Logical Invest

Investment Outlook

March 2017

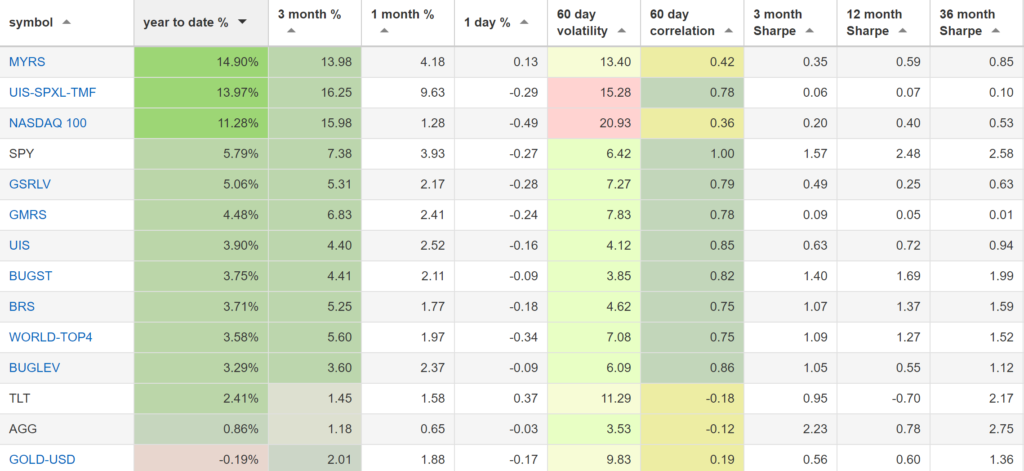

Our top 2017 strategies, year-to-date:

- The Maximum Yield strategy with 14.90% return.

- The Leveraged Universal strategy with 13.97% return.

- The NASDAQ 100 strategy with 11.28% return.

SPY, the S&P500 ETF, returned 5.79%.

News:

- Our in-depth 2-hour QUANTtrader webinar, with Frank Grossmann. Get a behind-the-scenes look at our strategies.

- We are testing a new U.S. Sector-based strategy that should be available in the coming months.

Market comment:

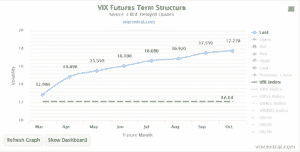

The S&P 500 is reaching new all time highs, currently at +10% from it’s previous support in the summer of 2016. It is following a straight line with no major corrections since the U.S. elections. This type of movement makes investors nervous about a coming correction. Interestingly, looking at the VIX term-structure we see the following picture:

This is highly unusual. Having near-month VIX contracts at very low prices is normal as the SP500 is breaking upwards. What is interesting is that far-out contracts are at extremely low levels as well, making the curve somewhat flatter than normal. This implies that market participants expect low levels of volatility in the future, even 9 months out. We will see how this plays out in the coming months.

Our top 3 strategies are all U.S. market based and have achieved returns above 10% in just 2 months. Our Maximum Yield strategy, has returned an additional 4.1% in February, bringing year-to-date returns to 15%. Our 3x UIS strategy added 9% due to equity performance as well as a small upward reaction from oversold Treasuries. Our Nasdaq 100 added just 1.2% for the month. Of note is that the Nasdaq strategy has the lowest 60-day correlation to SPY, just 0.36, second only to our Gold-USD strategy’s 0.18.

Apart from our high flying strategies, it is worth mentioning and tracking our more defensive ones.

Our Universal Investment Strategy has shifted its bond allocations from TLT (the 20+ year Treasury ETF) and has been invested in TIP (the inflation-protected treasury ETF) since January. It has returned a stable 3.9%. The BUG (our version of the enhanced Permanent Portfolios) have benefited from a small rally in foreign bonds and convertibles, as well as U.S. equity, and returned 3.5%. Both have less than 2/3 of the 60-day S&P500 volatility. Our Bond Rotation strategy continues to be our favourite low-key performer returning +3.71 for the year.

We wish you a healthy and prosperous 2017.

Logical Invest, March 1, 2017

Strategy performance overview:

Visit our site for daily updated performance tables.

Symbols:

BRS – Bond Rotation Strategy

BUGST – A conservative Permanent Portfolio Strategy

BUGLEV – A leveraged Permanent Portfolio Strategy

GMRS – Global Market Rotation Strategy

GMRSE – Global Market Rotation Strategy Enhanced

GSRLV – Global Sector Rotation low volatility

NASDAQ100 – Nasdaq 100 strategy

WORLD-TOP4 – The Top 4 World Country Strategy

UIS – Universal Investment Strategy

UIS-SPXL-TMF – 3x leveraged Universal Investment Strategy

AGG – iShares Core Total US Bond (4-5yr)

SPY – SPDR S&P 500 Index

TLT – iShares Barclays Long-Term Trsry (15-18yr)