Updates

- ETFs UGLD and ZIV are set to be delisted on July 12, 2020. We have adjusted our Maximum Yield and Leveraged Universal Strategies accordingly. You may close any positions in UGLD and ZIV to avoid delays. Please read more here.

- New pricing extended to all subscribers.

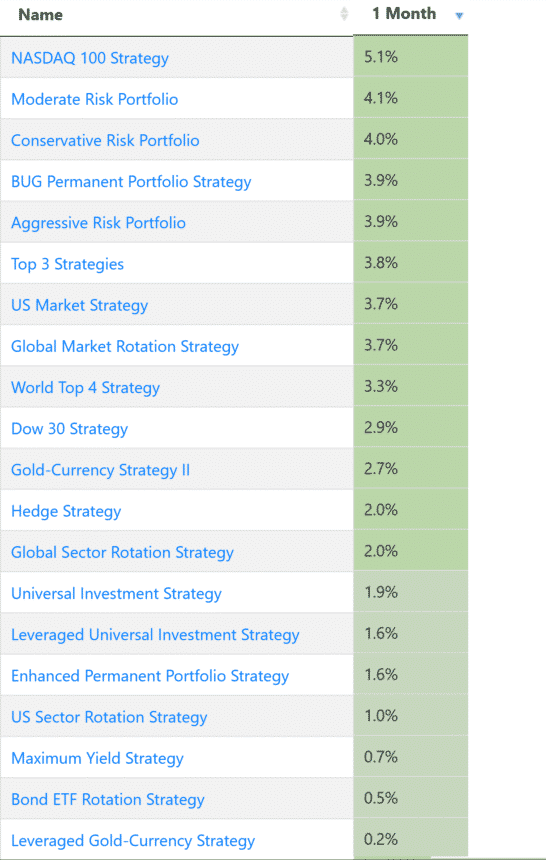

All strategies positive for June

All strategies were positive in June and most outperformed both the S&P 500 (1.8%) and the Long-Term Treasury (0.3%).

Hedging and diversification is the way forward

‘If you don’t have a tail hedge, I suggest not being in the market [as] we’re facing a huge amount of uncertainty.’

Nassim Nicholas Taleb -author “Black Swan: The Impact of the Highly Improbable”- CNBC Interview

At the start of the year, before the current health crisis, we upped our hedging allocations. This has proven to be the right choice so far and we are continuing on the same path. Extraordinary measures from the world central banks have lifted all asset classes although looking at YTD returns, Treasuries (TLT:+22%) and gold (GLD:+17%) have benefited the most.

Equities have performed fairly well with the NASDAQ index breaking all new heights (QQQ:+17%) but emerging markets (EEM: -10%) and even the U.S. market (SPY: -3%) are showing signs of possible weakness.

It seems having variable exposure to all three main asset classes has been and continues to be the right choice.

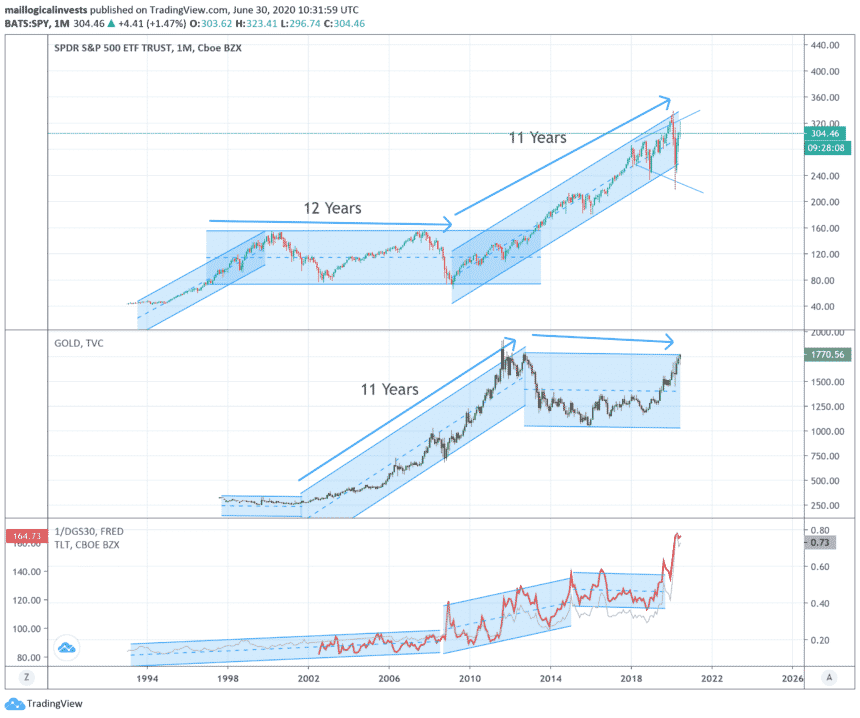

Above are three long term graphs of the SP500, gold and Treasuries.

