Historically and up to 2013, equities have exhibited a positive bias during the end of the month, called the turn of the month effect.

Is the turn of the month effect still effective?

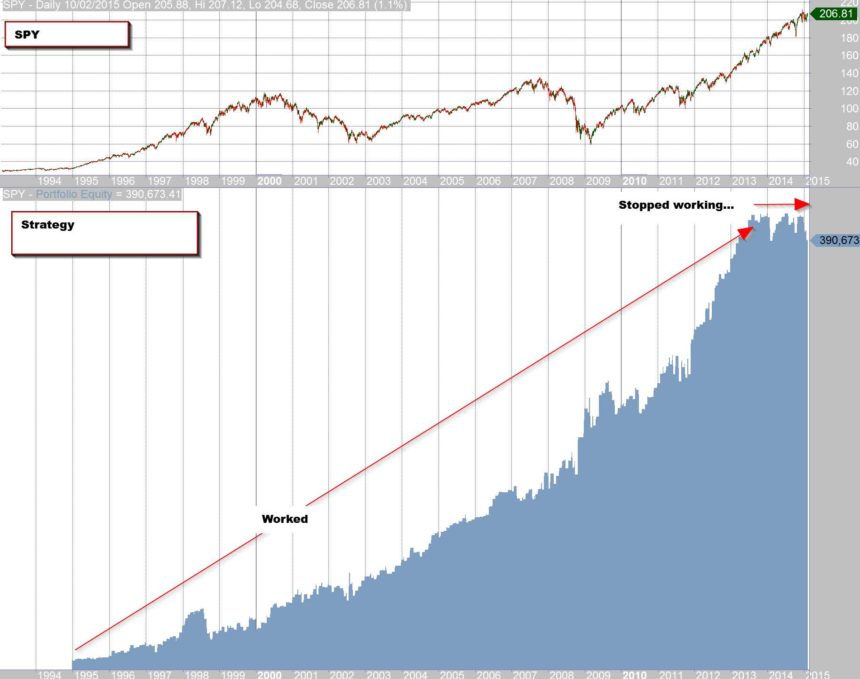

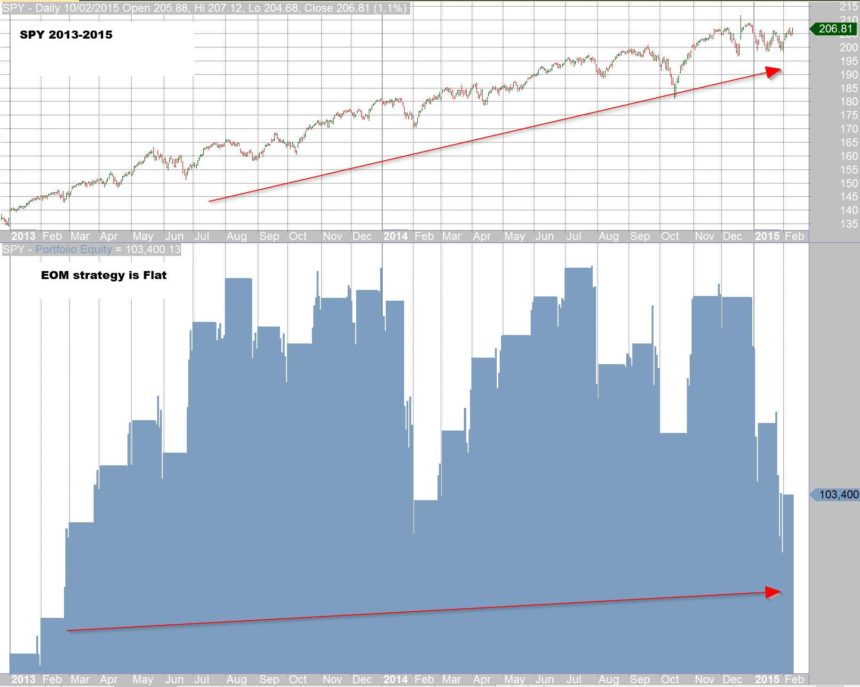

Here is an turn of the month effect example of buying the SPY etf on the first down-day after the 23rd and selling on the first up-day of the next month . Trading is at the same day close.

Turn of the month effectinvesting has been well documented in academic papers as well as blogs. The main reason quoted for this persistent bias has been turn of the month effect window dressing and rebalancing of big funds.

As one of my favorite author/blogger/trader, Mr. Grøtte, has also recently blogged here the turn of the month effect is no more.

Turn of the month effect is no more

Why is this important to know?

A lot of investors re-balance monthly. The day of the re-balance used to be somewhat important as there was an turn of the month effect bias. So it was better to ‘buy’ at the end of the month rather than at the beginning of the month. As of late (2013) this is less true.

What this means in practice is that the specific timing for re-balancing monthly strategies may be less important than it used to be. It does not mean that turn of the month has no effect at all, it is just less relevant than it used to be.

Broader Strategy Development Implications from the turn of the month effect

Market edges are best revealed by understanding and measuring pattern based human behavior. For a long time, the money flows supported end of the month as a buying edge but recently market patterns shifted.

Market edges are not eternal. As they are observed and traded, they can morph. Logical Invest’s process first involves uncovering edges that are well grounded. Next we systematically statically test for the stability of these edges. If we are using them in a model, we monitor if an edge sufficiently shifts out of bounds from historical patterns, then we further investigate and adjust the models and guidance as appropriate.

Great post.

Thanks Peter. Maybe we will do more of these.

Does this suggest that L-I may move from monthly re-balancing to re-balancing when required?

Not really.You can say that ‘monthly re-balancing’ and ‘re-balancing required’ are one and the same. Exception is the MY strategy which re-balances every two weeks. If we create a new strategy that needs specific re-balance timing, of course we will follow and publish the specific timing rules.

So far most of our models work with monthly re-balancing.

Also didn’t worked from 2008 to 2010…

Assumption is that each periodic balancing period is the same, ie time is constant, which is where people become unstuck.

Nice website, will be interesting to see how the strategies perform into 2018-2019 particularly during live bear markets.

Would be interesting to test the Turn of the Month effect, when there’s historical seasonal alignment with individual stocks, indexes, sectors etc.