A proper inflation hedge: The Gold-Currency strategy

I had a dream the other day: I was 9 years old, sitting on the edge of a small harbour, my legs swinging above the water. My grandfather was sitting next to me. We both held fishing rods, staring into the horizon, waiting for the occasional fish to bite. He was telling me stories about the times after world war II where money became worthless, just pieces of paper that lost their value every day. People starved. Only food had value, common things like bread, lentils and olives. Meat was like gold. And gold itself was the only acceptable means of transaction.

Later on, I remembered some things learned in economics classes:

If you expect inflation, buy gold.

If the government carries too much debt, buy gold.

If your government prints too much money, buy gold.

If you expect fiat currencies to devalue, buy gold.

Worthless advice?

We are running at 8% and 10+% inflation in the U.S. and Europe respectively. But gold is down. How is that possible?

Well, one answer is that USD is the new safe heaven. The dollar has appreciated so much that gold seems weak in comparison. But this is the case for Gold/USD. That is not what Europeans, Japanese, Australians, British and Canadians and most other investors experience. They experience a devaluation of their currency vs the dollar and wish they kept their saving in gold (or USD).

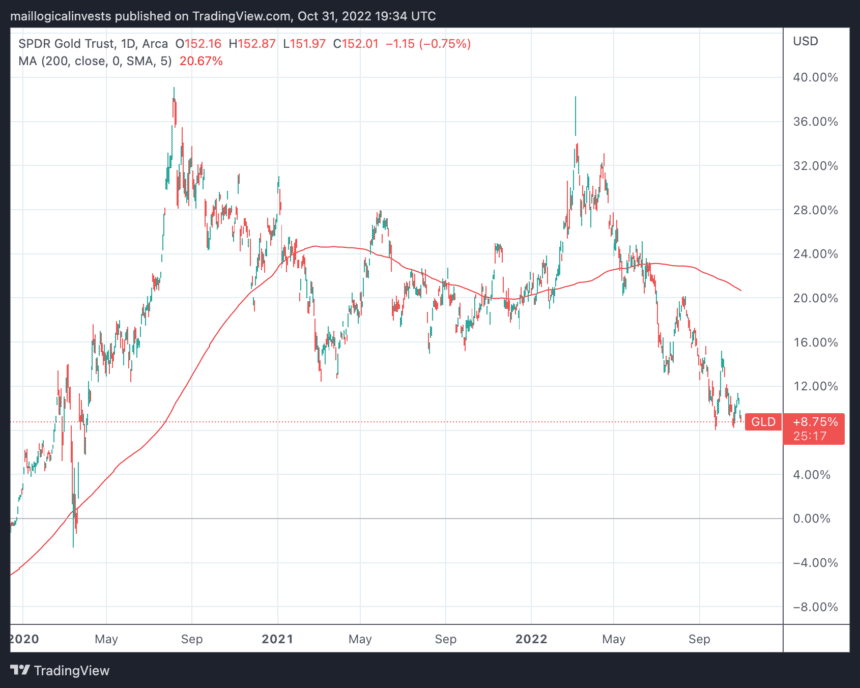

Below is the chart for the gold ETF (GLD) from Jan 2020 to today. Up roughly 8% against USD.