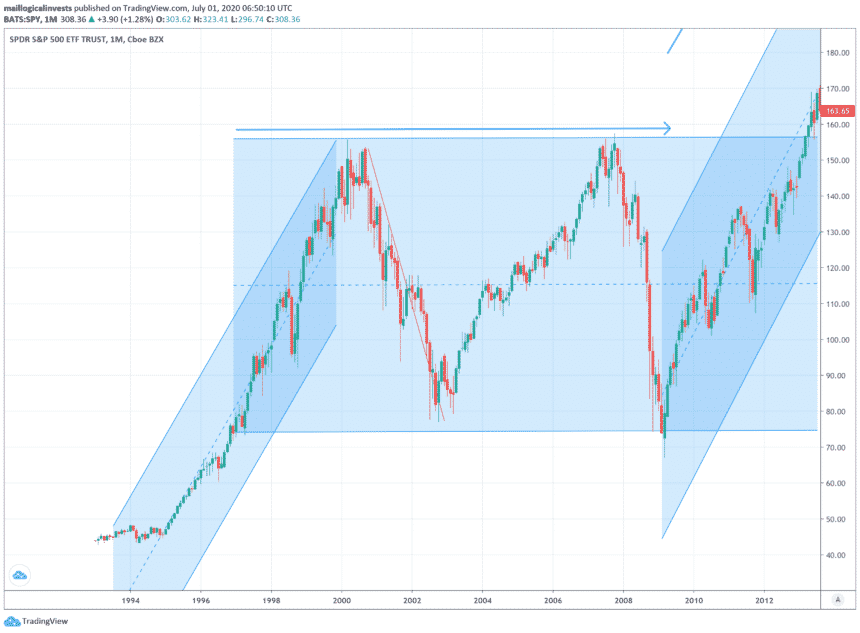

Stocks don’t always go up

If you started investing during 1997 you would have ‘twice-gained’ and ‘twice-lost’ all your money only to get back to your original capital by 2009.

That’s 3 years of happiness, followed by 3 years of fear followed by 4 years of happiness followed by 1 year of despair and frustration. That’s a terrible way to spend 11 years of your life.

But having access to bonds and gold you could have part of your portfolio grow steadily for those 11 years.

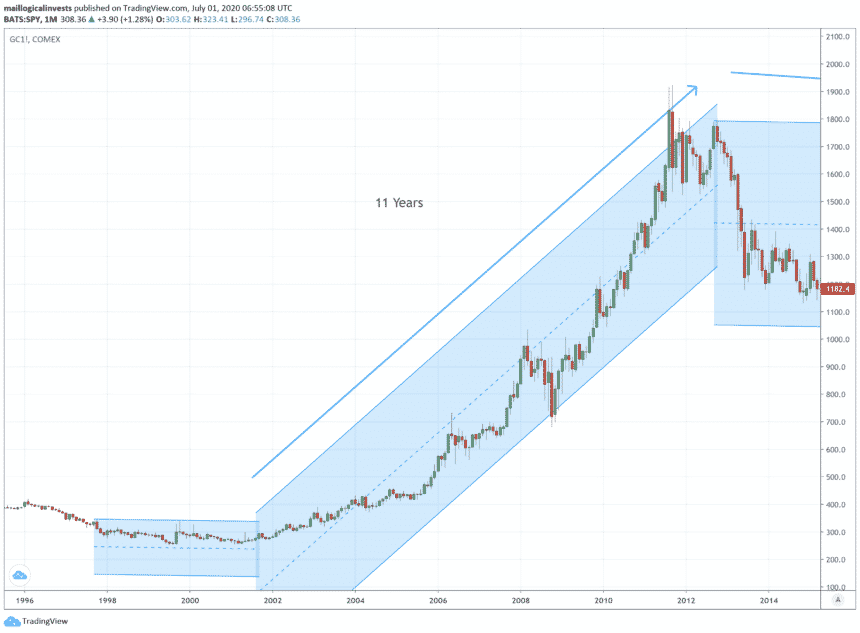

On the other hand, if you invested in gold during 2012, you would suffer continued losses and would eventually break even just this month. That’s 8 years later! The SP500, however, went on a long bull market during those 8+ years. So having a portfolio and strategy that can access all three major asset classes is a must, especially as we enter into unknown territory.

A note on bonds: As we reach almost negative real yields, it is hard to say if they will perform as usual or if they will enter a multi-decade bear market. So far, contrary to what people have expected for many years, bonds have performed exceptionally.

Here is an excerpt from our forum in 2016 where yields were considered to have bottomed out:

But, I’m genuinely concerned that bonds are no longer a reliable hedge due to monetary policies. Do you think this thesis holds water? If so, how will the strategies adapt?

e.p. 09/13/2016

TLT has returned 34% since then and have performed properly as an anti-correlated hedge during this latest 2020 crash.

Notably some of our strategies have switched to TIP (Inflation-Protected Treasuries) rather than TLT as the preferred hedge.

What about going to cash?

Let’s look at the yield curve. Longer term subscribers will recall that we closely monitored the Treasury yield curve before, during and after it’s inversion last year. As we noted then a correction could follow but could be delayed by an average of 9 months. But how is the curve now?

| 1m | 2m | 3m | 6m | 1 Y | 2 Y | 3 Y | 5 Y | 7 Y | 10 Y | 20 Y | 30 Y | |

| 06/30/2020 | 0.13 | 0.14 | 0.16 | 0.18 | 0.16 | 0.16 | 0.18 | 0.29 | 0.49 | 0.66 | 1.18 | 1.41 |

As strangely small as the number may seem, the curve is no longer flat. This is an incentive to invest towards the future rather than hoard funds into short term yield. There is a viable scenario that assets including equities, commodities and real estate will be further inflated which will result in cash loosing it’s value vis-a-vis real cost of living. Cash may be a solution short term but history shows that long term hoarding of cash has eventually under-performed.

One more thing… New Pricing extended to all subscribers

As essential part of our community spirit we’ve always pledged to reflect an increase in our subscriber base into our subscription prices. Thanks to the many new subscribers who have joined us in the last months, we are now ready to ‘walk-the-talk’ with a 40-50% discount. As of June 30 we have finished the transition of all subscribers to our new pricing structure. Whereever possible we updated the subscriptions to the new, reduced pricing by ourselves. You can see your updated subscription always under “My Account”.

Please join the forum and discuss the recent changes in the markets, our portfolios and LI strategies.

Stay safe.

The Logical-Invest team.