Update: You can see the most recent performance our our inverse volatility strategy here. Consult vixcentral for the daily VIC term curve.

In this paper, I present five different strategies you can use to trade inverse volatility. Why trade inverse volatility you ask?

Because since 2011, trading inverse volatility was probably the most rewarding investment an investor could make in the markets. Annual returns of between 40% – 100% have been possible which crushes any other strategy I know.

Smartly Trading inverse volatility

In modern markets, the best way to protect capital would be to rotate out of falling assets, like we do in our rotation strategies. This is relatively easy, if you are invested only in a few ETFs, but it is much more difficult, if you are invested in a lot of different shares. In such a situation an easy way to protect capital is to hedge it, going long VIX Futures, VIX call options or VIX ETFs VXX.

If you trade inverse volatility, which means going short VIX, you play the role of an insurer who sells worried investors an insurance policy to protect them from falling stock markets. To hedge a portfolio by 100% an investor needs to buy VXX ETFs for about 20% of the portfolio value. The VXX ETF loses up to 10% of it’s value per month, because of the VIX Futures contango, so this means that scared investors are willing to pay 1.5-2% of the portfolio value per month or around 25% per year for this insurance. Investing in inverse volatility means nothing more, than taking over the risk and collecting this insurance premium from worried investors and you can capitalize on this with a few simple strategies, which I will show you below.

Something seems afoot. Why do investors pay 25% per year to hedge 100% of an S&P 500 portfolio which traditionally has only achieved a return on average of around 8% in the last 10 years? I am sure many investors must have lost more money paying for this insurance than they would have lost from falling stock markets. But I guess, they are paying for their own peace of mind.

Traditionally, it has always been better to hedge a portfolio with US Treasury bonds. These normally have like VIX products a negative correlation of about -0.5 to -0.75 with the US stock market, but unlike VIX volatility products, they can achieve long term positive returns.

However, since June 2013, US Treasuries have lost their negative correlation to the stock market, and at the moment there is no other choice to hedge a portfolio than to buy these very expensive VIX products or inverse index ETFs.

This is good news for people like me, who like to trade inverse volatility. However, there is something you need to know. You should never ever trade inverse volatility without being 100% clear on your exit strategy!

Here, I want to present some strategies which may be new to you and will allow you to participate in these high return volatility markets.

The Basic “Contango Rule” Strategy for VIX and Inverse Volatility

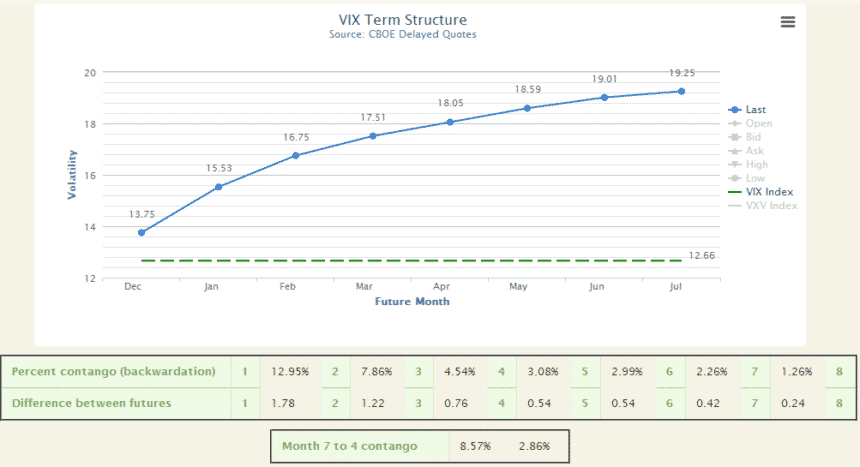

For this strategy, all you have to do a daily check of the VIX term curve. You can find this curve for example at www.vixcentral.com

Courtesy VixCentral

As long as the front month is in contango (curve goes up from left to right), such as in the chart above, you can go short VXX or long XIV. Sometimes you will see the front part of the curve go up until the front month goes to backwardation.

