Coming Inflation?

It seems like everyone is discussing inflation and hyper-inflation scenarios. Let’s look at the data:

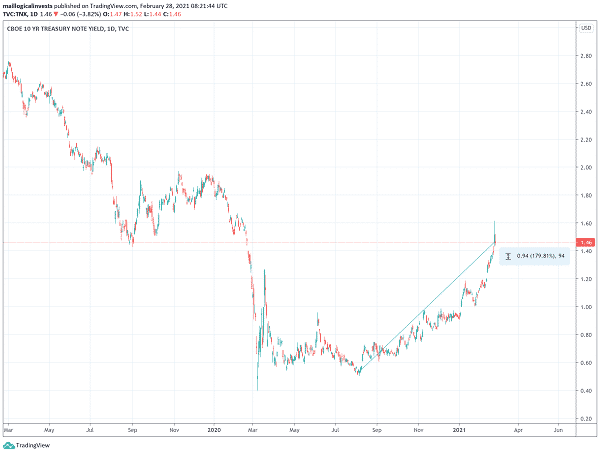

The above chart shows the yield of the 10 year Treasury. The yield has increased by almost 180% in the past 5 months. Although percentage-wise this increase is substantial, in hard numbers the yield is still barely at 1.46% which is not that high historically speaking.

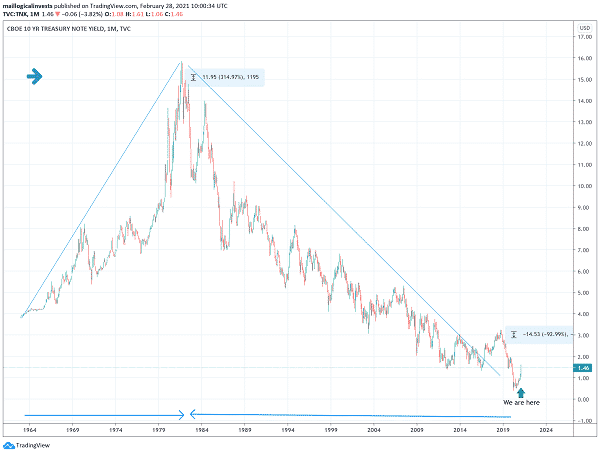

If we zoom out we see decade long trends. From the early 1960’s to late 70’s the super-trend for yields was to increase, reflecting inflationary pressures. For the past 40 years, from the 80’s to today the trend has been towards lower yields. This trend to ‘zero’ yield accelerated in the past few months due to government easy fiscal policy and the March 2020 crash. In this context, the rise back up to 1.46% seems to be a mean-reversion reaction towards more ‘normal’, but still very low yields.

I guess the question in everyone’s mind is whether this uptick will be the begining of a new inflationary super-trend. Looking at the chart it is far too early to tell.

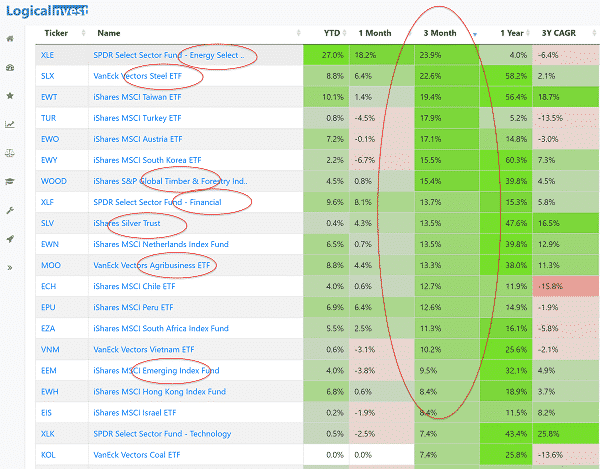

Performances of Inflationary assets

Looking at performances of asset classes during the past 3 months, it is clear that inflationary assets have outperformed.

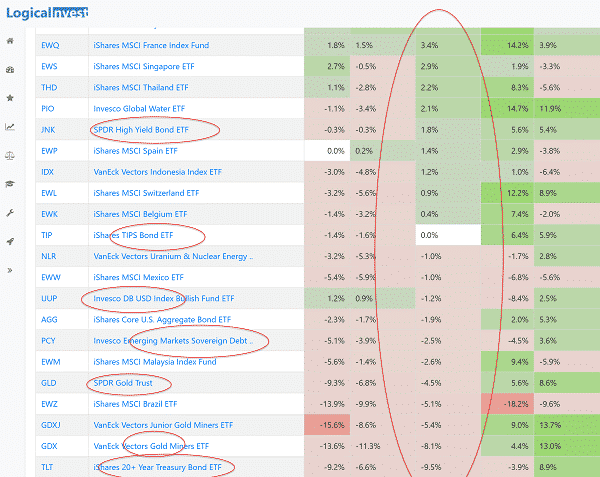

While bonds (and interestingly gold) has under performed:

Source : https://logical-invest.com/app/rankalletfs

February performance

Our strategies took a hit this month mainly due to exposure to gold and TIPS. Although in principal both are good choices for a market with rising inflationary expectations, this month was different. Gold was down -6.8%, and TIPS -1.6%. The S&P 500 fell by -0.9%.

One could argue that March was actually ‘deflationary’ as most portfolio holding a equity, gold and/or bonds fell in value. On the other hand, march winners was Energy and Financials.

So there seems to be an interesting sub-division amongst assets that are considered inflation hedges.

We are monitoring the markets and may adjust our strategies accordingly.

PS. If you have an opinion on why gold is down please let us know via the forums.

Please join the forum and discuss the recent changes in the markets, our portfolios and LI strategies.

The Logical-Invest team.