Several times I have been asked why we invest in ZIV (inverse mid-term volatility) and not in XIV (inverse front month volatility) in our Maximum Yield Rotation Strategy and in the “Global Market Rotation Enhanced Strategy” to harvest the volatility premium.

Harvest Volatility Premium smartly

After all, front month VIX Future contango is about 2-3x bigger then medium term contango. At the moment XIV profits from nearly 9% monthly VIX Futures contango. ZIV profits from about 3% monthly VIX Futures contango, or volatility premium

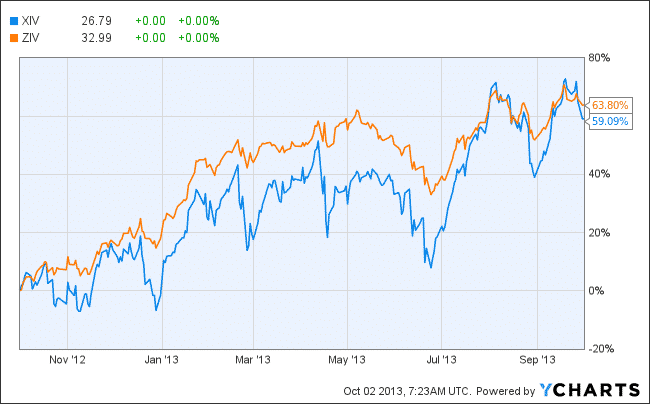

Normally you would think that XIV should have a far better performance than ZIV, but now look at this chart of the 1 year performance. ZIV has performed very well. With 64% annual performance it performs nearly 4% better than XIV and this with much less volatility – thus allows better to harvest the volatility premium.

The main problem is that both of the ETFs are inverse ETFs. This means that underlying they are constructed by shorting VIX futures. These ETFs are rebalanced every day and this results in a quite big time decay. XIV has a very high volatility of about 55% compared to only 25% for ZIV. Higher volatility means also bigger time decay losses.

The 25% volatility of ZIV fits very well to the volatilities of our global market ETFs (MDY, FEZ, EEM, EPP, ILF). Rotation strategies work better, if the ETFs have more or less the same volatility.

Rotation Strategy backtests – all to benefit from volatility premium

If I backtest our Maximum Yield Rotation Strategy with XIV instead of ZIV, then I only get an annual performance of 31% with a volatility of 48% since 2011. With ZIV, I get 70% annual performance with only 27% volatility. This is a huge difference, which shows you, how important it is, that the ETFs of a rotation strategy fit well together.

| Rotation Strategy | annual return since 2011 | volatility |

|---|---|---|

| MDY, ZIV, EDV, SHY | 70% | 27% |

| MDY, XIV, EDV, SHY | 31% | 48% |

Sharpe ratio check of different ways to benefit from volatility premium

Another way to check which ETF performs better is to calculate the Sharpe ratio. Never look only on the Return of an ETF, without also looking at volatility. Volatility means risk. With XIV you can have big losses in short time. The Sharpe ratio calculates the risk weighted return. Now you see, that ZIV had a Sharpe ratio of more than 2 (63,8%/25%) and XIV had only a Sharpe ratio of about 1 (59%/55%) for the last 12 month.

Conclusion

For longer term investments, ZIV is the far better ETF than XIV to use smartly the volatility premium. But even for ZIV you need to have an exit strategy. The most basic exit rule, is that you exit ZIV as soon as the front month or the whole VIX term structure goes into backwardation. You can check this at www.vixcentral.com/.

However XIV can be interesting for short term investments if you buy it on VIX spikes and sell it some days later. XIV has a much higher volume than ZIV, but probably the main reason is, that short term investment ETFs which attract day-traders always have more volume then longer term investment ETFs, but both harvest volatility premium

The low volume of ZIV should not be a big problem, as this ETF is based on VIX Futures which have a much higher volume.

An alternative to ZIV or XIV investments is to short VXZ or VXX. However if you hold VXZ for a longer period you would also have to rebalance from time to time, because a VXZ short position will become smaller and smaller when at the same time a long ZIV position gets bigger and bigger.

Without rebalancing, you cannot make more than 100% profit if you short an ETF. You see this at the 3 year performance of ZIV which is +172% compared to +78% for the same VXZ short position.

check out SVXY, it has a lower MER than XIV

Yep, tx, I trade SVXY, long stock + short options. It has lower liquidity however.