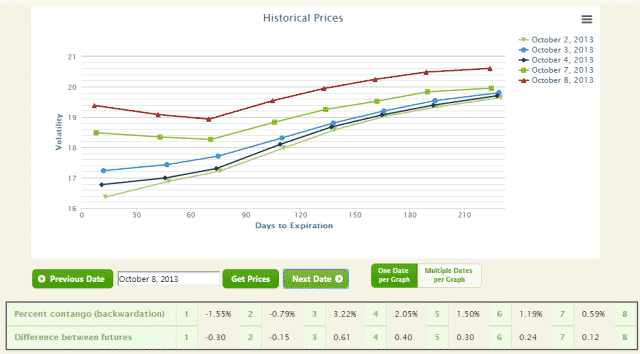

Here in this graph by VixCentral you see the days of the last fiscal cliff fear spike.

Courtesy VixCentral

If the two front month of the VIX term curve are in backwardation and the curve drops downwards, such as in the chart above on October 7.-8., this is a clear sign to exit VXX or XIV. From October 10, the curve returned to contango and you could have again shorted VXX or gone long XIV.

It is clear, that most of the time when you have to exit it is because of a short VIX fear spike (such as above) which is over after a few days. You will have to realize a loss, but, this is inconsequential. Normally, you need only a few days to cover these losses again as the normal VIX contango situation is restored. In the example above, the front month future was below 20, which is not that worrying, but in 2008, this value spiked to 70. This means that going short VXX would have meant the possibility of realizing 300% losses if you didn’t strictly follow any exit rules.

This “contango rule” strategy is not really a strategy, because it doesn’t give you a clear exit signal, however, if you invest in inverse volatility, you MUST know the VIX Futures term structure.

The Bollinger Band or Simple Moving Average Strategy

These are strategies which work well and which have the advantage that you can backtest the strategies, or you can even automate these strategies. I used to trade the Bollinger band strategy for quite some time automatically with Tradestation.

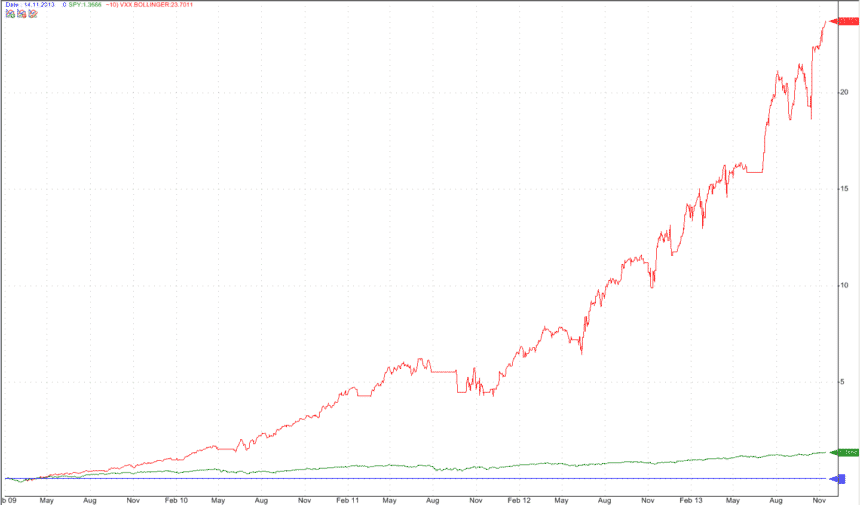

Here is the backtest of this strategy since Feb. 1, 2009 which was when the VXX started. The performance has delivered a 96.41% annualized return or 2370% in total if you reinvested all profits. If you invest always the same amount which is what I did, then you get 5.8% per month which is a very nice monthly income.

The SPY ETF has delivered only a 20% annualized return or 137% total return during the same period. This is also very good, but pales in comparison to the VXX strategy return.

The maximum drawdown of this strategy was 27.7% compared to 20% for the SPY ETF. The risk to return ratio of such a strategy is 3.27 compared to 0.99 for the SPY ETF. So, even if trading VXX is considered risky, with the right strategy you could have had a 3x better risk to return ratio than for the US equity investment (SPY).

The parameters for this strategy have been optimized in QuantShare. The Bollinger band period is 20 days and the upper line is at 1.4. If VXX crosses the upper line I will exit (cover) VXX the next day at open. If VXX goes below the middle line, then I go short VXX the next day at open.

You can also use two SMA lines with 15 and 5 days and sell or cover at the crossings. The return is more or less the same as for the Bollinger strategy.

