A guest post by our subscriber Richard Thomas

I would like to discuss a strategy I have been working on and would welcome any feedback.

All my optimizations use a 5-year lookback period. I know there has been much discussion about this over the years and there does not appear to be firm consensus on the best period to use, however 5 years covers a good growth period and some good pullbacks in 2015, 2018 and 2020 so it feels to me to be a reasonable representative period.

Whenever I run the optimizer, I do not always use the red square. I try to find a good result square that also has good stable results for the 8 squares immediately around it.

I have not carried out any analysis using the volatility limit or the advanced QT settings.

All the stats are based on data at the end of Sept 8th 2020.

Starting Point Permanent Portfolio

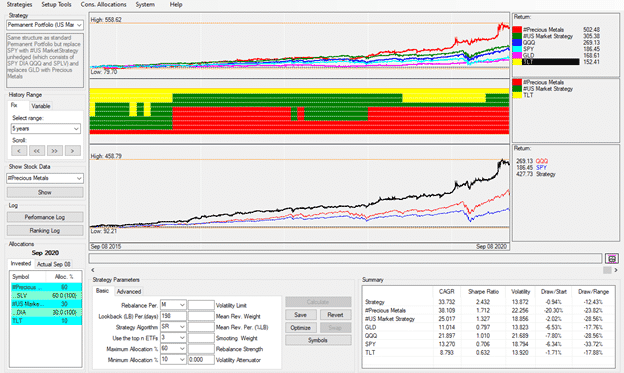

My starting point was the Permanent Portfolio. I like that this is a very simple strategy that only uses three ETFs and is “self-hedging”. The 5-year results are CAGR = 11.192 with MaxDD = -17.38. My objective is to increase the CAGR to 20+ and reduce the MaxDD to better than -15.

I started off with finding a replacement for GLD and created a Precious Metals (PM) strategy that consisted of GLD, SLV, PALL, CPER, JJC and PPLT which gave much better results than GLD alone. On further analysis removing the worst performers (CPER, JJC and PPLT) gave much better results.

Incorporating my PM sub-strategy into the MPP with SPY and TLT also gave much better results so I knew I was heading in the right direction.

Improving Treasury Hedge

I then tried to find an improvement on the treasury element and replaced TLT with the Treasury Hedge. Despite the TH having similar CAGR to TLT but a much better MaxDD it actually gave a worse result when combined with the PM strategy and SPY. I have found this on multiple occasions when using sub-strategies in a meta strategy in QT; sub-strategy A may have better stats that sub-strategy B but the combo of B with another sub-strategy C gives better stats than combining A with C because B marries with C better. There is no way of knowing this beforehand, so I always have to run multiple versions of sub-strategies with sub-strategies.

Equity – Stock & ETF option

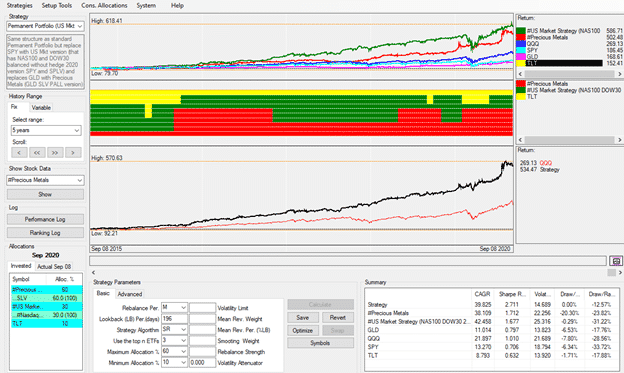

So, the final piece of the picture was to find an improvement on SPY. I tried multiple options of this – QQQ, Nasdaq 100 balanced hedged and not hedged and finally came up with two options; a stock option and an ETF option.

The ETF option is to use the LI US Market Strategy which selects one of QQQ, SPY, DIA or SPLV.

The stock option uses my modified version of the US Market Strategy and replaces QQQ with my version of Nasdaq 100 balance unhedged and replaces DIA with the LI version of DOW30 balanced unhedged and leaves SPY and SPLV unchanged.

Both gave excellent results with the ETF version having a CAGR of 33.73 and MaxDD of -12.43 both of which exceeded the targets I had set myself at the beginning of the exercise.

The stock version has a further improvement in CAGR at 39.82 for effectively the same MaxDD at -12.57

When constructing my stock version of the US Market Strategy I did look at using the hedged versions of the NAS100 and DOW30, but these variations all gave worse results. One thing I have found with the LI strategies is that as most of them are hedged, when they are combined into a meta-strategy which itself can also be hedged there can effectively be an overabundance of hedging, so using the unhedged versions of the base strategies will usually give better overall results.

There are probably improvements to be made to this strategy and other testing to be carried out, but it looks to me like it has a reasonable platform for going forward and it did capture the big jump in SLV in July.

You can download a QuantTrader version with all the needed files here: QuantTrader527S Modified Permanent Portfolio.

I would welcome any comments.

Richard Thomas

Thanks for your explanation and sharing your work.

I have questions in the forum for this post.