Credit Suisse announced recently the delisting of ZIV and UGLD, among other ETN. These ETN will continue to trade on the Nasdaq Stock Market up to and including July 2, 2020. The delisting of the ETNs will become effective on July 12, 2020.

We currently employ ZIV in our Maximum Yield Strategy (MYRS) and UGLD in our Leveraged Universal Investment Strategy (3XUIS). We will modify both strategies effective July 1, 2020 as follows:

ZIV – Maximum Yield Strategy (MYRS)

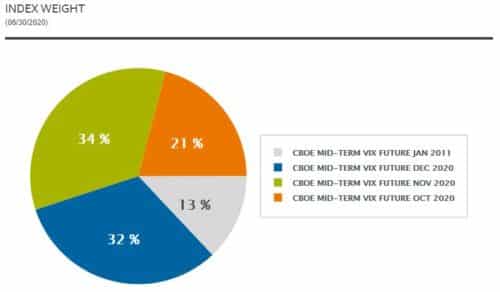

ZIV seeks returns that are -1x the returns of the S&P 500 VIX Mid-Term Futures Index for a single day, so basically a short positions of the month 4-7 of the VIX futures contracts. Here the current holdings as of June 30, 2020:

We will replace ZIV with a short position in VXZ (iPath Series B S&P 500 VIX Mid-Term Futures ETN). VXZ mimics the daily returns of a long position in the month 4-7 of the VIX futures contracts, so in order to replicate an inverse position it is necessary to short the ETN.

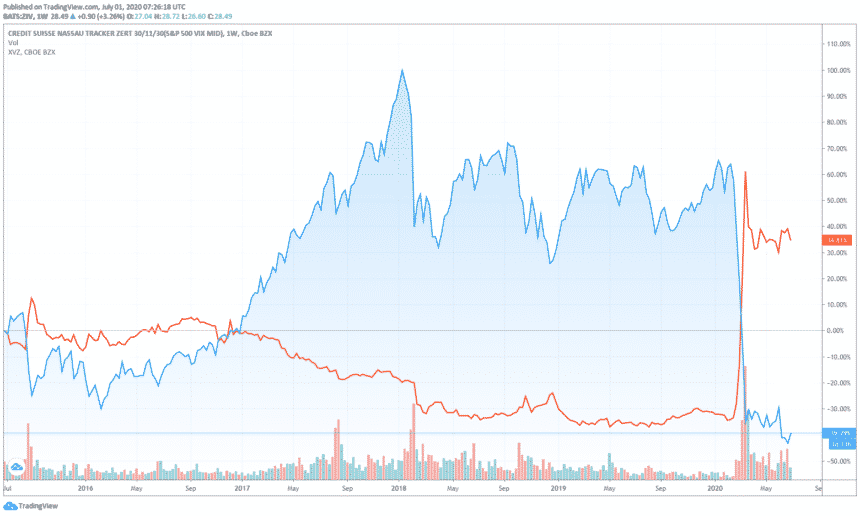

Here 5 years chart of ZIV (blue) and XVZ (red), you can see that they are inverse positions:

In comparison to ZIV, VXZ has a much lower daily volume of only 15,000 shares per day, compared to the +100k shares traded daily if ZIV. However we believe that there are sufficient shares to borrow available for a typical retail account size. Shorting VXZ offers the benefit of a lower expense ratio (0.85% vs 1.35% ZIV), which depending on the broker’s fee for shorting will be partially offset.

An potential alternative to shorting VXZ is shorting VIXM (ProShares VIX Mid-Term Futures ETF), which has a similar volume and expense ratio as VXZ, but a worse tracking record. VXN is structured as an ETF, in contrast to VXZ which is structured as an ETN. Depending on broker and plan limitations you might not be able to trade ETNs, so VIXM might be the only alternative.

Subscribers experienced in futures trading can also directly short month 4-7 VIX futures contracts in a similar notional value, these have very high liquidity and lower transaction costs.

Subscribers not able to enter short positions or trade futures will sadly not be able to continue investing in MYRS, as there are no other long ETNS available after the delisting of ZIV.

The overall performance of MYRS with a short VXZ position is similar, if not better than the former version with ZIV, here a 5 years backtest chart after the change:

UGLD – Leveraged Universal Investment Strategy (3XUIS)

UGLD mimics a 3 times daily return of GLD after fees for the leverage. There are no other 3 times leveraged gold ETN available as a direct replacement.

We evaluated a replacement with UGL, ProShares 2 times leveraged gold ETF, but it is structured as a commodity pool, which would cause issues to many US investors, and also has a high expense ratio of 0.85% (while lower than the absolute 1.35% of UGLD).

Instead we recommend to use leverage in a margin account to invest in a 3 times leveraged GLD position, as this is easy to implement (if feasible) and reduces overall transaction cost (even after considering typical borrowing fees).

