- As many new people have joined in the past weeks, here is a quick recap on How to use our desktop app QuantTrader to cut signals on your own.

Team LI reveals personal favorites

Please visit our forum as we reveal Logical Invest Team’s own personal allocations!

Mixed month for Assets

May was a mixed month for asset classes: The S&P 500 advanced +4.8% while long-term Treasuries lost -1.8% and gold gained +2.6%.

The Strategies

The best performers were our equity based strategies including the NASDAQ 100 strategy (+5.6%), the U.S. Market strategy and the Global Rotation strategy (+3.8%).

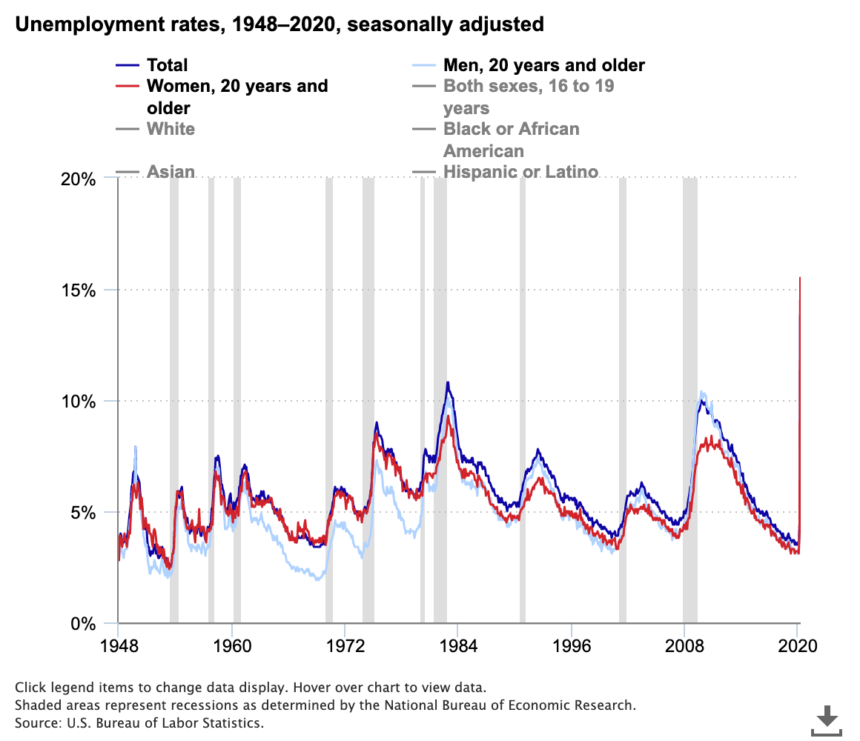

Wall Street – Main Street

April’s 14% unemployment measurement seems like an ‘outlier’, a statistical data point so far away from the norm that it looks like a mistake.

It seems the markets share this point-of-view:

The US market has recovered part of the losses. It sits less than 10% below its all time high having past the 3,000 mark this past Wednesday, May 27 2020.

The Nasdaq 100 has returned to pre-virus levels:

Gold has been up 13% YTD but has been flat for the past 2 months. Taking a very long term view, gold sits just 12% below it’s all time high of 9 years ago (2011).

