Logical Invest

Investment Outlook

September 2017

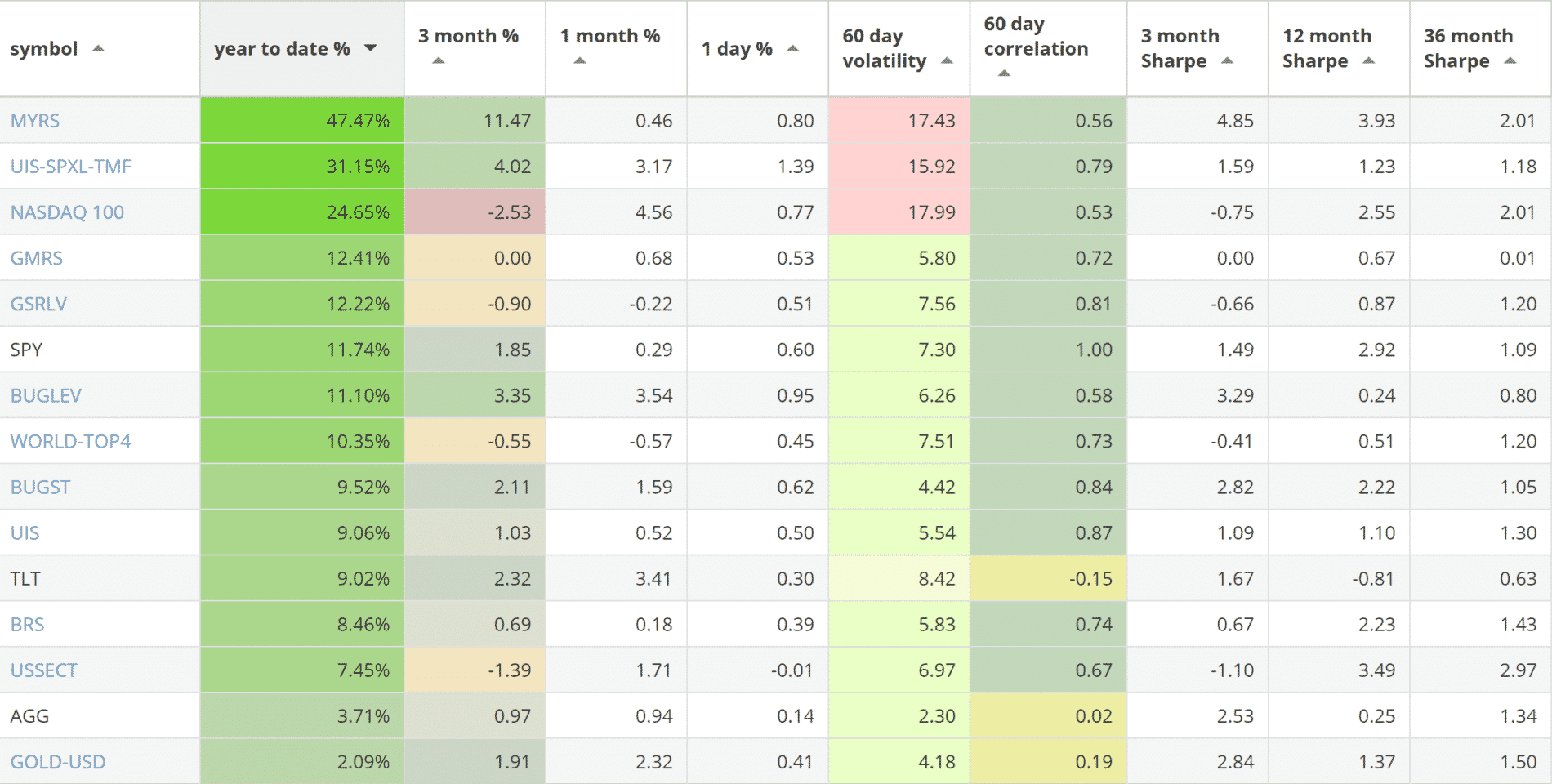

Our top 2017 investment strategies, year-to-date:

- The Maximum Yield strategy with 47.47% return.

- The Leveraged Universal strategy with 31.15% return.

- The NASDAQ 100 strategy with 24.65% return.

SPY, the S&P500 ETF, returned 11.74%.

Market comment:

After more than three months of extremely low levels of volatility, VIX spiked on August 10th peaking at the 16.04 level. The index has now dropped around the 10 – 11 level awaiting further possible market disruptions. The move has triggered an upward reaction to traditional safe heavens assets with TLT (Treasury ETF) returning 3.41% and GLD (Gold ETF) 4.2%, for the month. This has benefited our strategies since a majority of them use these assets as a hedge.

