Logical Invest

Investment Outlook

October 2018

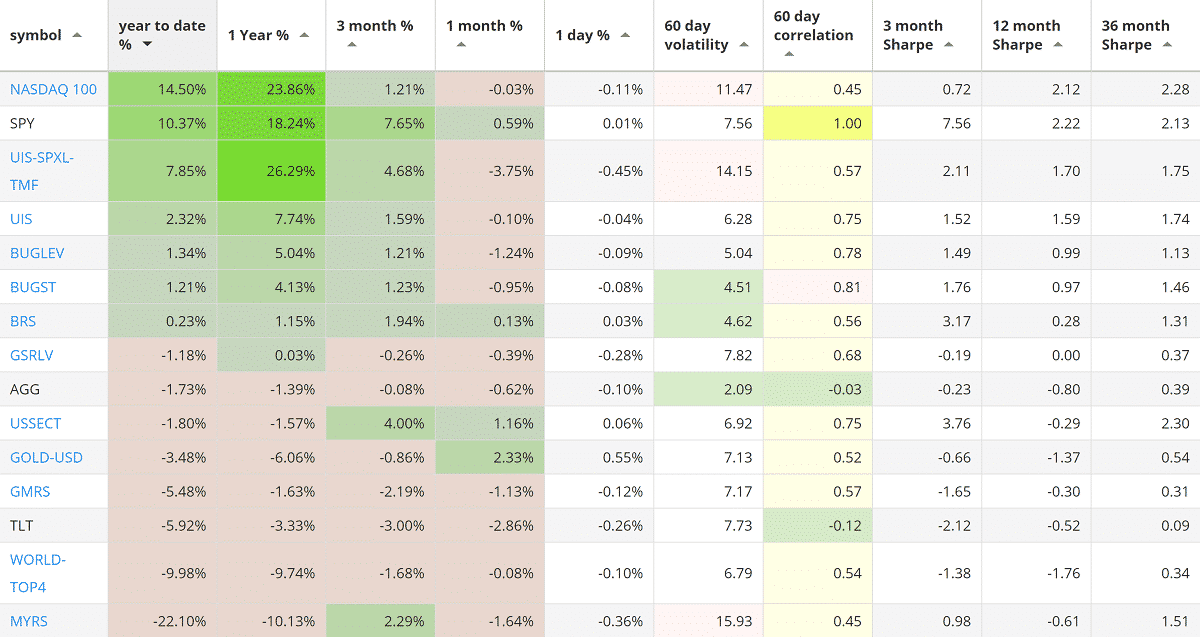

Our top 2018 investment strategies, year-to-date :

- The NASDAQ 100 strategy with +14.50% return.

- The 3x Universal Investment strategy with +7.85% return.

- The Universal Investment strategy with +2.32% return

SPY, the S&P500 ETF, returned +10.37%.

Market comment:

We are continuing to experience the symptoms of the end of Quantitative Easing: Higher interest rates and slightly higher inflation. The FED is normalizing policy and it seems that moderate growth and low inflation have helped make this into a controlled, gradual process. This is all good news, but it brings a side effect: As foreign investors move money into higher yielding Treasuries, the dollar rises. Much like 2015, any dollar-denominated asset has benefited while everything else, including emerging markets and gold, have lost value. Tactical Allocation strategies (TAA’s) tend to suffer in this environment as their main promise is diversification across assets and geographical locations. TAA’s are risk controlling entities and although they will outperform in the long run, they do poorly in a straight dollar run.

We are now moving along the longest bull run in the history of the U.S. market. We are also close to an inverted yield curve, which to many is a red flag. It feels like an immenent correction may come and destroy what we have built these past years. And yet we are at a favorable point seasonally. Not only are November and December good months to invest but we are at the end of a mid-term elections year which in the past had brought additional returns.

The point is we don’t really know what will happen. After 10 years of 0% policy, ‘easy money’ and straight gains we are entering a new era. Borrowing is no longer free. One could argue that this will lead to a re-pricing of assets, worldwide. Which in turn is an argument against passive investing but in favor of active, flexible management that can adapt to a changing market.

The best performing strategy for September was the GLD-USD strategy. Although gold lost 0.66% for the month, the strategy benefitted from being ‘short Yen’ (ETF” YCS +4.93%) and came out positive at +2.33%. The U.S. sector strategy returned +1.16%. Our Bond Rotation remain flat while most other strategies came in negative, mainly due to Treasury (TLT -2.86%) and foreign equity weakness.

We wish you a healthy and prosperous 2018.

Logical Invest, October 1, 2018

Strategy performance overview:

Visit our site for daily updated performance tables.

Symbols:

BRS – Bond Rotation Strategy

BUGST – A conservative Permanent Portfolio Strategy

BUGLEV – A leveraged Permanent Portfolio Strategy

GMRS – Global Market Rotation Strategy

GMRSE – Global Market Rotation Strategy Enhanced

GSRLV – Global Sector Rotation low volatility

NASDAQ100 – Nasdaq 100 strategy

WORLD-TOP4 – The Top 4 World Country Strategy

UIS – Universal Investment Strategy

UIS-SPXL-TMF – 3x leveraged Universal Investment Strategy

AGG – iShares Core Total US Bond (4-5yr)

SPY – SPDR S&P 500 Index

TLT – iShares Barclays Long-Term Trsry (15-18yr)