Logical Invest

Investment Outlook

August 2018

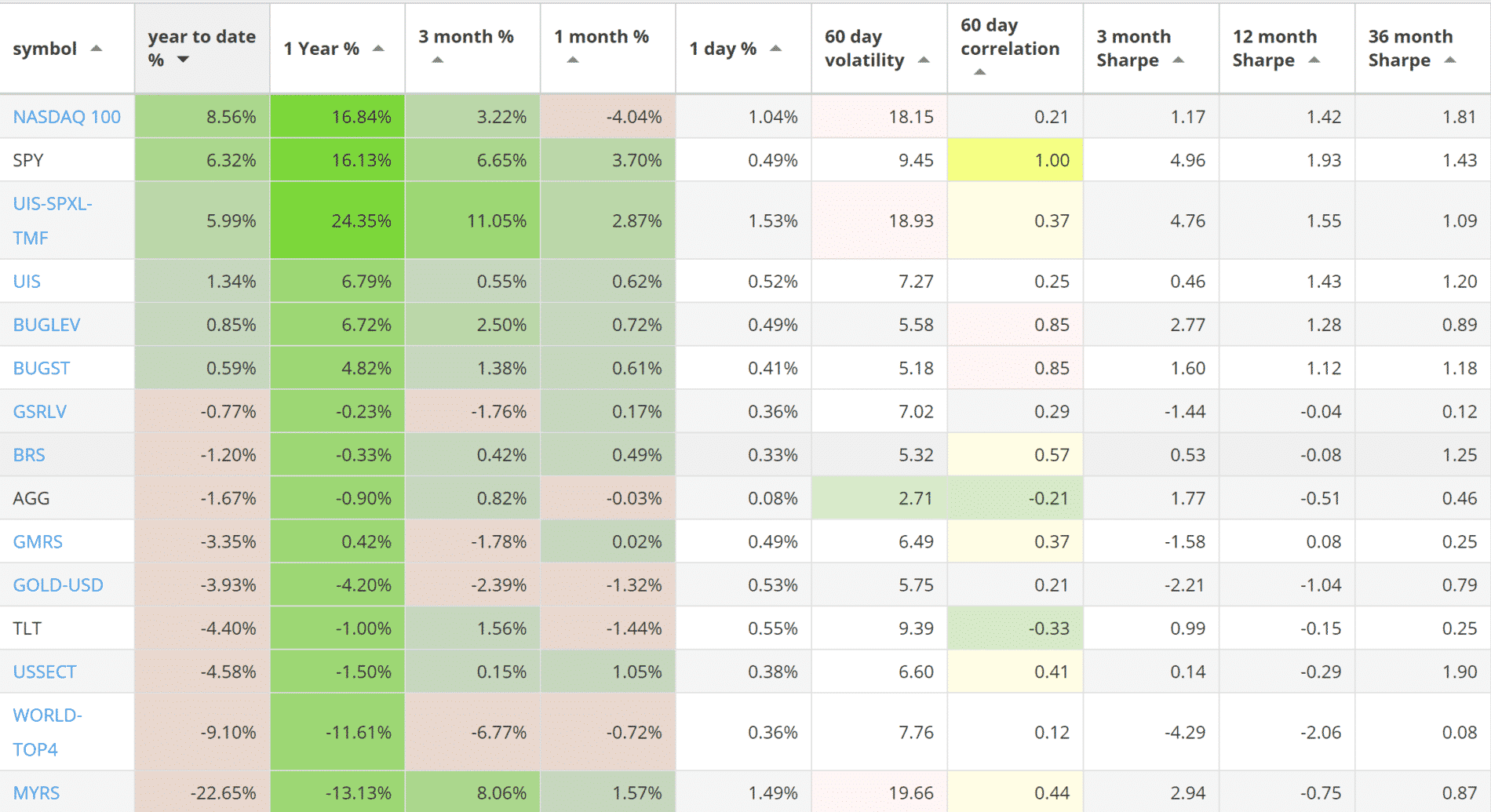

Our top 2018 investment strategies, year-to-date :

- The NASDAQ 100 strategy with +8.56% return.

- The 3x Universal Investment strategy with +5.99% return.

- The Universal Investment strategy with +1.34% return

SPY, the S&P500 ETF, returned +6.32%.

Market comment:

August starts with very much the same market preoccupations as the previous summer months: Fear of a trade wars and questions about central bank policy. The possibility of additional tariffs is holding back international growth and is keeping foreign markets weak, although there were some notable exceptions. The expectation the Fed will further increase rates has been replaced by fear of foreign central banks tightening policy. The Japanese central bank decided against a hike at this time but the possibility of such a move in the near future does raise the question about the Fed’s hand being forced. Further short-term rate hikes could eventually lead to a flattening or even inversion of the interest-rate curve which in turn brings closer the possibility of a future recession.

Emerging markets and Latin America have been hit hard these past months and in July we saw a bounce from oversold conditions: Brazil (EWZ) returned +12.6% while the broad Latin America ETF (ILF) was up +11.2.%. Emerging markets (EEM) was up +3.53%. On the safe-heaven assets side, Gold fell by -2.24% while TLT, the 30 year Treasury ETF showed weakness at -1.43% for the month. ZIV, which we use at our MYRS strategy, was up +5.86%.

This month most of our strategy were slightly positive or remained flat. The leveraged Universal Investment strategy (3x UIS) returned +2.87, the Maximum Yield strategy +1.57% while the U.S. sector strategy +1.05%. The biggest loser was the Nasdaq 100 strategy at -4% being particularly affected by losses in NFLX and FOXA.

Cryptocurrencies bounced up from the critical 6000 levels and touched 8400, giving much needed hope to HODLers before coming back down to 7000 levels.

We wish you a healthy and prosperous 2018.

Logical Invest, August 1, 2018

Strategy performance overview:

Visit our site for daily updated performance tables.

Symbols:

BRS – Bond Rotation Strategy

BUGST – A conservative Permanent Portfolio Strategy

BUGLEV – A leveraged Permanent Portfolio Strategy

GMRS – Global Market Rotation Strategy

GMRSE – Global Market Rotation Strategy Enhanced

GSRLV – Global Sector Rotation low volatility

NASDAQ100 – Nasdaq 100 strategy

WORLD-TOP4 – The Top 4 World Country Strategy

UIS – Universal Investment Strategy

UIS-SPXL-TMF – 3x leveraged Universal Investment Strategy

AGG – iShares Core Total US Bond (4-5yr)

SPY – SPDR S&P 500 Index

TLT – iShares Barclays Long-Term Trsry (15-18yr)

I see that the 3x UIS has a 5.99% YTD, UIS a 1.34%… but the simple and easy SPY has a 6.32%, outperforming both of the strategies. I wonder if you know the returns YTD of shorting the -3x leveraged SPXS-TMV instead of SPY-TLT; would have it been better?

long term, the best is to short the -3x leveraged ETFs because of their rebalancing losses. Since quite some time any sort of hedge was quite bad for the performance of any strategy, but this can change quite fast if there is a serious correction.