Now is when you need rules – Subscribe

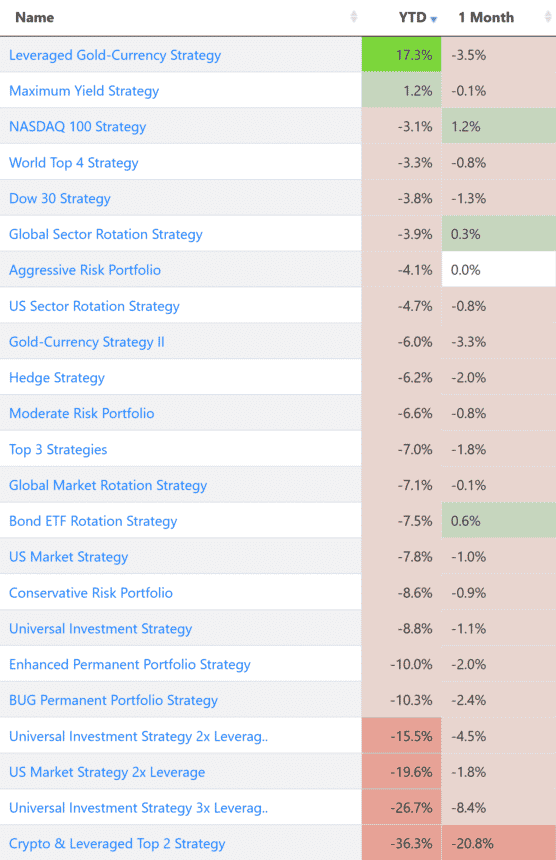

This has been a tough year as most portfolios suffered losses. Neither equity nor bonds have provided protection, while gold has remained flat. It is a good time to stick to rules and protect capital while being able to participate in any rebound.

Top 3 Strategy Allocations -Follow up

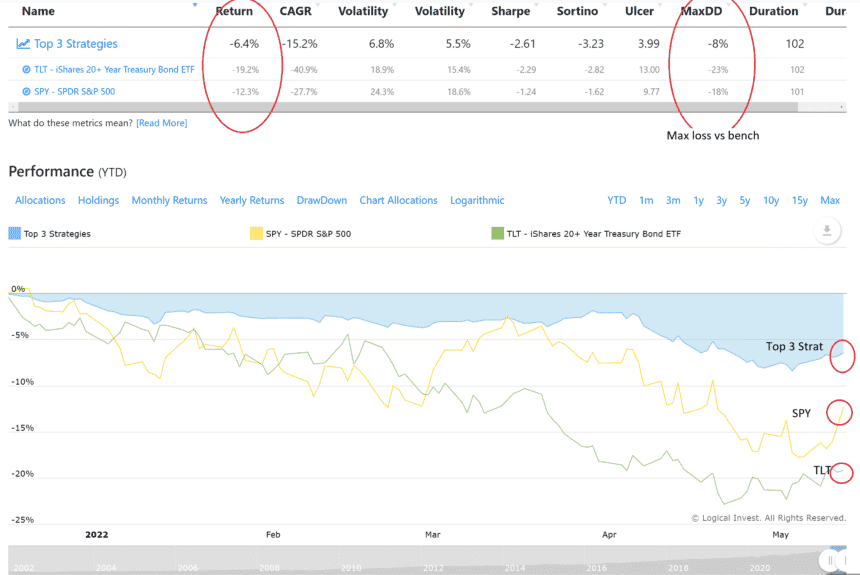

Following up on last month’s publicly announced allocation to the Top 3 strategy, we can see a tolerable -1.2% loss for the month and a manageable -6.4% for the year.

In the chart below you can see the Top 3 strategy vs the SPY and TLT ETFs. The max loss one had to withstand using the strategy was -8% vs 18%-21% for equity and bond investors.

Further correction and rebound

In May the SP500 ETF (ARCA:SPY) continued it’s correction touching the 380 level, a -19% drop from the January 2022 highs. It has since bounced and sits at a -12.8% loss year-to-date. Non-leveraged LI Strategies average a -6-7% loss YTD.

A reminder to be careful using leverage

Through the past long bull market, we have developed leveraged strategies to boost returns while keeping losses reasonable.

Please invest wisely and do not underestimate what leverage can do when markets go against us.

Get Ideas

Logical Invest has many other model strategies that you can research and take ideas from. https://logical-invest.com/app/asset_list

Let us know what you think in our forum.

The Logical-Invest team.