Based on the feedback we received last month after the changes in the Maximum Yield (MYRS) and Leveraged Universal Investment Strategy (3xUIS) we are again implementing several changes this month:

New 2 times leveraged Universal Investment strategy

Many subscribers reported issues implementing the leveraged GLD positions we did to circumvent the delisted UGLD. Also the process of having to scale down the positions manually raised many questions, as did the effective leverage of the scaled down versions. On the other hand, many subscribers seem to have no issue with this and enjoy now a reduction in the expense ratio and better tracking record.

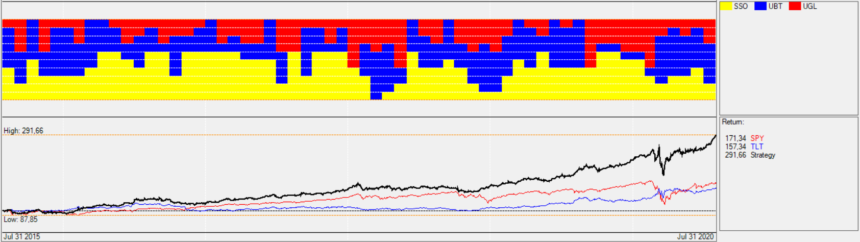

So we decided to implement also a two times leveraged sibling, using:

- SSO – ProShares Ultra S&P500 (2x)

- UGL – ProShares Ultra Gold (2x)

- UBT – ProShares Ultra 20+ Year Treasury (2x)

Here a 5 years view of the allocations:

As an alternative for UGL you can also use DGP – DB Gold Double Long ETN, which does not require a K1 reporting for US investors.

This new strategy probably is the easiest for most investors, so we will make it the defaults choice in the portfolios. For those interested in continuing with the three times leveraged version we recommend to build a custom portfolio using the Portfolio Builder or Portfolio Optimizer.

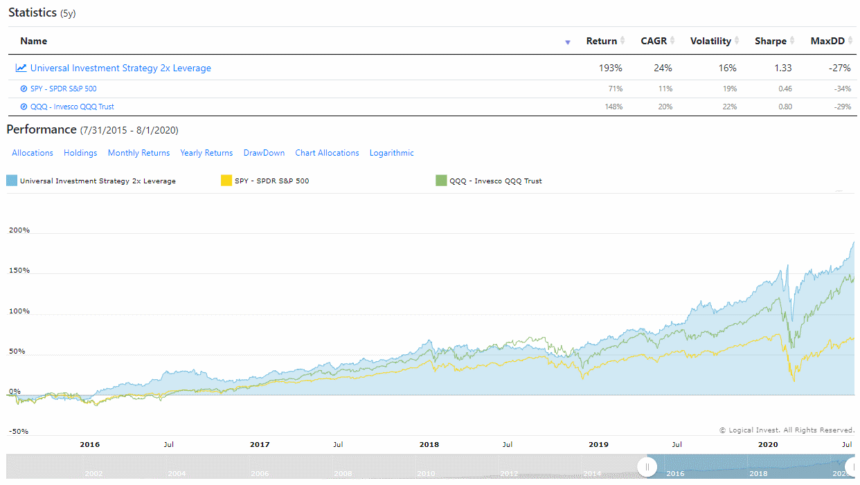

The performance and equity curve, also over 5 years:

See the live 2 times leveraged Universal Investment strategy.

