Logical Invest

Investment Outlook

August 2017

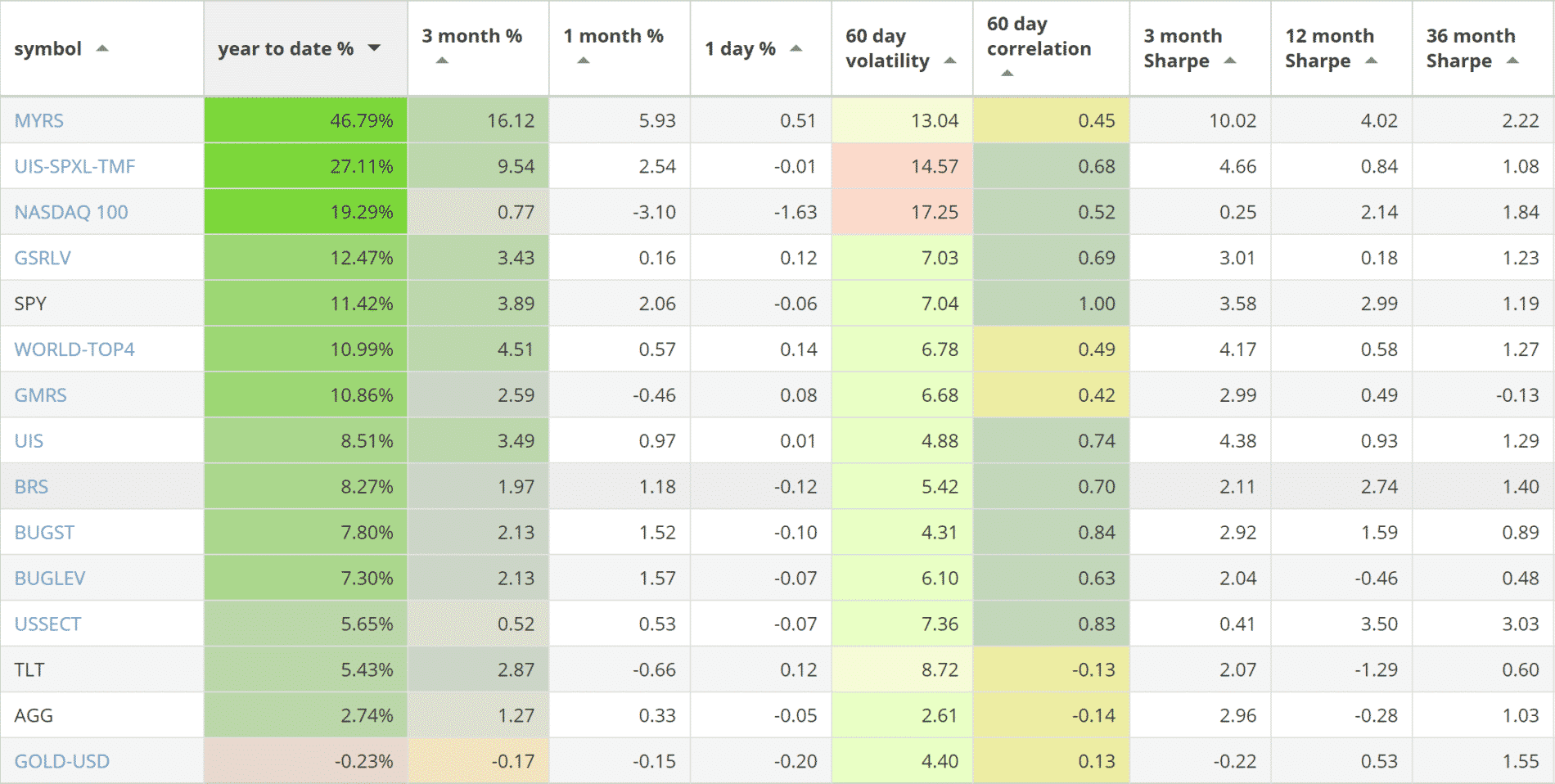

Our top 2017 investment strategies, year-to-date:

- The Maximum Yield strategy with 46.05% return.

- The Leveraged Universal strategy with 27.11% return.

- The NASDAQ 100 strategy with 19.29% return.

