Election volatility

October turned out to be a volatile month that ended up negative for most assets classes: The U.S. market lost -2.5%, gold (GLD -0.5%), Treasuries (TLT -3.4%) while the U.S. dollar was flat (UUP +0.1%).

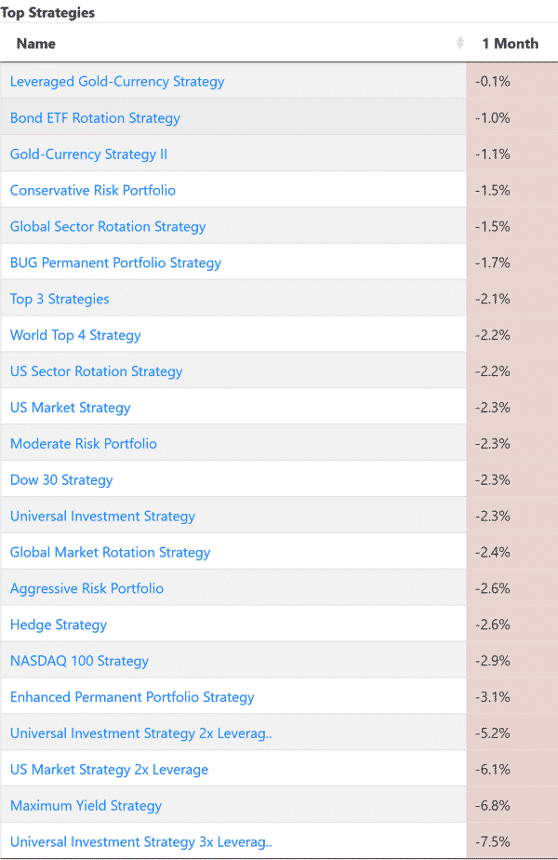

Our strategies pretty much followed the market correction with performances ranging from -0.2% to -3.1% for non-leveraged strategies. The HEDGE for this past month was almost half in Gold and half in TLT, so the large drop in Treasuries did not help.

It is very rare that all strategies are in the red. We are looking forward to a rebound in one or all asset classes and are looking closely as our hedge shifts between GLD/TLT/CASH and TIPS.

The markets are expecting a fairly volatile environment in the next days as the U.S. elections plays out and as Europe is entering partial lock-down due to the 2nd wave of the pandemic.

Please join the forum and discuss the recent changes in the markets, our portfolios and LI strategies.

The Logical-Invest team.