For September, the upcoming U.S. Congress needs to agree on a budget for fiscal year 2018 and raise, once again, the so-called debt ceiling, The Federal Reserve may start a large winding down of its crisis-era balance sheet while the European Central Bank is considering scaling back its asset purchases. Tensions between N. Korea and the U.S. may escalate. All these factors could cause VIX to spike.

As mentioned in the previous newsletters, the dollar index continues to show weakness, benefiting foreign (non-U.S.) equity and emerging market bonds. The Euro continues to show some strength. Gold has been showing strength in 2017 after reaching a low on December 2016.

Our best strategy performers for August are:

The Nasdaq 100 strategy, recovered from last month’s correction adding +4.56 %. The Bug Leveraged strategy added +3.54% to reach a very respectable 11.10% year-to-date. Our 3x Universal Investment strategy returned 3.17% for the month. The Gold-USD strategy made a 2.32% profit and finally turned positive for 2017.

The performance of the Bug Leveraged strategy was due to holding full (leveraged) positions in ‘safer’ assets: GLD (+4.2%), TLT (+3.4%) and PCY (2.18%). Our flagship volatility strategy, the Maximum Investment strategy managed to stay positive despite the August 10 36% rise in the VIX level. The strategy over-weighted the TMF hedge for the second half of the month (which returned +6.38% and was weighted @60% of portfolio) neutralizing any ZIV losses.

Lastly, it may be worth mentioning the continuing strength of Bitcoin and the largest alt-coins (Ethereum, Monero, ZCash, etc) as the continuation of ICO’s (Initial Coin Offerings) continue to draw hundred of millions of venture capital into promising but unproven and yet-to-be profitable companies. These alternative markets are rising in such parabolic fashion that are starting to remind us of the late ’90s tech exuberance.

We wish you a healthy and prosperous 2017.

Logical Invest, September 1, 2017

Strategy performance overview:

Visit our site for daily updated performance tables.

Symbols:

BRS – Bond Rotation Strategy

BUGST – A conservative Permanent Portfolio Strategy

BUGLEV – A leveraged Permanent Portfolio Strategy

GMRS – Global Market Rotation Strategy

GMRSE – Global Market Rotation Strategy Enhanced

GSRLV – Global Sector Rotation low volatility

NASDAQ100 – Nasdaq 100 strategy

WORLD-TOP4 – The Top 4 World Country Strategy

UIS – Universal Investment Strategy

UIS-SPXL-TMF – 3x leveraged Universal Investment Strategy

AGG – iShares Core Total US Bond (4-5yr)

SPY – SPDR S&P 500 Index

TLT – iShares Barclays Long-Term Trsry (15-18yr)

Hi Vangelis,

There was an interesting article in the NYTimes a few days ago about a hedge fund founder, Christopher Cole, who predicts the sky is going to fall. Of course, hedge fund and Wall Street guys and run-of-the-mill contrarians are always predicting the sky is going to fall, but in this case there may be some evidence for it. Selected paragraphs (www.nytimes.com/2017/09/13/business/dealbook/market-volatility.html):

” ‘Optically, volatility is still very low, but fear is increasing,’ Mr. Cole said, pulling up a chart on one of his six trading windows. It showed that in the months beyond the 30-day period measured by the Chicago Board Options Exchange’s VIX index, investors were expecting some violent moves to come in the stock market.”

“ ‘The fact that everyone has been incentivized to be short volatility has set up this reflexive stability — a false peace,’ he said. ‘But if we have some sort of shock to the system, all these self-reflexive elements reverse in the other direction and become destabilizing as opposed to stabilizing.’ ”

“A little-known British investment firm, Ruffer Capital, has caused a stir by predicting a shattering denouement, and many hedge funds are buying up cheap VIX options, which will pay off handsomely if the index shoots up.”

Any thoughts?

Here are my thoughts:

If you run backtests covering 20+ years you reach certain conclusions:

a. It does not pay to be in cash.

b. It does not pay to go against the market, long term.

c. It is best to be long-term invested but somehow limit maximum draw-down. If you can do that you will see much improved compound returns over these timeframes. Two of possible ways to do this is by timing the market or by buying a hedge.

Other than that, it is all true, the VIX could spike, stocks could plummet. We simply don’t know. The question then becomes: How long do I stay in cash? How long do I stay short the market? And when do I reverse? Which may lead to anxiety, sleepless nights and bad decisions.

Money is not the only item in scarcity. So is good health and free time.