2 issues 1) it would not be allocated 70/30 to just 2 stocks? also, it is labelled custom portfolio whereas Max Sharpe I believe would be labelled as such on the excel output file. My guess (again a guess) is this is similar to the previous time it is saying calculated but it isn’t. Maybe a log file isn’t recording everything. I used a screen copy otherwise I can download going forward. Perhaps in any file downloaded you can include some info about the search query/timestamp etc… to be able to debug.

Yes, tool easier. if there are funds to not be invested then I would suggest having a ticker for cash (perhaps there is one).

12/01/2017 at 11:26 am #47933daniel morton

MemberHi Alex,

Are the CROC purchase signals in Max Sharpe/Min volatility correct? I don’t recall seeing CROC purchases. I am not sure how I would check. I would need to look at each strategy and then each security in each strategy unless there is another way. thanks.

12/01/2017 at 11:28 am #47934Nelson Brady

MemberWow, start working on the re-allocation and the announcement about Flynn completely trashes all the numbers. I expect the new allocations would change if done again now.

How often are the prices updated? Is there a way to force a new price update? In the browser tool not excel.

12/01/2017 at 2:58 pm #47942Alex @ Logical Invest

KeymasterHi Daniel,

the Gold/Currency switched to 50% CROC, and indeed that’s the first time since 2015, see here: https://logical-invest.com/portfolio-items/the-gold-etf-currency-strategy/

12/01/2017 at 3:00 pm #47943Alex @ Logical Invest

KeymasterHi Nelson, indeed, quite some movements last days, and today once again. Prices in the online tool are updated once an hour.

12/01/2017 at 8:03 pm #47945daniel morton

MemberThanks Alex. Is there anyone else offering managed account services than EPG? I pay 0.8% on pretty active bond managed funds where there is daily credit/leverage analysis. The managed account LI is essentially an automated order execution platform. I would prefer to pay you guys. If there isn’t another investment advisor, anyway to automate it with IB? Thanks.

12/02/2017 at 10:41 am #47964Alex @ Logical Invest

KeymasterHi Daniel,

for the time being EPG is the only adviser offering our strategies under MAs, we´re discussing some other options, but not yet ready. Pricing is a question of scale, we´ll definitely reduce the % once reaching some 40-50m USD – but not yet there. For a 150k amount the 0.9% is close to a wash for our all strategy subscribers, only 30 USD more a month to have your account managed, we feel that´s not bad to start with, but indeed will share future scale effects with our subscribers.

In IB I use the “Rebalance Portfolio” tool, where you can simply upload the tickers and target % to rebalance. It then creates the orders, which you can default to “IB Algo Adaptive” in your config, and just let them run with one click. I do not want to fully automate this as it takes some practice and always should be monitored by the account holder. But after some practice you can rebalance in just 5 minutes or so.

Attached the CSV for rebalancing a Max CAGR <15% Vola portfolio as of yesterday. After uploading you just have to review other positions, e.g. set YCS to cero, or adjust % down if you´re not trade 100% of your account with this allocations, e.g. have other positions.

Here the help in IB: https://www.interactivebrokers.com/en/index.php?f=20160

12/02/2017 at 6:10 pm #47976daniel morton

MemberHi Alex,

Great thanks, that is the tool I need.

12/03/2017 at 8:46 pm #48000Patrick @ Logical-Invest

KeymasterI am considering trying out M1 Finance to manage a LI portfolio. They charge 0.15% for accounts over $100k and NO transaction fee. You create a portfolio, called a pie, and then assign percentages to each slice. Each slice can be another pie, such as an LI strategy, or individual security. Then you just update the holdings in each pie (strategy) and click rebalance. My only concern is that they use market orders so there could be significant slippage on some of the lower volume ETFs. They claim to mitigate slippage by splitting orders into smaller chunks.

12/09/2017 at 7:46 am #48102reuptake

Participant[quote quote=47976]Hi Alex,

Great thanks, that is the tool I need.

[/quote]

Yeah, it’s fantastic tool, I can’t live without it. And sometimes I have to, since it’s not available in mobile version of their app. I wrote them asking to introduce it on mobile, too. If anyone could ask them the same, it could be helpful.

