There is no better moment to realize the value of a hedged and diversified investment strategy than now during this difficult coronavirus crisis. Logical-Invest has been developing hedged investment strategies for years with the goal of minimizing risk.

Since we have been in a bull market for 11 years now, it has been hard to explain why an investor should not invest 100% of their portfolio in equity. Many investors started to believe that markets will always go up and if there was ever a problem, governments and central banks would step in to solve it.

Always Include a Hedge

The main reason to always include a strong hedge in any strategy is the belief that a very rapid, rare and unpredictable market correction is possible at any time. Additionally, there is a high probability that central banks will not be able anymore to fight such sudden corrections due to limited resources.

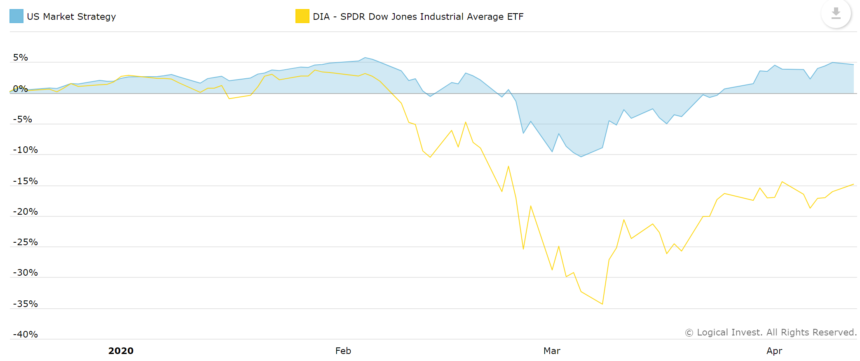

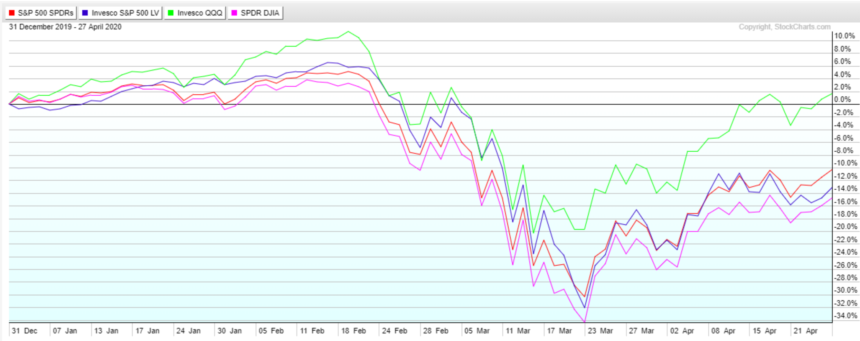

Below is a chart, which shows how the “hedge” inside the “US Market Strategy” dampened the actual drawdown compared to the DOW30.

(The daily updated dynamic 20-year charts can be seen here)

Corona Black Swan Event

For me, the coronavirus pandemic is the first unpredictable so called “Black Swan” event I have experienced since I began investing in 1990. All other market corrections, like for example the 2000 “Dot Com” and the 2008 “Subprime” crisis, had an economic background and developed gradually over several months. You had plenty of time to reallocate your investments, but even then, most people just closed their eyes and experienced the full market correction. Worst case, they sold what was left at the bottom of the crisis.

A “Black Swan” event is dangerous, as it hits the markets extremely fast. The coronavirus market correction is still quite a slow-developing event if you compare it to a possible atomic or biological terror attack over the weekend in a large city. Such an event could result in a 30-50% market crash at the Monday morning stock market opening. Under such circumstances, there will be no way to reduce your equity exposure or to buy any sort of hedge in time, due to illiquid markets.

The only way to prepare for such an event is to invest cautiously and always hedge your equity exposure. During bull markets, most people forget that a high return alone does not mean that they are good investors. Most of the time they just risk more than others, so it is more a sort of gambling which can quickly come to a fast and painful end.

How to Judge a Good Investment

To judge if an investment strategy is good, you always need to look at the risk weighted return, called “Sharpe value” (Sharpe = return/volatility) of an investment. Before explaining how our “US Market Strategy” works, I want to refer to one of the oldest but still best strategies, the “Permanent Portfolio Strategy” of Harry Browne where he described how to build an “all weather” portfolio investing in 4 main asset classes. Read more in our article about the Logical-Invest Permanent Portfolio approach and see the chart.

