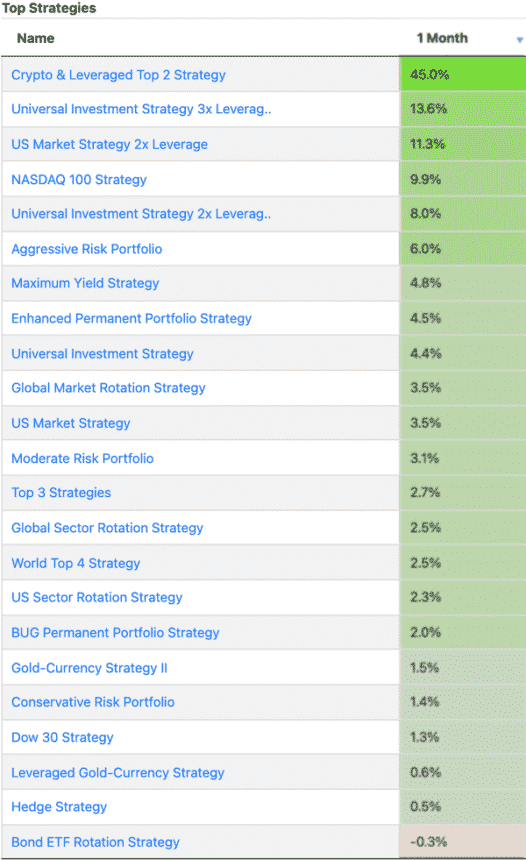

Everything is green again

October was an exceptional month for our strategies. Our newest and most aggressive one, the Crypto and Leveraged Top 2 returned an exceptional 45% for the month.

Our non-crypto leveraged strategies also had a good month as equity (SPY +7%), bonds (TLT 2.5%) and gold (GLD 1.5%) returns were all positive. For October, our long running Universal Investment Strategy 3x Leveraged strategy returned 13%, our US 2x Market strategy 11% while our Nasdaq 100 strategy turned a 9.9% profit.

Even thought the SP500 is once again at all time highs, all eyes are on crypto as the first ever U.S.-based ETF, the ProShares Bitcoin Strategy ETF, reached 1 Billion AUM in two days of trading. The Valkyrie Bitcoin Strategy ETF followed at the end of last week, currently at 52 million AUM.

The following charts give you an idea of where Bitcoin and Ethereum stand. Bitcoin touched it’s all time high of $64,000 just before the Proshares ETF launched was announced. It has now retreated to around $61,000.

Ethereum at first lagged behind Bitcoins sudden rise but eventually broke it’s own all time high and is currently oscillating around $4300.

The CL Top 2 Strategy: Can it be traded with ETFs, BITO or BTF?

The short answer is yes.

- The underperformance vs holding Bitcoin should be small enough to justify using it.

- The CLT2 strategy rebalances every 2 weeks so this is not a buy and hold position.

Why will the ETF underperform Bitcoin?

As you may know these ETFs hold CME’s Bitcoin Futures rather than spot Bitcoin. That means they are similar to USO (United Stated Oil Fund) and other commodity ETFs that hold futures contracts and are forced to roll them over every month. Most of these commodity ETFs underperform the spot price because of contago and constant loss as they roll over to the next (usually) more expensive contract.

In the case of Bitcoin the contago is not that large compared to the volatility of Bitcoin. In other words the cost of rolling a contract is small compared to the actual moves of Bitcoin which can easily be 10% or more in a weekly basis. So the underperformance of holding the ETF vs Bitcoin should not be that substantial and should be worth the convenience and peace of mind the ETF provides.

For those with large enough pockets, the strategy would be to take the other side of those new ETFs: Hold spot Bitcoin and keep selling the front month futures as they expire, while collecting the risk-free premium. The problem is the high margin costs required to short a CME Bitcoin contract.

End of year is upon us

Usually November and December are historically the best months of the year to be in the markets. If you are still on the sidelines and want to enter you will eventually have to ask yourself when and how.

Please join the forum and discuss the markets, our portfolios and LI strategies.

The Logical-Invest team.