01/16/2018 at 1:03 pm #49136daniel morton

MemberHi Alex,

Happy New Year. Is there any way to make the export tool from consolidated signals in the format for IB import? so similar to you offering CSV, Excel, PDF, offer IB? separately, have you considered adding any stop losses on the strategies? It seems there should always be some downside mitigation the only issue is how much downside. Thanks.

01/16/2018 at 1:54 pm #49137Alex @ Logical Invest

KeymasterHi Daniel,

let me see if I can export in the IB format, but actually it’s probably quicker and safer if you do manually. My biggest concern is safety, e.g. prefer everybody spending a minute more and making a conscious reality check before uploading. For example if you’re holding other stuff in your account beside LI strategies (let’s say 70% LI, 30% others) you must manually reduce the percentages in the upload file to total 70%, and either set the other percentages to total 30% or leave them blank in the IB Portfolio Rebalance tool.

The format itself is simple just 5 columns with 2nd being ETF/Symbol, 3rd exchange (SMART) and 4th the %allocation, example:

DES, GLD, STK, SMART/AMEX,11.4Attached an example file, what I normally do is to download/export the current allocation and then fiddle in the new percentages, save as csv, import, trigger orders, set to IBAlgo (if not default), adjust limits, pray, count to ten, and hit transmit..

I very much enjoy automating things, but this 5 minute routine makes me sleep better .. and protects me from divorce.. :-)

Re limit orders: Yes we’ve backtested many different options, but it always boils down to getting whipsawed, e.g. selling low and missing re-entry. With the “mini-crashes” we had more frequently in recent years this can happen in question of some minutes.

If you want to protect “tail-risks”, e.g. harsh crashes better do a free or low-cost collar with options, e.g. buy -10% long term (6mo, 1yr) puts and finance them (partially) selling +10% (or lower) calls. Can do this free or for around 1% of assets depending on protection, and with the low volatility and upside skew it’s a good time.

01/16/2018 at 5:48 pm #49140daniel morton

MemberThanks Alex. Yes, I understand it might be quick to do manually but my experience with excel/trading is that I prefer to spend the time on checking/reviewing rather than doing any manual changes, that is where we (I) make mistakes. If you have IRAs, different accounts etc… you could have 3+ places to rebalance. Again my preference would be a 3rd party but 0.8% is too high as I mentioned before for just execution. Numbers work on $100K investment but not on $1M.

Sorry I didn’t understand the tail risk, what security are you referring to?01/17/2018 at 10:48 pm #49182Alex @ Logical Invest

KeymasterOk, let me see how to most easily do a downloadable sheet in IB format. And heard you, EPG will approach you to see how to limit your suffering % wise :-)

Was talking about OTM put/calls on SPY (or IWM), currently cheap as never due to low vol and low put/call ratio.

02/01/2018 at 8:46 am #49698UkiwiS

ParticipantFeb 1 2018, consolidated signals.

I’m new and I’m struggling with the signals for 1 Feb. I’m using the “Max 15% Volatility” radio button for the portfolio options and when the allocations populate the numbers seem a little screwed up. UGLD doesn’t have a “Symbol Name” , Price or quantity plus the total for the portfolio doesn’t sum to what it should. I also noticed that the allocations for MYRS strategy don’t total 100%, ZIV is 80%, UGLD is 2.83% and TMF is 8.0%…that’s close to 91%…where’s the rest go?

AM I missing something?

02/01/2018 at 9:17 am #49705Alex @ Logical Invest

KeymasterThe description and price of UGLD was not properly populated, that’s fixed now, sorry for the glitch. MYRS is 80% ZIV, 8% TMF and 12% UGLD, but the table moved due to missing UGLD description.

02/01/2018 at 9:47 am #49712UkiwiS

Participant[quote quote=49705]The description and price of UGLD was not properly populated, that’s fixed now, sorry for the glitch. MYRS is 80% ZIV, 8% TMF and 12% UGLD, but the table moved due to missing UGLD description.

[/quote]Thanks Alex.

Here’s something else.