Permanent Portfolio

The breakdown of the original Permanent Portfolio is as follows:

- 25% in U.S. stocks (equities), to provide a strong return during times of prosperity. For this portion of the portfolio, Browne recommends a basic S&P 500 index fund such as VFINX or SPY.

- 25% in long-term U.S. Treasury bonds (fixed income), which do well during prosperity and during deflation (but which do poorly during other economic cycles).

- 25% in cash in order to hedge against periods of “tight money” or recession.

- 25% in gold (commodities) in order to provide protection during periods of inflation.

This “original” permanent portfolio strategy can be easily backtested since 1950 and always did a good job protecting your money. The stock market has not always been as bullish as in the last 11 years. There can be many long periods where stocks under-perform and Treasuries, gold or cash perform much better. It is possible that we are entering such a regime where the stock market under-performs these other asset classes. Nevertheless, most financial advisers will not tell you to sell some of your stocks in order to invest in Treasuries, gold or cash.

Logical-Invest uses the QuantTrader application to determine the best allocation between these assets on a monthly basis. The idea of investing in these 4 different asset classes is still the basis of all our Logical-Invest strategies but instead of just using fixed asset allocations like Harry Browne we are now more flexible and modify allocations on a monthly basis.

US Market Strategy Mechanism

Below I want to explain the mechanism which is behind our very popular US Market Strategy: The 2020 year-to-date performance of this strategy is +5% compared to -15% for the Dow30 as of April 27. The strategy was able to reduce the maximum drawdown or risk by more than 2/3rd due to the strategy hedge.

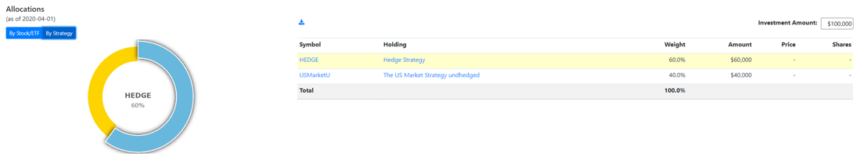

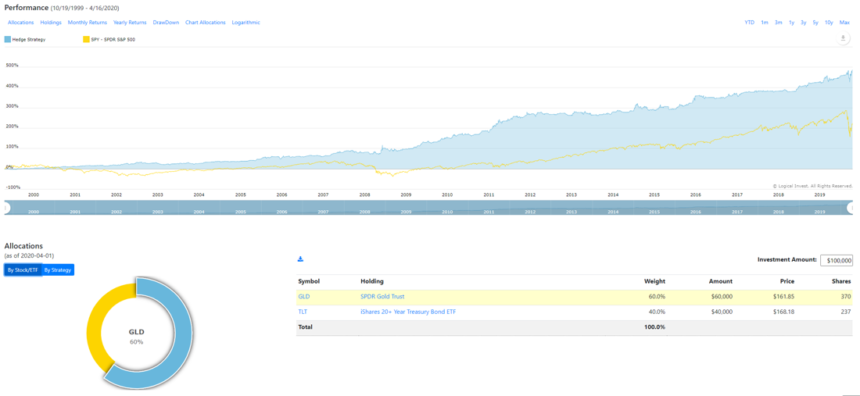

The US Market strategy is composed of two sub-strategies. The first is the US Market equity strategy and the second the Hedge strategy composed of the safe haven assets, Treasuries and gold. Below you can see the current allocation between these two sub-strategies. The allocations change from 40% to 60% between the two sub-strategies. At the moment the strategy is hedged at the maximum 60% with only 40% of equity

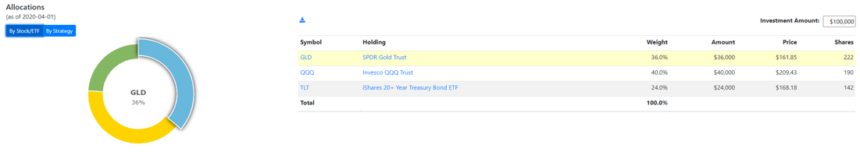

If we dive-down to the ETF-level allocations, we see that we are invested 36% in gold (GLD), 24% in Treasuries (TLT) and 40% in Nasdaq 100 (QQQ).