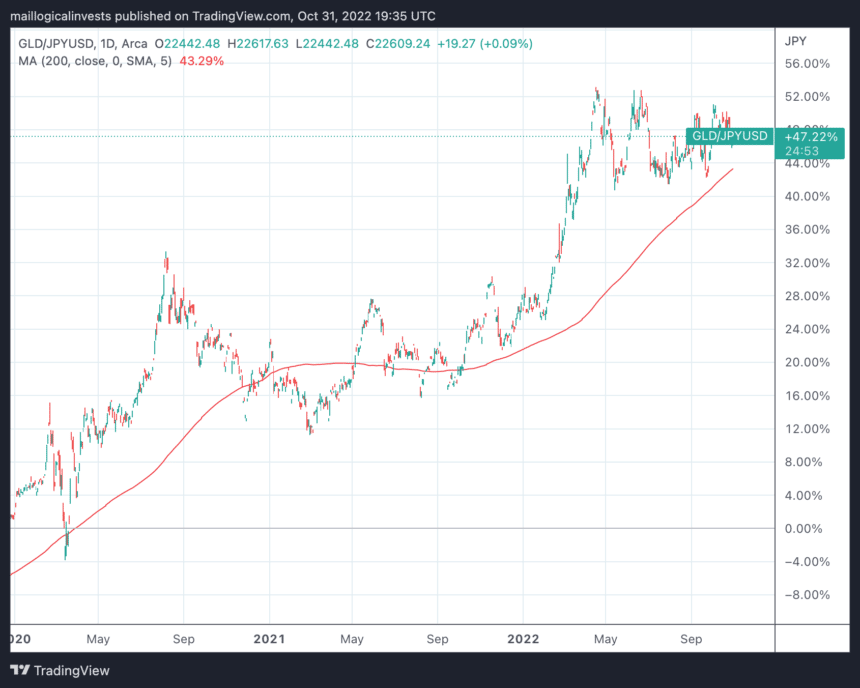

If we look at gold from a Japanese investor’s point of view the chart looks different with gold up +47%!

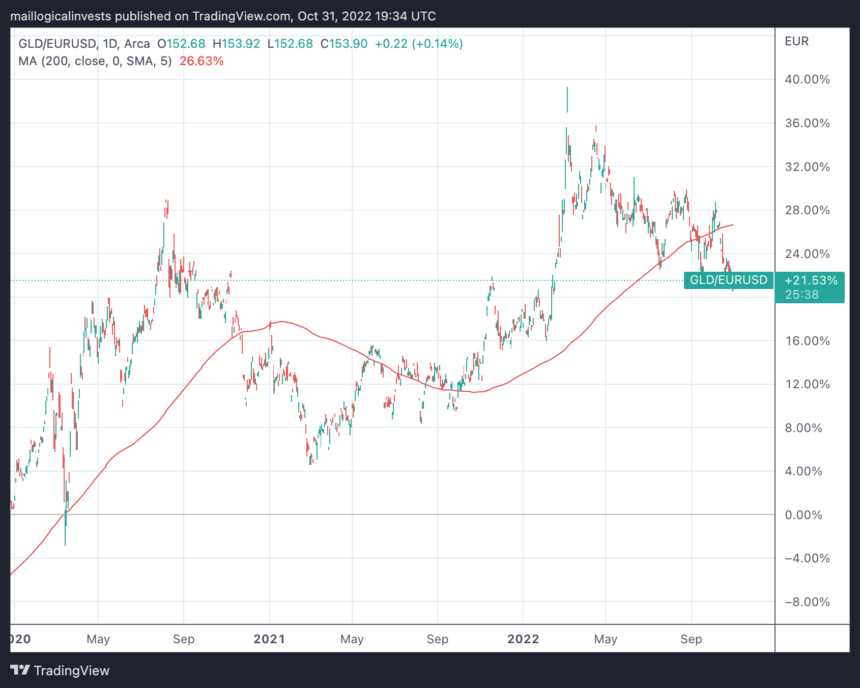

For a European, gold is up 21%. Or seen from a different perspective the Euro has lost 21% of it’s purchasing power…