For the “custom portfolio” any selection for “US Sector” is not being included or shown in the “Consolidated Allocations” section of the page.

02/01/2018 at 10:09 am #49716Alex @ Logical Invest

KeymasterThanks, fixed!

02/01/2018 at 10:17 am #49718UkiwiS

Participant[quote quote=49716]Thanks, fixed!

[/quote]Is it?

Why do the weights in your picture, for the USSECT sum only to 80%?

Is this the reason the total portfolio is less than 100%???

02/01/2018 at 10:21 am #49719Vangelis

KeymasterYes, the US Sector is 20% in cash.

02/01/2018 at 12:28 pm #49735UkiwiS

Participant[quote quote=49719]Yes, the US Sector is 20% in cash.

[/quote]Got it, thanks.

02/01/2018 at 5:41 pm #49744daniel morton

MemberAlex,

Do users of the quantrader have this same issue? I have multiple versions of Max Sharpe over the course of the day. They have different instruments, different weightings all for the same strategy. You can see my log under my email.

Separately, I believe if you use the copy function (as opposed to CSV) it is error prone (or my error) since it is not parsing correctly in excel eg. DLTR probably b/c of the , or .

Thanks.02/01/2018 at 9:35 pm #49747Alex @ Logical Invest

KeymasterHi Daniel,

yes, we had some problems with the Online tool in the early morning US time with UGld and US Sector not being properly displayed. I see this is when you were most busy, sorry for that. QuantTrader is much more stable as it is an integrated application, not relying on the several queries I´m doing here. Once our followership gets acquainted to using the brand-new Consolidated Signal functionality in QuantTrader we´re going to phase out this online tool.

Glad to get your feedback on the QuantTrader functionality, can download here.

02/02/2018 at 2:42 pm #49773Richard

ParticipantHello Alex,

Before the on-line Consolidated signals tool is retired in favor of the QT version, the QT tool should present the crosswalk between the symbols and the strategies, as the on-line tool currently does, as well as the symbol consolidation across strategies.

Thanks for all the recent innovation!

Richard

02/02/2018 at 3:26 pm #49774Richard Thomas

MemberI agree, Richard. The Portfolio Builder Excel can generate strategies with user supplied variables such as MaxCAGR with MaxDD < X%, where X is specified by the user. QT should have these capabilities before the PBE is retired.

Richard T

02/02/2018 at 5:24 pm #49776Alex @ Logical Invest

KeymasterThanks for the feedback, appreciated. We´re just softly starting to motivate the use of QuantTrader. We´ll keep adding the requested features and provide training as requested – before we retire any of the other tools.

02/04/2018 at 9:49 am #49814Mark Faust

MemberAlex,

I see that you updated the Consolidated Excel File as well on 2/1.

I am still using this as my base as I get more familiar with QT Lite…

In the 2/1 Excel file, I did not see SDP as an entry??? but isee where QT shows it in the allocation side???thanks

Mark02/04/2018 at 11:34 am #49816Alex @ Logical Invest

KeymasterHi Mark,

indeed there was a change in the allocations for the US Sector strategy between our online signals and what QuantTrader showed after the close.

Based on feedback we received by email we looked into it in detail, and it´s due to timing differences when we cut the online signals in QuantTrader. Also it´s based on a very marginal call in the ranking algorithm, the difference in the ranking is only a fraction of a percentage, which is basically saying it´s an “either or” call and both are statistically the same.

Main reason for this “timing difference” is that the data adjustment for splits and dividends at the data providers are done a couple of hours after the close. As we try to have the signals out for breakfast US time there might be still minor adjustments in the raw data when we cut the signals. We thinks it´s a good balance between speed and accuracy to stick to the current time-table.

02/05/2018 at 4:31 pm #49858UkiwiS

ParticipantI signed up about 5 weeks ago and structured my portfolio based on the “max 15% Max vol” radio button. My year to date return is now a staggering -8.60%…oh well, never mind. I only hope it doesn’t get too much worse. I’m lamenting my poor timing.