Let’s see how the two sub-strategies have been selecting these ETFs.

Sub-strategies of US Market Strategy

The US Market equity sub-strategy can invest in 4 different US Market ETFs:

- SPY (S&P 500)

- DIA (Dow 30)

- QQQ (Nasdaq 100)

- SPLV (S&P 500 low volatility ETF)

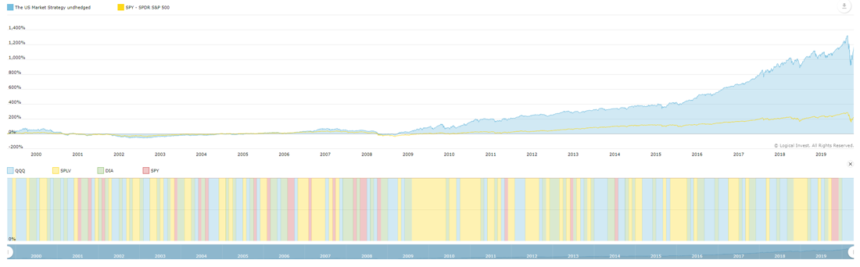

Below you see how the strategy switches between these 4 ETFs.

Our proprietary QuantTrader software normally selects the ETF which had the best Sharp (return/risk) value during the previous month, however it also checks for some mean reversion between the 4 ETFs. This make sense because for example the S&P low volatility ETF (SPLV) and the normal S&P 500 ETF (SPY) performed nearly the same over the last 10 years, however the month-to-month performance can be quite different. As these differences are normally equalized within a short time, it makes sense to buy the cheaper one and hope for a mean reversion between the two ETFs.

The coronavirus crisis shows us that sometimes it is better to let a program select the ETFs. Personally, I would have avoided the Nasdaq 100 (QQQ) ETF and invested in the low-volatility ETF (SPLV) during such a difficult and volatile market, however QuantTrader selected the Nasdaq 100 ETF (green chart below) and this proved to be the right choice with a nearly 14% better performance compared to other ETFs.

Hedge Strategy

Now let’s have a look at the Hedge strategy. The Hedge strategy is an independent strategy with a mostly negative correlation to equity. A negative correlation means, that equity drawdowns are reduced due to an inverse (negative correlation) movement of the hedge ETFs. Below, you see how the Hedge performed since 2000. It is composed of two sub-strategies which can be allocated between 40-60%.

The GLD-UUP sub-strategy allocates between gold (GLD) and the US dollar index (UUP). Both ETFs are safe haven ETFs and at least one of them should always have a negative correlation to equity. Normally a strong US dollar is not good for gold, however, during market corrections investors normally go to cash or gold or both.

The other part of the Hedge strategy is the Treasury hedge sub-strategy which invests in 3 Treasury ETFs of different duration. These ETFs are TLT which is a 20+ year Treasury ETF, TIP which is an inflation protected government bond ETF and GSY which is a short duration (less than one year) bond ETF. Now, the Hedge strategy is invested in 60% GLD and 40% TLT which makes sense, as these are the classic safe haven ETFs during difficult market conditions.

Putting it Together

The allocations of the two sub strategies result in a “US Market Strategy” investment of 36% in gold (GLD), 24% Treasuries (TLT) and 40% in Nasdaq 100 (QQQ).

Personally, I do not trust the actual strong recovery of the equity market. It is possible that we may experience an extended crisis with quite a delay. Additionally, the huge amount of debt used to cure this crisis could result in a period of inflation or even deflation if consumption and production does not recover within a short time.

Nobody will be able to predict the precise outcome of this crisis, however for me one thing is clear — if you are limiting your investment horizon to “equity only”, then you are risking too much. Better think like Harry Browne and consider diversifying to more asset classes which perform well during any economic condition.

Logical-Invest, April 28.

Frank Grossmann

I am new to LI, but very excited to be here. Thanks for the informative article.

Dan

Hi team, can you share email id to contact? Tried reaching you over contact form but no replies received

My email – [email protected]

You can contact me using [email protected]