Subscribers not able to use leverage in their accounts can scale the positions down to match 100% total allocation. Here an example using today’s 3XUIS signals using either GLD, or UGL:

| Ticker | With leverage | Scaled down | Scaled down (UGL) |

|---|---|---|---|

| GLD | 150% | 75% | 60% (UGL) |

| SPXL | 10% | 5% | 8% |

| TMF | 40% | 20% | 32% |

| Total | 200% | 100% | 100% |

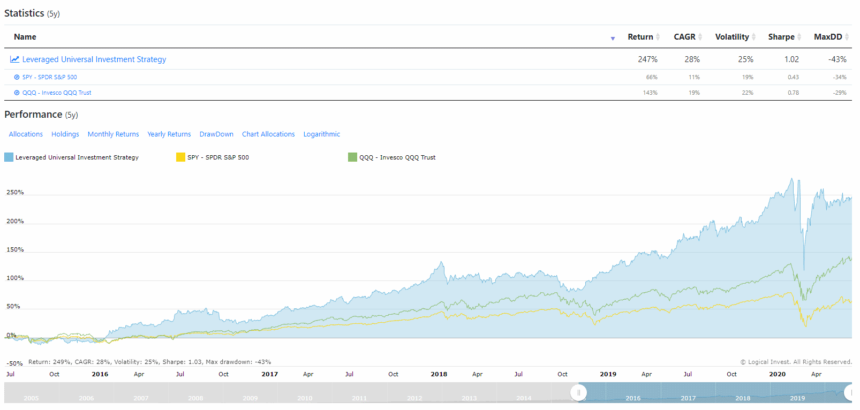

The overall performance of 3XUIS with a 3 times leveraged GLD position is similar, if not better than the former version with UGLD, here a 5 years backtest chart after the change:

Portfolios holding MYRS or 3XUIS

All portfolios holding MYRS or 3XUIS will as of today reflect the changes in both strategies, that is, holdings of the the new instruments and due to the leverage and shorting the total allocations might not add up to 100%. We are aware this might not be feasible to implement for some subscribers, so we are currently evaluating to drop MYRS and 3xUIS from some portfolios, or to replace them with easier to implement options.

Wrapping up

The sudden delisting of ZIV and UGLD have been received as a sad surprise by the market, and certainly we also miss to important instruments in our toolbox. While in theory shorting VXZ and leveraging GLD the performance of MYRS and 3xUIS is similar or even better, we are aware that this is another hurdle for subscribers with limitations on their retirement accounts.

The important point to take away today is that both ZIV and UGLD will stop trading as of tomorrow, July 2, 2020, and in order to avoid unwelcome surprises due to low volume and higher volatility on the last trading day we strongly recommend to close any position as of today using limit orders and giving them time to fill within a close range.

We hope to receive a vivid feedback to discuss alternatives and a suitable way forward in the portfolios.

Your Logical Invest team,

July 1, 2020

Hi Alex,

thanks for the update! Two questions

(1) Seems that for MYRS UGLD has been replaced with UGL and not 3x GLD. Is that intentional or what would be the rational for replacing UGLD with 3x GLD for UIS but not for MYRS?

(2) I understand that in QT a 3x GLD allocation can be achieved by setting the multiplier in the strategy to 3. I also understand that the % allocation shown in the “Consolidated Allocations” tab is the 3x allocation, i.e. the dollar amount for the investment needs to be tripled to have the correct allocation. What happens if I mix different strategies in the “Consolidated Allocations” tab, e.g. the Nasdaq strategy and the UIS where the Nasdaq strategy has GLD with a 1x multiplier and the UIS GLD with the 3x multiplier?

Best regards

Marcel

1) Yes, in MYRS we intentionally used the leveraged UGL position. This way we avoid having a short VXZ position plus a leveraged GLD at the same time, and keep the overall leverage of the strategy at a 100% allocation only slightly reduced. You can of course use a 2 times GLD position, especially if you have one already. Open to suggestions if this should be changed.

2) First the good news: The consolidated signals in the web-app do work – with a bit a coding in the back-end, but that’s not visible. See the Vol <15% portfolio for example.

Now in QuantTrader indeed this currently is an open challenge we still need to find a solution for. As of today you would have to manually review and adjust the GLD position from 3xUIS with the multiplier. Alternatively you can use the pre-canned portfolios in the web-app or build your own in the meanwhile. We hope to find a way around this, see also the separate email we send to all QT subscribers in the last minutes.

Thanks for the update. I don’t have any leverage available in my IRA account. I cannot neither short ETF. but i would like at least to still have the option to trader the agressive core portfolio. Is there any downside to replace the entire GLD postion by an adjsuted postion on UGL (UGLD market Value /2) ?

Can you elaborate more about the possible tax implications ?

Benjamin.

Indeed using UGL when scaling down is the better choice, as you retain more leverage. It would be 60/8/32 – see comment below and updated table above.

Thanks. It will be great if you can provide on your web application or /ans on quant trader a version of your library portfolio lwith the total allocation matching 100%.

Hello, by scaling down the portfolio for the 3xUIS at 100% allocation instead of 200% does the CAGR is still at 28%?

When using the scaled down version you reduce also the leverage of the strategy, so the expected return would be lower. But see comment below and updated table in the post using UGL, that minimizes this effect.