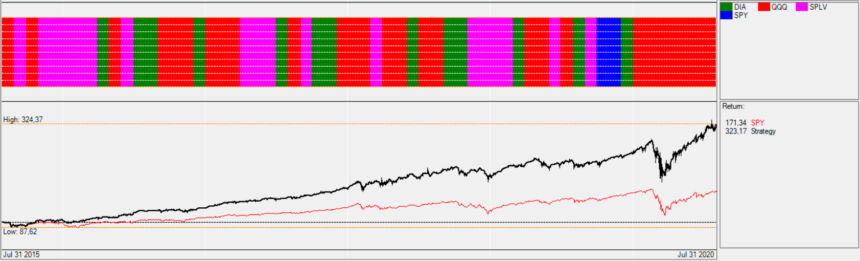

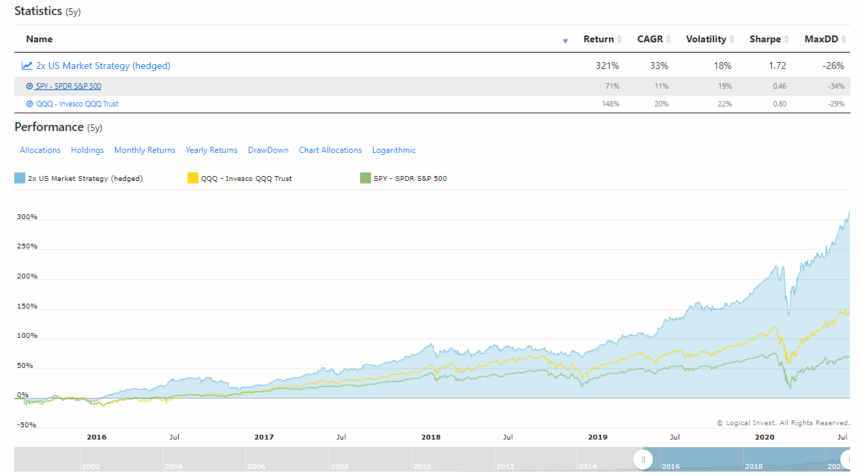

New 2 times leveraged US Market Strategy

Several subscribers approached us with the idea to create a leveraged version of the US Market strategy which we introduced in May – and we feel this is very nice addition to our range of leveraged instruments. The equity part of the 2 times leveraged version consists of the following:

- SSO – ProShares Ultra S&P500 (2x)

- QLD – ProShares Ultra QQQ

- DDM – ProShares Ultra Dow30

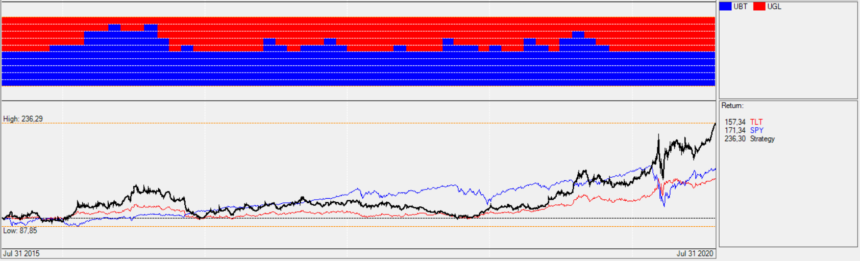

And is complemented with a two times leveraged version of the Hedge strategy consisting of:

- UGL – ProShares Ultra Gold (2x)

- UBT – ProShares Ultra 20+ Year Treasury (2x)

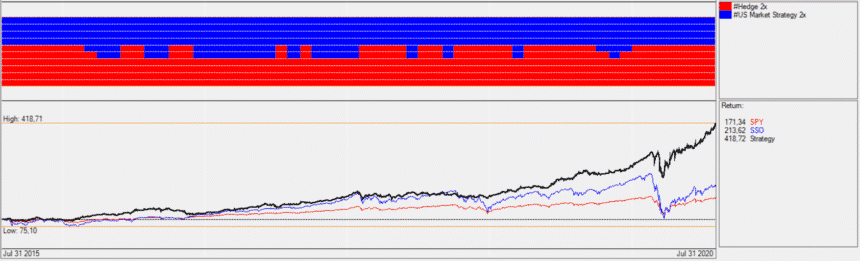

A 5 years view of the alternating allocations of the unhedged version:

The 5 years allocation of the hedge:

An the final, hedged strategy:

The performance and equity curve, also over 5 years:

See the live 2 times leveraged US Market strategy.

New Portfolio Optimization

In the last months there was an ongoing discussion in the forum on how to improve the default portfolios we offer. Main topics were:

- Feasibility of single-stock strategies like the Nasdaq 100 and Down 30 in retirement accounts, but also the worry that both strategies suffer from a survivorship bias, that is they only use the current constituents of the respective index, and do not account for delistings, new inclusions, mergers and change of tickers.

