Changing environment – Protect your capital

This is exactly the kind of environment where Logical Invest strategies are designed to perform!

It’s easy to invest well when the S&P and the NASDAQ run double digit yearly returns. But what happens when the market environment shifts?

It’s not just about making money—it’s about protecting capital and allowing strategies to adapt to what has clearly been a different landscape since the start of 2025. Often, strategies can adjust faster than investors…

So is this a different environment?

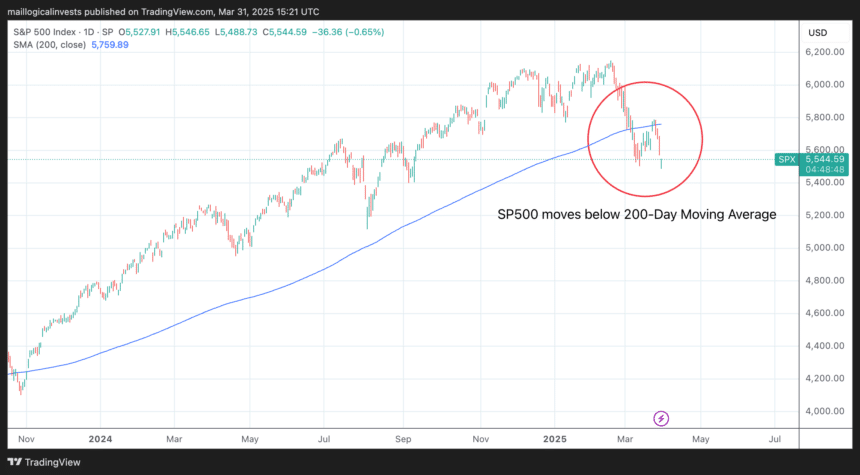

A. The SP500 is under it’s 200-day moving average and it is the start of a month.

Historically, this suggests that volatility may be higher than normal, leading to a ‘bumpier ride’ with larger drawdowns.

SPY Volatility Analysis

Period analyzed: 2007-04-05 to 2025-03-31

When price is ABOVE 200-day SMA:

Average 5-day volatility: 11.53%

Number of days: 3367When price is BELOW 200-day SMA:

Average 5-day volatility: 29.20%

Number of days: 959Difference in volatility: 17.67%

Source: Logical Invest Research

In other words when the S&P is below its 200 day simple moving average, the average 5-day price movements are 2x-3x times larger. That usually means larger drops in daily prices which in practice means more anxiety and an increased possibility of exiting the market at a loss—something we’ve seen in the past couple of weeks. It is possible that this environment could still get worse.

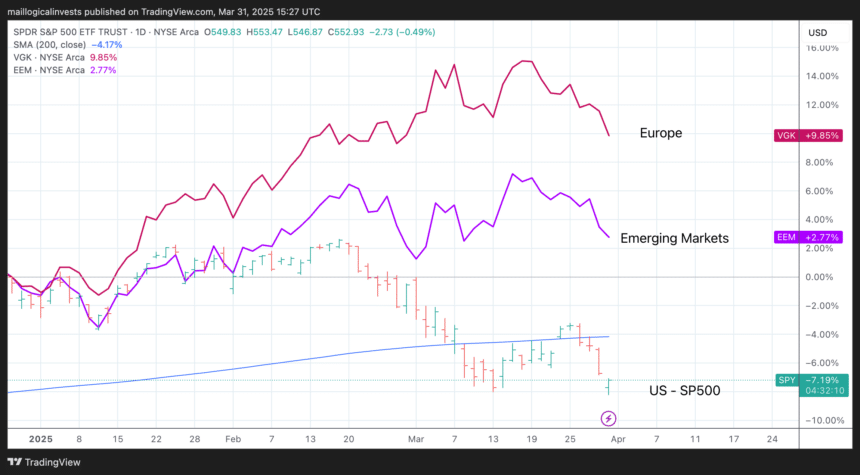

B. International Equity is outperforming year-to-date

After nearly a decade of U.S. equity outperformance, things may be shifting. So far in 2025, foreign markets have been outperforming the U.S.

