- Update: We have a new ETF Ranking page.

Industrials, Steel and Dow up. Safe assets down.

March proved to be a good month for U.S. equities especially for the steel ETF (SLX +14%), the utilities sector (XLU +10.6%), industrials (XLI +9%) and the Dow stocks (DIA: +6.9%).

The SP500 was up 4.5% while emerging markets were slightly down (EEM -0.7%). The long term treasury ETF price continued its free-fall (TLT -5.2%). Gold managed to loose another -1.1% from its already poor 2021 performance.

Strategy Performance

It was a fair month for our strategies with returns ranging from +6.4% to -3.4%. The best performing strategy was the Leveraged Gold strategy which returned 6.4% for the month and 10% year-to-date.

A quick look at the Leveraged Gold Strategy

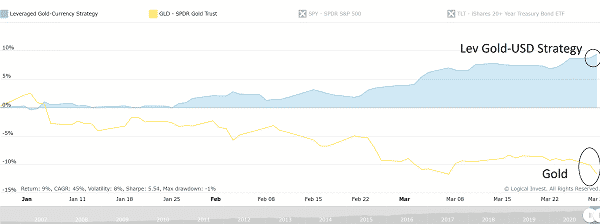

The leveraged Gold strategy is meant to protect gold investors from large losses as well as outperform gold in difficult markets. Below is the year-to-date chart of the strategy vs gold.

The strategy takes advantage of the historically negative correlation between gold and the U.S. dollar. It switches between the two assets based on their recent, risk adjusted performance, enabling the strategy to provide protection against severe gold corrections due to dollar strength.

This version of the strategy uses inverse leveraged currency ETFs (inverse Yen, inverse Euro and inverse AUD) to take advantage of foreign currency weakness vs gold.

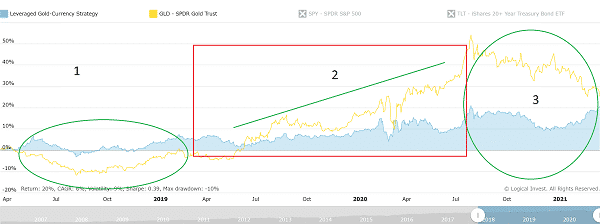

Below is a chart of the strategy (blue area) vs gold (yellow line).

During 2018 (labeled as 1. on the chart) gold corrected while the strategy remained flat to slightly positive. During 2019 and 2020 it lagged in performance, managing a descent 20% vs gold’s large bull run that peaked at +50%. This is normal since the strategy is not meant to outperform a ‘pure’ bull run.

During the recent correction (labelled as 3) it pulled back during the end of 2020 but actually outperformed in 2021: +10.3% vs -10.2% for gold.

Some retirement accounts are restricted from trading these ETFs. In this case our GLD-UUP strategy provides an alternate form without leveraged ETFs which also lowers the overall return and volatility.

Please join the forum and discuss the recent changes in the markets, our portfolios and LI strategies.

The Logical-Invest team.