You can also do such strategies with XIV which is the inverse of VXX. However, the maximum annual return which I could achieve is 84% per year, which is 12% less than with VXX. This lower performance is mainly due to time decay losses which are quite strong for such volatile ETFs.

So, this is quite a simple strategy. You can even set a stop at the level of the upper Bollinger band line + 1%, so that the exit is automatic in case something very bad happens.

The Cautious Investor Medium Term Inverse Volatility Strategy

The two strategies above are for traders willing to check their investments on a daily basis. If you do not want to do this because you like to go on long holidays or you just don’t like to look every day at your PC screen then it is better to invest in the medium term inverse volatility. You can do this by going long ZIV or going short VXZ. VXZ has higher volume than ZIV but the results are similar.

VXZ and ZIV have less than half the volatility (vola=25) than VXX or XIV (vola=55). Also, the contango structure is more stable than for the front month. Also, during the fiscal cliff crisis last month, the midterm futures never went into backwardation.

You can also use a Bollinger or SMA trading system for these ETFs. You will achieve about 44% annual return trading VXZ and you can do so with less than half of the volatility. This way you have about the same return to risk ratio as if you had traded the VXX.

However, because the volatility and behavior of ZIV or VXZ is very similar to the stock market, you can also include for example ZIV in a rotation strategy. In such a strategy it is a ranking mechanism which will tell you when to exit ZIV. This is normally better than using moving averages, because the switching points are much smoother.

Investing in Medium Term Inverse Volatility with the “Maximum Yield Rotation Strategy”

A strategy I employ which gets most of its return from inverse volatility is the Maximum Yield Rotation Strategy which I presented in Seeking Alpha around two months ago. With such a strategy you can outperform a simple ZIV or VXZ SMA strategy by up to 20% per year. The advantage is that you only need to check the ranking of the ETFs every two weeks. No need to check daily the VIX term structure or the ZIV charts. Rotation strategies are very sensitive to changing market environments.

In case of upcoming market troubles, US Treasuries will quite early outperform ZIV and the strategy will rotate out of ZIV into treasuries. The main advantage of such a strategy is that it not only exits ZIV during market corrections, but the strategy will then rotate into Treasuries which can produce very nice additional returns during market corrections.

The High Probability VIX Future Trade Strategy

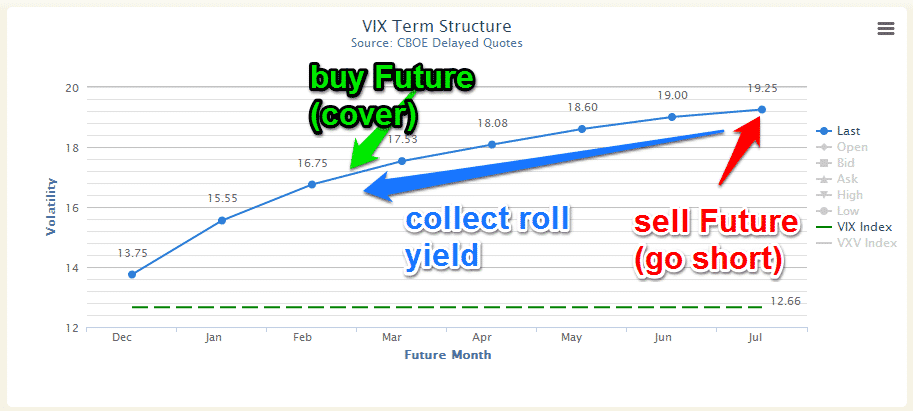

Instead of investing in VIX ETFs, I prefer to sell the VIX Futures directly. Normally, somewhere during the third week of the month, the front VIX future expires and is removed from the VIX term structure chart (see chart below). Now the second month will move to the front month position and on the curve end a new Future will appear. I always go short a few of these Futures (red arrow) and then just let them slowly move down the curve until they arrive about at the green arrow position. At this point I cover my short position and collect the roll yield for the about 4.5 months. On this chart, this would mean going short at about 19.25$ and covering (buy) at around 17$. That means a profit of 2.25$. Sometimes I have to wait a little bit longer to sell, for example if there would be a VIX spike of some nature. But, for more than two years, I have never seen a loss.

