Logical Invest

Investment Outlook

May 2017

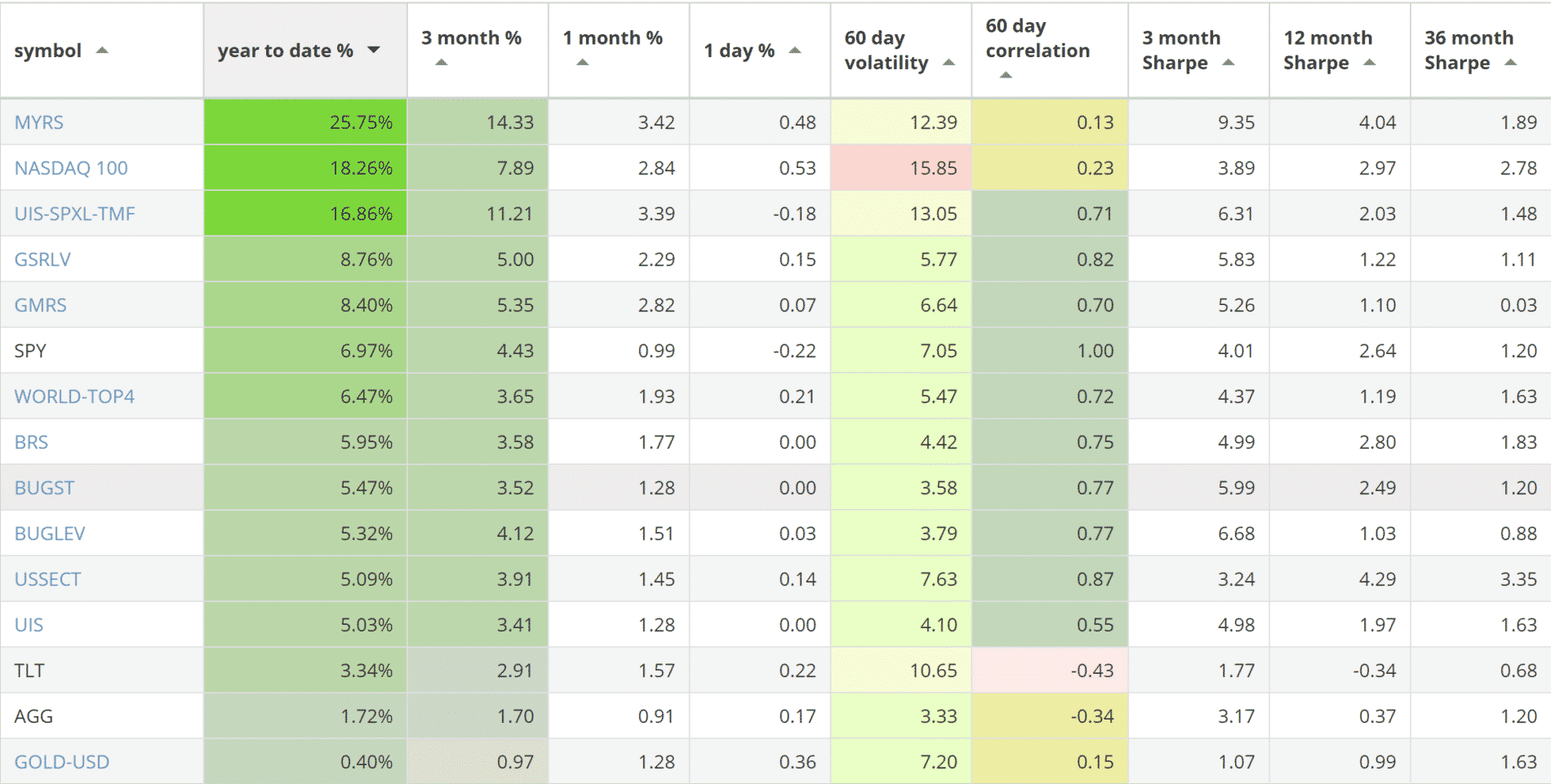

Our top 2017 investment strategies, year-to-date:

- The Maximum Yield strategy with 25.75% return.

