In the past 20 years I traded nearly everything you can trade, including commodities. Since about 10 years, I have gone from purely emotional trading to systematical rule-based trading. Today, I don’t trade anything anymore, if I cannot reproduce a positive backtest of my trading strategies.

Today I stopped trading commodities, because it is very difficult to get good results with backtested strategies. My core investment strategy is the “Global Market Rotation Strategy“, which I presented in my first Seeking Alpha contribution. This is a very good and safe strategy and also this year the return is already 28.4%.

The only commodity I trade at the time is Silver. With Silver it is different. There is no way to include silver in a successful rotation strategy. Silver is much too volatile and it is much too easy for big investors or banks to influence the price.

However, one thing I still think I understand is the value of something. I do not like value investing with shares, because shares can go to 0. With commodities it is different. Today you can buy silver for $22/ounce and we know that production costs are between $25-$30. Even if there is no shortage of silver at the moment, I think for a longer term investment silver is extremely interesting. No commodity ever remained for long time below production cost. With such a constellation the downside risk of the silver price is much smaller than the possibility of higher prices.

The other interesting argument for a silver investment is, that silver is extremely cheap to buy.

I am using a broker (Saxo-Bank) in Switzerland which allows you to trade silver like a Forex currency. I can buy nearly every amount of silver with extremely tight spreads and no initial margin is required. With Forex trading, the bank will lend me the US dollars I need to finance my trades and all I have to do is to pay some borrowing interest. At the moment I pay 0.4% of yearly interest (USD overnight swap rate) on my silver position. This is much less than the about 1.5% US inflation rate. This is important, because one thing you know is that over the years the silver price should at least rise with the inflation rate. So, inflation will pay you 3x the interest on my USD borrowings.

Another very important advantage of silver compared to other commodities is that I do not have to fight the strong contango of many other commodities. Just compare for example, crude oil ETFs with the crude oil spot price and you see that in the long term you just lose money.

With silver it is different. You can just keep silver and wait. Sooner or later it will go back over the production cost again.

Now the nicest thing of silver is the high volatility. Because of the low price below production cost, this time high volatility does not really mean higher risk. However, it gives you the big advantage that you can make silver work for you.

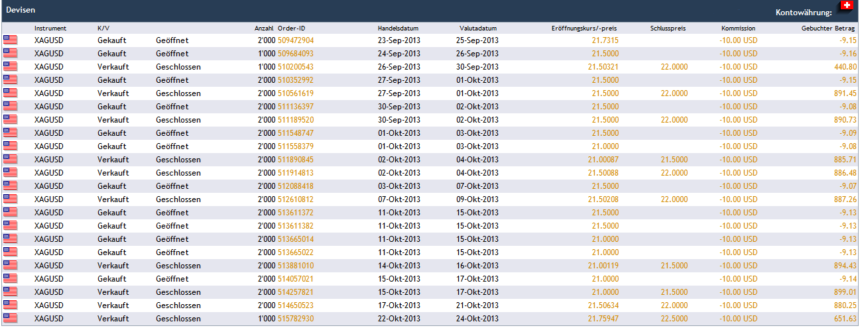

And here, with the next screenshot, I can tell you that silver really works hard for me since quite some time.

This screenshot (sorry, it is in German) shows you the silver trades of month (September 23-October 22). I always buy 2000 ounces of silver if it goes 50 cent down and I sell it again if it is 50 cent up again. This is the very basic buy-low-sell-high strategy. During last month for example, I made 8200 Swiss francs which is about 9100 USD with 10 trades and this only because of the silver volatility. The silver price was exactly the same on September 23 and October 22, so with a buy and hold strategy I would not have made any money at all.

So, you see it’s a dream. I bought nearly 40,000 ounces of silver at $19.50. When the Silver price goes to $30, I will have sold everything at a rate of 2000 ounces/50 cent price increase.

So, now I hope that everybody will invest into silver, so that the price goes up quickly with a lot of volatility.

Attention! If you invest at 2000 ounces per 50 cents, then you would have bought an additional 16000 ounces of silver when the price falls down to $18. This would mean a book loss of $16,000. To this comes the loss of your actual silver position. You should have enough money in your account to cover such book losses. If you really have to sell it, then this strategy would end with big losses.

Our backtest software QuantTrader allows you to build your own commodity investment portfolio, using Silver ETF, Gold ETF and other commodity ETF. Give it a try using our free 30 days trial.

I am also very excited about the future of silver (and other commodities, in general)!

Just curios if you know of any other banks/brokers that allow you to trade silver like this? In the US, the best way I can see is to use a silver ETF like SLV. I have also heard of BullionVault out of the UK.

Cheers,

Nate

Most brokers let you trade silver also as Forex. For IB this would be XAGUSD and is London silver fix. This is probably the most effective way to trade silver 24 per day. I personally like to trade silver using SLV options. Instead of buying SLV I would sell a 3-6 month ATM silver put. This gives you a nice premium.