SPY, the S&P500 ETF, returned 11.42%.

News:

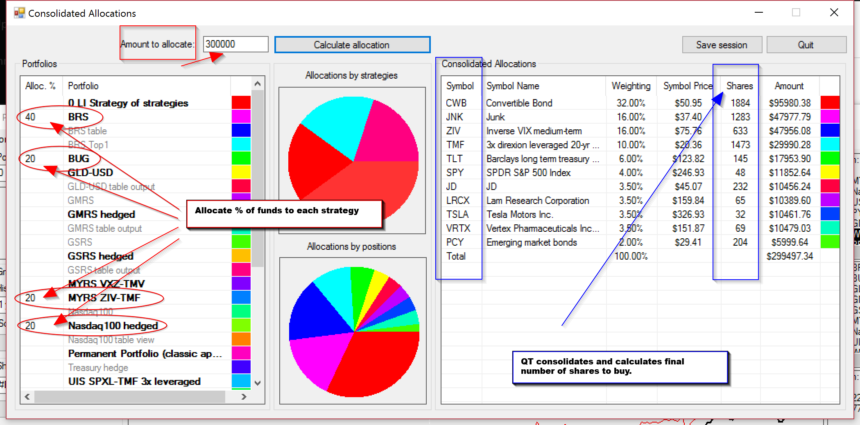

Our professional portfolio software QuantTrader has reached version 5.0 with improvements including being able to load your custom set of strategies and a new consolidated signals screen. You can now allocate your funds in multiple strategies and have QuantTrader calculate the number of shares of each stock/ETF you need to buy.

Market comment:

Just as we mentioned in our last June newsletter, we continue to observe low volatility and a weakening dollar. The VIX index hit a record low on July 26th, falling temporarily to 8.84, a level last seen back in 1993. Moreover the index stayed under the 10 level for 10 consecutive days showing persistence. The U.S. dollar fell to a 13-month low against a basket of currencies. The Euro has broken to the upside, reaching 1.18 against the dollar, a level last seen before December 2014. The Euro is 11% up year-to-date. Certain commodities that have had terrible returns for the past years are this month’s top performers: Sugar, Gasoline, U.S. diesel Heating oil, Nickel, Coffee and U.S. oil (USO) ETFs all gave more than 10% returns for the month. Of course if you look at a graph you will see this is just a tiny reaction to multi-year bear markets.

Taking advantage of the extended low volatility environment, out top strategy, the Maximum Yield strategy, added another +5.93% to reach +46.79% return for the year. The Universal Investment 3x strategy added 2.54% for a +27.11% YTD return. All our other strategies were positive in July. The exception was the Nasdaq 100 strategy that corrected -3.1% causing this month’s allocations to change significantly. As a last note, our U.S. Sector strategy has allocations to both cash and to a small short position in one of the sectors. You can see the allocations using our free subscription.

We wish you a healthy and prosperous 2017.

Logical Invest, August 1, 2017

Strategy performance overview:

Visit our site for daily updated performance tables.

Symbols:

BRS – Bond Rotation Strategy

BUGST – A conservative Permanent Portfolio Strategy

BUGLEV – A leveraged Permanent Portfolio Strategy

GMRS – Global Market Rotation Strategy

GMRSE – Global Market Rotation Strategy Enhanced

GSRLV – Global Sector Rotation low volatility

NASDAQ100 – Nasdaq 100 strategy

WORLD-TOP4 – The Top 4 World Country Strategy

UIS – Universal Investment Strategy

UIS-SPXL-TMF – 3x leveraged Universal Investment Strategy

AGG – iShares Core Total US Bond (4-5yr)

SPY – SPDR S&P 500 Index

TLT – iShares Barclays Long-Term Trsry (15-18yr)

How come you are not reporting performance for GMRSE

GMRSE has been discontinued. It was an effort to do an all-in-one strategy. It was a mixture of Maximum Yield (our inverse volatility strategy) and the Global Market Rotation. It has been discontinued since 2016 and has not been available as we shifted to our new multi-strategy paradigm. Instead of trying to do all-in-one (GMRE = MYRS+GMRS) you can now diversify across each one (as well as others) and control how aggressive or not to be based on % allocation to each strategy. I hope this makes sense.