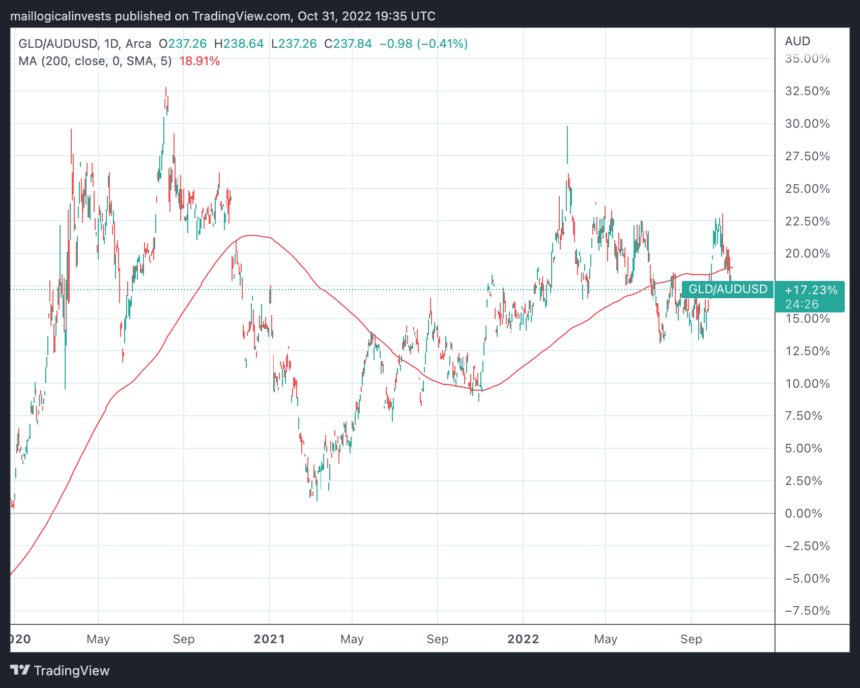

…while Australians experience a 17% rise in the gold price in the same period.

Leveraged Gold-Currency strategy

And that is how the Gold-Currency strategy idea came about. Could we just own gold but rotate it against the weakest currencies, not just USD?

The Leveraged Gold-Currency strategy is one of the few winning strategies of 2022, currently up around 30% YTD.

For more information on the strategy, Frank has detailed the strategy logic in this piece:

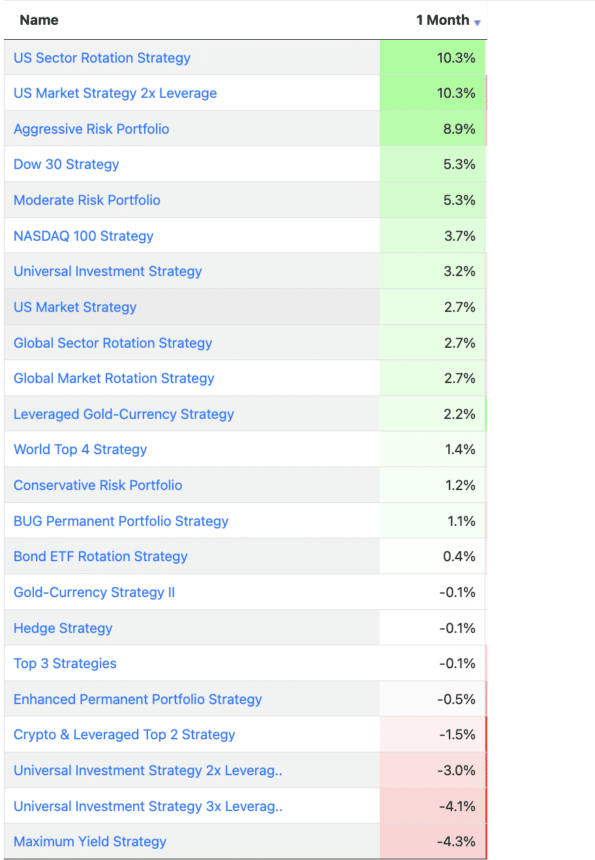

Performances

Best performers for the month were the US Sector Rotation strategy, holding energy (+25%) and health (+9.6%) sectors as well as the Dow 30 strategy (DIA +14%).

Let us know what you think in our forum.

The Logical-Invest team.