So, this is a high probability trade. Once per month you go short the last or second last future and at the same time you enter a stop limit and a cover limit. For the July Future in the chart below, I for example go short at 19.25. I activate a stop loss limit at 21.50 (=+2.25) and I activate a take profit limit at 17.00 (=-2.25). Now I just wait about 4 months until one of these limit is executed. As long as the contango of the VIX futures is there, this will be a trade with a profit probability of 90%-100%.

Courtesy VixCentral

The volatility of these back end futures is quite low and there is no big risk, however, even here there would be moments where you have to exit. The main reason to stop such trades is when the back end of the future curve gets completely flat or even goes into backwardation. However, this is relatively easy to check online at VixCentral.

I’d be curious to see how these strategies (especially the Bollinger Band and the Futures strategies) would have done in 2007 and 2008. I understand that the only way to generate these data with artificial values for VXX and for VIX futures, and I have no idea how hard it is to get these data, but they would be extremely interesting.

I don’t think I would have used this strategy 2007 or 2008. At this time VIX futures did not have the stable contango like they have today.

I agree about the change in VIX fiutures. Do you have a theory as to why contango has stabillized since that time? Has the market itself changed, or does it have something to do with the internals of volatility futures?

Or, to phrase my question differently, if you were trading these strategies in realtime in 2007 or 2008, how could you have known to hold off because of an unstable contango?

If we get a10% mare correction xiv will lose from 50 to 90 %

A -10% correction of SPY translates in about a -30% correction of XIV. This is the short term effect. If then the VIX futures stay in backwardation, XIV declines further even if SPY is the same.

Thank you Frank. Always like to get more opinions. I follow a couple of “gurus” on the internet that are incredibly bullish on stocks. One of the guys is saying he thinks stocks are undervalued because the Russell 2000 is only 80 times trailing earnings, in his opinion with interest rates under 1% it should be well over 100 p/e, although historical number is about 25. He is also saying Dow to 100K in about 7 years. Very interesting times I think, if you follow Tobin’s Q or market cap/GDP or Shiller p/e or those things they all say 1150 or lower S&P but I think it’s more likely we go to 5000 in about 5, 6 years area. Cheers!

If the VIX term structure represents the XIV front month and ZIV is midterm 2 month, is there a ZIV term to watch for backwardation?

Just look at http://vixcentral.com/ and you see the amount of contango for ZIV. It’s the “Month 7 to 4 contango”=6.08% or 2.03% per month

Frank,

I’d appreciate your thoughts on using the “month 7-4” contango to time ZIV or its equivalents.

FWIW, I looked at using this measure in conjunction with your “shorting back end VIX futures” strategy, and, during periods of extreme market stress, such as 2008, one would have suffered significant losses before it would have gotten you out.

Alex

Hello Alex and Frank, hope you all are well. I am quite amazed how ZIV never seems to drop.

I am wondering a couple of things. First when you say the strategy recommends being in ZIV at a given time, what % of your portfolio is in ZIV? Do you ever put a large amount of your assets, say 25% or more, in ZIV? Finally for those of us in taxable accounts who live in high tax areas, do you think it is OK to mostly just hold ZIV rather than trading out to avoid the tax hit? Blessings!

I think you can stay invested 98% of the time in ZIV and only during really big financial crisis you have probably to exit. But if you do this you need to hedge ZIV with long term Treasuries. So, this would be 50%ZIV and 50%EDV or 70%ZIV and 30%TMF or the best 30%VXZ short and 70%TMV short.

However you need to rebalance from time to time. I am not sure if this is allowed in these “taxable accounts”.

Thank you Frank! I am not sure either but I guess I will find out! Short TMV frightens me a bit since if we see an interest rate spike TMV could explode higher! Let’s see how it plays out, ZIV has been continued very strong.

Hi Frank.

In your post above the third example is:

“or the best 30%VXZ short and 70%TMV short.”

Is that correct or should the values be reversed?

I’m considering your MYRS and implementing it with VXZ and TMV shorts.

Thanks in advance for your reply.

Bill

Yes, it should be reversed. It’s always the same as the ZIV-TMF allocation.

A TMV short position is not more risky than a TLT or EDV long position. It is the same but sure, because of the leverage you need to short less (1/3 of TLT or 1/2 of EDV) of TMV than for normal Treasury ETFs.

