Dear Subscribers,

We are happy to announce that the full QuantTrader version is now available to individual investors for $150 a month or $1500 per year.

We will cross-subsidize a bit with the high interest we´ve received from institutional investors like RIA and hedge-fund managers so far. Fair play requires that subscribers who manage their own or other people’s assets above $1m subscribe to the institutional offering.

QuantTrader is a fine piece of art mixed with a lot of investment technology. Knowing that all the knobs and options might lead to an initial overload – at least compared to the 60/40% off the shelff solutions out there – we will also continue with our 60 days money back guarantee.

You can find a short description of QUANTtrader here. We have prepared extensive Help & FAQ site and a dedicated forum to get you started in an interactive mode. If there is interest we can also organize a webmeeting for a more detailed walk-through during the coming weeks, just let us know in the comments.

In anticipation of a vivid discussion,

The Logical Invest Team

And now some further promotion, just to show-off our pride a bit:

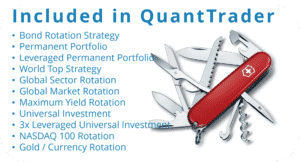

All you need for steering your investment process in one place:

All you need for steering your investment process in one place:

Powerful Asset Allocation Algorithms

Lightning fast Backtesting & Optimization

Highly flexible data exchange with other programs

Hedging with different instruments

Investment History and Log

Get access to all current and future Logical Invest Strategies

No strings attached – nothing to hide! Adjust and modify all our strategies to your needs:

- Optimize to your own preferences

- Replace assets with those from your 401k or IRA account

- Add hedging through inverse ETF, Bonds, Currencies, Commodities

Develop your own custom strategies on the fly

Whether you love simplicity or look for sophistication. We got you covered when building your own investment solution!

- Select your own assets in the custom asset allocation

- Pick from different ranking and optimization algorithms

- Add volatility limits and hedging options

- Backtest and modify in milliseconds with a simple click

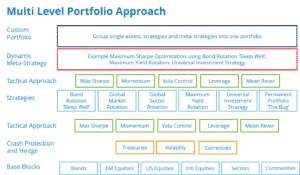

Design sophisticated portfolios of Strategies

Design your – and your family’s – water and bullet proof portfolio:

- Blend our and your own strategies into a Portfolio

- Let momentum and mean reversion steer the dynamic allocation among strategies

- 60/40 was yesterday: Always switch to the fastest horse depending on market environment

- Hedge and limit volatility at strategy or portfolio level

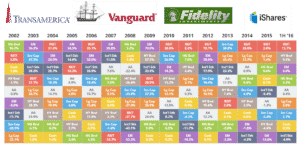

Use funds from all 401k and IRA Custodians and mix with different asset classes

Whoever your 401k or IRA plan provider is – build high-performing strategies based on assets they include.

We use publicly accessible data that can track virtually all existing asset classes:

Equity indexes, Stocks, Bonds, Commodities, Currencies, Volatility indexes. You name it.

Even more functionalities under the hood

Some more functionalities, but do not get scared – usage not a must:

- Daily automatic download of the ETF/Stock closing prices

- Daily updated strategy performance visible. The software shows performance charts and detailed statistical information

- Performance logs and ranking logs can be exported in excel format. Like this it can be included easily in reports.

- Every day the optimum allocation is indicated. This allows strategy rebalancing whenever you want. This way, you can for example rebalance before the official end of month rebalancing.

- It is very simple to change strategy parameters. This way an investor can fine-tune its risk return profile. It is for example simple to limit volatility of a strategy to a certain level (for example 5%)

- Access to our proprietary Modified Sharpe Optimization, four powerful ranking algorithms, Momentum and Mean Reversion logic

- Dynamic Volatility Scaling: Minimum Volatility, Maximum Sharpe Optimization, Riding the Efficient Frontier

- Limit Portfolio Volatility at your own preference

- Flexible setting of minimum and maximum allocations by asset

- Volatility scaling by asset

HI Alexander ,

this is very good news for us small guys !

2 questions if I may

1/ Can I build strategies for non USA markets eg Australia ? ( so I would be using yahoo data such as STW.AX) Will all the logic still work and can I benchmark against ASX indices ?

2/ I recently joined up LI on a 12mth subscription , can I “upgrade” to QuantTrader on a pro rata basis ? ( ie , pay the delta between my existing subscription and the QT subscription for my remaining term ?

regards

Ivan

ok , sorry , I should have read the help file first, looks like question 1 is answered “yes”

Hello Ivan,

yes, you can use all assets that have historical data in Yahoo Finance. STW.AX has only a short history, but you could use index data as proxy: https://finance.yahoo.com/quote/STW.AX/history?p=STW.AX. The same applies to banchmarks, you choose the benchmark asset or index. We have some EUR based strategies running, with European ETF.

We can simply swap your subscription, just sign up to QuantTrader on a monthly subscription and we net any difference.

Hi Alexander,

if I upgrade to QuantTrader , do I still get access to my current signals service ? I know QT effectively makes the signal service redundant, however I have invested quite some time setting up my processes around it and if I start using QT, I may just want to play around with it for a while and still rely on the signals service for the interim .

regards

Ivan

Hello Ivan,

The quanttrader subscription includes the All strategies subscription. Effectively it is the All Strategy package + the software. You will still receive our signal emails.

1) Does QuantTrader enable me to run Monte Carlo probability distributions?

2) Is there the ability to backtest and run walkforward optimizations?

Thanks,

Larry

No. QT will not do MC runs or walk-forward optimizations. Both could be interesting additions for future development.