- The NASDAQ 100 strategy with 18.26% return.

- The Leveraged Universal strategy with 16.86% return.

SPY, the S&P500 ETF, returned 6.97%.

News:

- Our new U.S. Sector Rotation strategy is live (and for a limited time, free!). Unlike what you may have seen before, this strategy consists of 5 sub-strategies tracking sector momentum, mean reversion and relative under-performance to create a variable-beta play on the U.S. market. And yet it is very simple to implement. Give it a try.

- Thank you for your support of our QUANTtrader forum were you can share and discuss your own custom strategies.

Market comment:

As we are heading into early summer, most assets classes are performing well partly due to a weakening U.S. dollar. Domestic equity continues to reach new highs, foreign and emerging equity markets are up while junk bonds and foreign bonds have now recovered from past corrections. Commodity performance is mixed but commodities do present a longer term opportunity for portfolio unclusion, as inflation resistant assets. Treasuries remain flat. The story in the media is that we are entering a more mature business cycle in the U.S. while foreign markets (China, India, Brazil and partly Europe) are also in growth and recovery mode. The sentiment is positive, at least as far as the major management companies go while individual investors are cautious, expecting a possible U.S. equity correction. The year long expectation of higher volatility due to tighter policy still is discussed but we have not seen this in the actual market. Far from it, we are seeing extremely low volatility levels compared to historical norms as well as perceived political risk in the U.S. and Europe.

Our strategies performed as expected. Maximum Yield strategy added another 3.42% in April, keeping it in our top spot at +25.75 for the year.The Nasdaq 100 and the leveraged Universal Investment Strategy added 2.84% and 3.39% each, for a +18.26% and 16.86% YTD return respectively.

The rest of our strategies are all above 5%, with notable exception the GLD-USD strategy that remains flat. The “average” return an investor would achieve by weighting equally across our strategies would be 8.85%.

Our Bond Rotation strategy continues to be a solid performer returning +5.95% for the year. The BUG (our version of the enhanced Permanent Portfolios) reached 5.32%. It’s interesting to note that our leveraged Bug strategy is once again at 130% leverage and picking up a considerable allocation in gold.

For this issue I will briefly touch upon 2 aspects of our performance table: 60-day volatility and 60-day correlation.

Let’s say you are becoming increasingly worried and cautious as the indexes reach new heights. Maybe you remember the old saying, “sell-in-may-and-go-away” and are considering going flat for the summer. But instead of exiting altogether you may want to consider investing in the least risky strategy in order to keep some reasonal exposure to the market in case of continued upside. Ranking our table by 3-month volatility we see that the BUG has almost the same volatility as the aggregate bond (AGG) ETF, which is a defensive play. So instead of ‘going-to-cash’ one could allocate to the BUG strategy or the Universal Investment Strategy. For even better protection you would have to use our more sophisticated tools and see how you can create a multi-strategy portfolio combining more than 2 strategies as well as take advantage of possible non-correlated behaviors between them. If you think this makes perfect sense, then you should use our QuantTrader software. If this sounds too complicated, you should opt for an EPG/LI managed account.

We wish you a healthy and prosperous 2017.

Logical Invest, May 1, 2017

Strategy performance overview:

Visit our site for daily updated performance tables.

Symbols:

BRS – Bond Rotation Strategy

BUGST – A conservative Permanent Portfolio Strategy

BUGLEV – A leveraged Permanent Portfolio Strategy

GMRS – Global Market Rotation Strategy

GMRSE – Global Market Rotation Strategy Enhanced

GSRLV – Global Sector Rotation low volatility

NASDAQ100 – Nasdaq 100 strategy

WORLD-TOP4 – The Top 4 World Country Strategy

UIS – Universal Investment Strategy

UIS-SPXL-TMF – 3x leveraged Universal Investment Strategy

AGG – iShares Core Total US Bond (4-5yr)

SPY – SPDR S&P 500 Index

TLT – iShares Barclays Long-Term Trsry (15-18yr)

Great article. I know you can’t give specific market advice, but this explains HOW to react if one expects volatility to rise.