Hi Frank,

Sounds like your BB or SMA strategy is outstanding. But your futures strategy makes about 2.75% a month, or 38% annualized. So why use this strategy when the BB/SMA shorting strategies return 96% annually with a risk/return of 3.3 and a max drawdown of 28%?

Also, with sector rotation, you are re-evaluating twice monthly, and I believe you use a look-back period of 4 months or so. How can this be more sensitive to changing market environments compared with a BB or sma crossover strategy using a daily chart? And how could it outperform a simple ZIV shorting strategy by 20%? Seems like your rotation strategy ought to be returning much more than ~60% or so per year if that were true.

What am I missing here?

If you trade front month volatility, then you really have to monitor the market daily. Medium term volatility is much safer. Also, even if the return is smaller, the Return to Risk ratio (Sharpe ratio) is higher for medium term volatility. This is why I also prefer ZIV over XIV.

Thanks Frank, but you didn’t really answer my questions. I understand the differences between XIV and ZIV, and short-term/medium-term volatility.

What I am asking is this: why don’t you still use your strategies that short VXX using the BBs or SMA crossovers to time entries and exits? You indicate that strategy is very successful (~ 96% per year), so why not continue with that strategy?

That strategy need not involve daily monitoring of the market, and could even be automated and traded algorithmically. Also, it could be modified to short medium-term volatility, i.e., shorting VXZ instead of VXX. The same BB or moving average crossover signals could probably be applied successfully to VXZ.

The strategy that shorts futures will not return nearly as much as the above strategies. And, many people don’t want to trade futures, partly because of the price of the contracts ($15,000 to $20,000 or more for one contract, now that the mini VIX futures are gone).

So why don’t you trade the short VXX strategy anymore?

Hi, Frank. I have two questions regarding the “Contago Rule Strategy”.

1. On the vixcentral.com charts, is the “front month” the left-most month (i.e. the nearest-term) or the right-most month (i.e. — the longest term)?

2. Do I understand correctly that a Buy/Hold signal for XIV is generated whenever the “front month” of the VIX Term Structure curve is in contago (i.e. — sloping upward), but that a Sell signal is not generated until there are TWO CONSEQUTIVE months of backwardation?

1. The front month is the left-most month

2. If you trade the front month (which can be dangerous), then backwardation of the first two month is a big warning light. Best is to exit your XIV position. The point where you can open the position again is not so clear. But you do not have to wait until the 2 front months are 2 months in contango again. Better check the VIX and try to invest again if there is no VIX up trend anymore.

I would also be interested in an answer to Terence’s question.

And thank you, Frank, for all the great ideas you make available on your website.

Hi, Frank. Thank you for responding to my question above.

I think I understand the “rules” of this strategy, but am having a problem understanding the basic concept of the strategy’s indicator and resulting recommended actions. In using the above chart “VIX Term Structure” as a strategy indicator, the recommended action is that so long as the front month is in contago (i.e. — the curve is sloping upward from left to right), a trader should go short VXX (or long XIV). My question is: If the curve is rising from left to right, does that not indicate forecasted increased volatility, or am I misinterpreting the curve? If the upward-sloping curve is forecasting increased future volatility, why is the strategy action to short the volatility?

Hi Richard,

My understanding is that the VIX futures term structure is just one consideration in trading volatility. But because the futures are in contango about 87% of the time, then shorting ETPs that roll their positions into steep contango keeps the wind at your back when contango is present.

But also, the VIX doesn’t often rally in a sustained fashion, but rather tends to spike. And the VIX spends considerably more time below 20 than above 20.

So to exploit these, most strategies spend the majority of their time short volatility in some fashion.

But I believe your question is why the futures that are further out are priced higher than the futures that are near term (of the spot VIX). The answer usually is that this is simply risk compensation (i.e., the risk premium). I think of the futures pricing as something akin to options pricing: the longer the time to expiration, the greater the uncertainty is in the actual volatility (vs. the expected volatility). Therefore, there is a risk premium that is added to the price of the futures contracts, and that premium increases as you go further into the future.

Similarly, longer duration bonds must pay higher interest than shorter duration bonds to compensate bond buyers for the risk that interest rates will rise and make their bonds less valuable. The longer the duration, the greater the uncertainty in what interest rates will be in the future. The interest rate differential that is a function of bond duration is analogous to risk premium.