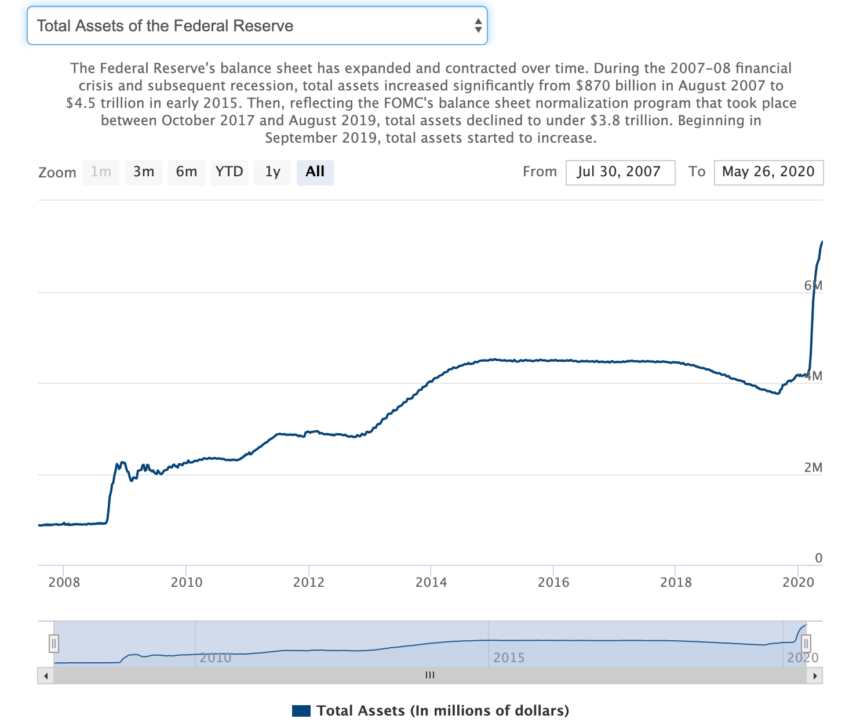

The reason for all this seems to be coordinated policy effort across the world including the Fed and the E.U.

Real life is different

As the summer approaches and many countries open up for business the new reality becomes apparent. The new social distancing regulations are bound to have a lasting effect in how we go about doing things. Schooling is changing, public transportation is affected, airline and hotel capacity limits are reduced. De-globalization is accelerating due to the dangers of travel while “virtual” globalization is increasing as remote work is adopted. The energy markets are changing and a new era of clean energy is upon us. Tectonic changes are accelerating and the extra boost in ‘helicopter’ money may just speed things up.

Nevertheless, the effect of the virus is not quite over yet: Brazil is being hit by the coronavirus while Argentina which was more successful in containing the virus has once again defaulted on a (some claim impossible) $500 million interest payment.

Update on Crypto-currencies

A quick update on crypto-currencies:

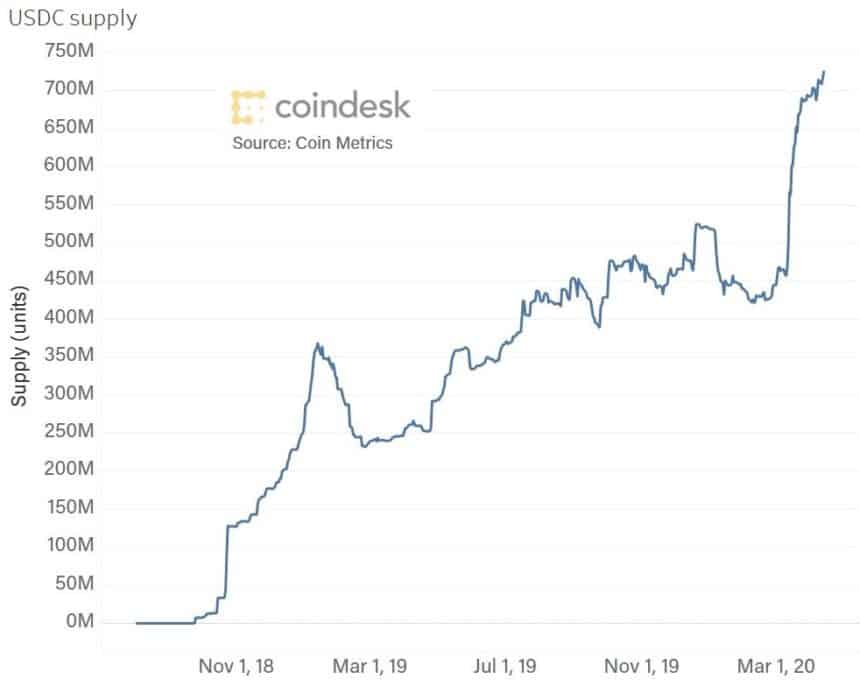

Stablecoin adoption is on the rise. Below is issuance of Circle’s USDC stablecoin.

Bitcoin is once again flirting with its recent $10,000 upper limit. After March’s shocking crash of more than -60% the crypto-currency has managed to recover 140% from the crash low keeping it’s reputation of being wildly volatile and unpredictable very much intact.

Please join the forum and discuss the recent changes in the markets, our portfolios and LI strategies.

Stay safe.

The Logical-Invest team.