Election and volatility

On September 22th, we received the following message as our main broker increased margin requirements for U.S. stocks:

Consequently, to protect (the broker) and its customers, … will increase margin requirements by as much as 35% above normal margin requirements leading up to the November U.S. election. With the increase fully implemented, the new requirements would be 67.5% Initial and 33.75% Maintenance (vs 50% and 25%)

In effect, this is similar to pulling money out of the system by forcing fully leveraged traders to sell assets in order to cover margin for existing positions.

Unsurprisingly, September turned out to be a correction month for most assets classes, including the U.S. market (SPY -3.7%), foreign markets (EEM -1%) as well as gold (GLD -4.2%). Treasuries gained (TLT +0.8%) while the U.S. dollar index rose by almost 2% (UUP +1.8%).

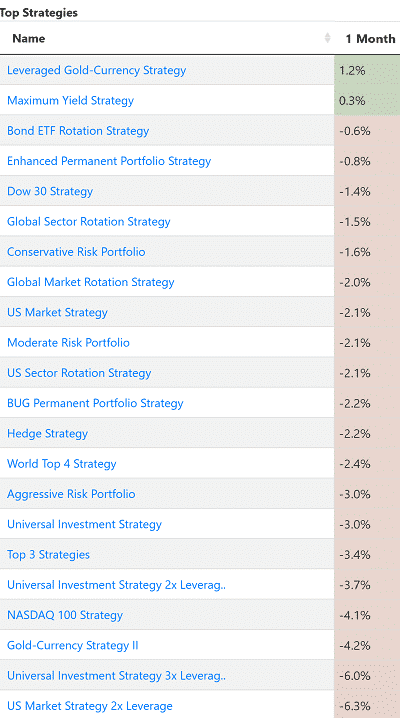

Our strategies pretty much followed the market correction with performances ranging from +0.2% to -3.4% for non-leveraged strategies. The HEDGE for this past month was 60% Gold, 40% GSY so the gold correcting did not help.

Seasonality in Election years

Since this year’s U.S. elections is on everyone’s radar, let’s run some backtests and see how investors would have done during the last months of an election year. The following backtests start at 1994:

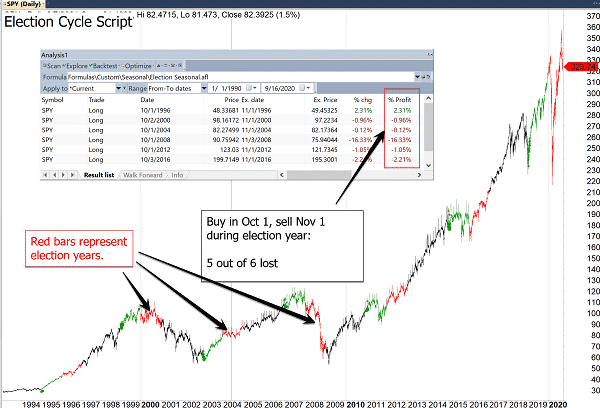

Test 1: During an election year buy SPY on October 1 and hold for 1 month.

5 out of 6 times you would have lost. 1996 was the only election year where the October return was positive.

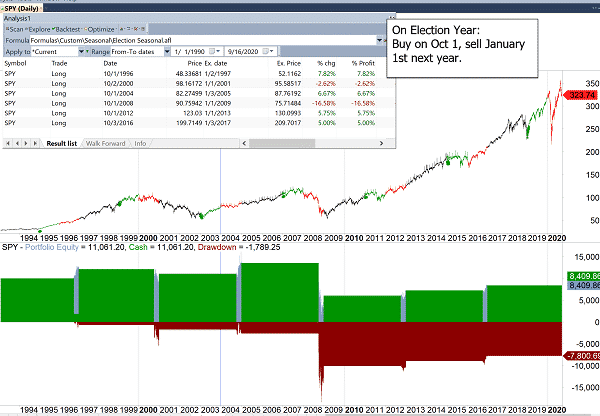

Test 2: During Election year, buy SPY on October 1st and sell at the end of the year.

This turns out slightly better with 5 wins and 2 losses. Part of the reason for the improved results is that November and December have always been the strongest months of the year, regardless of the election cycle.

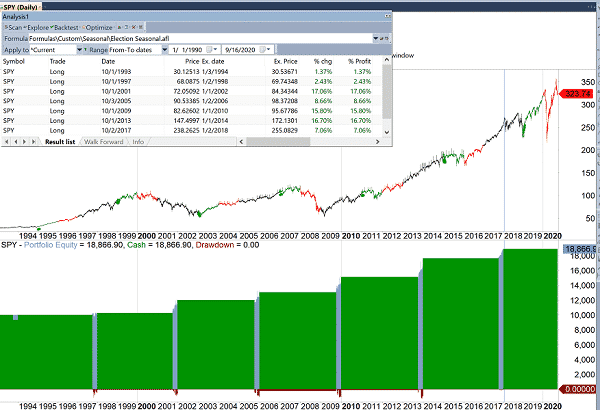

Just for fun we will try the same strategy but entering on the 1st Year after the election.

Test 3: During the first election year, buy SPY on October 1st and sell at the end of the year.

Interestingly that strategy produced profit every single time and earned 80% profit with very little risk. It is somewhat non-intuitive as one would expect the first year of a term not to be positively biased (as are pre-election years, for obvious reasons).

We can run many such tests and the outcome usually comes to this:

In the long term, it is better to be invested but hedged than try to time the market and stay in cash for long periods of time.

That said, we have been defensive on the markets since January by raising our HEDGE allocations and are monitoring with great interest the political and social events that are playing out in the biggest economy of the world.

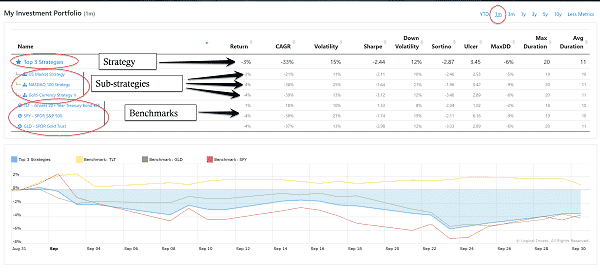

Performance information at a glance:

A quick reminder for new users on how to read your dashboard and get the most relevant info at a glance.

First you select the time period on the top right, in this case 1 month.

The first line shows you the strategy performance.

Lines 2, 3 and 4 are the individual sub-strategy performances.

The last three lines are your selected benchmarks, in this case SPY, TLT and GLD.

Please join the forum and discuss the recent changes in the markets, our portfolios and LI strategies.

The Logical-Invest team.

The broker you referenced sent another email and clarified their margin increase statement:

“(the broker) plans to increase equity index futures and derivatives margins by the aforementioned 35%. By example, ES futures and similar products based on the S&P 500 index would go from a scanning range of approximately 7% to 9.6%.

Stocks, however — both those under Portfolio Margin and those under the U.S. Reg. T margining model — will not be impacted as their margin rates already exceed 20%. ETF’s on equity indices are already at margin rates higher than their futures equivalents, and will be similarly unaffected. Other asset classes including commodity products, foreign exchange, bonds, etc. will also not be affected.”