This suggests there may be value in diversifying into non-U.S. equities—a tough decision for many investors. Fortunately, our strategies use quantitative rules to access a wide range of foreign equity ETFs, and some are already picking up on this trend (Top 3 Strategies).

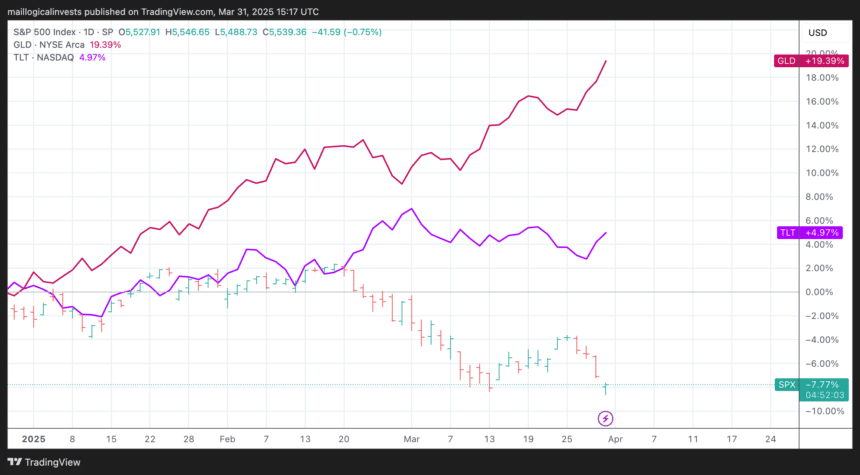

C. Safe heavens hedges are back

As we mentioned in our previous newsletter, gold and Treasuries have once again proven to be highly effective, non-correlated hedges with a positive bias.

Our Hedge Strategy is designed to protect most of our equity-based strategies from large drawdowns rather than generate profits. However, it has still delivered over a 7% return on its own. This is because it allocates to gold, Treasuries, and short-term cash (GSY). Gold alone is up nearly 18% year-to-date.

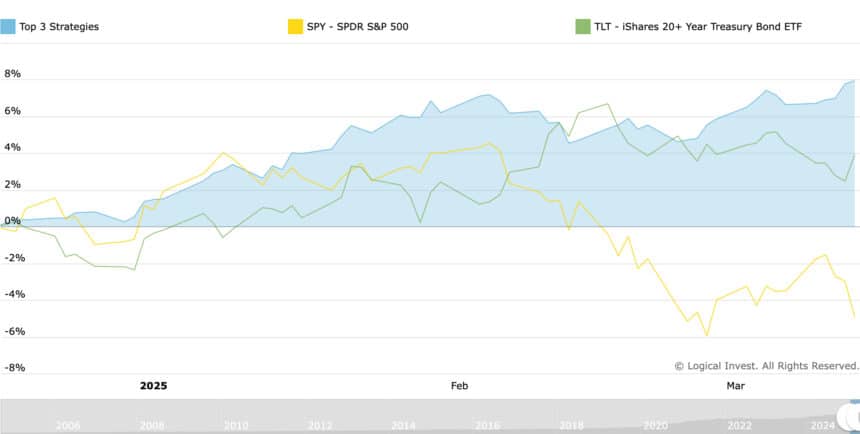

When in doubt pick our most diversified

The Top 3 Strategies is a “meta-strategy” that selects the three best-performing strategies from our lineup and diversifies across them.

Last month, it allocated:

- 1/3 to the Dow 30 Strategy

- 1/3 to the Gold-Currency Strategy II

- 1/3 to the World Top 4 Strategy

Each of these strategies also includes its own hedging mechanism, adding an extra layer of risk management.

Use our models to validate your own decisions

Our strategies and portfolios adapt objectively to changing market conditions, eliminating emotional bias. They can also inform or validate your own investment decisions, enabling market participation with built-in protection and reduced emotional influence.

Share your thoughts in our forum!

The Logical-Invest team.