Hi,

Thanks for the update. A couple of questions.

1) So, if one were trading Leveraged UIS in an IRA without access to short positions, and wished to trade UGL to achieve max leverage , just to make sure I have the math right, that would be 60% UGL / 8% SPXL, 32% TMF?

2) Have you tried backtesting SVXY in MYRS? If so, what did you find?

Thanks,

Tom C

Tom

How did you calculate those ratios? Would it not be 75/5/20? I may be off on this. Sure could use some guidance on this issue.

Ned

Hi,

The short answer is at the end, you have to have the same ratio of stock to bond to gold as you did before. so with 75 you would have 150 units of gold at 2x, and with 5 you would have 15 units of stock….so that would be 10x instead of 5x.

Long answer:

The calc would be this:

Target Percentage / (fund leverage / sum of fund leverages)

—————————————————————-

Sum of all the Target Percentage / (fund leverage / sum of fund leverages)

so in this case target percentages are 50, 40, 10, fund leverages are 2x, 3x, 3x, sum of fund leverages are 8x

so for UGL: 50 / ( (2/8) / (50 / (2/8) + 40 / (3/8) + 10 / (3/8) )

for TMF: 40 / ( (3/8) / (50 / (2/8) + 40 / (3/8) + 10 / (3/8) )

for SPXL: 10 / ( 3/8) / (50 / (2/8) + 40 / (3/8) + 10 / (3/8) )

hopefully I got that right.

Tom C

And this is probably obvious, but your current leverage will be your fund leverage times scaled allocation / original allocation . For this month,

SPXL 3 times 8%/10% = 2.4

TMF 3 times 32%/40% = 2.4

UGL 2 times 60% / 50% = 2.4

so instead of running a 3.0x fund, this month, you would be running a 2.4x fund. The dilution will depend on how much UGL is required for the month.

Tom C

Hi Tom,

1) Great point, using UGL you retain more of the original leverage. Yes, the %s are right, have just added them to above table.

@Ned, to get to these %s you would first replace GLD by UGL, so 75/10/40, which results in a total allocation of 125%. Then scale down another 25% and you get to 60/8/32, which sums 100%.

2) SVXY is way to unstable for a “lazy” strategy with bi-weekly signals like MYRS. You’re riding the front months of the VIX – and that was a wild ride for example in March, in some days from 10 to 80, and it’s no fun being short a 10k future contact when it suddenly goes to 80k against you.

Alex,

I was wondering because since SVXY went to 0.5x leverage back after the vol crash in February 2018, the returns had been a lot more “stable” (and I only say that comparably to something like ZIV). I ran a ratio chart of SVXY / ZIV from February to March. On February 9, the high of the ratio of SVXY to ZIV was about 89.7%. On March 9, the low of the ratio of SVXY to ZIV was about 75%. That seemed to me like it tracked reasonably well (not to minimize 15%), but I know the TMF hedge was kicking in pretty well during that period.

Tom C

I just tried to get to a meaningful strategy using long SVXY, and also short VIXY (simulating a 0.5 leverage) so to have a longer data history, but could not find any option that’s not jumping around like crazy.

You’re right that since the reduced leverage SVXY is much smoother, which can be expected as it’s like cutting exposure to 50%, yet it is still too wild for a monthly or bi-weekly trading system.

Some time ago we (tried to) developed a “nearby realtime” trading system for VIX futures on a 15 min base. The idea was to find some edge using short/long spreads between month 2/3 and 5-7, but after 6 months of development we stopped it because even if there seemed to be some “juicy” equity curves we noted there was not really some statistical edge behind them. VIX is like a wild animal, nice to look at but unpredictable, and one rather stays at a safe distance – means here: months 4-7.

Not saying it’s impossible to ride the front months, there are probably many sharp guys doing a lot of money – it’s just not convincing enough to us – or we’re not sharp enough ..

Alex,

One follow up. One other thing I was thinking about doing, now that UIS has a little bit of reduced leverage, was running Enhanced Permanent Portfolio at 3x (or modified 2x with UGL), since the assets involved SPY/GLD/TLT are easily available leveraged. Looks like given the drawdown numbers the results would be similar to UIS Lev 3x. Just a thought. Have you ever run this?

Thanks

Tom C

Hi, it is possible for you to give the allocation with 2xGold for the leverage universal strategy? With the CAGR? Tks

Have just updated the table in the post. The leverage would be about 80% of the “old” 3xUIS with UGLD, and the historic CAGR accordingly.

lex…thanks for the update. Can you please outline the correct ratios if I would like to use UGL for the leveraged UIS strategy portion of the aggressive core? I am using a Roth IRA so I do not care about tax consequences. I am hesitant, because of lack of experience, to use margin through my broker (I use M1 and I will have to pay an annual fee to use their M1 plus features).

Alternatively, If I were to consider using margin, I could use a little guidance as to how to structure the portfolio at M1 as they do not allow me to exceed a 100% allocated pie.

Regards,

Ned

Hi Ned, can understand you’re hesitant to use margin in an IRA. See updated table and comments above for the allocations with UGL.