02/06/2018 at 2:50 pm #49893Alex @ Logical Invest

KeymasterIndeed, would also appreciate a time travel to Jan 2017 right now :-)

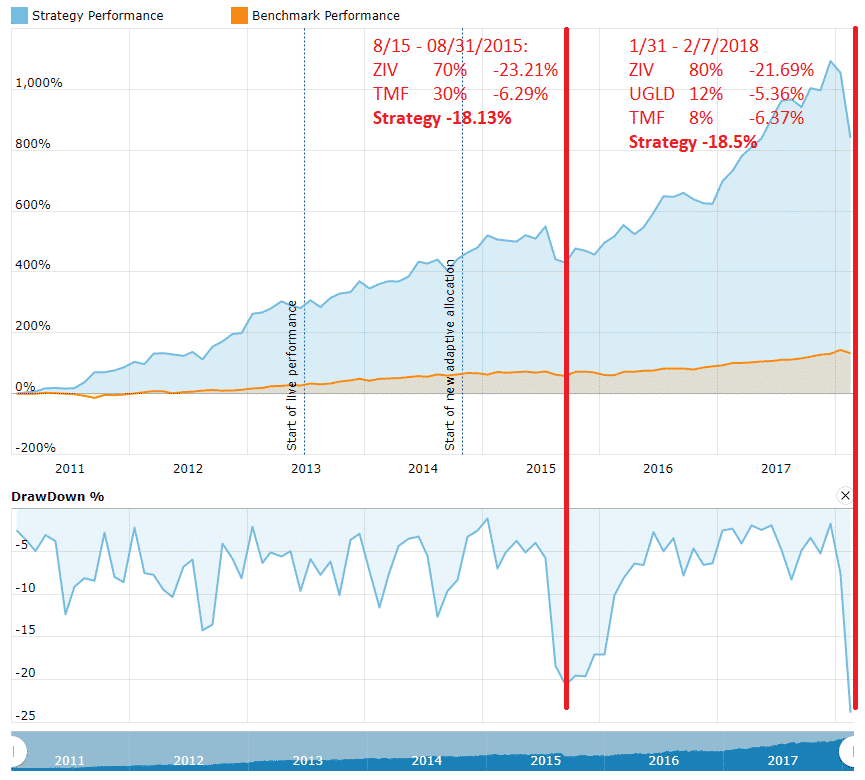

02/07/2018 at 4:05 am #49904reuptake

Participant[quote quote=49858]I signed up about 5 weeks ago and structured my portfolio based on the “max 15% Max vol” radio button. My year to date return is now a staggering -8.60%…oh well, never mind. I only hope it doesn’t get too much worse. I’m lamenting my poor timing.

[/quote]I’ve subscribed much earlier, but just this month I’ve put considerably more funds into new mix of strategies. Of course I’ve checked volatility, drawdown and so on for the last 10 years. And guess what? The max drawdown in live trading set new maximum on the third day of trading!

02/07/2018 at 7:19 am #49911Alex @ Logical Invest

KeymasterI can surely understand the frustration looking at my own account!

This probably took all by surprise, but here is the thing: As many followers will recall, we were in a similar situation in August 2015 – when some stepped out, and missed the recovery and right part of the chart in 2016 and 2017.

Indeed this marks a new max drawdown for MYRS from the top on Jan 8th. But the move is so far well within the historical volatility range of MYRS. If the VIX term-curve keeps on coming down this might look much better at the rebalancing day end of next week. Stepping out at current lows is not recommended.

02/07/2018 at 8:38 am #49915UkiwiS

ParticipantI was a little concerned with ZIV not trading and various people saying it was going to be de-listed. I have to admit these were on sites I’d be better off not reading!

Thanks Alex for the perspective to counter my reality check.

02/07/2018 at 8:57 am #49916reuptake

ParticipantI’m more astonished than frustrated (and I don’t even have have MYRS in my portfolio) :)

Most of my losses are from 3xUIS strategy which is much more exposed to equities than UIS. Why is that? I know there could be a difference between UIS/3xUIS, but this time 3xUIS is much less hedged than UIS.

Overall I’m optimistic. Nothing changed fundamentally.

- AuthorPosts

- You must be logged in to reply to this topic.