- Practical obstacles for many investors to implement the changes in the MYRS and 3xUIS after the delisting of UGLD and ZIV: The short position in VXZ and leverage of GLD using margin created a lot of confusion, and also problems in the reporting due to the sum of the allocations being less or more than 100%.

- A general question of how much the ongoing COVID-19 pandemic and the impacts on the stock exchange needed to be reflected when choosing the right portfolio.

After a long back and forth and balancing of the different options we decided it was the right moment to implement the needed changes now, even if we normally try to keep the portfolios stable during the year. But the benefits of the changes seem so important to us that they outweigh the potential impacts especially for new subscribers.

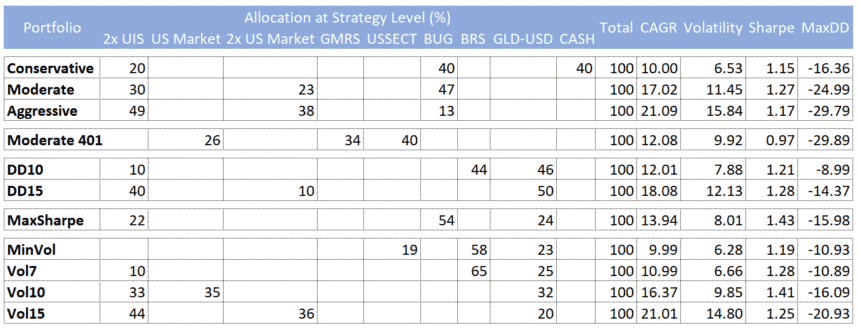

The changes in overview:

- We eliminate the single stock NASDAQ 100 and Dow 30 strategies from the default portfolios. Subscribers eager to include them can use the Portfolio Builder and Optimizer to build a personalized portfolio.

- Exclusion of the 3xUIS and MYRS from the default portfolios, at the same time we include the above mentioned 2 times leveraged UIS and 2 times leveraged US Market strategy.

- Re-optimization of all portfolios using January 2007 until July 2020 as the optimization period, and limiting the maximum number of included strategies to three.

Here the resulting portfolio allocations at the strategy level with the main metrics for 2007 – July 2020:

See the new Core Portfolios (Conservative, Moderate & Aggressive) and the Portfolio Library with the other portfolios.

We are convinced that with the two new strategies and the newly composed portfolios the overall tradability of the portfolios is greatly enhanced. Please recall that the default portfolios are thought as a starting point for building your own personalized portfolio. You can do so by clicking on the “pencil” icon on any portfolio detail view (example Aggressive Portfolio), or by using our Portfolio Builder or Portfolio Optimizer.

As always we’re keen to hear your feedback, ideas and points for further improvement!

Best,

Your Logical Invest team

I would like to create all three previous core portfolios. can someone help with what the allocations and the strategies were? thanks.

Here the allocations of the previous portfolio versions at the strategy level:

Conservative:

BUG: 24

NAS100: 40

DOW30: 36

Moderate:

NAS100: 50

USMarket: 10

DOW30: 40

Aggressive:

NAS100: 55

UISx3: 15

DOW30: 30

If you click on the “pencil” icon of any portfolio you can update the strategies and %’s and save as your custom portfolio. Or use the Portfolio Optimizer to see several variations and pick your preferred one based on risk/return or other preferences.

Would your momentum/mean reversion algo be able to time between the 3 core portfolios, i.e. select the aggressive when risk is low and moving to conservative when risk is high or expected to become high?

Hi Placido,

actually each core portfolio is designed to limit risk by itself. “Risk” in our terms is volatility (or actually “variance” of the returns), so by limiting risk what you want to do is limit the volatility.

Our core portfolios are designed to cap the historical volatility, very similar to the “Vol 7, 10, and 15%” portfolios, just with some additional constraints. So they hold by default a certain level of hedge, and when the “risk” or volatility in the market increases the underlying strategies move to “less risky” assets, when volatility is low they move to a higher equity allocation.

So when you pick one of the core portfolios you actually pick the level of risk you are willing to enter, let’s say 7, 10 or 15% – you can see that in above table in the “volatility” column.