When the VIX spikes (especially if this is sustained to any extent), then the term structure tends to shift towards backwardation. My view is that the reason for this is because market expectations that a rise in the spot VIX can be sustained steadily decreases as the VIX goes higher and higher, just because of the fact that the market knows the VIX historically spends less and less time at higher and higher levels. This eventually negates the risk premium at the point where the market believes that the current levels of the spot VIX cannot be sustained into the future for long enough to justify the added risk premium. In other words, the market thinks it more and more likely that the VIX will drop back down to more normal levels, and therefore begins discounting the futures contracts that are more distant if the spot VIX rises any further.

So the risk premium becomes a discount when the market believes it is more likely that the spot VIX at the time the particular contract expires will be less than the current spot VIX. That discount is directly manifested as backwardation over the duration of the various futures contracts going forward.

Hope this helps,

Terence

Richard,

You shouldn’t consider trading volatility products until you fully understand how they work. Here’s a good place to start: http://seekingalpha.com/instablog/70713-marcjoli/1102401-anthology-of-writings-essential-to-volatility-traders.

Alex

Thank you Terence and Alex for your replies.

After perusing your comments, it seems that trading volatility directly is more complex than I originally thought. I will continue to try to educate myself; but in the meantime will continue to follow Frank’s MYR strategy because of its simplicity.

Thanks again for your advice.

Richard

The links that Alex provided are excellent, and you’d do well to sift through as much of this as you can digest. Keep in mind that the VIX is not terribly well understood even by “experts.”

I am not at all suggesting you shouldn’t learn as much as you can. But the good news is that you don’t have to become an expert in the VIX to capitalize on it. Frank’s MYR is sort of a hybrid of TAA and volatility trading. Essentially, he uses ZIV to boost returns from what would otherwise be a pure TAA strategy.

But if you want to develop an unadulterated approach to trading volatility, there are more than a dozen strategies out there that trade the VIX using some vehicle or another, and most do a darn good job. I have my own approaches, and it is not difficult to create these once you understand some basics and at least some of the detail.

I would caution you on just one thing: be very careful taking long positions in volatility, and make sure you understand why it is difficult to make a profit trading long volatility ETPs. Examine the long term charts carefully. Never forget that the VIX futures term structure spends about 87% of the time in pretty strong contango. That’s why it is much less risky to be short volatility than long volatility. I’m not saying you should never trade volatility long, but you better understand the risks first.

Hope this helps,

Terence

Alex is right. The Volatility Made Simple site is very readable and gives a lot of good information, but does not devolve into arcane esoterica that you don’t really need to understand.

My pleasure, Richard.

Here’s another great source of information about how the VIX works: http://sixfigureinvesting.com/2014/07/how-does-the-vix-index-work/

For a great education on various volatility strategies, you could do a lot worse than volatilitymadesimple.com.

And, Terence’s points are excellent and should be given careful consideration.

There’s now a backtest of Frank’s Bollinger Band strategy on volatilitymadesimple.com.

Yes, I saw that. But VMS added 5 years to the backtesting by using synthetic prices. Annualized returns were about 55%, with a Sharpe of 1.31. Win rate was 64%, and there were about 9 trades per year on average.

The bad news is that the Ulcer Performance Index was 1.80, and the max drawdown was 72% (!!!)

One of the acid tests of a volatility trading strategy (and any other strategy for that matter) is how it performs when you really really need it to perform. But the maximum drawdown for this BB-based trading strategy occurred exactly when one would hope that a volatility trading strategy would come to the rescue of an otherwise suffering portfolio: during the recession and market meltdown of 2007 – 2009.

So to me, this is not a viable volatility trading strategy, at least in this current form.

One thing I look for in these strategies is consistent returns. So, I examine rolling 3 month, 6 month, 9 month, and 12 month returns for example. The greater the number of rolling periods that show positive returns, the better. What you hope for is that the majority of the volatility is to the upside (and that is true with some volatility trading strategies).

Sometimes things like Sharpe ratios and CAGR can be misleading, and this is a good example. This BB strategy went through at least one long period of nearly 3 years when it was producing steadily worsening losses. Personally, I couldn’t tolerate that, and I suspect there are not many who could. After a year or so, you would begin to wonder why you didn’t just invest in CDs or treasuries instead !!

Frank hasn’t intervened in quite some time. I hope that all is well, Frank.

I closed the position because the 7th and 8th month went into backwardation. Was that correct?

This was wrong. The front month is even not in backwardation now. Such corrections are normal. Just keep the future until month 4.

Hi, Frank,

I have been implementing the MYR Strategy for a while, and it has been profitable so far. However, I presently am concerned regarding the probability of another major market drop similar to 2007/2008.

Above, you state: “I don’t think I would have used this strategy 2007 or 2008. At this time VIX futures did not have the stable contango like they have today.”

What are the general conditions that would cause you to stop trading the MYR strategy? Is there a certain criteria that defines a “stable contango”, the absence of which would cause you to stop trading the MYR for a while?

If you’re interested in strategies for trading inverse volatility, please take a look at http://www.tradingtheodds.com/ .

Best,

Frank

@tradingtheodds

Hello Frank and welcome. Congrats on a great blog!

Hi, I know this is coming from quite far compared to the publishing date of this very interesting article, i’d like to share the following.

I created and backtested the VXX strategy with moving averages cross overs.

Since the creation of the VXX ETF, total return has been 1748% and max DD 51%.

I will review the bollinger bands strategy but so far the DD seems way too risky.

Angel

Hi Frank,

Looking at the VIX since 1990, the present price is in the lowest 1% percentile. From what I understand above, it is not easy to go Long the VIX with a simple buy and hold strategy. Will the MYRS perform if one believes in VIX mean reversion which puts it at 19 vs its current 10? thanks.

Put differently, in what situation do you believe the MYRS will stop performing? thanks.

Markets are much more efficient and liquid today and the FED instantly calms markets if volatility gets too high. This means that today a mean VIX is rater at 15 and not 19. There can always be quite big drawdowns for ZIV if the market dives. The question is how fast this happens. If economy turns slowly into a recession like in 2008, then MYRS has plenty of time to change the allocation towards Treasuries.

The real danger is a sudden “black Swan” event similar or worse than 9/11. Then you don’t have a chance to react. But anyway, very high volatility spikes will hurt momentarily, but they are probably the best occasion to make money by investing in the fear of irrational people. So, I would just stay invested and not worry too much. The nice thing is that Volatility always comes back to the mean which is something which you can not really say for the stock market.

I would like to ask if you would consider creating synthetic data to take the Max Yield strategy back to beginning of 2008 to give us an idea of how this stat would perform in the market swoon in 2008-2009. This would be very useful.

Hi Barry,

we´re just working on an application to permanently create synthetic data, as this has to be recalculated with dividend adjustments each time. Then we´ll publish the backtest and include it into the strategy page.

For the meantime here a bit of info on how to create and use synthetic tickers: https://logical-invest.com/forums/topic/using-synthetic-data-or-external-data-sources-in-quanttrader/

I don’t think this makes really sense. The volatility index VIX is well known since many years, but VIX futures have only been traded with sufficient volume since 2010. Before this the term curve of these futures was doing erratic swings because this products have not been traded liquid enough. ZIV is only interesting to trade because the futures are nearly 100% of the time in contango. Before 2010 this was not the case and so the strategy would not have made any sense.

OK— thanks for your comments.

I’ve been trading XIV for a few years using a 5-day EMA x 15-day EMA crossover for entry and exits. Always put in a 5% stop loss under the trade initially; then a 7% trailing stop loss when there’s some profit. Have average annual return of 64%; max drawdown -16%. Still a bit concerned that my stop loss my not get triggered in the event of a BlackSwan event….I’ve allocated 3% of my portfolio for this strategy.

I also use Logical Invest’s MYRS – love it!

Good luck,

Jim

Hi James,

thanks for the input, very much appreciated!

Would you mind publishing your backtest and/or trading results with a bit more comments? Especially how often your stops and profit takers have been triggered?

We´re doing similar stuff for our own, but using futures. Benefit of XIV is that losses are limited to 100% of your capital, while when shorting futures you bet much more. Beside that, why do you use XIV and what are your experiences?

Might be worth publish a guest post if you’re interested, please drop us a mail at [email protected] (just for you :-))

Thanks,

Alex

Alex

Sure…but gonna be about a month as I’m preparing to launch a new commerce business. I’m also going to be testing variations to the 5x15EMA plan.

James